Thailand J

-

Posts

1,621 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Thailand J

-

-

- Popular Post

- Popular Post

48 minutes ago, redwood1 said:I will say there is no way the disorganize, corrupt, flip flopping mess that is the Thai government could ever in a million years track and keep up with the personal finances of the expats from all these countries..

Some may think cheating is unlikely to get caught here..plus the magic of brown envelope will keep you from harm.

but I know I can't sleep well if my tax is not in good order...I may walk into a tax revenue office to confess 🙂

-

8

8

-

- Popular Post

- Popular Post

31 minutes ago, NoDisplayName said:You don't get the $14,600 standard deduction or the $47,150 0% LTCG tax rate (2024). You do get the 60K baht Thai standard deduction, but your capital gains are taxed as ordinary income, possibly at up to 35%. That's ALL your capital gains. You don't get to offset with capital losses.

I don't mind paying some tax but applying current Thai tax code on US capital gains is ridiculous. I will end up paying up to 6 times more tax here.

Thailand can kiss my $ good bye.

-

7

7

-

18

18

-

5

5

-

8 minutes ago, chiang mai said:

The discussion in the article is about taxing world income which means EVERY type of income would be taxable, in Thailand, for Thai Tax residents, not just overseas mutual funds, everything.

In the article, Kulaya Tantitemit, the director-general of TRD stated income tax would not include income from mutual funds investing abroad.

Let the forum members read the article and make up their own mind, I don't like to dwell on this .bye.

. -

3 minutes ago, chiang mai said:

Yes I saw that. Do you understand the Thai Revenue Code only allows deductions/allowances against Thai Mutual Funds, that means a mutual fund raised and owned by a Thai bank or securities company and managed under Thai SEC rules, regardless of the securities contained in that fund?

thats is true in the past, were talking about whats gonna happen according to new statement on BP from someone from TRD.

-

6 minutes ago, chiang mai said:

Aw look, the posters confused and doesn't understand the difference between Thai mutual funds and overseas mutual funds.....probably shouldn't be investing in anything if that's the case!

I read the Sept Bangkok Post article, did you?

Did you see mutual fund investing abroad?

Pause the youtube video below at 16:44.

-

Bangkok Post article stated excluding income from "mutual funds investing abroad."

I don't believe US mutual funds dont fit the Thai mutual fund definition so much so that they arent considered mutual funds.

-

I have read the article, very few useful info.

It appears that TRD is targeting overseas earned income and overseas private fund inventing income. Overseas mutual fund investment income will not be taxed, which is the opposite of what used to be.

-

1

1

-

-

Jomtein Air remove the stickers before installation.

Ask them how. 0868899001.

-

2 hours ago, TheAppletons said:

would exclude income from mutual fund investing abroad

Happy to see this.

This is new.

If this is true, plus the DTA which exempts US SSA benefits, and my LTR visa, I will have no tax to pay here.

-

- Popular Post

- Popular Post

On 9/2/2024 at 10:51 AM, edwardflory said:I do it the simple way. I use my US BANK MC DEBIT to make deposits into my Thai bank account, ONE trip to the bank, make deposit from US card, withdraw THB at Thai bank ATM.

On 30,000THB, my TOTAL CHARGES from US Bank last week was $3.12, exchange included ( based on XE exchange rate )

I do it the simpler way.

I have my SSA benefit deposited into my Schwab account.

Use my Schwab ATM card at any ATM . No fees after rebate.

-

1

1

-

2

2

-

15 hours ago, josephbloggs said:

I went to the website, clicked on "online booking", and then " Book now for Foreigner".

scrolled down to see their prices on leftside of the screen.

I am interested in whole spine MRI, 27000B here.

Yesterday I was quoted 22,000B at Bangkok Pattaya Hospital. I hope there is no misunderstanding over the phone. I am going to visit the hospital today to confirm .

-

Kamala can handle herself just fine.

-

1

1

-

-

-

Kao Gang is where they give you a plate of rice and you chose two or three precooked sides placed on the same plate.

Kao Gang at Pattaya Terminal 21 food court is very good. The pork pumpkin massaman curry is delicious.

-

-

Apa Talay Pao Jomtein. Not the cheapest but good.

Price includes soft drinks. Buy 3 beers get 1 free.

Roast duck was very good at Jomtein branch .Ayuthaya branch didn't serve roast duck when I went there.

There are two similar buffet restaurants side by side, dont goto the wrong one.

Live band is very load, don't sit too close to the stage.

https://maps.app.goo.gl/Xdt8csrgcMNFNR5s6

-

1

1

-

1

1

-

-

-

Mix Borax with sugar, put in bottle caps place under the sink. No ants, no roaches.

-

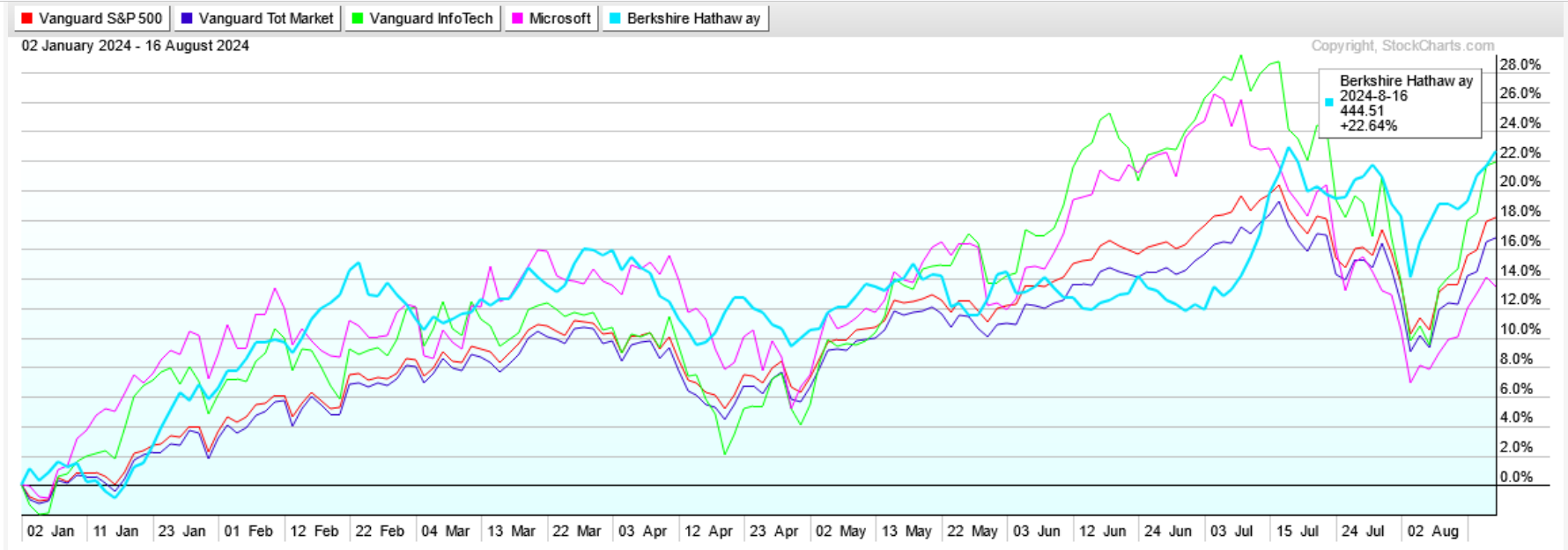

Brk B is up 21% year to date. Buffett will be 94 next month.

-

1

1

-

-

-

I will get the second shot when the time comes, vaccine reactions are unpredictable, not something I will worry about, just be prepared.

-

1

1

-

1

1

-

-

2 hours ago, how241 said:

I see the ThaiTravelclinic in Bangkok is showing the price of Recombinant zoster vaccine (Shingrix® 5,199

The new pink line has a station right in front of my bangkok condo so it's easy to goto Travel Clicic. I paid 6060B on July 1 for Shringrix. As i recall the advertised cost was 5400 not 5199.

The advertised cost does not include doctors fee plus after hour fee outside of certain hours.

Make sure you clear you schedule for the next few days if you decided to take the vaccine, the side effects may make you feel sick. For me it was joint pain, fever, headache, just like a bad flu minus the coughing sneezing.

-

1

1

-

-

I am sick of Fidelity. To add a Thai bank with a standing order on file you'll still need a medallion signature. If I do not transfer money for some time all of the links to my banks disappeared accept one. I have 30+ years account , this happened a few times. Now I just have one domestic bank linked. I don't bother to add the disappeared links back.

I am using Schwab for money transfers, where I can add any international bank online.

-

S&P 500 index is up 17.5% year to date.

It was 5572 at last closing, will it be at 15000 by 2030? Tom Lee thinks so.

https://www.fool.com/investing/2024/06/25/1-index-fund-buy-before-it-soars-174-wall-street/

Ceiling Light Fixtures

in The Electrical Forum

Posted

In the bathroom and kitchen ceiling I use LED 6w circular panel. In the kitchen under cabinet light is a must. IKEA has a nice under cabinet light set but i just use a small tube from Homepro.

Bedrooms and living room I have LED MR16 3W-5W (see pictures below), which I seldom turn on. Table lamps with fabric lamp shades are much better.