Thailand J

-

Posts

1,449 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Thailand J

-

-

On 11/15/2023 at 12:59 PM, ding said:

We don't have plans to return to the US but things can change, especially with age.

You can get Part B, cancel when you are sure of not returning to US, doesn't matter what other expats do.

-

1

1

-

-

"Cancellation of benefit" (withdrawal of application)is when you started the benefit at say 62 and change your mind, you have 12 months to do so and have to pay back the benefits.

"Suspension of benefit" is after 67 you can halt the benefit to have it restarted later with a bigger payout.

For example in my case I have started the benefit at 62 more then a yr ago, I can't cancel but I can suspend the benefit when I reach FRA at 67. Good to learn something new. Thanks.

-

1

1

-

1

1

-

-

15 minutes ago, poobear said:

Taking you Social security early is not a one way street You can suspend your benifits after you have stared them

I thought you can only cancel application within 12 months of application, have to pay back the benefits, and reapply on a later year.

-

-

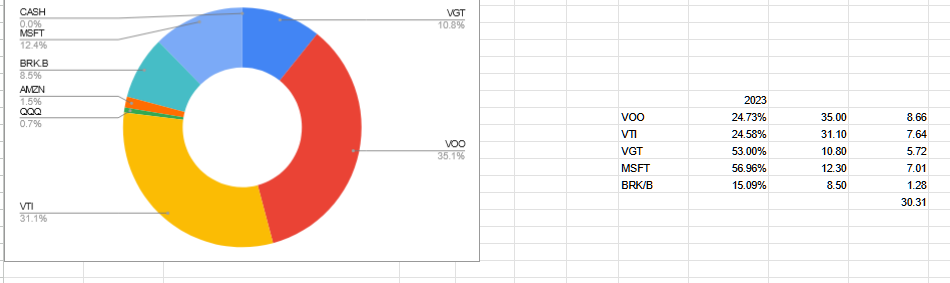

My best performing investment in 2023 was not any fund, it was Microsoft up 56.96%. Closed at $376. I bought in at $50. My investment in Vanguard VGT ( tracking Nasdaq tech stocks) was up 53%.

Berkshire Hathaway was up 15%, no complains, better then keeping cash which I would have done if I didn't buy BRK/B.

Overall up 30%, a quick rebound from 2022 downturn, not too bad long term neither.

-

1

1

-

-

The longer the time span, the less likely active funds were to have outperformed the benchmark.

-

1

1

-

-

I recall it was Magellan manager Jeff Vinik who sold tech stocks in the fund in 1995/1996. He predicted a tech stocks correction 4 or 5 years too early and missed the rally.

-

1 hour ago, Mike Lister said:

take the fund into different things or at least mitigate the effect of the fall

I believe fund managers do everything to help, not just that, but no thanks.

The only non index fund i have is BRK/B where I moved all my cash reserve in my portfolio into, thinking that it is a stable investment.

-

I used to have money in Fidelity Magellan under the management of legendary Peter Lynch. Did very well for a few years. That was where I learnt most managed funds don't beat the broadmarket in the long run and moved my money into index funds.

Last decade Contrafund was good but not outstanding compared to the broadmarket. You must have got in before that.

Contrafund vs VOO, 10 yr, 5 yr and 3 yr:

-

1

1

-

-

On 12/28/2023 at 5:24 PM, JimGant said:

Suggest you re-read.

If I reply to you posts I will just be repeating what I've posted.

I suggest you re-read my posts.

-

US citizens are taxed as US residents using the same tax form as the residents : IRS Form 1040. Foreign income is reported on form 2555 attached to form 1040. This is going to be the same in the future unless there is a a major policy change in US which I see no hints of happening.

-

US taxes IRA distribution if you are a US citizen.

If there is another state that is able to and actually does impose tax on the the same distribution then there will be an arrangement such as tax credit.

so far it has not happen with US -Thai tax where US IRA is taxed in Thai.

I am not sure why you try so hard.

Open your eyes, non of us here who stay in Thailand ever paid Thai tax on our IRA distributions.

-

swiss actually tax US income but Thai so far has not.

and if Thai does next year it wont be the same way as Swiss does.

different country different deal. .

Stay with Thai_Us tax.

-

On 12/19/2023 at 12:50 PM, daejung said:

The location of these stops on Google maps is not clear for me. Do you know where they exactly are?

The first stop was right after the turn into Suk.

The second stop was at the pedestrian bridge near south Pattaya Tai.

https://maps.app.goo.gl/3RpNj231dqAt7Dxc6

https://maps.app.goo.gl/tXRdah9bLP6d7ZKr6

-

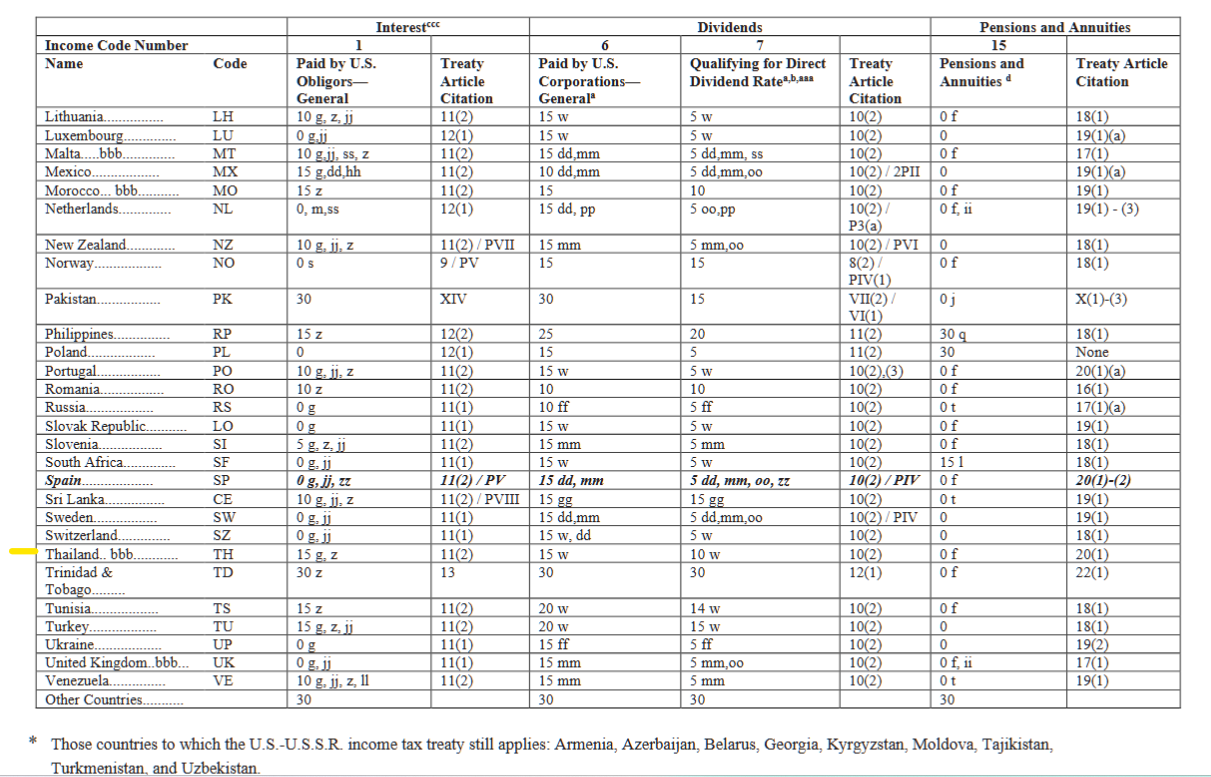

every tax treaty is different. Different income different rates etc.

You can't replace a country name and make an arguement.

as of today thai tax law tax no IRA benefits remitted the year after.

and with 162/2566 it's a complete different game.

Does Swits has the exact same DTA with US as Thai?

Does Swiss has the same tax rules regarding foreign incomes as Thai?

-

17 hours ago, Guavaman said:

According to the DTA, Thailand has priority in collecting tax from your IRA distributions.

True for non US citizens non residents who file 1040NR.

Not for US citizens who file 1040, who are taxed as US residents disregard of where they may live the entire tax year.

-

-

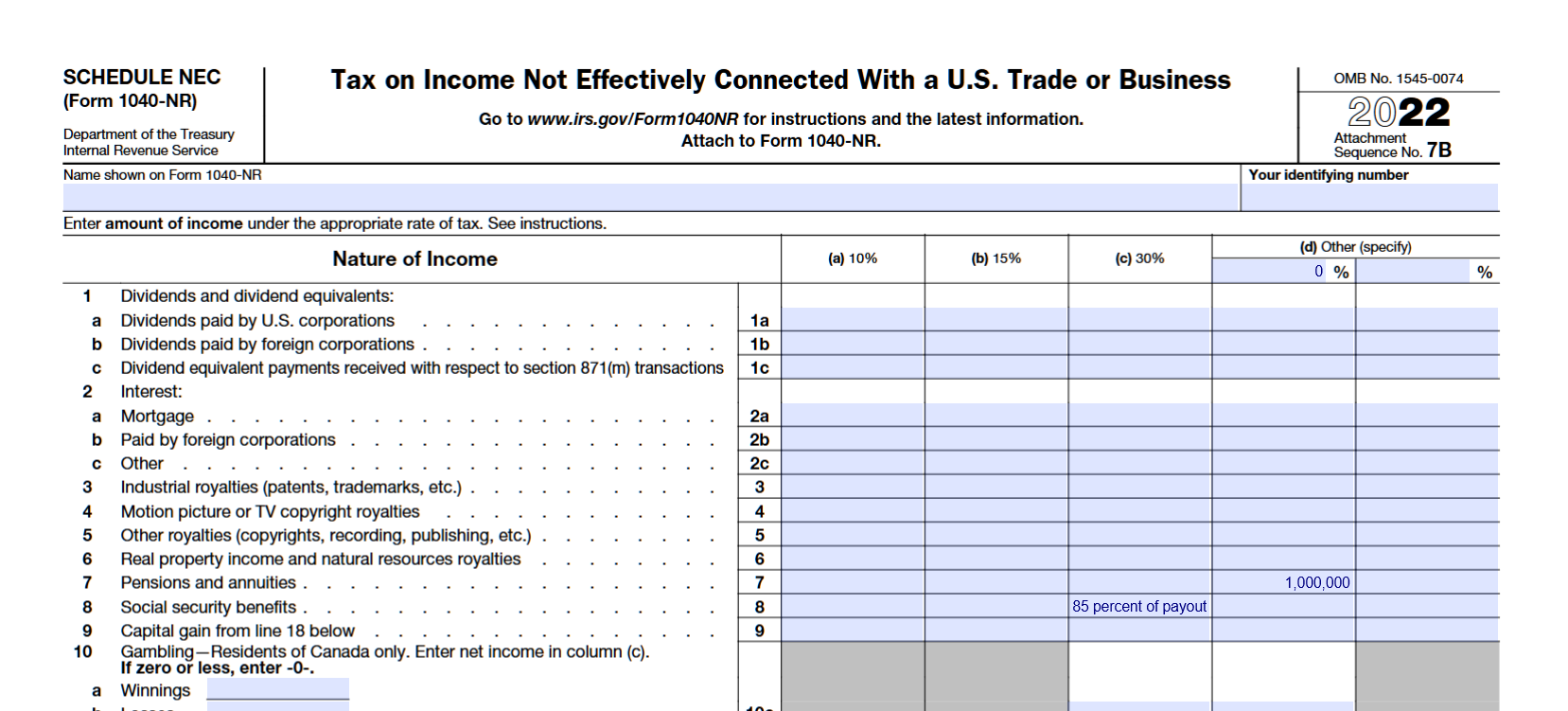

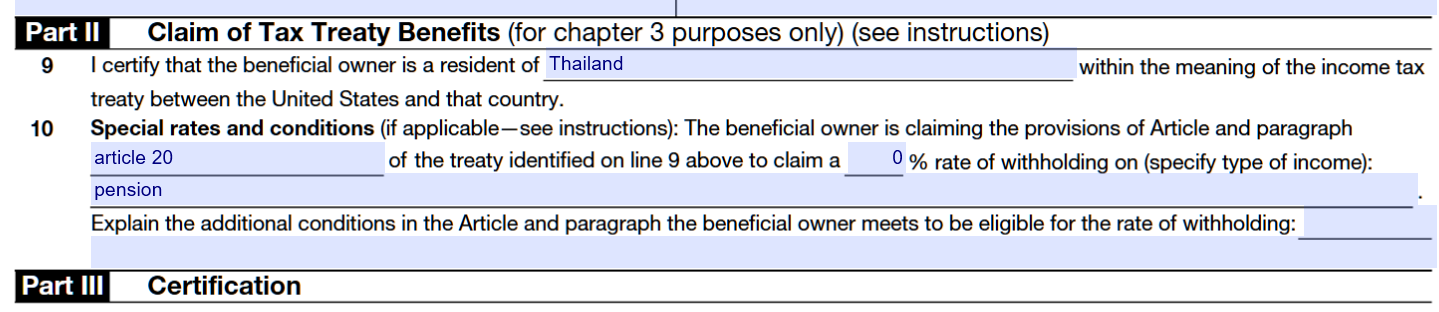

There are 3 parts on the form, part I is personal data ,part III certification signature.

For IRA's, part II should look like the picture below.

If your spouse is non US citizen and non US resident she can claim double tax treaty article 20 which prevents US from taxing the IRA benefits. On Thai side she may have to pay tax on the oversea remittance pending Thai revenue department new rules.

-

From my experience, yes two sets of documents were required, meaning two sets of passport copies. Medical cert can't be copied, both had to be original . Residency cert can be a copy for the second set. There are shops across the street if you needed to copy documents.

-

Long post nothing new.

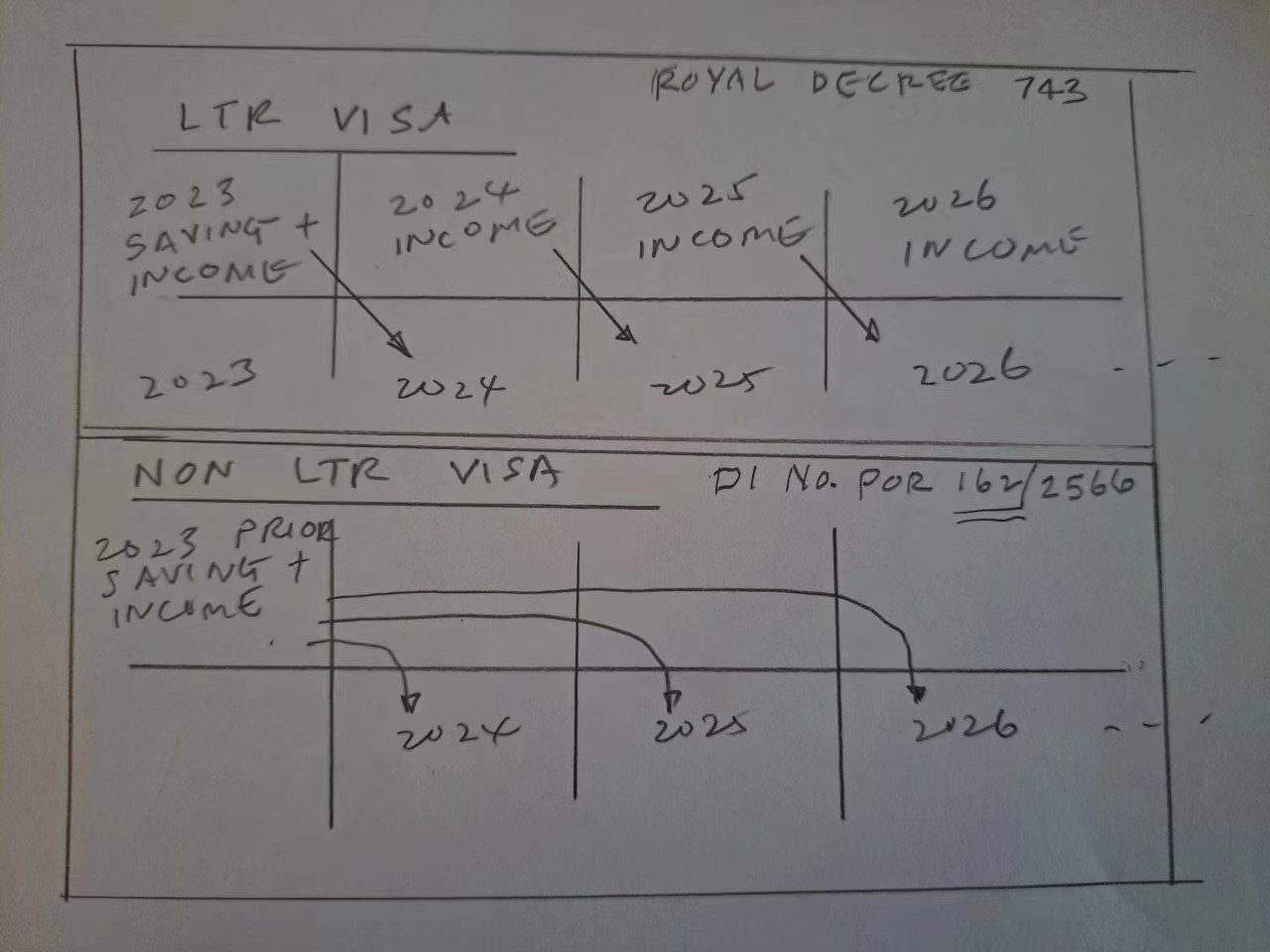

If they had published 162/2566 earlier I may not have gotten the LTR visa.

-

14 hours ago, Guavaman said:

Paragraph 1

Paragraph 1 provides that private pensions and other similar remuneration paid in consideration of past employment are generally taxable only in the residence State of the recipient.

The phrase “pensions and other similar remuneration” is intended to encompass payments made by private retirement plans and arrangements in consideration of past employment. In the United States, the plans encompassed by Paragraph 1 include: qualified plans under section 401(a), individual retirement plans (including individual retirement plans that are part of a simplified employee pension plan that satisfies section 408(k), individual retirement accounts and section 408(p) accounts), non-discriminatory section 457 plans, section 403(a) qualified annuity plans, and section 403(b) plans.

Paragragh 1 emcompass private retirement plans.

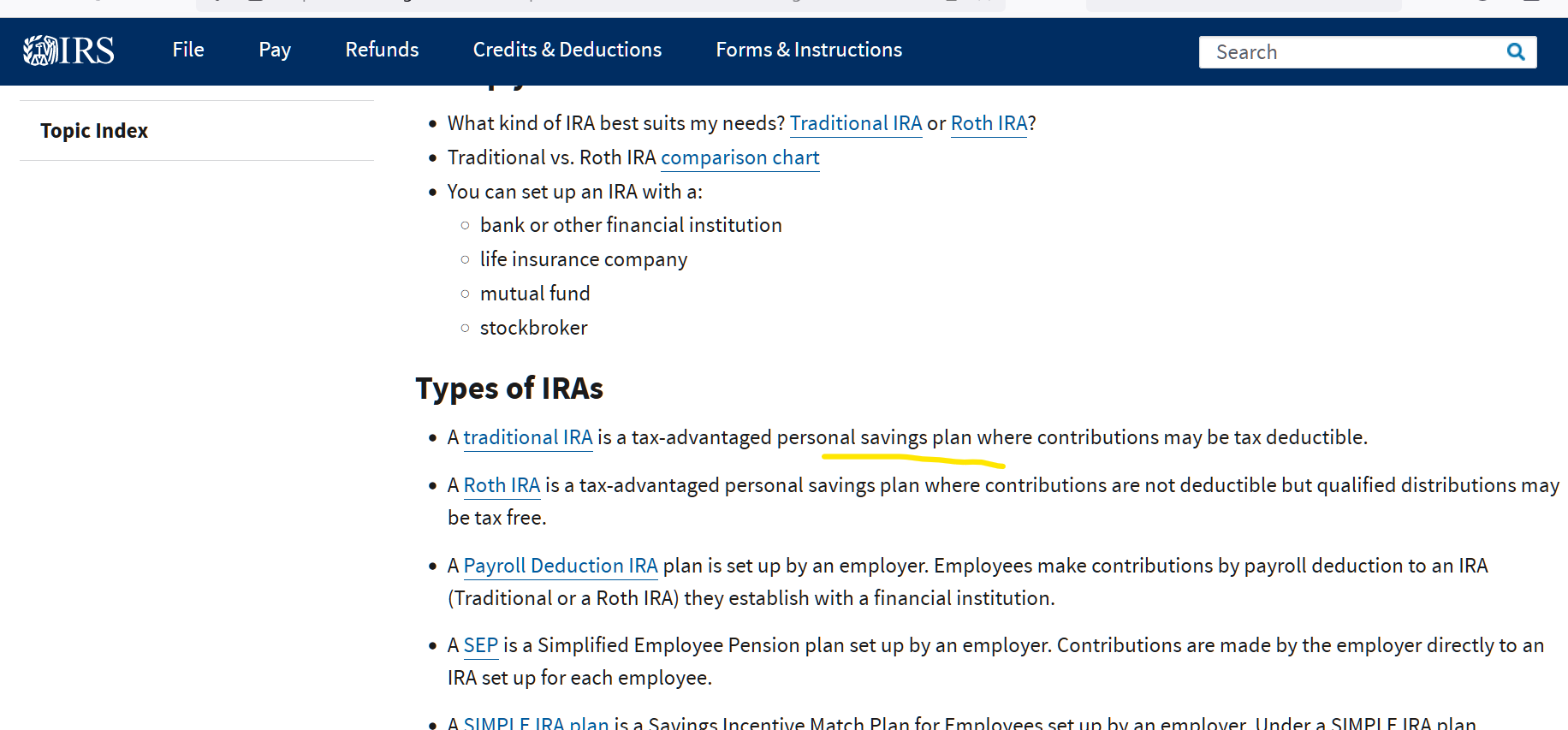

Self administered IRA accounts are not part of any private retirement plan, it's just an account defined as savings account by the IRS.Per RD DI 162/2566 the remittance of the withdrawals into Thailand should be tax exempted.

This has nothing to do with double tax treaty.

-

U S government pension and SS are exempted by DTA , that's clear.

IRA's are not necessarily private pension plans. Both traditional and Roth IRA's are saving plans. Per RD DI 162/2566, the balance in any IRA prior to Jan 1 2024 is tax exempted if you tranfer into Thiland in the future years. This is my understanding.

https://kpmg.com/th/en/home/insights/2023/11/th-tax-news-flash-issue-146.html

-

Keep your 2023 year end financial account statements. If you tranfer part of the balance in the future years it's tax exempted per DI 162/2566.

-

1

1

-

1

1

-

-

Looks like everyone has a way out.

For most LTR visa holders, income from previous year is tax exempted by RD 473.

For non LTR visa holders, income and prior savings from 2023 are tax exempted per Thai RD Departmental Instruction No. Por 162/2566. https://kpmg.com/th/en/home/insights/2023/11/th-tax-news-flash-issue-146.html

-

1

1

-

LTR and 90-day Reports

in Thai Visas, Residency, and Work Permits

Posted · Edited by Thailand J

If you have filed online, sign in to the website, click on "Check the status of application". The page with refresh and you will see all the old receipts as small PDF icons which you can click and print.

BOI requires an old TM47 ( 90days) receipt for LTR visa applications :