alanrchase

-

Posts

3,547 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by alanrchase

-

-

I bought one from Lazada awhile back, came with a zinc strip. Charged via USB. I used it to make a couple of battery packs for a cordless hedge trimmer. Picture below as the seller I got it from no longer exists. I also got the connecting strips from Lazada.

-

Thailand is no different to anywhere else. If I legally owe tax here I pay it, if not I don't. Do you pay tax on your substantial Thai bank accounts?

-

-

15 minutes ago, Crossy said:

That makes sense, I was 65 in April 2024 so it should apply.

Still waiting for the company accountant to get back to me.

Keep us informed of what they say. My birthday is in April as well and it would be nice to get the extra allowance for the year I turn 65 as well.

-

2

2

-

-

On 2/15/2025 at 12:04 PM, driveout said:

Hello everyone,

I have a question regarding CRS (Common Reporting Standard) and AEOI (Automatic Exchange of Information) regulations. My home country participates in these programs, and I currently have a personal bank account in Thailand. However, I reside in Thailand for less than 180 days per calendar year.

If I receive an international transfer of $5,000 from Vietnam to my Thai bank account, will the Thai bank report this transaction to my home country? Does it make a difference if I have or do not have a Tax Identification Number (TIN) registered with the bank? Did anyone here been reported to there home government?

I appreciate any insights or experiences you can share. Thanks for your time!Where are you tax resident? CRS is partly to do with tax evasion. Your country of tax residency will be your main concern. If they think you are trying to evade tax and they are a CRS member, they could ask other CRS members for your financial information which may include the source of funds.

-

- Popular Post

3 hours ago, ikke1959 said:Than the police has a lot of to do as many Thais every day without being fined, but if a foreigner does it it is payment time

Not really true is it? I was stopped one day for licence check. Handed my licence over and the cop waved it at the queue of Thais waiting to be issued tickets saying, "the foreigner can get one so why can't you lot".

-

3

3

-

1

1

-

On 2/10/2025 at 2:23 AM, GammaGlobulin said:

Dear Folks,

I am very, VERY pleased with the A55-5G phone, for what I normally use it for.

Great amount of RAM, 12GB

Adequate internal memory storage: 256GB

Very reasonable cost, quite undeniably!

However, when it comes to photography...haha....because...

IMHO, it's still a JOKE compared to my old camera which I purchased...back in...1978.

This is why, anytime anyone asks me why I use my camera phone to take, mostly, nothing but images of store-purchase receipts, or maybe the neighbor's cat in my yard, I just say that it does not measure up to my 50-year-old camera, made by Nikon.

For example, just a few minutes ago, I noticed that my mango tree was blossoming early this year.

I decided to document it by recording an image of said blossom.

I turned the camera on the phone to MACRO, and got up close, but not too close.

Still, here is what the phone camera recorded....

What's wrong with this picture?

Or, what's wrong with the camera of the phone, for that matter?

Here is an image of my Nikon F2AS, a camera which I loved....so deeply.

Also, it was a film camera, another thing I loved....so deeply.

Do you even think that a Nikon would take such as sorry photo of a mango blossom as you see, above you?

It never would.

It never did.

On the phone-camera, there is no way to focus the lens.

Everything seems automatic.

And, so, sometimes, the images turn out like this.

I am not one to take many photos, daily, as I once thought I might.

Still, when a mango blossom image turns out like this...then...it's such a let-down.

Also, just look at the difference in the size of the lens!

This is a 50mm lens, a NORMAL lens, on the Nikon.

Gods only know what kind of creepy lens is in my Samsung phone.

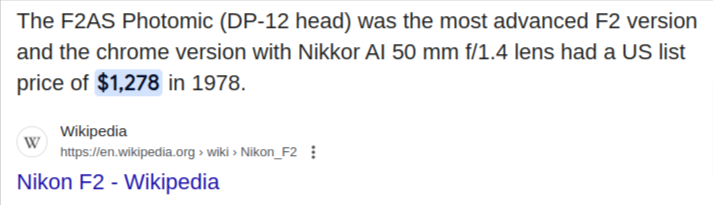

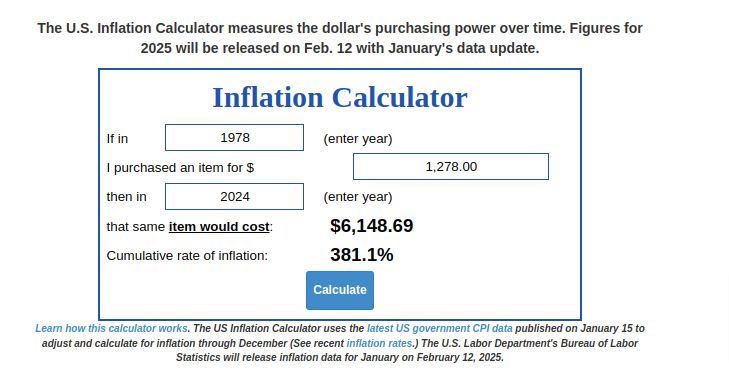

I must admit, the Nikon F2AS, back in 1978, cost about....

Today, the price of the F2AS would be about....

Therefore, I have absolutely NOTHING to complain about.

I am ONLY asking and wondering about....

What's wrong with this mango-blossom picture?

Next time, I hope to do better.

Thank you.

Regards,

Gamma

Note: Although this might, at first, seem like an Agricultural Topic, or a Photography Topic, or even a PHONE Topic....still.....

Please keep me in the Pub, where I belong....

Thank you.

The problem with your picture of a mango blossom? The main problem is it is not a mango blossom.

-

Something in the electricity bill box.

Couple of huskies at Cha Am.

-

On 2/5/2025 at 3:27 PM, Barney13 said:

That's possible, but would only be 200 baht (per print-out, not per month). I knew that I was almost certain to be under the taxable level, therefore didn't need the print-out, but was slightly annoyed to have to pay, why can't the app. go back to whichever month/year you want, total robbery!

Just ask for an FST for each transfer, they are free and are all the TRD want to see.

-

- Popular Post

- Popular Post

48 minutes ago, 10000Baht said:First of all I would like to tell you that what you wrote here is disrespectful to Thai people. Only my opinion!

Not in my case, because I really have no assessable income. My income is exclusively from a state pension. I know that and the tax authorities in my area revenue office know that too. In a 15 minute personal talk in his office the lawyer there also showed me the relevant legal text in the DTA, which I already knew. So in my case it is not a lack of knowledge about their tax rules. I think it's more the lack of guidelines for my specific case. I am not happy with: "Keep records and wait and see"!

My attempt to get his name and something in writing was answered by saying that I should ask to the area revenue office in writing. We did this in Thai language a few days later. After 3 months and several inquiries about the status, I received a written reply from the regional revenue office. Unfortunately, this did not help me either, because on a whole page only my personal details were repeated and it was confirmed that especially my income is exempt from tax in Thailand. My main question was, if I can get a TIN and have to file a tax return even though I have no assessable income. I didn't get an written answer to that question, but my area revenue office refused to give me a TIN because I have no assessable income.

After I got this letter from the regional revenue office in August 2024, I wrote an email (attached my correspondence with the regional revenue office) to the Revenue Department Bangkok, to get an answer to my main question. No answer. To date I wrote 4 emails at regular intervals, but have not received a single reply!

Do you have a bank account in Thailand? Do you get interest paid and withholding tax taken on that account? If so you are paying tax in Thailand on that assesable income and they should issue you a TIN. That was the reason I gave my local revenue department a couple of years ago.

-

1

1

-

2

2

-

1 hour ago, DrJack54 said:

Which immigration office

Ratchaburi. Bangkok Bank have not stamped and signed any of the 12 month statements and immigration has said nothing.

-

1

1

-

-

28 minutes ago, Speedhump said:

Why don't you strongly request that they do? Krungsri in Hua Hin do it without being asked.

Because my office accepts it without a stamp and signature.

-

1

1

-

1

1

-

-

22 hours ago, ronnie50 said:

That's a pity. It will probably look exactly the same..

Bangkok Bank do not stamp or sign the 12 month statement they provide for me. The statement is obviously printed by a business style printer and not a home printer.

-

1

1

-

-

1 hour ago, NoDisplayName said:

Not arguing. Merely asking for clarification. This is all new to most here, and the rules are.........complicated.

Asked about tax credits, because none have reported actually filing with a tax credit approved. (unless I missed one)

Asking whether your interest (which really wasn't interest?) was earned pre-2024, but TRD wouldn't let you claim prior savings.

It appears you could easily have self-determined, and provided documentation if asked, that your remittances were all non-assessable.

In that case you didn't need to pay tax, didn't need to file, and may not have even needed a TIN.

It appears you chose to self-determine, for your own reasons, that your remittances were assessable, and chose to owe tax.

Again, not arguing, asking for clarification. Your case would be atypical.

Not saying you are arguing, saying I don't want an argument with the TRD.

The money is interest.

Yes, I could just tell myself the money transferred was pre 2024 but as I was paid interest from the account in 2024 how would I prove to the TRD that I transferred pre 2024 capital and not the interest earned? Maybe they would never ask but for this year I am happy to keep it simple.

If there is more clarification about what they will and will not accept during the year I will adapt to any confirmed information.

-

1 minute ago, NoDisplayName said:

Wait................you declared US$13,500 interest earned entirely in the first quarter of 2024?

None of that was "in the bank" prior to Jan 01 2024, and thus non assessable?????????

I am not getting into arguments about whether interest earned was left in the account and savings from 2023 were transferred with the RD over 3,774 baht. I inherited some money from my grandmother years ago, I suppose I could argue that I have not spent any of that yet and am just starting to use it in Thailand. That would be tax free as well.

-

11 minutes ago, NoDisplayName said:

I assume you were unable to apply a foreign tax credit for any tax paid on that interest?

My accounts are tax free offshore.

-

3 minutes ago, NoDisplayName said:

If you had entered your foreign interest in 40(4), the system may have required matching with bank withholding records, with option not to declare if tax paid.

Might be that the system is designed for the Thai banking system with interest withheld at source, and taxed at a standard 15%.

Foreign interest likely does not fall under the Thai 15% rule, and is taxed as normal income, according to your specific tax bracket.

Putting the foreign interest as "derived from employment" means you should have paid tax at the 5% rate. That also allowed you to take the 100K exemption. If declared as interest, the "pension expense" would not be applicable.

Just my guess.

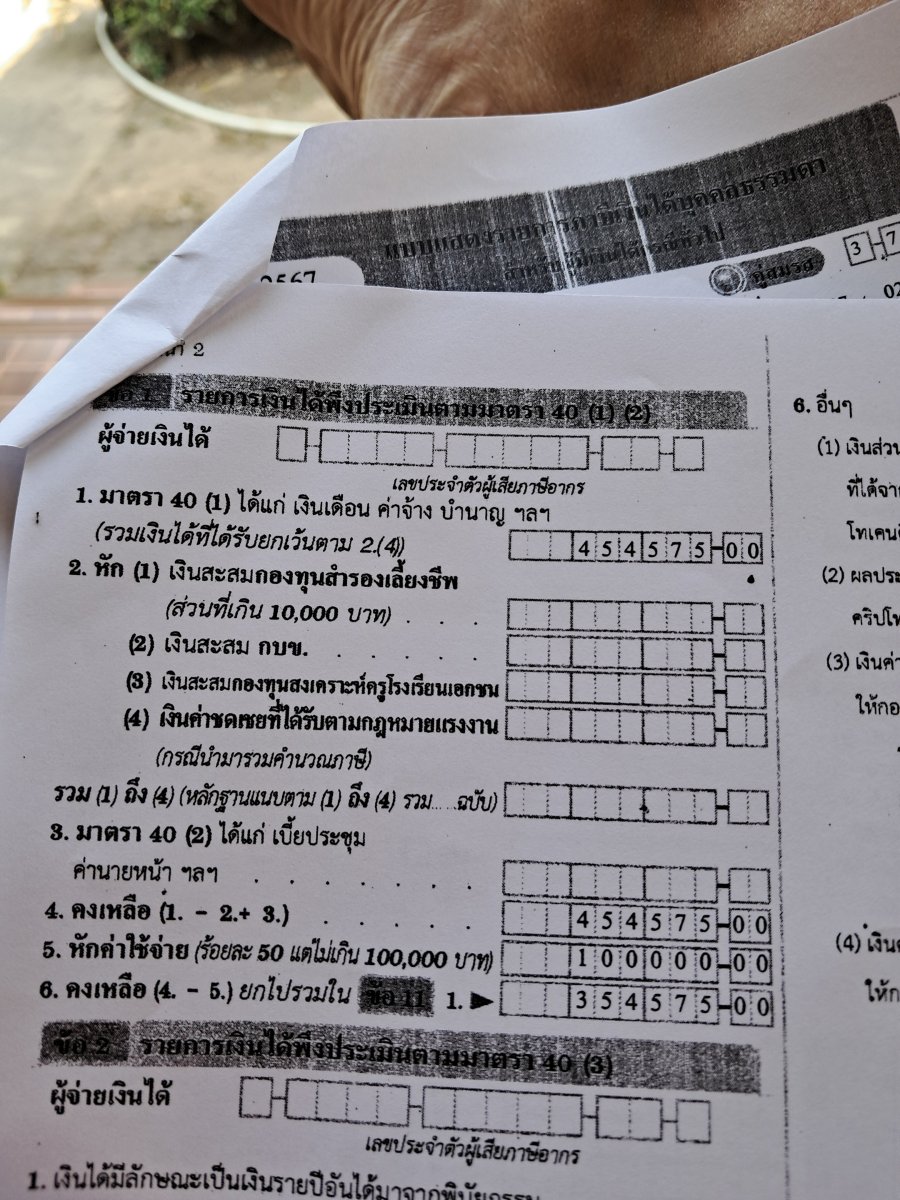

The calculations were as follows

Declared 454,575

Deductible expenses 100,000

Total 354,575

Thai bank interest 4,542

Total 359,117

Then 2×60,000 deductible for personal allowance for wife and I.

Total 239,117

First 150,000 tax exempt

Total 89,117

Tax bracket 5%.

5% of 89,117 = 4,455 to be paid

Subtract 681 for withholding tax paid

Total 3,774 tax to be paid.

-

1

1

-

-

54 minutes ago, Nickcage49 said:

I have a question. How do all of these wanted criminals get through immigration when they enter the country?

No question about how they are allowed out of the country they committed the crimes in?

-

1 hour ago, anrcaccount said:

OK, I stand corrected, one individual managed to pay a hefty 3774 THB.

I wonder what the income was processed as on the return, looks like we'll never know, as the paperwork was not received.

The income was processed under 1. 1. 40(1). That is for salary, wages, pension etc.. Theoretically it should be under interest I suppose but I am retired so it is like a pension to me.

If anyone is interested I put it into the tax calculator below and the amount it gives agrees with what I paid if my Thai bank interest and withholding tax is not taken into account. The calculator has no way of entering that.

https://www.uobam.co.th/en/tax-calculation

I include a picture from the copy of my return for the skeptics.

-

1

1

-

-

4 hours ago, thaibeachlovers said:

Even if that is no more than political speak, it's great to hear a politician admit that they don't have a mandate to waste taxpayer's money on any old nonsense, as has been happening as long as I can remember.

Then why has the money spent on condoms for Hamas doubled under the Trump administration? Last week Trump said it was $50 million and yesterday he said it was $100 million.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

Just been and done mine.

Situation, one year extension based on retirement, 63, married to a 62 year old Thai, one adult child who is working, wife does not work, 454,000 transfered from an offshore account, source of funds declared as interest, no dual taxation treaties apply.

Started at Bangkok Bank, asked for a withholding tax statement for myself and my wife. A bit of confusion because of the word "statement", their term is withholding tax receipt. Got mine, wife never keeps enough in her account to require one. Then requested a FST for the single transfer I had made in April last year, no issues getting that. If you haven't requested those documents before they were done at the teller desks in my branch. I tried at the sit down desks first which wasted a bit of time.

Went off to the local revenue office on my own, wife went shopping and home. Handed the nice lady behind the desk my withholding tax receipt, FST, tax ID and passport. Explained in my poor version of Thai why I was there. She seemed up to date on the requirement for me to file. She took my wife's details from a picture of the ID on my phone. I explained the money was all interest on a bank account and she asked me to sit and wait. I tried to point out a transaction for my motorcycle insurance that I made with a foreign debit card, she nodded but I am not sure she understood, the information was on a Thai insurance app and I had no hard copy of the transaction. Provided phone number and cleared up a few questions she had regarding passport. Shortly after that she printed the documents, pointed out I had 3,774 baht to pay and asked me to sign. Paid with QR code via bank app and was handed the receipt.

Asked if I could have a copy of the paperwork which was a mistake. They will do it but it is an "official" copy which requires more copies of passport, more signatures, stamps on each copy and a fee of 42 baht.

Started in the bank at 10am walked out of the Revenue office at 12:00. Would have been 20 minutes earlier if I hadn't asked for the copy.

-

1

1

-

1

1

-

2

2

-

2 hours ago, rwill said:

My sim card is in my wifes name. No problems using SCB so far.

The problem my wife has is with the KTB app. It will not run with our Bitdefender malware program on the phone. It pops up a message saying you need to uninstall it to use their banking app. The SCB app does not have that problem.

Had a similar problem with the BBL app a couple of years ago using Avast antivirus. Needed to deselect an option in Avast to get the bank app to work.

-

A 1992 2.4 litre Nissan Pathfinder. Nothing fancy about it and a bit underpowered compared to Land Cruisers, Patrols, Range Rovers and Cherokees. Used it mainly for fishing trips to the Red Sea. It could go anywhere and never got stuck. Pulled numerous more powerful 4X4s out of the sand and mud with it. Abused it for ten years and it never let me down.

-

1

1

-

-

Thank God this DEI stupidity never happened on Trump's watch?

https://www.faa.gov/newsroom/faa-provides-aviation-careers-people-disabilities

https://medium.com/faa/opening-doors-to-the-controller-workforce-d8d2ace46fa5

Will Thailand always remain a Third World Country?

in ASEAN NOW Community Pub

Posted

If you think nothing has changed in decades then you have not actually been here for decades. Monumental changes since I first visited in 1988.