- Popular Post

-

Posts

4,003 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Airalee

-

-

- Popular Post

- Popular Post

Anybody notice something in that picture?

Look who is missing.

I recently had the opportunity to talk with a group of black men in Los Angeles as I was passing through. When I asked them what they thought about DEI, their unanimous feeling was that it is great!*

*if you are either a woman and/or gay.

-

2

2

-

1

1

-

2

2

-

39 minutes ago, Ralf001 said:

There was no "change" other than the announcement the existing laws would be implemented.

I thought that the original law was to tax income that was remitted in the same year that it was earned.

Can you point me to where it previously stated that savings were to be taxed?

-

And it’s totally normal to find metal in vaccines…

right? RIGHT?

-

1

1

-

-

-

1 hour ago, impulse said:

Steak ‘n Shake announced that they will switch completely from cooking in vegetable oil to “100% all-natural beef tallow” by the end of February.

I remember how the taste of fast food fries took a nosedive when they went from real fat to faux oil. Thirty or 40 years later, we've found out that most vegetable oil is horrible for you.

I switched back to real butter 20 years ago for cooking at home. And it tastes so much better than margarine. Can't wait to taste French Fries cooked right.

https://dailycaller.com/2025/01/17/donald-trump-robert-f-kennedy-jr-beef-tallow-steak-n-shake/

Steak ‘n shake makes great burgers!

Butter is one of my essentials. Can’t live without it.

-

1

1

-

1

1

-

-

33 minutes ago, farangkinok said:

I forgot Virgie Tovar too.

-

2 hours ago, Ralf001 said:

These "taxes" are not new, been around for many many years.

Ok. It looks like the changed it to include savings as of 2024.

Good thing I decided to make Thailand a part time refuge.

It will be nice to spend more time back in the States and Vietnam

-

10 minutes ago, Will B Good said:

What did he do?

Oh….do you want me to google that for you?

I’ve heard that getting Covid lowers ones IQ substantially and all the mud bloods seem to be getting Covid quite frequently these days.

I already gave you a link to read when you first brought up Samoa.

now go back to mouth breathing

-

2 minutes ago, Will B Good said:

Well I’m doing better than the 80+ kids RFKJr wiped out in Samoa.

And much, much better than the thousands that Bill Gates shafted in India and Africa.

Now go do some push-ups

-

1

1

-

1

1

-

-

3 hours ago, thaibeachlovers said:

Well pointed out.

Whenever I see some fat frumpy short haired political woman on the tv I don't need to be told that they are leftist ( Democrat ) sort.

Q How can you tell if a woman is liberal without asking her?

A Tell her a joke and if she doesn't laugh, odds on that she is a liberal.

It’s the same thing with the pronoun crowd.

Even though I don’t vote and rarely get involved in any sort of political discussion, I am convinced that the left are fraught with personality disorders.

-

1

1

-

1

1

-

-

3 hours ago, Lacessit said:

How convenient, you forgot Taylor Swift.

Sarah Palin? I'd rather stick my d!ck in a rat trap.

Do you remember the video you posted of you and your girlfriend as she was jumping up and down your bed like the child she is?

I rest my case.

-

1 hour ago, Will B Good said:

“………..stating Kennedy “knows more about the science than most doctors.”

Wow…only been logged on for 2 minutes and already found the most cretinous statement of the day.

Lol

You sound jabbed.

-

1

1

-

-

22 minutes ago, rattlesnake said:

Nice and easy to read. I wonder what’s up with Ethiopia.

Here’s a detailed breakdown in case you’re interested

https://www.scribd.com/document/706856900/Deagel-2025-Forecast-by-Country

-

2

2

-

-

10 minutes ago, KhunLA said:

I guess you should have brought that in last month. Not like people didn't have plenty of warning.

Don’t you mean 2023?

Last month was 2024 and people are expected to file tax returns on remittances in 2024.

We didn’t know about this in 2023.

-

1

1

-

-

46 minutes ago, rattlesnake said:

Yeah, the guidestones were taken out with military precision… To my knowledge we don't know who did it.

Let me put on my tinfoil hat.

What is interesting about the Deagel reports is that it states that the population of western countries would collapse by up to 77% in the UK 68% in the US…but for Thailand, only 3.7%

On one of the old “pro-vaccine” threads had a comment where the poster stated that he went to get his MRNA shot and when inquiring about one for his girlfriend was told that “these vaccines are only for foreigners” or something to that effect.

Things that make you go hmmmmm. 🤔

-

1

1

-

-

3 minutes ago, rattlesnake said:

Interesting…

Deagel predicted in 2020 that the world population would drop massively by 2025… which is most likely not happening (though there are concerning trends) and the report has since been removed.

But when one looks at who is behind Deagel, it gets very interesting as those are some of the most powerful people in the world.

The Exposé did a paper on it in 2023:

Dark Secrets Exposed: CIA is behind Deagel’s Shocking 2025 Depopulation Forecast & Official Excess Death Figures in the Millions prove it’s on Target & not just an Estimation

We can confirm that Dr. Edwin A. Deagle Jr., who passed away on February 16th 2021, is the confirmed figurehead authorities would like you to believe is solely behind Deagel.com.

During his life, Dr Edwin served as the Assistant to the Secretary of Defense and the Deputy Secretary of Defense. He was also the Director of International Relations for The Rockefeller Foundation, an influential global philanthropic organization.

https://expose-news.com/2023/08/06/cia-deagel-2025-depopulation-on-target/

Ahh…I’m going to have to read that article. I only read tidbits here and there by commenters on other sites. I never knew who Deagel was or his connections.

I wonder if all those powerful people behind Deagel side with Malthusian economics.

I also heard that the Georgia Guidestones were removed shortly after the pandemic started.

🧐

-

1

1

-

-

12 minutes ago, Lacessit said:

You just can't be polite when someone disagrees with you. You also respond to factual posts with nothing but abuse. It's called argument ad hominem.

The tax thing is way overblown. based on my own situation. I won't be paying taxes here for at least ten years. IMO many other retirees will find their situation is similar.

My experience with Thai government hospitals has been better than I could expect in Australia.

If you don't like it here, go back to whatever country you came from. I for one won't miss you at all.

Lol

pot, kettle

-

1

1

-

-

1 hour ago, rattlesnake said:

That's a pretty compelling speech she made there.

There is no more stopping the truth at this point.

What happened these past few years was terrible.

I hope it will be possible to help all the injured people who are still alive, and hold the criminals accountable.

The insults and gaslighting seems to be the same as it ever was here on the forum. I expect it to be the same worldwide.

I wonder how much this all ties in with that Deagel population projection report I read about.

-

- Popular Post

- Popular Post

-

8 minutes ago, bkk6060 said:

Is it worth not paying taxes to be there?

What is the girl scene like?

I’m here with my Thai girlfriend so the girl scene is great as far as I’m concerned.

For single men, I couldn’t really tell you although the women here haven’t ballooned out like people seem to complain about the Thai women doing.

-

1

1

-

-

- Popular Post

- Popular Post

-

1

1

-

1

1

-

1

1

-

1

1

-

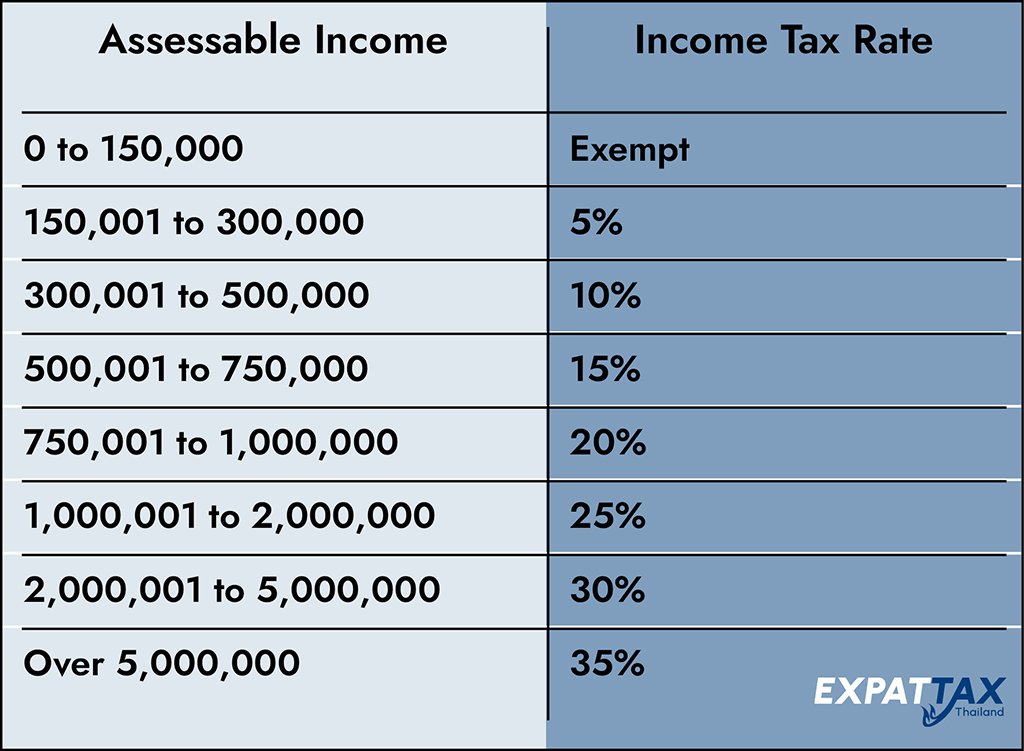

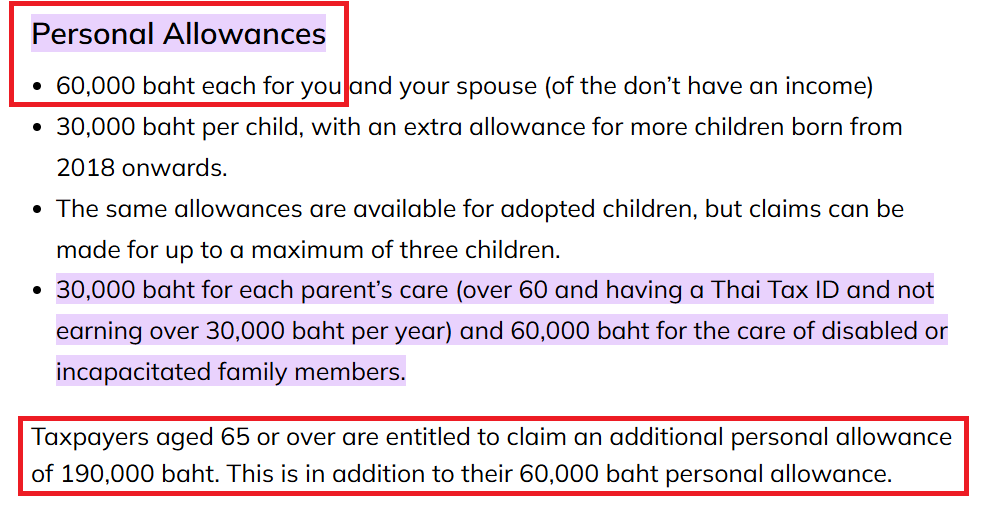

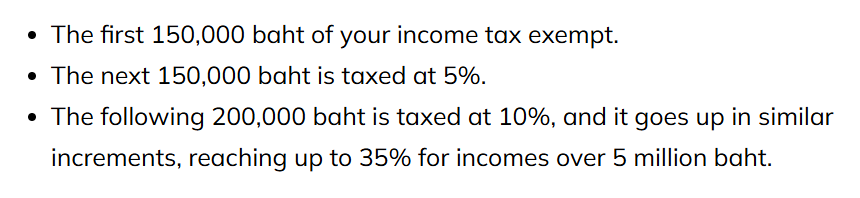

47 minutes ago, KhunLA said:

Don't know where you are getting 600k exemptions from.

I did forget about the first 150k is exempt, so that would be 210k (150 + 60).

Of course if 65 +, then another 190k exempt.

My #s are for single person 50-64 on visa for retirement, with no deductions. Most negative scenario.

300k (150k) @ 5% = 7,500

next 200 @ 10% = 20,000

next 90k @ 15% = 13,500

Total ฿41,000

That's not worth leaving for.

Taxes definitely aren't an issue.

Worse case scenario of ฿41,000

Now run those figures on double the amount (1.6 million) for not married, under 65 with half the income being from long term capital gains.

I thought about transferring $100k USD to use as an emergency fund for healthcare. I would sell off a small amount of stocks to get part of that $100k so most of my income for that year would be long term capital gains back in the US (Nevada).

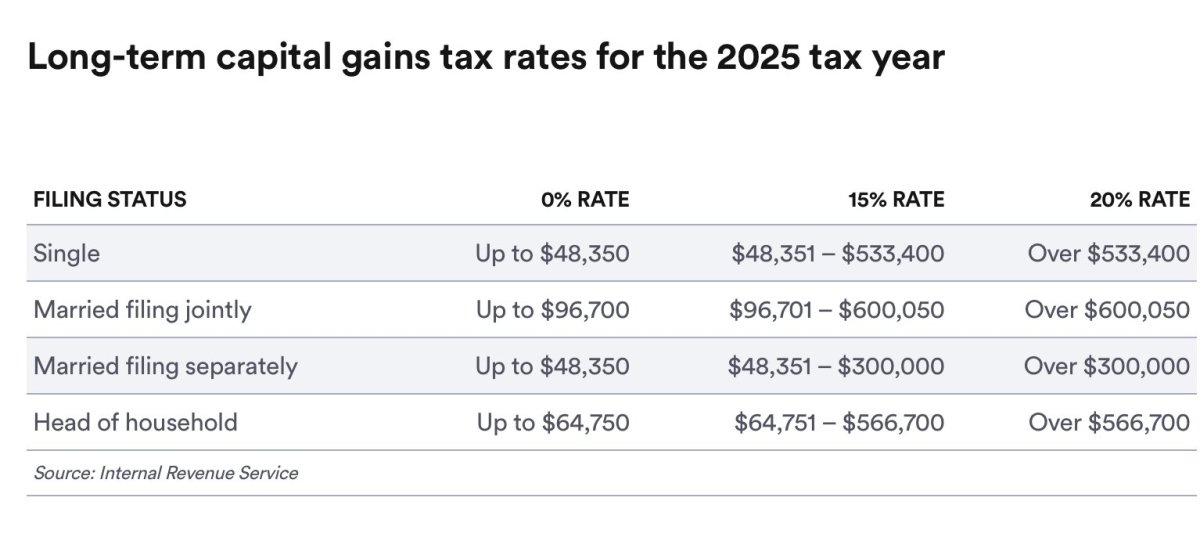

Here is the chart showing the federal capital gains tax brackets for 2025

Tell me that it’s not worth bouncing out of Thailand for 6 months when those amounts are involved.

But there are a lot of people who seem to be angry about that and want to give me some kind of lecture about choosing to limit my time in Thailand.

Why should they care what I do? Why should they even address what choices I make? Jealousy perhaps?

-

- Popular Post

47 minutes ago, Lacessit said:The roads in Chiang Rai are fine. There is a very good government hospital, three or four private hospitals. Three shopping malls, a large day market. Perhaps you are living in the wrong part of Thailand.

You use the term leftist as approbrium.

Here's a news flash - leftist governments in Australia brought in universal healthcare, subsidized medicines, the Fair Work Commission, and the Austraiian Consumer and Competition Commission.

It's nothing like the dog-eat-dog cluster###k that America has, where its citizens are conditioned from birth to regard "left" as inherently evil.

Only a leftist would post pablum such as this…

“So you have never used or benefited from the Thai transportation infrastructure? You know, the airports, roads, BTS, SRT and domestic airlines?

You may have not had to use the services of the Thai healthcare, fire or police services but they are all there and will benefit you if you need them.

The people who service your demands at the retailers, government offices, restuarants, hotels et al all have to be educated and assisted like any other nation does.

The cost to deliver the electricity and water you receive and use are not covered by the user fees. It's the government that pays for the dams and electricity and water delivery network.”

When I take a taxi, I am paying for the service of a private company. The same goes for the BTS as it is mostly privately owned and operated by BTS group holdings.

When I need healthcare here in Thailand, I pay for it. The few times I have used it at a government hospital, I still had to pay for it….and more than a Thai person would have to pay. The “special after hours clinic” at Chulalongkorn Hospital is actually more expensive than the private hospital I usually go to.

When I go to a public park, I have to pay for it. Ten times as much as a Thai.

When I take a trip on a plane, I pay airport taxes. Sometimes, the taxes are higher than the fare.

When I go to a restaurant or a hotel, I pay for it. The fact that people who work there were educated somehow in the past does not mean that I should be paying extra taxes for the privilege of buying something from a private company.

All of Patongs assertions are indeed extremely leftist and dishonest.

If I am expected to have a certain amount of money here (800k) to live in order to show that I can take care of myself and not be a burden on the government. That is fine.

But to expect me to pay more taxes, and stating that it is my responsibility to pay these as part of the social construct, then I do not think it is unreasonable to expect the same benefits that Thais would receive from paying these taxes.

The Thai government can’t expect us to pay taxes while still benefitting from different Thai/foreign prices. That is crap.

-

1

1

-

2

2

-

1

1

-

2 minutes ago, marin said:

You are being aggressively disingenuous right now, fact!

To have even brought this up shows something. We are discussing a Serbian immigrant to Canada and his trolling and you come up with "disingenuous."

Who has an agenda? Only you....

no. Telling me that taxes are covering my healthcare is disingenuous.

Telling me that I should pay taxes to pay for potholed roads that never get fixed, dangerous sidewalks that never get fixed, schools that can’t even provide decent educations, even bringing the “street food seller” into the argument is disingenuous.

It’s leftist nonsense.

If Thailand wants us to pay the same taxes as other Thais, then we should get the same benefits as other Thais. Period.

-

1

1

-

1

1

-

1

1

-

The Troubling Decline of DEI: A Step Backward for America

in World News

Posted