-

Posts

4,002 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Airalee

-

-

4 minutes ago, atpeace said:

Really! That is not an official Thai document but simply a guide to help international execs in Thailand file taxes.

In the three examples for 3 tax years there is no mention of cap gains -555. They do quickly go over cap gain but simply state it isn't taxable unless you bring those cap gains into Thailand or they are earned locally. How would you conclude that all cap gains earned will also be taxed at 30% vs the USA cap of 15% is nothing but insanity.

Calm down and re-read the article. Is that article the reason for your fear?

No. And it’s not an “article” like the slop we have been fed by independent tax advisors here on AseanNow. I trust KPMG a little more than what I read here.

And when the government clears things up so that there are no questions, I will reassess where I want to spend the majority of my time.

I’m quite enjoying Danang this year however 😁

-

1

1

-

1

1

-

1

1

-

-

3 minutes ago, atpeace said:

Hmm, and for some reason those saving have disappeared? Is there a reason you can't keep sending prior years savings?

I never said they disappeared. I just wanted to replenish them and pay capital gains tax at 15% and not have to pay the extra 15%.

Be thankful you are in a lower tax bracket.

How much do you keep in cash?

-

1

1

-

-

6 minutes ago, JonnyF said:

Up to you.

But it seems strange logic to reject a 10 year visa on the basis it is not long enough when you currently have to do annual extensions whereby the rules could change from year to year.

A bit like saying a Ferrari isn't fast enough so I'm just going to keep my Suzuki Swift.

How long has the non-o visa program been running so far? I expect it will continue. I’m quite happy with it.

With regards to the taxes, I’m fine being out of Thailand for half the year for the time being.

-

2

2

-

-

- Popular Post

2 minutes ago, Patong2021 said:Rubbish, because you cannot offer one intelligent counter argument.

I pay for my healthcare at a private hospital. It is not subsidized by the government.

The infrastructure is crap. The roads are crap. I barely drive and instead use taxis.

What you wrote was nonsense. But to be expected from a leftist such as yourself.

I’m quite content to have Thailand as a temporary residence from now on. It’s not worth hundreds of thousands of baht annually in taxes to live there full time.

Thanks, but no thanks.

-

2

2

-

1

1

-

2

2

-

5 minutes ago, atpeace said:

What ever. You know exactly how capital gains taxes that were paid in America will be handled here in Thailand. Keep at - it is entertaining.

Section 2.10

-

1

1

-

-

1 minute ago, JonnyF said:

So you are on a visa that needs renewing annually and 90 day reporting but don't like the idea of a 10 year visa with 365 day reporting that also gives tax benefits, fast track at the airport etc.?

Nope. Not interested.

-

2

2

-

-

7 minutes ago, atpeace said:

You don't know this and you stating your beliefs as fact is what make these threads so entertaining.

You should educate yourself on how the tax treaties work.

-

1

1

-

-

5 minutes ago, atpeace said:

You don't know this and you stating your beliefs as fact is what make these threads so entertaining.

This law is not new and I assume you are also back filing past returns where you didn't pay the difference. It was due by your definition and you are going to have a big tax bill.

Up until now, I was remitting only savings.

-

1

1

-

-

4 minutes ago, Patong2021 said:

So you have never used or benefited from the Thai transportation infrastructure? You know, the airports, roads, BTS, SRT and domestic airlines?

You may have not had to use the services of the Thai healthcare, fire or police services but they are all there and will benefit you if you need them.

The people who service your demands at the retailers, government offices, restuarants, hotels et al all have to be educated and assisted like any other nation does.

The cost to deliver the electricity and water you receive and use are not covered by the user fees. It's the government that pays for the dams and electricity and water delivery network.

And so on. Unless you are already paying coprorate and personal income tax, you are most likely one of the majority to takes more than he pays.

Nonsense

-

1

1

-

1

1

-

1

1

-

-

2 minutes ago, JonnyF said:

How long is your current visa?

Non-O retirement extension. It can be extended indefinitely.

I’m not willing to take the risk that they will want a lot more money stuck in the bank here in order to get a new non-o based on retirement when history has shown that people at lower levels (they used to require 400k before it went up to 800k) are grandfathered in.

-

1

1

-

-

Just now, atpeace said:

What about short term caps gains that are taxed higher than Thailand? What about income in different tax brackets that are taxed different? What about exclusions in one country vs another? What about prior year losses that are treated differently? The list could go on. IMO, Thailand isn't going to tax income that is already taxed.

There was a reason for tax treaties and the above what if scenarios was the reason. Up to you and you may be right. Again, I'm not going to lose any sleep over something I think is very improbable.

I’m referring to long term capital gains. Short term (for a trader) are taxed at income tax levels in the US. Higher than the 15% I will pay for the long term In Thailand, those gains will be taxed at 25-30% for me so I would be responsible for the difference between what I pay in the US and what Thailand wants.

Tax treaties don’t mean that you pay 0% taxes here on income taxed already in the US if the tax rates are different. You are responsible for the difference.

I don’t know why you are having such a difficult time understanding that.

-

15 minutes ago, JonnyF said:

Have you considered an LTR visa?

The 90 days becomes 365 days and I believe it also helps with the new tax laws (although being Thailand that is not clear yet).

It's reduced my income tax in Thailand significantly.

I won’t consider the LTR visa because it is only 10 years.

-

2

2

-

-

3 minutes ago, Patong2021 said:

Nice try. VAT does not cover anywhere close to what the government is spending for your benefit. In Thailand, VAT represents 33% of tax revenues. You receive far more in services than you contribute in VAT.

Tell us specifically what the government spends for our benefit.

Submarines and fighter jets?

We certainly aren’t getting low cost healthcare. And the infrastructure isn’t worth paying hundreds of thousands of baht for.

Your tax situation might be different.

-

30 minutes ago, Jonathan Swift said:

Here's where consulting an expert helps. I read and have been told that if you have documentation showing you have already been taxed in your home country Thailand will consider that income exempt. I don't know if it only applies to certain kinds of income, but there is supposedly an agreement between countries regarding this

No.

It depends upon the brackets and if Thailand has a higher tax at a certain level of income than in the US….which is applicable in my personal situation, we are required to pay the difference above what we already paid in the US.

For example. If something is taxed at 15% in the US and 30% in Thailand, I would pay the 15% in the US and then the difference of 15% would be paid in Thailand.

-

1

1

-

-

42 minutes ago, atpeace said:

I get it but seriously doubt you will be taxed twice on the same income. Might happen but in my estimation the odds are tiny. Personally not going to lose any sleep over it.

It’s not about being “taxed twice”

Capital gains tax in the US is 0-15% for my tax bracket.

Here, at the bracket I am in it would be up to 30%

Legally, I would have to pay the difference which is quite significant.

It’s not about “might happen”….it’s just the way it is. Thai capital gains taxes (on US based investments) are taxed differently.

Your tax situation might be different.

I’m not losing sleep over it.

-

- Popular Post

2 hours ago, atpeace said:Tax dodger?

I'm not worried at all about any new taxes in Thailand. I would bet you would fall into the category that earns income and resides here to avoid paying taxes on that income. If you have paid taxes in another country, I would chill and wait and see. Doubt your tax bill will more than zero assuming you aren't a freeloader. Severe anxiety sucks dude!

Not everybody is a tax dodger.

I pay taxes in the US even though I don’t necessarily like what they are spent on (never ending wars and illegal aliens instead of the homeless).

But being that Thailand taxes capital gains at income levels I am just fine spending more time back in the US and Vietnam and less in Thailand.

If we actually got something for the taxes we pay….such as healthcare, I would feel differently.

I’m not interested in paying for submarines and fighter jets.

-

2

2

-

2

2

-

1

1

-

5 minutes ago, placeholder said:

Epidemiological evidence shows that they will be more likely to dance on yours. Is there any particular dance style or song you'd like to request?

-

1

1

-

-

1 hour ago, Woke to Sounds of Horking said:

Why are the trees unaffected?

Did the man's property have fencing with iron nails and was that fencing burnt at the nail joints?

If there is a God why would God spare this man and nobody else? Hardly a merciful God then.

Is this Photoshopped? (thereby rendering the above 3 questions null and void...)

Some people just got lucky I guess. Here’s an article about it.

-

7 hours ago, kingstonkid said:

The fun for this state is going to be when people try to rebuild their houses and find out that they can't due to the new rules that have been in place for the building codes as well as the different parts of the California government that have to authorize the new buildings.

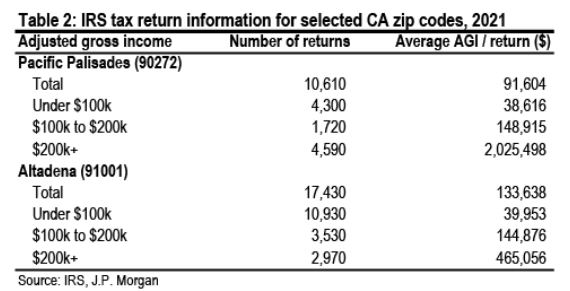

The majority of the people who lost their homes in both Pacific Palisades and Altadena are too poor to replace their homes. The fires supposedly have caused over $250 Billion in damage and there is only an estimated $20-30 billion in insured losses. Most have no insurance either through cancellation of their policies or they just couldn’t afford it in the first place. The California FAIR program only has about $750 million with an additional $2 or 3 billion in reinsurance.

Most people are conditioned to think people in those areas are super-rich…but they aren’t. Even though the average house in PP was $3.5 million and $1.2 million in Altadena, most of them are/were house rich (millionaires on paper only), and many of the homes were either bought a long time ago or inherited by children who also inherited the prop 13 tax basis (1/10th of what the people who bought recently) so could afford to hold onto the homes….barely.

Here’s some info on the incomes of the people who lived there….most will be lucky to afford a decent 1br condo when all is said and done.

-

28 minutes ago, Presnock said:

in the long run, can be cheaper than locking your money up in a Thai bank. Plus, no 90-day reports, in and out of the country free as much as you want, easier return at the airport...no need to obtain bank letters, etc every year. just saying, I was on a retirement o for 20 years and after reading the benefits of the LTR, changed as it fits me much better.

Understood. Your situation may be different than mine as you can see if you check out my post just a few above this one.

Of course…there are no guarantees with any visa I choose, but for me, I feel more comfortable with the retirement non-o

-

28 minutes ago, gejohesch said:

It is not at all uncommon that one would have to declare for tax in a given country even if that does not involve a tax liability.

I give an example I know very well. Certain foreign residents in Portugal have had for years been living under the so-called RNH system ("Residente Não Habitual") with the requirement to declare their worldwide income to the Portuguese authorities while as a matter of fact the taxation rate applied to the declared income was 0% (YES!). Needless to say, that system was fiercely attacked by other countries and the taxation rate under the RNH regime is not 0% anymore (but still rather low).

Thanks for the clarification 🙏

-

1 hour ago, oldcpu said:

Thailand is not that desperate yet IMHO.

I don't know the actual statistics, but I wager the majority of the unsold condos are Thai freehold.

If I am correct, and if Thailand really wanted to help sell unsold condos, they would change the condo foreign freehold ratio, allowing foreigners to own more than only 49% of the units. Say increase it to 60% max. They could at the same time add a clause that the 'combined vote ratio' of foreign freehold units is not exceed 49%. Which would mean in an annual meeting, a foreigner's vote would count a bit less than that of a Thai person. While that sounds ugly, in my experience the majority of those who actually show up and vote at a condo Annual General Meeting (AGM) tend to be foreigners (although that may only be the case for the high end luxury condo market).

However while there has been some talk, I would also wager there will be no change to the allowed foreign-freehold ratio.

That would be an interesting statistic to know. I’ve never been to an AGM in the 4 1/2 years I have owned my place. So far, it seems to be running fine without my vote. I’d be ok with my vote being worth less as you say.

-

27 minutes ago, JohnnyBD said:

Maybe for some, it's not having to worry about paying Thai income taxes on remitted monies, or the convenience of not having to do 90-day reports & yearly renewals, or the cost savings (I was paying 5,700B yearly, 1,900 + 3,800 MRE permit with my Non-O plus the cost of bank statements, taxis and the time to go to IM, so 50k for 10 years is only 5k per year, plus the 800k can now stay in my home country bank earning 4.1% interest instead of .1% in my Thai bank, that's a savings of 32k per year. Like you said it may not be for you, but it definitely was worth it to me and many others. Good luck...

Fair enough. I’m more interested in staying on the same visa and (hopefully) knowing that I can extend it until death and not be stuck with a huge change in requirements (financial/availability) when it comes time to renew a 10 year visa.

Old Non-O retirement visas are still grandfathered in at the 400k baht level and I hope they do the same with mine if they raise the bank account requirements in the future. Fingers crossed.

That’s why I never bought into the elite visa when it was 1 million baht (no frills option) as now, I would be 7 years away from needing to renew it and the cost is 5 million for the same 20 years. And that might not even carry me until death.

The best deal would have been the elite visa that would have been good for life but that was before my time and from what I understand, it was changed to 20 fairly quickly.

-

50 minutes ago, gamb00ler said:

I think it's unlikely that you can pay in US$ with a credit or debit card in Thailand. Usually the hospital's agreements with the VISA/MasterCard processing companies would limit them to Thai ฿ transactions. In the US those companies insist all purchases are processed in the local currency (US$).

I think paying with US currency would be easily accomplished.

Yes. I can. My hospital gives me the choice.

-

2

2

-

I am leaving Thailand - yes taxes!!!

in Jobs, Economy, Banking, Business, Investments

Posted

Yes, it is.

I’m not sure why it bothers people so much that some of us are deciding to pull up roots until the government makes things crystal clear.