-

Posts

2,586 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by RSD1

-

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

You are sure of that? And what about alcohol? -

Thai Olympic Boxing Gold Winner Jailed for Attempted Sexual Assault

RSD1 replied to webfact's topic in Thailand News

Hasn't aged very well. Doesn't look at all like an Olympic athlete. More like Som-Sack. -

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

I much prefer weed to PM2.5, don't you? -

Another great song for when you are high:

-

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

So you’ve tried taking a break? That’s interesting you get that kind of relief from cannabis because you are feeling pain-free 24 hours a day, but yet the half-life of THC and CBD in the body is usually no more than about 6 hours. -

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

Personally, I would never do it. I don’t smoke joints to begin with, nor would I want to consume a carcinogenic substance like tobacco. But lots of people do it in Thailand. Even with bongs. To me, it’s like putting ice in your beer, which is something else you see quite often in Thailand. -

Came across this last night when I was feeling pleasantly couch locked:

-

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

It sounds strange, but I see lots of people in Thailand doing the opposite. They aren’t cigarette smokers, but they add tobacco to the weed to make it less potent when they are rolling up a joint. This way they can smoke through a whole 1g joint without getting too zooted. I guess they figure it’s better than only smoking half a joint of pure cannabis and then having to keep the rest for later. -

Weed or Cigarettes? Which would you rather have?

RSD1 replied to RSD1's topic in Thailand Cannabis Forum

Ever thought about taking a week off from smoking weed to see how you feel? Not suggesting you stop if you enjoy it, but it could help you figure out if the joint pain might have cleared up on its own earlier and whether the relief is unrelated to cannabis use. Honestly, it sounds like it could possibly be a placebo effect. -

Love that Santana Supernatural stuff. Big fan. Otherwise Pink Floyd, Enigma, Depeche Mode, Everything But the Girl, Cafe Del Mar, and definitely some Sade when I’m burying the bone.

-

As of now, 20 grams of good weed in Thailand costs the same as a pack of cigarettes. A pack of cigarettes, which contains about 20 grams of tobacco, sells for an average price of around ฿140 in Thailand for Marlboro and other popular Western brands. Meanwhile, you can buy 20 grams of good weed at ฿7 per gram, totaling ฿140. In fact, you can even find decent weed for as low as ฿5 per gram, making 20 grams cost even less. So, which would you rather have?

-

Which ฿30/Gram Weed Seller Is Your Favorite?

RSD1 replied to HugoFastor's topic in Thailand Cannabis Forum

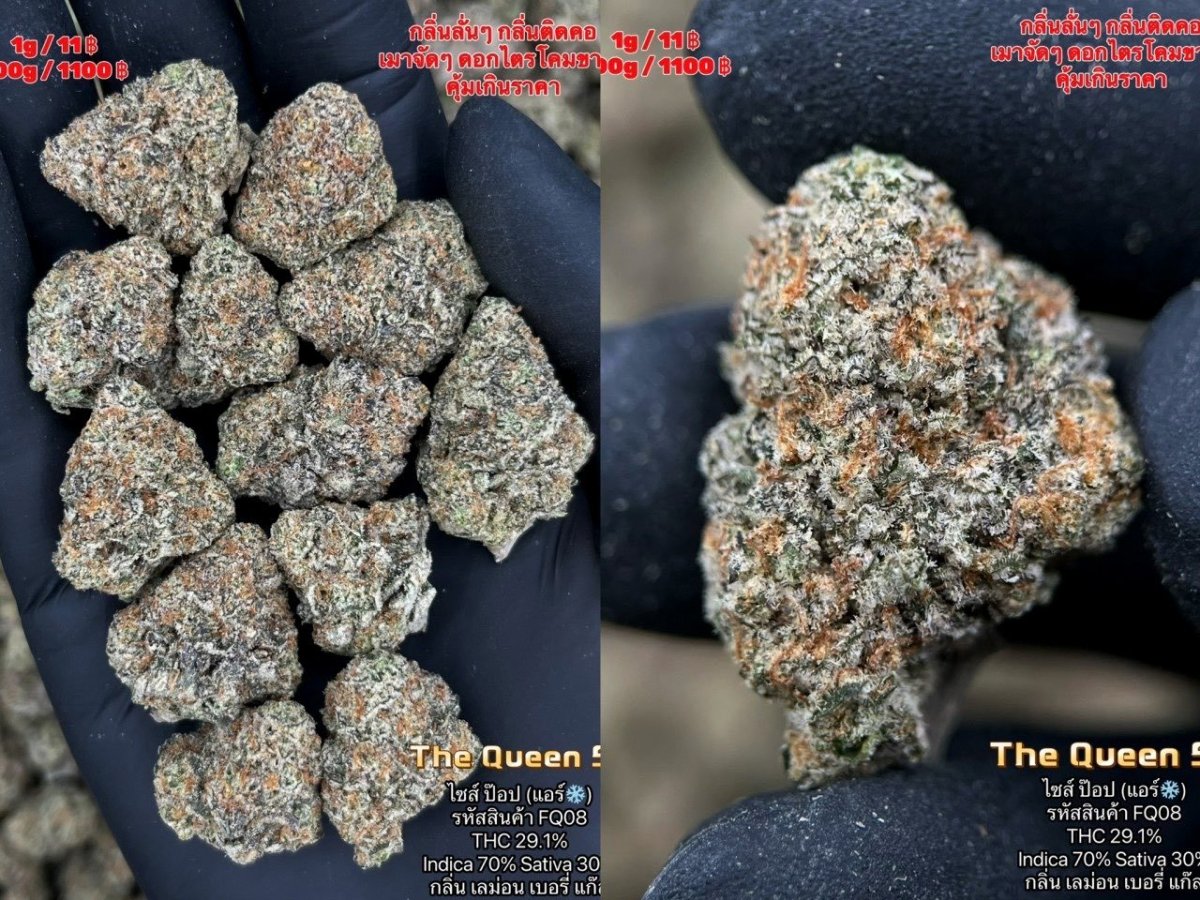

What I tend to do is look at is how many buds are in the hand in the photo on the left as it is often harder to judge the size and density of just one isolated bud in the fingers. If the hand is only holding 10-12 buds then I suspect the buds are generally good sized. The American Pie I just posted only has 10 in the hand and The Queen below has only 12 buds. On a lot of the stuff he offers you will see an average of 15-18 buds in the hand and some of it also looks a bit leafy. To me that suggests loose, leafy popcorn buds and probably not the best quality. The Queen strain below appears to be indoor grown and not Evap. Looks like really good value too for 11 Baht a gram. -

Which ฿30/Gram Weed Seller Is Your Favorite?

RSD1 replied to HugoFastor's topic in Thailand Cannabis Forum

This looks like some really nice, tempting bud (from @fh420 - Fis high 420). It is Evap, but these look like big dense nuggets with some nice trichomes. THC might be less than 20% in real life, but for 7 Baht a gram I am sure it is good value for money and I have never seen big nuggets like this for that price. A lot of what they are offering now is popcorn buds in the 5-7 Baht range, but this looks well worth the price. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Is porking your stepdaughter and accidentally impregnating her only considered misbehavior? Perhaps in South Africa. It didn't go so well for Woody Allen though. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

I sense he would much prefer going to Uranus. Really, any anus would be more suited for him for that matter. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

I didn't write those 1800 words. I merely copied and pasted that text from the link I provided. My post itself was really only a paragraph. Anyway, just "ignore it" all and thank me later. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Indeed, and neither history nor his legacy will ever include any of those titles. Justice! -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Yeah, I would hate to be on some distant planet when that car he launched into space falls on someone's roof. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Well, perhaps that is fitting and people should be remembered for the terrible things they did for the last 2/3 of their life instead of the impressive things they did in the first 1/3. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Completely off topic. This isn't another politically obsessed topic about Harris, Lefties, Righties, Liberals, POTUS or anyone else you want to throw in there. It is about one man, Elon Musk, with his decaying mental health and who is now the $44 billion king of false, misinformation being dumped onto the masses. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

More bad news. Thanks. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

People attacking Sam Harris throughout this topic are just another common case of killing the messenger. Personally, I know very little about him, nor do I really care who he is. It's what he wrote about Musk so pointedly that was relevant and why I created this topic. It could have been written by my dog and it would have been equally relevant. This topic is about Musk and not Harris. But as usual, people quickly digress, race to the lowest common denominator and/or decisive politics, and immediately lose sight of the goal post. However, for those who insist on focusing on Harris, he is an American author, philosopher, neuroscientist, and podcast host known for his work on topics such as philosophy, religion, neuroscience, and ethics. He is also one of the leading figures associated with the “New Atheism” movement, alongside thinkers like Richard Dawkins, Christopher Hitchens, and Daniel Dennett. Harris gained prominence with his 2004 book, “The End of Faith”, which critiques organized religion and advocates for a rational and scientific approach to understanding morality and the world. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

A group of crazy, eccentric individuals on the streets of Manhattan, ignored by everyone, cannot be compared to sophisticated disinformation presented through well-designed digital media on Twitt-X. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Around ten years ago, I was genuinely impressed by Elon Musk’s accomplishments and often praised him as someone making a positive impact on the world. Many of my friends were skeptical even then, dismissing him as just another dubious billionaire. At the time, I defended him, but looking back, I can see they were absolutely right. It wasn’t long after that my opinion of him began to shift dramatically. Today, I see him in a completely different light; lacking integrity, emotionally unstable, spreading lies, misinformation, and conspiracy theories. He now comes across as totally greedy, self-serving, and self-absorbed, acting like an immature and disruptive politically motivated troublemaker that the world could do without. And his recreational drug use only seems to make him even more erratic and unstable. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Pretty sickening. And as they say, the fruit doesn't fall far from the tree: https://www.snopes.com/fact-check/elon-musk-father-kids-stepdaughter/ He also comes across as quite deluded: