-

Posts

2,586 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by RSD1

-

As I already wrote as a response on a previous post, perhaps the source of confusion is that some vendors in Thailand, particularly small businesses or those operating with very narrow profit margins, may charge a 3% fee for payments made with a debit or credit card. This policy is not related to whether the card is from an overseas provider (like Wise or Revolut) or a local bank. The same fee applies regardless of the card’s origin. Essentially, this surcharge is the vendor’s way of covering the fees they incur from Mastercard or Visa for processing card payments, rather than absorbing those costs themselves.

-

Sorry, but not true. Once you add the Thai Baht currency to your Wise account then you can hold THB in a Wise spending account and you can also create THB jars. At the moment, I have THB in my Wise spending account and I also have multiple jars with THB in them as well. So it definitely works and it's definitely possible.

-

I can't say about Revolut, but I have a Wise card and I use it in Thailand daily and I have never gotten charged any surcharge at all by any vendor for using an overseas card. Perhaps where you're getting confused is that some vendors in Thailand, particularly if they are a small business, will charge a 3% fee for you to use a debit card or a credit card to make payment for your purchase. This policy has nothing to do with the card being from overseas or not and they would still charge you the same fee even if you were using a local card. It is merely the vendor tacking on a 3% surcharge to your purchase to cover their own fees that they will be charged either from MasterCard or Visa when accepting a payment from a customer who is using a debit or credit card. In those cases where the vendor tells me that there is going to be a 3% surcharge for using my card, then I normally just pay in cash or via bank transfer by scanning a QR code. With bank transfer, they won't charge you the extra 3% surcharge because they don't incur any fee for receiving the money electronically using this method.

-

Meet Wise Interest

RSD1 replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

All I know is that they deduct 30% from the interest I earn on my Wise account balances. And the address on my Wise account isn't in Thailand. -

Yes, they both offer the midmarket rate. But Interactive Brokers has no limit on exchanging at the mid market rate without fees whereas Revolut does have a limit and then starts charging fees. See below: When converting US dollars (USD) to Thai baht (THB) in your Revolut account, the fees depend on your subscription plan, the amount exchanged, and the timing of the transaction. Here’s a breakdown: • Standard Plan: • Exchanges up to $1,000 per month are free on weekdays. • A 1% fee applies to amounts exceeding this limit. • Plus Plan: • Exchanges up to $3,000 per month are free on weekdays. • A 0.5% fee applies to amounts exceeding this limit. The plus plan carries a fee of £40 per year. So Revolut is free on currency exchange only up to a maximum of $1,000 per month on their free standard plan. Revolut also charges a standard 1% fee on all weekend currency exchanges, regardless of plan or account type.

-

If you have a Thailand address on your account then the feature to order both physical and digital cards won't be available to you. If you are able to use your UK address on your Wise account as your residence address then the card features will appear. Basically Wise is only licensed to issue cards in the UK, European countries, the USA and possibly a few other countries. That's why it's all based on your residence address on your Wise account.

-

First, I transfer a foreign currency (dollars, euros, pounds) into my Wise account. I then convert it to Thai Baht when the exchange rate is most favorable. After that, I maintain a Thai Baht balance in my Wise account to spend from. This ensures that all my transactions are made from my Thai Baht balance, avoiding conversion fees on each individual card transaction. Wise typically charges around 0.54% to exchange most major currencies into Thai Baht. Revolut, on the other hand, allows you to exchange most major currencies into Thai Baht at the interbank rate with no exchange fee, but only up to $1,000 per month on the free plan. After that, they charge a 1% fee on exchanges. In essence, if you were to spend the equivalent of $2,000 in a month using their cards, the fees would end up being roughly the same (around 1%) with both Wise and Revolut.

-

Meet Wise Interest

RSD1 replied to CallumWK's topic in Jobs, Economy, Banking, Business, Investments

30% tax withholding on all interest earned is deducted and paid to the Belgian government. No refunds. -

In my opinion, neither Wise or Revolut is ideal for exchanging money between dollars, pounds, euros, or for holding cash in multiple currencies. A better alternative is an Interactive Brokers account, which can be set up online quickly. Once your funds are in the account, you can exchange between these three currencies as well as Australian dollars, New Zealand dollars, Canadian dollars, Japanese yen, Hong Kong dollars, and Singapore dollars. In total, Interactive Brokers supports 26 currencies, and all exchanges are done at the mid-market rate with no fees. By comparison, while Wise also provides the mid-market rate for most of these currencies, it charges an average fee of about 0.3% of the amount being exchanged. Additionally, if you hold U.S. dollars in your Interactive Brokers account, they are FDIC-protected, unlike with Wise. For spending purposes, you can transfer funds from your Interactive Brokers account to your Wise account. Interactive Brokers allows one free transfer to Wise per month, with subsequent transfers costing just $1 each. It’s also very easy to link an Interactive Brokers account directly to a Wise account, and transfers typically arrive within 24 hours.

-

Pacific Prime is a leading insurance broker with a branch in Thailand and offices throughout the region. They provide access to coverage from all major international health insurance companies offering expat health insurance in Thailand. For more information, visit their website: https://www.pacificprime.co.th/ Additionally, a few months ago, CIGNA ran an ad I saw which was stating that they offer coverage for individuals over 60 without denying coverage for pre-existing conditions. You can reach out to Pacific Prime for assistance with this or similar options.

-

What does that mean exactly? He has high blood creatinine? High BUN? Those baseline kidney tests alone aren't enough to go on to reach a complete and solid diagnosis. He needs to get a Crystatin-C blood test (the definitive kidney marker/function blood test) and an ultrasound done on his kidneys and reviewed by a nephrologist. Those tests will reveal a lot more about the state of his kidneys. He could also check his Blood Albumin. If that's high then that could also be an indication of poor kidney function. And do some urine tests for Urine Protein, Urine Creatinine and Urine Albumin to see if any of those are present in his urine. If they are, then that's another sign that the kidneys aren't filtering very well and that some of those waste products are leaching out into his urine when they shouldn't be. But before all those baseline diagnostic tests have been done then I wouldn't reach any definitive conclusions about his kidney function.

-

Swift transfer of Japanese Yen into Wise

RSD1 replied to RSD1's topic in Jobs, Economy, Banking, Business, Investments

Following is the reply that I received from Wise, along with the two links they sent me which are posted below it. This basically doesn't really answer any questions. But in conclusion, I expect, if you wire transfer JPY into your Wise account, that it will cost you about $25-$40 for the correspondent bank fee. --- Thank you for your inquiry. To transfer Japanese Yen (JPY) into your Wise account, it would indeed require a SWIFT wire transfer to your Wise bank account in the UK. While we do not charge any fees for incoming wire or SWIFT transfers, please be aware that correspondent or intermediate banks may apply their own fees. These fees are outside of Wise’s control, so it’s always a good idea to check with the sending bank or intermediary banks for any potential charges before making the transfer. Please note that we do not provide local account details for holding a JPY balance. However, you can receive JPY along with other currencies using your GBP Swift account details. You can receive the following currencies into your GBP Swift account: AED, GBP, EUR, USD, AUD, BGN, CAD, CHF, CZK, CNY, DKK, HKD, HUF, ILS, JPY, NOK, NZD, PLN, SEK, RON, SGD, UGX, and ZAR. For more information on how to receive non-GBP currencies via SWIFT check here. Should you have any more questions or need assistance, feel free to reach out. Best regards, Wise Customer Support https://wise.com/help/articles/3KEJruODkhi59TZbSxO2xn/what-are-swift-usd-correspondent-fees https://wise.com/help/articles/3TLlYBP6W8m2aNZJZd3EpK/how-to-use-gbp-details-to-receive-other-currencies-via-swift -

Swift transfer of Japanese Yen into Wise

RSD1 replied to RSD1's topic in Jobs, Economy, Banking, Business, Investments

Yes, I already spoke to the sending bank. They looked on the system and told me that the system is suggesting JP Morgan Chase as the intermediary bank, but the sending bank told me that they don't have the option to choose the sending bank and also said that if Barclays could be used as the intermediary bank, then there would be possibly no extra charge, but again, it is not up to the sending bank. They said that they don't choose the intermediary bank and that I would need to speak to Wise. I've already sent Wise a support email to ask the question, but it can be days before you even get a response from them. You used to be able to just call and get phone support, but that's finished now. Nearly impossible to reach them other than by sending an email and then waiting for days. -

Your welcome. Prescription glasses in Thailand are really very expensive. But with Zenni it's the complete opposite and you could afford to buy multiple pairs and keep them in different rooms in your house if you like.

-

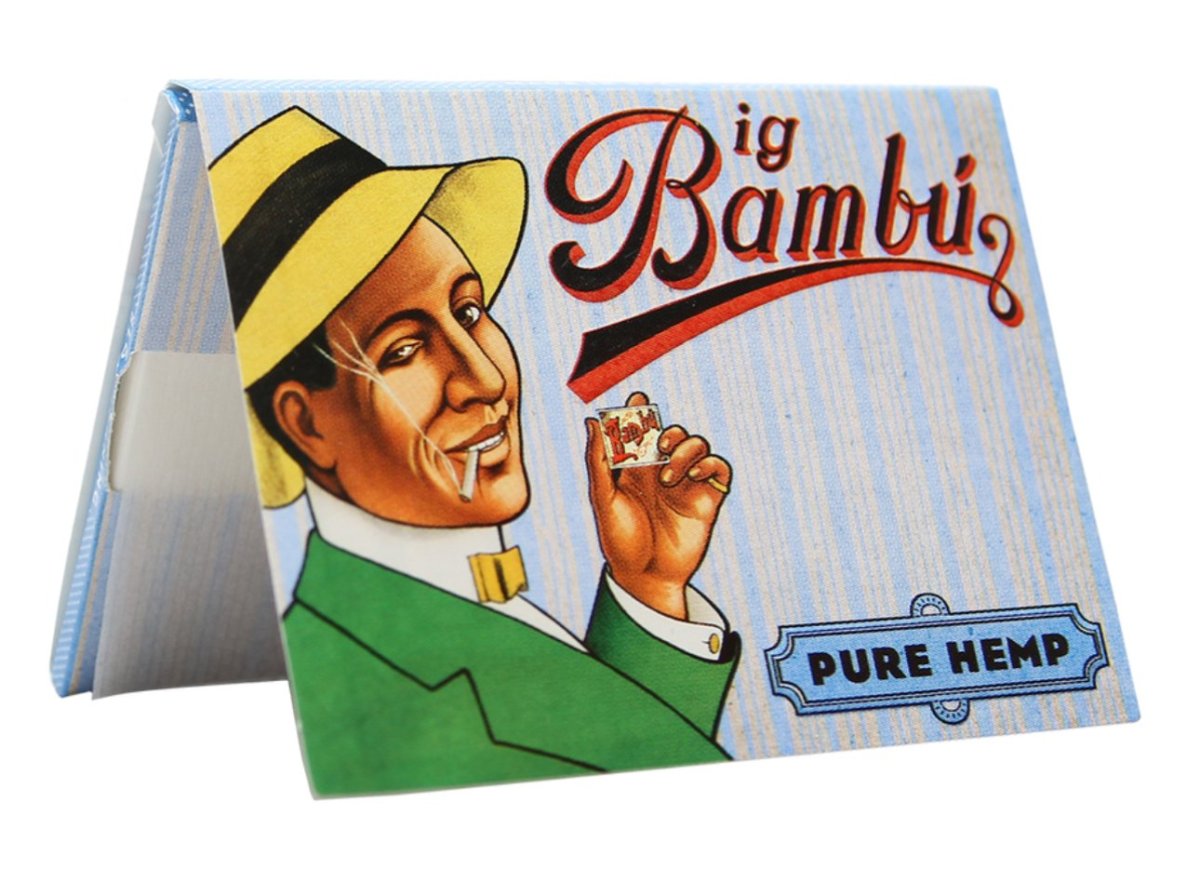

Not quite. Club (Italian made) are definitely the thinnest and don't even have gum on them. The company is about 150 years old. Then you have Rizla (French made), which have also been making papers for almost 250 years. Their papers are thinner than ZZ, but a bit thicker than Club. Big Bambu Pure Hemp (from Spain) are really nice too, not as thin as ZZ, but not made from wood pulp either, and so no harshness at all. Beautiful design artwork as well, featuring the smiling, winking Spaniard with his Spanish hat. The iconic design-work is almost 150 years old now.

-

Using a Wise virtual card

RSD1 replied to scubascuba3's topic in Jobs, Economy, Banking, Business, Investments

Yes, I’ve been using this method for a few years now. Another thing I do every few months is replace my digital card. If you go into the app, click on your card, and scroll down, you’ll find an option to replace it. I do this as an extra security measure, especially since card details often get stored in various Thai financial systems. I’m always cautious about the potential for hacks or data breaches in Thailand. I actually use two digital cards for different purposes. One is dedicated exclusively to my phone’s mobile wallet, and the other is strictly for online purchases. The online purchases card is saved in various online accounts with vendors, but I keep it frozen/locked in the app most of the time. I only unlock it temporarily when making an online purchase, then lock it again immediately after. This ensures no unauthorized transactions can occur, even if the card details are compromised by one of the vendors storing my information. The digital card in my mobile wallet, however, stays active at all times. As mentioned earlier, I replace this card periodically for added security. Another security feature you might find useful is the ability to create “jars” within your Wise account. These jars let you store most of your funds separately from the main balance linked to your card. You can transfer smaller amounts to the currency account you use for daily spending and link your card only to that account. For example, if you have ฿100,000 in your Wise account, you could move ฿80,000 into a jar and keep only ฿20,000 in your active Thai baht account. Then, you can link your card to the account with ฿20,000. This way, even if your card is compromised, the rest of your funds in jars or other currencies remain safe.