-

Posts

1,722 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Misty

-

No, the LTR visa couldn't be more different from a tourist visa. It's a visa that allows recipients to work, so it's a business visa, except better in so many ways. No need for 4 Thai employees, tax benefits, no messy, exp and time consuming annual renew as its for 10 years, and the BOI is not corrupt etc etc

-

I received the LTR visa in country, and the validity of the 5 year period permission to stay started on the day I received the visa, and ends when my passport expires next year. I plan to get a new passport from my embassy while in Thailand. The LTR unit said once I have the new passport, I'll receive the permission to stay through the 5 year date from when I received the LTR visa. It'll be shorter than 5 years at that point, however, since I received the LTR visa some time ago.

-

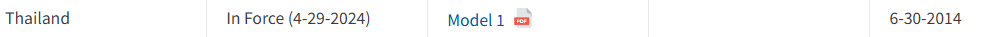

That would be good to know, if true. Could you provide a reference from the agreement saying Thai residents who are also US citizens are exempt from US information sharing? The Thailand-US IGA is a Model 1 agreement. https://home.treasury.gov/policy-issues/tax-policy/foreign-account-tax-compliance-act

-

The Thai government should now be receiving information on accounts in the US. Although the Thai-US FATCA IGA was signed in 2016, it only came into force last year. The IGA includes reporting obligations that go both ways (Thailand to US, and US to Thailand). Specifically Article 2 of the IGA, item 2b explains about what US financial institutions need to report to Thailand. https://www.mof.go.th/th/view/attachment/file/3134303034/FATCA_IGA_Us.pdf

-

Hi Samtam, Please can you post a link to where to complete the 2024 PND90 online? I've been trying to get a pdf of the new 2024 form and have only come up with old forms and translations. My apologies if this form is widely available - I've used google search broadly and also on this form and not been able to find the pdf. Just a lot of discussion about it. Thank you !

-

In case it helps - I'm an LTR holder and I've been filing TM30s when I return from overseas. I found having a TM30 really useful when getting Certificates of Residence from Chamchuri Square for things like buying a car, renewing Thai driver's licenses, getting an international driver's license, etc. Not sure what would happen if I didn't have the TM30 (for example, tried to use my lease or use a TM30 from a previous arrival). Maybe it would still be fine, but not going to tempt the fates.

-

Difference in service. I imagine you can still get a COR at another office for Bt200 if you'd prefer. At Chamchuri you get the form back in person and in an hour, and with very little hassle. Depending on your location the extra Bt300 might not be worth it for some folks, but it definitely is for me. Chamchuri much easier for me to get to, and the overall time/money/hassle trade-off is worth it.

-

As Pib says, BOI Chamchuri is pretty painless for Certificates of Residence. I've gotten two there and helped someone else get one and all were painless. Go to info desk & get paperwork checked, pay Bt500, submit paperwork counter 10, come back in an hour to collect. You can wait there, or have a coffee or meal downstairs. Counter 10 is even friendly.

-

Thanks, Pib, understood. I have 2 Factor on all my financial accounts, couldn't login otherwise. Agreed that you have to be very careful in any event. Phones unfortunately can get malware too. A friend was phished, downloaded malware, and had fairly high amount taken from their account (limit had been increased temporarily to facilitate a particular transaction). People are accustomed to clicking or swiping on anything that comes on their phone, including fake messages containing malware. Unfortunately QR codes can be faked too, and take the user to a site with malware.

-

Pib, am curious about the lack of security of BBL ibanking. Is that specific to BBL only, or do you think phone banking is safer than ibanking across the board? BBL is my company's bank and I can't see how I'd use phone banking for corporate tasks. A couple of my friends have lost money using phone banking (not necessarily BBL), but haven't heard of same for ibanking. I'm probably more like @JimGant - my phone is just a phone.

-

Thai PM Launches Project to Transform Thailand into Financial Hub

Misty replied to webfact's topic in Thailand News

Hi Ben, I've been living and working in Thailand for decades, and own and run a successful company here. But the regulatory and operating environment has been changing, and mostly not for the better. The one bright spot has been the introduction of the LTR visa. To answer your question, one would probably not start working and investing in Thailand today given all the red tape, bureaucracy, regulatory burden. Not to mention the recent confusing personal income tax changes. -

Thai PM Launches Project to Transform Thailand into Financial Hub

Misty replied to webfact's topic in Thailand News

There's a very long way to go to raise the bar from the current tangled, complicated, confused regulatory situation to make it just plain tolerable to foreign financial institutions. The so-called "regulatory guillotine" effort died ages ago. Make it attractive? Dream on. -

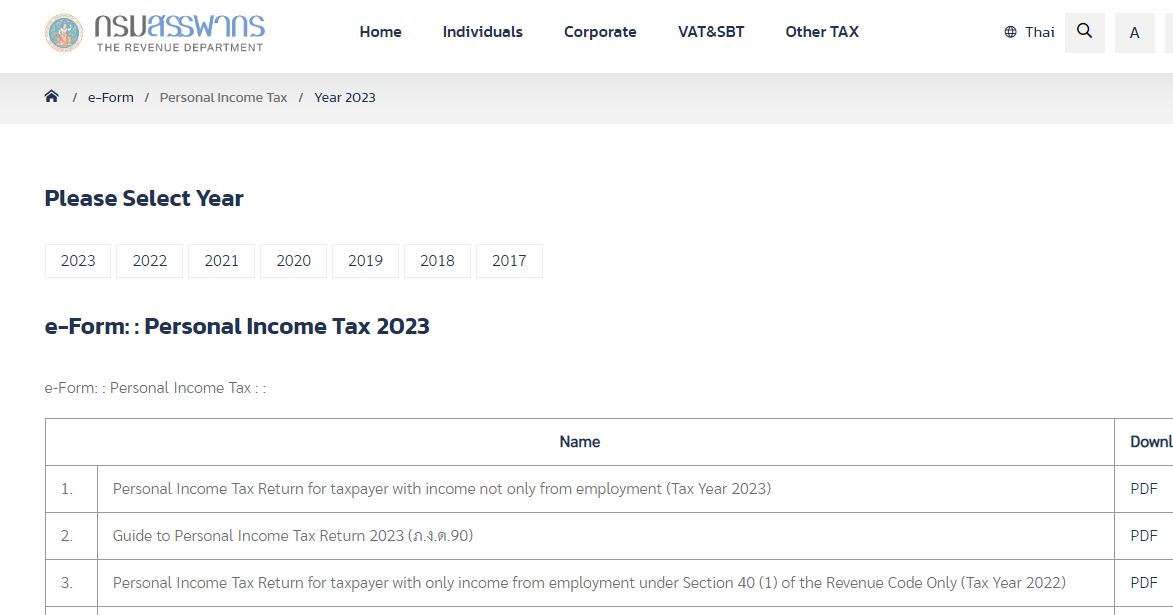

Thanks for providing the link above. When click on that link and then click through to tax forms you get to this page: https://www.rd.go.th/english/65308.html (screenshot below) I've been submitting Thai tax returns for decades, and until this year (2024) it's always been either the first or the third form in that list (PND 90 or PND 91). I filed that type of form for tax year 2023. PND 90 / 91 should still be useable for 2023. However, with all the changes coming I wouldn't be surprised if going forward PND 90/91 need to be updated.

-

When I had an extended NonB visa and work permit, I could only get 1 year extensions in Bangkok. I looked into the option of a two year extension and was told my company didn't qualify for that. I don't remember the exact reason, but it was something like my company would have to have a lot more registered paid up capital to qualify to use the One Stop Service in Bangkok. Since it didn't qualify, I had to go to the regular Dept of Labor and CW immigration for extensions, and could only get one year extensions. Thankfully those days are over. Was able to switch to a 10 year LTR visa/5 year digital work permit which is administered by BoI/One Stop Service in Bangkok.

-

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

FATCA update via AMCHAM Thailand Fri newsletter. The Thai-US FATCA IGA was signed in 2016, so it's taken awhile to get to this stage. Thai Revenue Department Begins FATCA Financial Data Exchange with the U.S. The Thai Revenue Department has begun exchanging financial account information with the U.S. under the Financial Account Tax Compliance Act (FATCA) agreement. Thai reporting entities can now report financial account information through the International Data Exchange Service (IDES). Earlier, Thailand and the U.S. signed an agreement to improve international tax compliance and implement FATCA, aiming to prevent tax evasion, enhance tax transparency, and improve tax administration efficiency. More information can be found on the Revenue Department website. Source: Royal Thai Government (06/27/24) -

Joe Biden Favored to Beat Donald Trump in 538 Election Forecast

Misty replied to Social Media's topic in World News

But was it Quint all along? -

Joe Biden Favored to Beat Donald Trump in 538 Election Forecast

Misty replied to Social Media's topic in World News

In the words of The Fonz: “Trump - Sit On It” (For those too young/not from Milwaukee that means “P1ss Off” -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Generally it looks like the table is referring to "tax resident" as opposed to "legal resident." Most countries have clear definitions of what they mean for each of these, and they are not necessarily the same thing. The US definitions and rules are especially complicated. According to the IRS, the US defines "tax residents" as meeting either the green card OR the substantial presence test (no green card needed). The latter is complicated: https://www.irs.gov/individuals/international-taxpayers/substantial-presence-test And for US taxes, even if you are nonresident alien, if your spouse choses to file MFJ, you are also taxed as if you are a tax resident. So a Thai citizen married to a US citizen but with no green card and living in Thailand, could still be taxed on worldwide income. -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Here’s a table comparing the tax systems of different countries on how they tax local income, foreign income of residents, and foreign income of nonresident citizens. The Philippines is noted to tax residents on foreign income, but there’s a note which seems to exempt foreign citizens. If this is correct, it would be nice if Thailand could consider doing something similar. According to the table as of now in SE Asia the tax systems of Vietnam, Philippines and Myanmar differ from Singapore, Hong Kong, Malaysia, and Thailand on these 3 parameters. https://en.wikipedia.org/wiki/International_taxation -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Yes, in fact that's what I said in my previous post as well, so I'm glad we agree. If it's short term gains (or unqualified dividends), the US tax would be 3x higher than your initial example of US tax owed, which assumed only long-term gains/ qualified dividends. As previously, my initial example wasn't about the US (never mentioned the US), it was for someone who said they owed 25% tax on rental income in Canada and they didn't want to pay 35% in Thailand. Many folks on here are posting as if any/all income will be taxed at 35%. The example I posted showed that the effective Thai tax rate would be 20.7%. Not great, but it's not a flat 35%. Hope that helps!