-

Posts

1,723 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Misty

-

I hope you are right. It isn't clear how this will work in practice. For example, if you bring the income to Thailand and then need to file a Thai tax return to claim the foreign (UAE) tax credit against any Thai tax due, you might find you only get a foreign tax credit of 0%. So you'd still owe Thai tax. This is how it already works for US taxes, just in reverse. There's a US-Thai DTA. US taxpayers are taxed globally, so have to file US tax returns no matter where they are tax resident. US citizens who are Thai tax residents can claim a foreign tax credit against any US tax due. If they pay 0% in Thai taxes on the income, they get 0% tax credit and still owe US taxes.

-

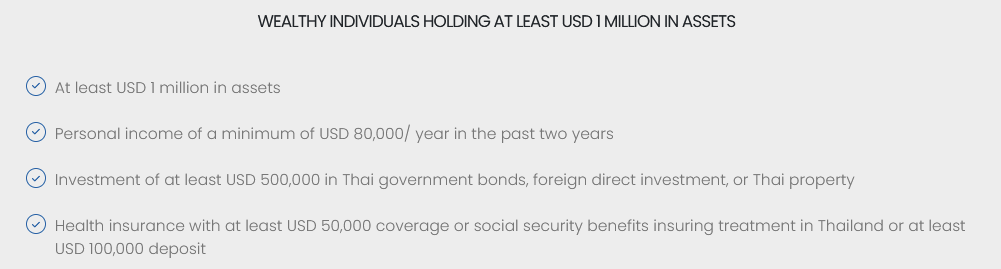

Yes, although for LTR-WGC they'd still need to show income of at least $80k/year for two years and invest $500k in Thai government bonds, foreign direct investment, or Thai property. https://ltr.boi.go.th/#what If they can wait until they're over 50 years old and can show between $40-$80k in income, they could then apply for the LTR-WP and only invest $250k in Thai government bonds, foreign direct investment, or Thai property.

-

Not sure these folks will feel they have limited powers. They seem to operate outside the law elsewhere. "In October, the US unsealed criminal charges against seven Chinese nationals accused of spying on and harassing a US resident and his family as part of efforts by the Chinese government to return one of them to China. Last month, one of the Chinese "police stations" in the centre of the Irish capital Dublin was ordered to close by the government as a result of Safeguard Defenders' work. And Canadian intelligence officials recently said they were investigating accusations that China had opened unofficial "police" stations on Canadian soil." https://www.npr.org/2023/04/17/1170571626/fbi-arrests-2-on-charges-tied-to-chinese-outpost-in-new-york-city

-

Thanks J, it is good to know. The answers I've received from BoI are also consistent with what you are reporting. I'm about to switch my LTR visa to the LTR HSP version to save on current year Thai income tax. LTR HSP doesn't offer this exemption, but I don't need it now. At some point in the future, though, it'll make sense to go back to one of the other LTR versions that exempt foreign source income remitted to Thailand.

-

The rules on who is a US tax resident are a bit complicated. But I think that it would be correct to say once someone is no longer a tax resident, the US wouldn't tax income not arising in the US. It may tax some types of investment income in the US as well as distributions from deferred income accounts such as traditional 401(k)s, IRAs, and Social Security. Here's a link to definitions for US tax residency: https://www.irs.gov/individuals/international-taxpayers/residency-starting-and-ending-dates The Thai definition is so much simpler.

-

Yes, it's important to note that the LTR Highly Skilled Professional visa is not included in the RD 743 exemption. LTR HSP visa holders must be employed by a Thai company, and receive a different tax break: a flat 17% tax on their Thai salaries. That alone can be a very significant tax break at higher income levels. At those higher income levels, LTR HSP should have less reason to bring foreign sourced income into Thailand. So perhaps it was reasoned that this is tax break enough for LTR HSP.

-

It looks like the original Thai tax code in fact may have been based on an existing system. For example, the UK taxes inward remittances for non-domiciled tax residents ("non-doms"). https://www.gov.uk/tax-foreign-income/non-domiciled-residents The difference is that UK non-doms I know avoid this tax by living on their income and remitting as little foreign income as possible. To make this work, they have to scrupulously keep their foreign accounts separate : those that remit income, and those that never do. High level executive non-doms usually get very expensive tax advice before they accept positions in the UK. They prepare for this tax in advance by opening and maintaining "clean" (nonmixed) accounts. So Thailand may not be trying to invent the wheel. Thailand (and arguably Malaysia) are potentially using similar tax code, but the situation in country is very different. Unlike highly paid UK non-doms, many foreign tax residents in Thailand remit foreign income regularly and have not segregated their accounts. Thailand switching horses mid-stream could be messy.

-

Thai central bank aims to cut household debt to 80% of GDP

Misty replied to snoop1130's topic in Thailand News

Article doesn't mention the Bt10k digital wallet initiative being part of the debt solution. I had thought that Bt10k was central bank digital currency (CBDC). But our staff seem to think that the digital wallet plan is not CBDC but rather courtesy of a private currency owned or controlled by the PM and/or Thaksin, sort of like the scrapped Libra/Meta plan. Anyone else hearing similar? -

Story Of My Thai Citizenship Application

Misty replied to dbrenn's topic in Thai Visas, Residency, and Work Permits

If this ad is real, it's absolutely chilling. Whether or not Thai citizenship and PR applications are affected. What Thai social media is it circulating on? -

Yes, your HR department should be able to clear this up immediately. At your compensation level, it sounds like you're most likely working for a major employer. It doesn't sound like you're working for a small school or other institution that wouldn't automatically file income taxes for its foreign staff. Most likely your employer filed online, in which case you wouldnn't sign anything. I know many expats of large employers where this is the case. Employers often do not automatically give tax filing documentation, unless it's requested. Many expat employees don't know about the Thai personal income tax filing process. Americans tend to be the exception, as they need Thai documentation to file their US taxes. Congratulations on getting your LTR HSP, and thanks for the heads up at the time required at the BoI. I'm returning to Thailand soon and will be switching over my existing LTR to a new LTR HSP. Hopefully the process will go as smoothly! The BoI staff said I can keep my existing 5 year digital work permit, so hopefully I can skip the step of getting a new one.

-

Congratulations on getting your LTR visa. I'm switching over to the LTR HSP visa and have talked to my company's accountant regarding the difference in Thai tax filing going forward. To date I've filed PND90/91 each year. My accountant has explained in the future I'll use PND95 for the 17% tax rate. Does your company currently file your Thai taxes? The reason I ask is that the PND90/91 is a fairly simple form (at least as compared to my US taxes) and my Thai accountant fills it out and files it each year on my behalf. Going forward, PND95 should be similarly streamlined and easily handled by my accountant. I've also worked with KPMG for corporate tax issues and have no doubt they can handle filing PND95 as well.

-

Presumably Putin remembers what happened with Victor Bout.

-

The Srettha road show comes to AMCHAM's AGM meeting on 25 Oct. I hope there will be plenty of time for member Q&A to include the AMCHAM Tax committee. Unfortunately I'm travelling and won't be able to go. https://connect.amchamthailand.com/events/details/agm-luncheon-with-honored-guest-h-e-prime-minister-srettha-thavisin-2469?calendarMonth=2023-10-01