-

Posts

1,722 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Misty

-

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

I used 25% as someone had noted they paid 25% tax on I think it was rental income in Canada, and that they didn't want to pay 35% to Thailand. Point simply being that the Thai tax owed may not be that high. And yes, I agree with your US example, as long as it's a long term capital gain and not a short term capital gain where the US tax would be 3x higher. -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

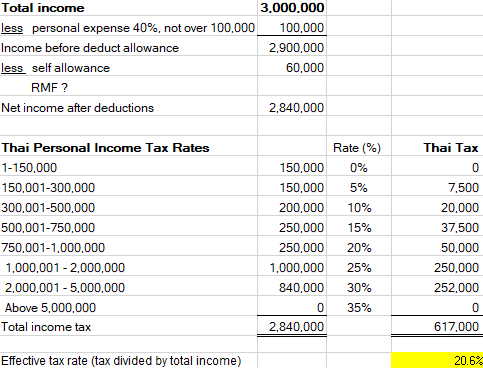

This potential change s*cks. That said, remember Thailand has a progressive personal income tax system. The top marginal rate is 35%, but you’d need to earn a lot of income in the lower brackets before your top-level income (last baht earned) starts getting taxed at that rate. For example, if you earn Bt3,000,000 in global income, your Thai effective tax rate would be 20.6% as per the table below. If you’re currently paying 25% in your home country, depending on DTAs and using Thai tax credits you might pay 20.6% in tax to Thailand, and then 4.4% in your home country. Someone with especially high earnings could consider contributing to a Thai tax advantage plan such as an RMF to cut Thai taxes further - at least to what they might pay in their home country. And if the Thais are serious about moving forward with this, as part of the change hopefully they'll also consider cutting the progressive rates to be more inline with nearby jurisdictions such as Singapore or HK. -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

This potential change s*cks. That said, remember Thailand has a progressive personal income tax system. The top marginal rate is 35%, but you’d need to earn a lot of income in the lower brackets before your top-level income (last baht earned) starts getting taxed at that rate. For example, if you earn Bt3,000,000 in global income, your Thai effective tax rate would be 20.6% as per the table below. If you’re currently paying 25% in your home country, depending on DTAs and using Thai tax credits you might pay 20.6% in tax to Thailand, and then 4.4% in your home country. Someone with especially high earnings could consider contributing to a Thai tax advantage plan such as an RMF to cut Thai taxes further - at least what they might pay in their home country. And if the Thais are serious about moving forward with this, as part of the change hopefully they'll also consider cutting the progressive rates to be more inline with nearby jurisdictions such as Singapore or HK. -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Don't know about PIT, but on the corporate side I've been told generally audits go back 3 years, but sometimes can go back 5. However, these limits generally apply only if a tax return was filed. If no return was filed /for certain cases they can go back 10 years (statute of limitations is 10 years). -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Yup ,wondering the same. I think some DTAs might address how to handle IRAs, Roth’s etc but my guess is the current US Thai DTA does not. Wouldn’t have been relevant at the time it was negotiated. Maybe some tax expert can clarify. -

Thailand to tax residents’ foreign income irrespective of remittance

Misty replied to snoop1130's topic in Thailand News

Under the US-Thai FATCA intergovernmental agreement signed in Mar 2016 unfortunately the ground work was laid to share individual’s financial information with Thailand -

Young girl shares six-year abuse ordeal; Stepfather arrested

Misty replied to george's topic in Thailand News

Nothing to do with reading comprehension. OP was ambiguous. -

Young girl shares six-year abuse ordeal; Stepfather arrested

Misty replied to george's topic in Thailand News

Actually, very good chance this is not an American. -

First, are you using one of the LTR unit Certified Agents from the LTR website? https://ltr.boi.go.th/page/ca.html If you really want to use an agent, I'd make sure it is one that the LTR unit has pre-screened as being acceptable. If you have any doubt about the status of your application, get your application number (aka "Doc Number) from the current agent, and call the LTR unit directly to ask them where things stand. If you can't get a Doc Number, then just call the LTR unit, explain you are trying to apply, and ask them how busy they are/how long it will take. For what it's worth, I was at the LTR unit last week and it did not look at all busy. One Stop Service across the hall was very busy, but not the LTR unit itself.

-

Thai-US powered operation crumbles cybercrime hacker syndicate

Misty replied to george's topic in Thailand News

Sounds serious. More than a house in Thailand - Wang was arrested days ago in Singapore. From other reporting Wang operated a global botnet controlling millions of individual IP address and rented them to others for some really rotten purposes. The group owned over $100m in property in at least four countries (Singapore, Thailand, Dubai, USA). "The charges against Wang are for allegedly deploying malware, and creating and operating a residential proxy service known as “911 S5”, a botnet that facilitated cyberattacks, large-scale fraud, child exploitation, harassment, bomb threats, and export violations, according to the DOJ." https://www.scmp.com/news/asia/southeast-asia/article/3264861/chinese-hacker-wang-yunhes-arrest-brings-fresh-scrutiny-singapore-wealth-flows- 45 replies

-

- 19

-

-

-

-

-

Mike I've checked both my old LTR e-visa from 2022 (a paper copy all in English from NY consulate) as well as the new LTR HSP visa stamp in my passport from this year. Neither says anything about "Non Immigrant". But my old Nonimmigrant B visa stamp did say "Non Imm." So clearly that was Non Immigrant, according to Thai Immigration. I would say the LTR program isn't the same. So a rose by any other name? Note that PR isn't necessarily "permanent" despite its name. If you stay outside of Thailand for more than a year, it gets cancelled as we saw happened to some unfortunate folks during the pandemic. An LTR visa wouldn't have been cancelled in the same circumstances. So LTR could be more "permanent" than PR.

-

Today at Chamchuri I asked if they can mail the certificate and was told no, unfortunately at this location you can only pay cash Bt500 and receive on the same day, within an hour. My experience was very much like yours, Pib - super easy. I brought a number of documents just in case, but in the end they only wanted the application, copies of my passport, LTR visa, and arrival stamp, and the TM30. I paid the Bt500 at Counter 8, submitted the documents at Counter 10, and was told to come back in an hour. I got a coffee downstairs and returned a little early. The certificate was ready about 5 min early. It was a busy day maybe ahead of the long weekend,

-

Judge Denies Trump's Mistrial Request Over Stormy Daniels Testimony

Misty replied to Social Media's topic in World News

Poetic justice. -

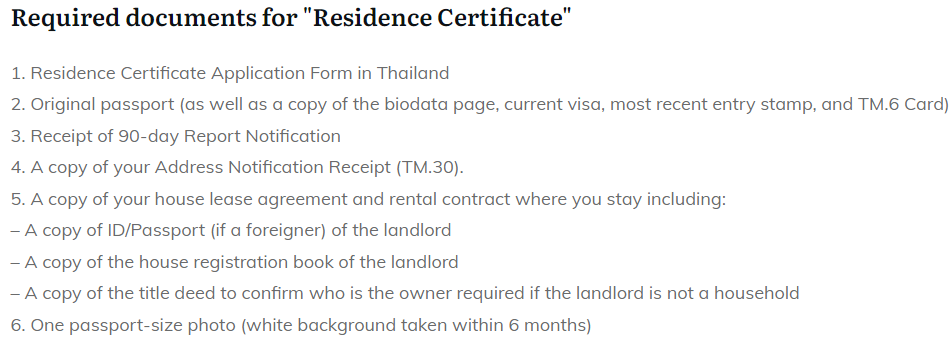

Thanks so much Pib. I'll download and fill out the form you note from the Immigration website and have it ready, along with everything else listed barring the unneeded 90 day report. Will be going to Chamchuri Sq as well, hopefully tomorrow morning if I can carve out the time. Documentation to choke a horse - Pib you aren't kidding! So glad the LTR visa cut out all this on the NonB/work permit extention front, but I guess TIT and you can't escape it entirely. For those LTR visa holders wondering if they would ever need a TM30 again, requesting a certificate of residence appears to be a case where it's needed. Car purchase is underway - buying my very old car off my company to clean up its books. Have most of the paperwork together for that/have already contacted the DLT but still need this certificate of residency to complete it.

-

Yes, that is how I understand it too. I have the LTR HSP now, switched to it after my profession qualified for it. Previously I had one of the other LTRs and had to pay a higher tax on my income. But I don't need to remit funds now so I prefer the 17% rate on income. At some point in the future when I'm no longer working I'll go back to one of the other LTRs, as long as the program still exists.

-

Hi Pib, thanks very much for this. There's a list of documents on the Thai Elite website that I was working off of, link & screenshot below. A couple of questions: 1) Where did you get the certificate of residence application form? 2) In the Thai Elite link it mentions also needing a copy of the lease agreement if renting, a copy of my landlord's ID and title deed in the case the landlord is not a person. Did you need any of those documents as well? If not, how does the Chamchuri Sq immigration confirm where you live? Just an aside: I also have two Thai drivers' licenses (car & motorbike) and on the back of each is my residence. Interestingly so far no one seems to be requesting or interested in copies of those, even for the car purchase itself. https://thailand-elite.com/what-is-a-residence-certificate-and-how-to-get-it/

-

Hi Pib, looks like I'll need a certificate of residence to buy a car. Did you need to make an appointment at Chamchuri Square for this, and was it with the LTR unit, or directly with Immigration? I now see the only advantage to having an old style work permit (a paper booklet) was that the last page listed my residential address. Never had to get a certificate of residence before this.

-

Thanks Mike, it's interesting that capital gains are listed as an acceptable form of passive retirement income. I guess if you can establish that the gains are a sustainable/repeatable source of income it could make sense. The challenge might be to make sure they keep coming each year so that at the 5 year point the LTR visa is renewable. And of course establish that the income is in fact a gain, so return on investment, and not return of capital.

-

The impression I’ve had is that the BoI’s LTR unit is looking for steady recurring passive income such as provided by a defined benefit pension, state pension, annuity, rental income, dividends, interest etc. However, capital gains from trading or a sale of assets might not qualify. From interactions with the LTR unit, It seems that they are just following the law governing the LTR visa, as it was written. The law isn’t perfect. Although the LTR unit is sympathetic to the imperfections, they don’t think they have room to interpret the law or maneuver outside of it. This might be different from Immigration where “VIP service fees” can be an influencing factor. The comment about the US 401(k) plan is interesting. I wonder if the BoI official was referring to a traditional 401(k) where Required Minimum Distributions (RMDs) have already begun. In that case a 401(k) will have be required to provide a steady passive income, a bit like a defined benefit pension. Same could go for a traditional US IRA undergoing RMDs. While other countries may not have these specific types of plans, they may have other types of pensions that would work in a similar fashion.

-

BOI LTR important to maintain qualifications

Misty replied to Presnock's topic in Thai Visas, Residency, and Work Permits

Definitely understand the frustration. Can you go to LTR unit in person? I did that a number of times, and that's when most of the really useful communication occurred. -

BOI LTR important to maintain qualifications

Misty replied to Presnock's topic in Thai Visas, Residency, and Work Permits

No, that sounds like something new. Interesting, I hope those folks are helpful! It sounds like you don't pay them, which is good. I first did a pre-application in Aug 2023, then formal application in Sep 2023. Then switched LTR visa type in a complicated process in 2H 2023 (Change in qualification for LTR HSP made that one financially much better). No videos or people calling themselves "BoI lawyers." Lots of calls, emails, and some in person visits though.