oliverphoenix2

Member-

Posts

46 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

oliverphoenix2's Achievements

-

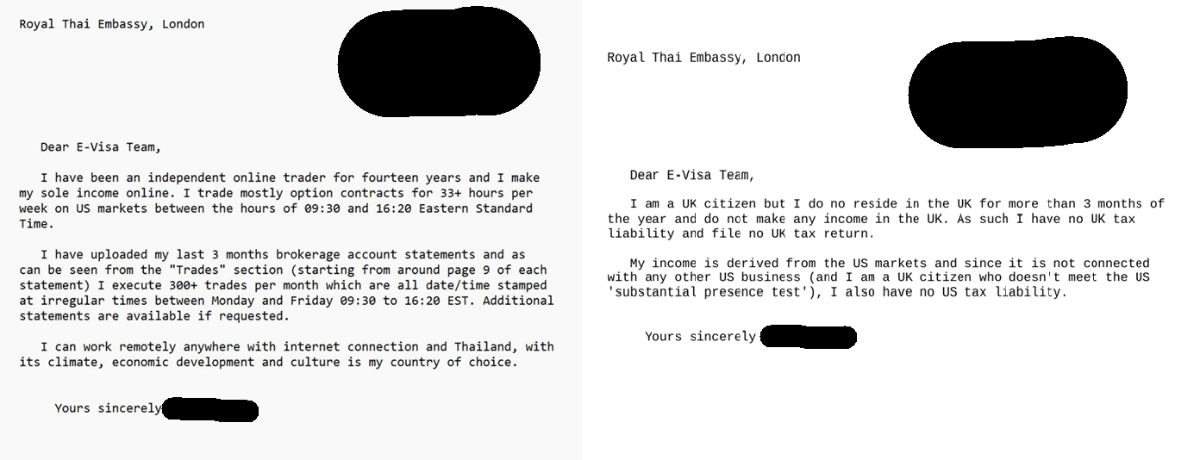

I got my UK DTV evisa as a remote worker in Aug 2024 from trading online somewhat similar to you. I uploaded my last 3 months Interactive Brokers account statements, a UK bank statement showing over GBP 10,000 and a short cover letter. Within a couple of days I got a document request for an explanation of my situation, tax return/assessment of estimated tax liability, full flight itinerary from UK to Thailand with transfer details and an explanation of why I needed to be in Thailand. I uploaded the 2 attachments and got the DTV within a week. My take is that at the very least you will need to show that you are doing what you are claiming and you are making a meaningful income from your online investing. My statements showed my daily activity and that I was making an income although I had no tax liability. If you could for example show proof of paying UK taxes on your activity it would help to verify that you are making an income.

-

Tax files

oliverphoenix2 replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

In the box at the bottom of page 2 it says "In the case of a country with a double tax treaty. There is no need to present a tax return in Thailand. Except in cases where it is necessary to show it to the agency that needs it only." Surely that flat out means that you do not need to file a tax return if your home country has a dta unless the RD specifically asks for one e.g. they audit you (even though you never filed a return for them to audit!). -

It almost sounds like they were trying to get you to sign a tax declaration in advance so that they would have a record of your tax liability straight away after obtaining a TIN. As already mentioned I believe you obtain a TIN first. There may have been some miscommunication or even RD incompetence, there is a big difference in their assessment and yours. You may get some definitive answers from other posters as to what is/isn't assessable if you're doubting the RD's assessment. If it's not too private it would be very useful to know some general details of what they were claiming tax on, e.g. was the income pre 2024, where the income was made, when/if it was remitted to Thailand, acknowledgement of exemption for any DTA, how they handled comingled accounts (LIFO or FIFO) ? Best of luck.

-

That's interesting. My UK Wise/Revolut accounts are in GBP. I get better rate with Wise than Revolut converting GBP to THB. Right now 12.28am KL... Wise 42.2864 Revolut 42.037 Wise exchange rate over .5% better than Revolut which more than offsets Wises' .5% conversion fee!!! Also I do not have extra fees using Wise at weekends!!! I use my virtual card linked to google wallet every day and always get spot exchange rate plus around .5% conversion fee on every day, in KL and Thailand and everywhere else I've used it. What extra fees do you believe Wise has at the weekends?

-

I 've used both cards for a few years. I think if you delve into the details you'll find that although Revolut charges no conversion fees (Wise charges .5% - .6%) Revolut gives about .5% worse exchange rate for Thai Baht (it fluctuates a little) and so it averages out the same. I have just reconfirmed this in my Wise/Revolut apps. And as already mentioned there is additional fee for Revolut on conversions over 1000GBP per month and also converting over the weekend. For me Wise inches out Revolut but I don't make international transfers or trade stocks/crypto.

-

I use Ghost Mail Limited, GBP29 +VAT per year for a low user mail forwarding account + handling/posting fee per item. If you're forwarding to UK address it will cost much less per year than your example, even forwarding 1 item/month to Thailand will probably cost GBP150/year. I think the last debit card I had forwarded to Thailand was around GBP10, it depends on whether you want it tracked or not. They offer different subscriptions depending on your needs - google it for their website. It will be cheaper if you have at least some stuff scanned and emailed to you. When they receive something for me (nothing so far this year) they email me and I instruct them what to do. I've been satisfied with their service over 4 years.

-

Double check in your message app settings that your bank is not 'blocked or spam".

-

Non-Immigrant Visa(O-A) Renewal

oliverphoenix2 replied to Koala123's topic in Thai Visas, Residency, and Work Permits

Assuming it is valid till Nov 24 you can re enter Thailand before it expires and get up to another 12 months entry as long as you have an approved health insurance plan that covers your stay. If you only have 6 months health insurance coverage you will only get 6 months permission of stay. You cannot extend from abroad and once expired it is dead. If expired by the time you are travelling you should be fine doing 2 visa exemptions (+extensions if you want and also assuming your country qualifies for visa exemptions - most/all European countries do) with short cross border trips. Alternatively 1 tourist visa and 1 visa exempt with an extension gives 5 months. -

I believe Samsung A55 (14000 BHT) is the only A series model that has Esim, and one of the cheapest makes overall with Esim . It has dual sim and one of the slots can double as an SD card slot, gorilla glass front and back, metal frame (all other A series are plastic), 8GB/128 or 12GB/256 (16000BHT), 120hz refresh rate, NFC for contactless payments, 5000mah battery, 4 years android updates and 5 years security patches. Camera seems perfectly reasonable for mid range phone. Not comfortable to hold in my hand but with a case it's fine. THB 14K in Thailand is good value when in UK/Europe 18K after rebate! This should make the shortlist for mid price esim phones.

-

A lot of people think that trading involves guessing/ knowing/predicting/having inside information about the price movement of an asset like a stock/bond/future/currency, and based on that traders will not have a better than 50% chance in the short term without inside info or psychic powers. For me (trading full time 15 years) it's about finding a strategy that gauges when something is cheap or expensive, buy low sell high. And whether something is cheap/expensive is defined by comparing it to something else! Gold is considered expensive when you compare it to wheat, iron ore, oil, silver etc. but is cheap when you compare it to enriched uranium, tritium, cut/polished diamonds etc. So to trade IBM stock for example you need to compare it to something that is fundamentally tied to the price of IBM (e.g. IBM option contracts), and because options are traded on different exchanges to stocks (often by different people, for different time periods), the two prices fluctuate relative to each other. It's these relative fluctuations that allow you to buy the cheap asset and at the same time sell the expensive one. It's called spread trading. You don't lose or make money from IBM going up or down in price because the option(s) value does the opposite and cancels it out. You make money from these fluctuations mean reverting back to in sync. """ You wait and watch for the prices to fluctuate out of sync. enough for you to profit from the reversion back.""" These fluctuations can happen on a daily basis or over longer periods depending on what you're trading. Often the shorter periodicity fluctuations will result in smaller gains but on a more frequent basis. No system is going to succeed 100% but that is not needed. If you are right 60% (or hopefully more) and you keep your trading costs down you can beat the 'market average' (SP 500 - @10% per year) with far less volatility i.e. no +30% drops caused by the likes of covid or the financial crises. Investing is generally considered a time based passive strategy - you would expect to make twice as much in 30 years as you would in 15 years and you would be quite happy to buy IBM at fair market value. Trading is a price based strategy - you buy and sell assets based on their price not where you think they will be weeks/years down the road and you would buy IBM when it is cheap (relative to something else) and not where you think it will be some time in the future.

-

Right now I have UK multi non o (ret) so I need to exit every 90 days and theoretically should not have problem with a border bounce. In November I flew Phuket-KLIA2-Phuket, had a mobile boarding pass on my phone and only a carry on bag. In the less strict years before covid I bounced KL without going through immigration at least twice from memory and entered Phuket on visa exempt entries with no problems (I had proof of onward flight/funds and as usual it was not asked for). These days there seems to be a lot more scrutinization. I don't know what the specific immigration requirements are regarding an entry stamp into another country before re entering Thailand but obviously if you go back to your home country you don't get a stamp and also for UK passport holders you don't get a stamp entering/leaving Hong Kong. Land borders may well have slightly different rules. The MDAC (Malaysia digital arrival card) I think is only required if you need to pass through Malaysia immigration. From UK.GOV website.....

-

''' I can't remember seeing a sign but I imagine there is one for 'departures'. ''' If you have your return flight boarding pass and 'no checked in luggage' follow the signs for international departures and you will get to the departure area without having to go through Malaysia immigration. If you have checked in luggage you'll have to go through immigration to pick it up and check it in for return flight and then through immigration again to leave.

-

''' You have no choice but to clear Immigration in KUL, you cannot just "turn around and come back". ''' You can transit Kuala Lumpur KLIA2 Air Asia without going through immigration and return to Thailand OK. I just did it in November (and pre covid). There is access to the upstairs departure area near the immigration arrival hall although it is a little obscure, I can't remember seeing a sign but I imagine there is one for 'departures'.

-

Cheapest U.K. SIM card for OTP overseas

oliverphoenix2 replied to sometimewoodworker's topic in Mobile Devices and Apps

I've used Lebara for 4 yrs. While in Thailand you don't need to pay for a monthly plan if you're not making calls/texts. OTPs are free and to keep my sim active I send myself a text once every 3 months (49p), minimum topup is 5GBP. For the minimal cost I think it's smart thinking to keep a home country sim for things like banking OTPs.