- Popular Post

Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

3 hours ago, Pattaya57 said:

Drinking 19 crimes Cab Sav for 599 baht a bottle from Central. If only they made that in 5 litre casks as yummy 😀

Cab Savs give me a raging hang-over & 19 Crimes is (for me) particularly "Offensive" (as in raging hangover next day, it's an easy drink), but my Brother & Mother both swear by it as it's one of their regular tipples.

Too each their own, I get on much better with a nice Barolo, D'asti, D'alba, Malbec, Merlot (probably in that order) & would move on to the Whites before I got to Cab Sav (Though I'd drink my own p155 before a Rose).

-

1

1

-

-

1 hour ago, JimTripper said:

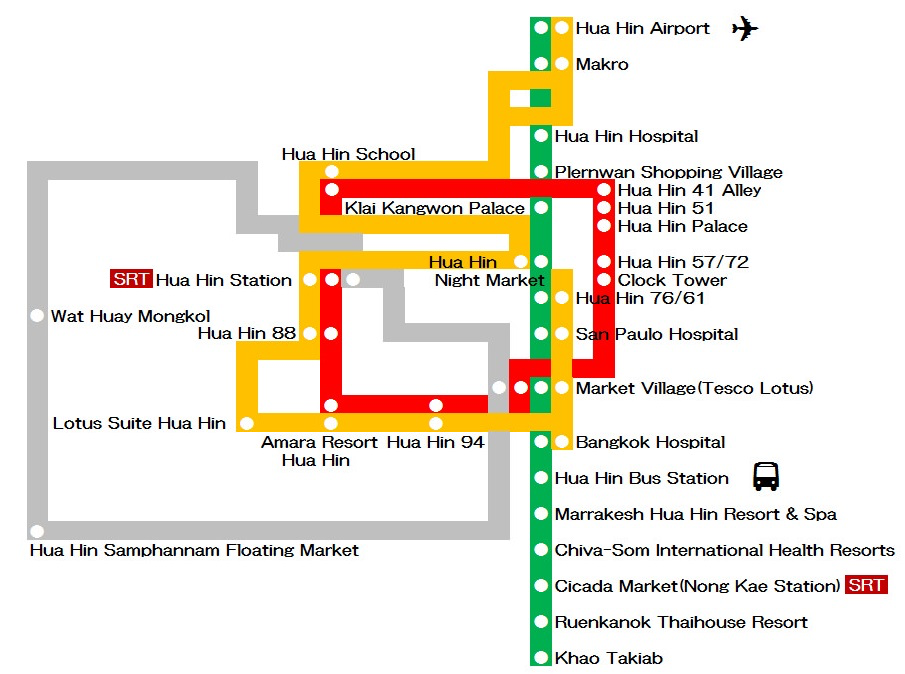

Thanks Jim, have saved that for our next trip to Hua Hin (GF has family there).

FWIW I found Grab to be excellent in Hua Hin though think Bolt is a better choice in Pattaya.

-

2 hours ago, anrcaccount said:

Webinar was actually held on October 3rd, but we'll see. If you do receive any source link or TRD documentation, be great if you share it on here.

Sorry I didn't attend the Webinar & assumed it was held within the past couple of days as the Video only went up this morning so was giving them the benefit of the doubt.

I have had a good trawl through the site & the only potentially interesting article I can see regarding Capital gains is again about Crypto https://www.expattaxthailand.com/cryptocurrency-tax-thailand/

I don't really see a difference between Gains made on Crypto, Shares, bottles of wine etc... so would assume that the rules would be the same when it comes to calculating the Gain but it would be nice to see that documented somewhere officially.

Edit: Interesting that the article quotes Section 40 (4) (h) but when I look at the TRD English site it only goes up to 40 (4) (g)... https://www.rd.go.th/english/37749.html

-

59 minutes ago, dinga said:

He was challenged on this point during (I think the last) webinar and said he would re-confirm the TRD accepted those methods and would put the confirmation on his website. Has that happened???????

He did say in this video that he would look to email out the TRD documentation & add it to the website, Video was only released today so might take a couple of days to get it on there.

Although this article is aimed at "Digital Assets" it does say that FIFO & Average Cost should be used for Capital gains... https://drkilaw.com/index.php/component/spsimpleportfolio/item/28-b-thailand-s-digital-asset-tax

From a much older article it looks like if you physically held the share certificates then you would use the cost of the certificates you settle the trade with, if you hold the assets electronically (Scripless) then you could use FIFO or Average Cost... https://www.bangkokpost.com/business/general/299691/when-the-revenue-department-changes-its-mind-the-taxpayer-gets-the-headache

-

2

2

-

-

- Popular Post

- Popular Post

You don't mention anything about having your own transport, if you or your GF doesn't drive then I wouldn't recommend Hua Hin as from what I've seen on my 5-6 visits there, things are quite spaced out.... Pattaya may serve your needs better.

Before people jump in about Pattaya being a "Cesspit", it is possible to live here without being exposed to the "Nightlife", I live at Wongamat beach which has nothing like "That" but does have Bangkok Pattaya Hospital (Private) & Bang Lamung (Government) Hospital approx. 10 mins away + a pretty decent government school 5 mins away.

-

5

5

-

3

3

-

1

1

-

- Popular Post

- Popular Post

Latest ExpatTax video on Capital Gains...

-

1

1

-

2

2

-

1 hour ago, henrik2000 said:

Other Red Wine Brands?

I find the Eagle Hawk Merlot (399B) an ok tipple but would stay away from their Cab Sav (or any Cab Sav... NB I know nothing about wines, only what I enjoy drinking & what doesn't give me a raging hangover the next morning which most reds tend to do).

Might want to have a look as this thread to get some ideas...

-

1

1

-

1

1

-

-

28 minutes ago, Maine_MoFo said:

I’ve been going to OrthoSmile in North Pattaya for a couple of years now. Always great service. They also do orthodontics and I knew a girl who was very happy with her braces treatment. My current girlfriend needs braces plus a bunch of other dental work which I will do through them next year. I live in Jomtien and don’t mind the drive over.

www.orthosmiledental.com

I also use these guys so know that they do Invisalign, much quicker at straightening your teeth out than braces but not cheap.

-

1

1

-

-

34 minutes ago, ravip said:

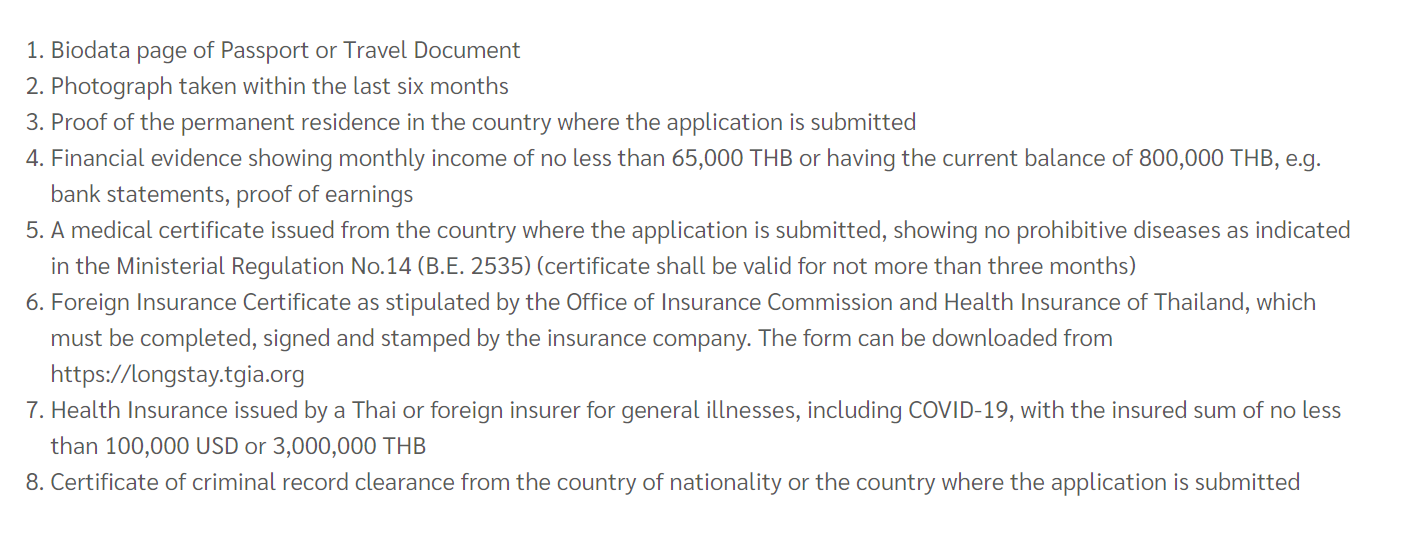

Are you sure you're not reading the Non-IMM OA requirements as Medical Certificates / Health Insurance / Police clearance checks aren't normally required for a Non-IMM O

-

1

1

-

-

7 hours ago, Yumthai said:

Maybe you should the thread to understand my point.

You use a foreign CC in Thailand. It's a loan/credit line from a foreign financial institution/company. If it's never refunded (paying back only interests) it cannot be assessable income in Thailand.

Thank you Yoda... Thread shall I read to understand point you have (Sorry, I know it was a Typo but I couldn't resist 🙂.. In my defence I'm up before 4:30 so yet to have a coffee 🙂 ).

IMHO the only germane point about Credit Cards is the money used to pay them off, if you never pay it off then clearly it's a loan & you've not remitted money anywhere, if you do pay them off then (IMHO) it becomes a discussion about the funds used to pay them off more than the credit card itself.

Now, about that coffee....

-

Just now, Yumthai said:

Point was a loan never refunded is not assessable income.

And my point is....There are yet undiscovered tribes in the Amazon rain forest who could have told you that BUT...

WTF does that have to do with Thailand?

-

1

1

-

-

6 hours ago, Yumthai said:

Sure but if the credit line is never paid back then the source of funds remains forever money that has been borrowed.

I'm sorry your point being?

You not paying your credit card bill is exactly the same as...

You not sending yourself that money to Thailand?

You never taking that money out of an ATM?

You never bringing & exchanging that cash into Thailand?

Point?

-

5 hours ago, gk10012001 said:

In my case, I only have a light carry on and I enjoy a bus ride and looking out the window. The bus from pattaya north station to Ekamai is fine with me and gets me to a BTS station.

And I'm sure you're smart enough to get off at Udom Suk to save yourself from 20-30 mins of SukV Traffic 🙂

-

1

1

-

-

29 minutes ago, ravip said:

Thank you. That's good. As I do have 800k in my BKK Bank Account. Will they email me a statement (if I request via the Mobile App) - which the immigration will accept?

Bangkok Bank will email you a statement... Click on "More Services" bottom right hand corner of the mobile app, then "Request Account Statement" - Can't quite request a 1 year statement (e.g. I can order one now from 1st November 2023) but am sure you only need 3 months anyway (Maybe best to get 4 as you can't pick the starting day, it always starts from 1st of the month).

Do note that BKK Bank Statements do not include your address but as long as you're not using it for proof of address you should be ok.

As a test I just requested a statement from November 2023, took approx. 5 minutes...

-

1

1

-

1

1

-

-

Season 2 of "The Devil's Hour" has been released... https://www.imdb.com/title/tt14379784/

I seem to remember enjoying the 1st series & the 2nd one sounds good....

https://m.imdb.com/news/ni64794646/?ref_=tt_nwr_1

The Devil’s Hour Season 2 sees Lucy (Jessica Raine) and Gideon (Peter Capaldi) forming an uneasy alliance to prevent a recurring tragedy and hunt down an elusive monster.

Lucy’s double life sees her torn between family and duty as she finds herself in the crosshairs of her past-life husband, Di Ravi Dhillon (Nikesh Patel). Assisting Dhillon in his investigation is DS Sam Boyd (Saffron Hocking), who Di Lucy Chambers mentored in a previous life.

Meanwhile, Isaac (Benjamin Chivers) is discovering new emotions daily and struggling to keep his balance in a reality that rejects his existence. Fresh mysteries unfold as our stories converge on one explosive moment that will change the fate of our characters for the rest of their ever-recurring lives.-

1

1

-

-

6 minutes ago, jacko45k said:

Isn't it about 130 or 135?

For some reason I had it in the back of my mind that it had gone up to 164B but their website & online booking still has it at 131THB

-

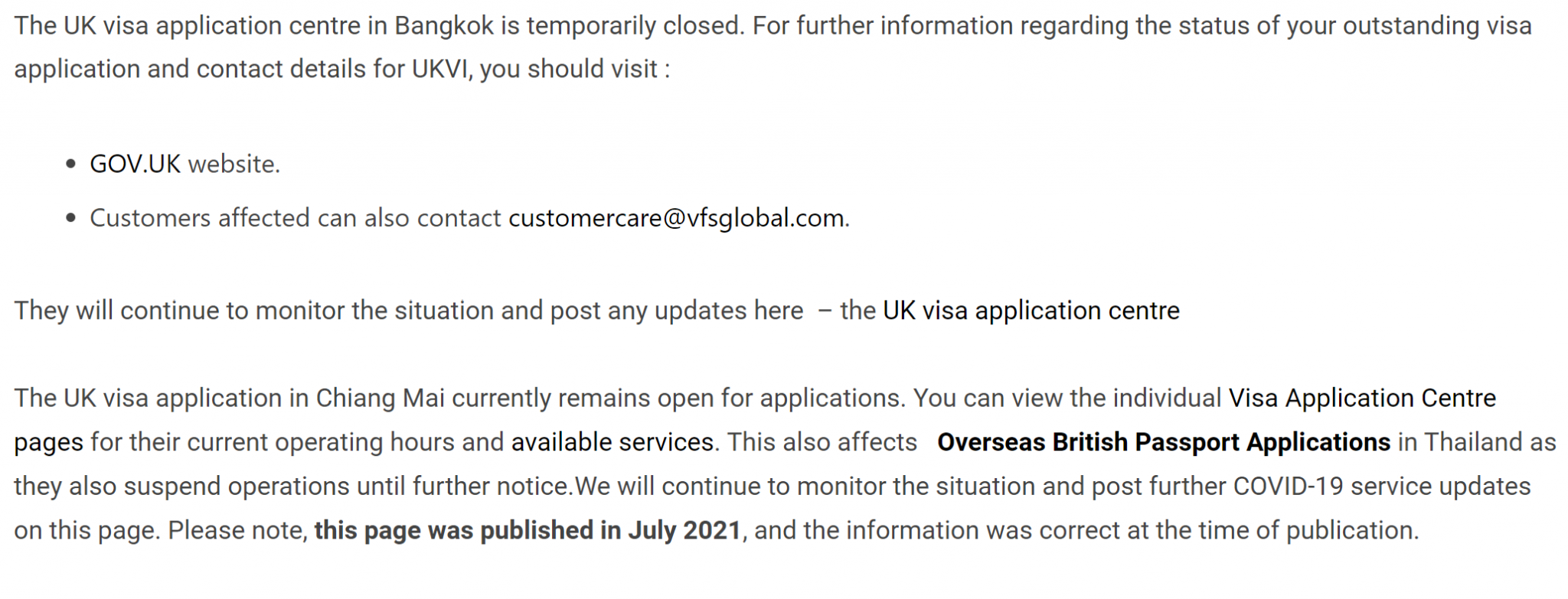

32 minutes ago, OJAS said:

I came across it after clicking on your original https://thaivisa-express.com link by:-

(1) scrolling down & clicking on READ MORE under the UK VISAS heading, then

(2) scrolling down 3 levels with the offending statement then appearing on the left-hand side.

Not sure where you got the 21/7/2021 publication date from, but this is not explicitly stated in the offending statement as I would have expected it to be, consistent with what I understand to be good website management practice.

More importantly, I would have expected Thai Visa Express to have taken down the offending statement from their website completely once VFS had reopened their UK Visas office, again consistent with good website management practice. How many more potential visa applicants are going to be totally misled - not to mention unnecessarily alarmed - by this offending statement until such time as Thai Visa Express feel sufficiently motivated as to take it down from their website completely?

Why would anybody look under "UK Visas" if they were looking to renew their UK Passport, surely they would look under "British Passports" (Just under "UK Visas" so not hard to miss)

I (sort of) take your point about people applying for UK Visas but if you read the page it clearly says...

So I doubt there would have been a lot of people concerned by it (Unless they happen to be applying for a UK Visa in the middle of COVID & were incapable of clicking on the "UK visa application centre" link https://visa.vfsglobal.com/th/en/news/information-about-the-uk-visa-application-centres-in-thailand for the latest updates - Granted this link was poorly encoded)

So I doubt there would have been a lot of people concerned by it (Unless they happen to be applying for a UK Visa in the middle of COVID & were incapable of clicking on the "UK visa application centre" link https://visa.vfsglobal.com/th/en/news/information-about-the-uk-visa-application-centres-in-thailand for the latest updates - Granted this link was poorly encoded)

I do agree that it's poor website management as it seems somebody has removed the offending article from the Passport Section but not from the applying for a UK Visa section, maybe they should be more like Key Visa & not even try to keep people informed with what's going on at VFS.

Oh & I also find it bloody annoying when sites don't publish the date on their articles & I have to go hunting for the "Published Date" through the page source.

-

- Popular Post

- Popular Post

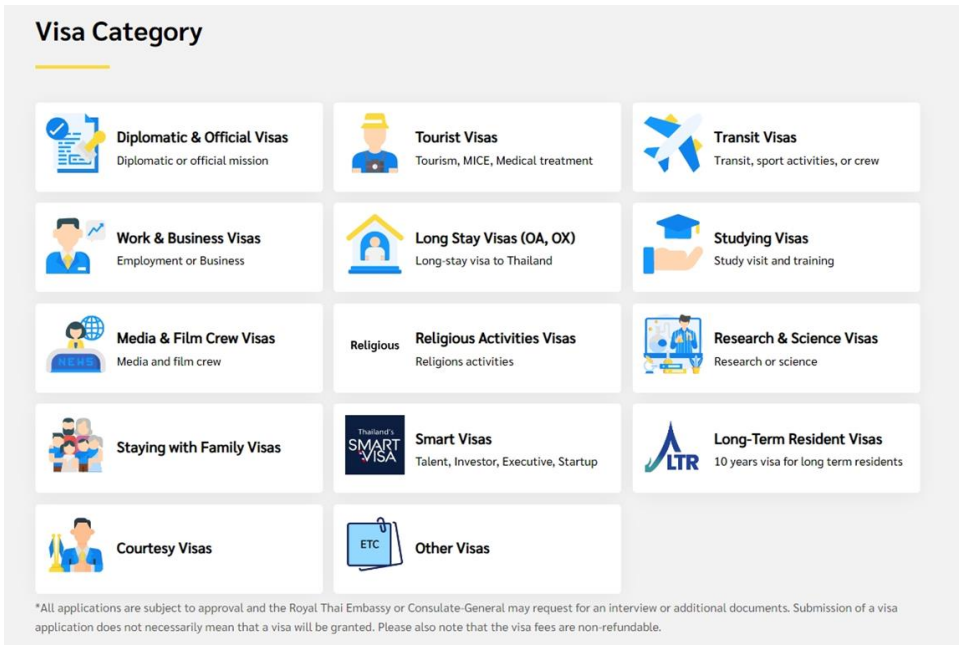

1 hour ago, ravip said:Non-IMM O is under Other Visas "Retirement (pensioner aged 50 or above with state pension who wishes to stay in Thailand for no longer than 90 days)"

1. Don't worry about the "State Pension" part, you don't need one you just have to show the normal financials

2. Don't worry about the "No Longer than 90 days" part, that is just your Visa, once you have the Visa you can start doing 1 year annual extensions.

-

1

1

-

3

3

-

1

1

-

2

2

-

3

3

-

2 hours ago, OJAS said:

https://aseannow.com/topic/1340999-uk-visa-application-centre-in-bangkok-temporarily-closed/

If this outfit are still peddling grossly out-of-date info on their website as regards UK visa applications, then how can they possibly be trusted to get things right when it comes to handling UK passport renewals on our behalf? Certainly doesn't look particularly good IMHO.

Key Visa strike me as a better option personally:

I've no idea how you came across the article linked in the topic above as you wouldn't come across it browsing their main UK Passport page https://thaivisa-express.com/category/british-passport-applications/ but it was published 21/7/2021 (Mid-Covid) so am sure was correct on that date.

They posted another article (which is on their main UK Passport page) on 27/7/2021 saying that HMPO centre would reopen on 30/07/2021 ... https://thaivisa-express.com/bangkok-hmpo-resumption-of-services/

I don't see a problem with that,.

TBH it was a toss up between them & Key Visa but I live in Wongamat so instead of me popping in when I happen to be in town (at least once per week) I would have had to make a couple of trips out to South Pattaya (Where I go maybe once per year).

Have to confess I was also nervous about the service from Key Visa since Darren died, but doing the research beforehand have read some very positive feedback about them so if I lived in South Pattaya or frequented Big C, Lotus, Makro, Outlet Centre etc... there I may well have gone with KV.

As it is, I used TVE to renew my UK passport in July & their service was flawless so can personally recommend them, other's may have used KV and say the same.

-

Have used Bolt 100s of times (I don't drive so use them 4-6 times a week) & the only problem we've had with them was trying to travel Pattaya - Bangkok during Covid lockdowns when intra-provincial travel was (supposed to be) banned.

- 1st Driver turned up (Blue & Yellow Fortuner Taxi), stuck the bags in the boot then realised we were going to Bangkok & said he didn't want to go.

- I messaged the 2nd Driver & explained that we were going to Bangkok so to cancel the ride if he didn't want to take us, he told us he had a mate that would do it, took us to meet him & we got to Bangkok no problem.

We were moving from Bangkok to Pattaya at the time so got the contact details of the guy who took us & he ending up taking us back & to a couple of times with no problem.

Nowadays, we have the contact details of a Bolt driver we trust so when doing long journeys we call her & arrange a price between us (I usually offer 30-40% more than what Bolt is), if she's not available then her husband (a "Proper" Taxi driver) will take us for the same price.

For airport runs it's Nam's Taxi every time.

-

For almost 1 year I was going Bangkok twice per month (sometimes just for the day to go see my Dentist, others overnight see my mates), never had anything more than a rucksack with me so would take the bus & the roundtrip costs would be:-

- 2 x 100B Bolt (approx. 25B tip in each of those) to/from Pattaya Nua Bus Station = 200B

- 2 x 131B RR Bus (may have gone up now) = 262B

- 2 x 70B (this is a guess, I just topped my cards up when they got low) for the BTS/MRT to Silom = 140B

Total = 602B

Taxi (Condo to Dentist) would probably be around 1,500B (You can get it on Bolt for around 1,250B + Tolls but you risk the driver not wanting to take you, Grab is more likely to take you but you're looking at around 1,700B) - add on + I00B Tip = 1,600B so a saving of 998B (x 4, I was doing 2 return trips per month) = 3,992B per month saving.

But I agree, if I were lumping luggage around with me I would choose the Taxi route

-

1

1

-

- Popular Post

- Popular Post

6 hours ago, chiang mai said:"If a Thai resident earns foreign-sourced income in 2024 and brings it into Thailand in the same year or any subsequent year, they will be subject to PIT on that income, regardless of whether they are resident in Thailand at the time".

Using that interpretation, that means any tax resident is taxable on foreign sourced income, even if they are not tax resident.....say what!!!

I understand it to mean that any income you earn whilst Thai Tax Resident is taxable when you remit it even if you are not Tax Resident in the year it was remitted.

E.g. If I earn £20,000 this year but leave it in the UK & remit it next year when I'm not Thai Tax Resident then the income is still taxable.

This discussion has been had before & the counter argument is "If I spend less than 180 days in Thailand then I'm not Thai Tax Resident so I don't have to file a return", but that is wrong, you can spend zero days in Thailand & be Tax Resident if you have Thai Sourced income so the question is whether there's any difference between you having taxable Thai sourced income (say from rental properties) & remitting taxable income (i.e. Income earned whilst you were Tax Resident in Thailand) when it comes to filing a return.

When it comes to remitting large amounts of money (Sales of property, PCLS etc...) Then I'd make sure I was non Thai Tax Resident in the year the income was "Earned" & try to be in the year it was "Remitted" (Though this isn't necessary).

-

3

3

-

1

1

-

7 minutes ago, Upnotover said:

I have read the same many times and it seems to be the case. Of course the only issue to consider is if wanting to travel in the last 6 months or not, if staying put then no problems.

Although not relevant for the OP as he's said he's not travelling, one thing to watch out for when you have a UK passport is that for travel to the EU it must be less than 10 years old.

I.E. if (like me) you renewed your previous passport 7 months early, you wouldn't be able to get into the EU with 6 months remaining on it as the passport would be 10 years & 1 month old.

https://europa.eu/youreurope/citizens/travel/entry-exit/non-eu-nationals/index_en.htm

OP: If you're in the Pattaya area then I'd recommend going to Thai Visa Express https://thaivisa-express.com/ for 12,000B (Includes a Jumbo Passport) they'll do it all for you without you having to go to Bangkok Twice & for an extra 1,000B they'll transfer over your visa/extension/re-entry permits...

-

3 hours ago, Presnock said:

Yeah, I lived and worked around the world, many countries and kept a log on the good and bad things in each place. Thailand ranked at the top as retirement came along and PI was a close 2nd, I spent 6 years there too, loved it especially since I am a scuba diver did advanced open water there near the old US naval base. But although warm weather only, i didn't like the number of typhoons, earthquakes (big ones), volcanic eruptions - there during Pinatubo, near Manila), and the food was not a whole lot to my liking unlike that here. I plan to spend my final years here and have thought the same since I arrived. I did live at first in BKK but the traffic got to me so moved to CM due to schools for daughter. Not a fan of pollution but we own a house there in a 100 house mooban and are renting a house in BKK where our daughter is going to college. WIfe has indicated that we might have to travel on those worse months - daughter may be in Seoul for graduate study so might check that out during the worse months. Anyway, you won't won't read many negative notes about Thailand from me. Hope you get to stay as long as you want. Maybe when the go to worldwide income taxation (if they do) they might do as the PI and not taxes on retirees unless working in country. Good luck and have a good one.

I love reading about people's lives like this, so thank you for sharing... I know we're on a Tax thread so probably shouldn't be getting into this sort of stuff, but I really did enjoy reading that so thanks again... 🙂

-

1

1

-

What Movies or TV shows are you watching (2024)

in Entertainment

Posted

Not everybody's (including mine) cup of tea but if the LGBTQ side of it doesn't take over the whole of the storyline then I for one am happy to watch along...

It's when the LGBTQ side of things takes over the story that I tend switch off... Sorry, but I have absolutely no interest in other's sexuality, much prefer a decent whodunit 🙂