Mike Teavee

-

Posts

3,594 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Mike Teavee

-

-

9 hours ago, fredwiggy said:

I cook all of the food when I'm home with my daughter and only spend about 3000 baht a month, and this includes oatmeal, soy and regular milk, eggs, chicken, ground chicken, salad greens, oil, rice, vegetables, fruit, yogurt,tea, coffee, pasta, sauce, bread, Italian Bread, parmesan, tuna, Equal, jelly, garlic, and a few other things.

We eat >95% of our meals at home (GF is an excellent cook) & my grocery bill is approx. 30,000 THB PM (No alcohol included) for the 2 of us, mainly due to my foibles when it comes to eating (I don't eat Chicken or Fish which are cheap here & will only eat high quality meat so no Thai beef & only eat lean pork which is approx. 360 THB per KG) + my love of Cheese, Butter & Korean/Japanese spices doesn't help, but also because she loves Chicken, Fish & Seafood so will often cook 2 completely different meals.

NB. I don't dispute that you can eat out or at home very cheaply in Thailand but it's not something that I would want to do, & would rather give up other things (e.g. rent a cheaper condo, socialise, go on holiday less etc...) before I went down that road & turned vegetarian (Cos I still wouldn't eating Chicken, Fish or cheap Thai meats).

-

1

1

-

-

4 hours ago, gargamon said:

It looks like there's a $360 yearly fee for the SRRV. So essentially the same cost as getting your tourist visa extended. From the govt link on srrv:

There's a maximum of 3 years that you can extend your tourist visa (not even a visa, just the 30 day stamp you get on arrival) so you would need to add in the costs of a trip outside of the Philippines.

Plus it seems like some immigration offices are cracking down on people (ab)using tourist "Visas" to live in the country & have scrapped the 6 month extensions so you can now only get 2 months which means the extension costs for the 1st year could be...

- 29 days free

- 30 day extension = 3,030

- 60 day extension = 9,700 PHP

- 60 day extension = 9,700 PHP

- 60 day extension = 9,700 PHP

- 60 day extension = 9,700 PHP

- 60 day extension = 9,700 PHP

= 51,350 PHP or approx. $900 USD

-

2

2

-

-

There's been a lot of talk in the news about same sex Civil Partnerships/Marriages (and about time to), but can a Hetro couple enter into a Civil Union/Partnership in Thailand?

Long story short I've never believed in marriage unless children are involved but reading the T&Cs of my pension it seems survivor benefits are only guaranteed if they go to my Wife or Civil Partner otherwise it's at the discretion of the Trustees & I wouldn't want to rely on their "Generosity".

Does anybody know if Civil Union/Partnerships between a man & a woman are legal in Thailand and if so has anybody been through the process and could share some information on how to go about doing it.

Thanks

MTV

-

37 minutes ago, TigerandDog said:

Sorry DrJack but your answer re arrival by air is incorrect. There is a limit of 6 times per year when arriving by air. "Those who arrive at the airport without a prior visa will continue to receive a 30-day stamp up to 6 times per calendar year."

Before you start saying the link is NOT the Thai Embassy, I'm aware of that, but it's been posted to support my post correcting your comment re "no stated limit via air".

New Visa Rules for Border Entry to Thailand | ThaiEmbassy.com

There is no date on that article (Edit: it's from 19th April 2015) but pretty sure that the rule got recinded years ago (If I had to guess I'd say 2017/2018 but certainly before COVID).

There's a lot of dated/misleading information out there, E.g. the London Thai Embassy (Edit: dated 16th October 2022) says max 3 times in 6 months...

Foreigners who enter Thailand under this Tourist Visa Exemption category may only do so for 30 days at one time with a maximum of 3 times in a 6 month period by flight and 2 times a year for overland crossing.

End of the day it's at the IO's discretion so whilst there may/may not be a maximum limit, you are more likely to be challanged the more visa exempt entries you do so best advice for longer stays would be to get a Visa rather than relying on extensions + border bounces.

-

1

1

-

2

2

-

-

52 minutes ago, Liverpool Lou said:

From which source did you get that information?

There was a thread about it on The Thaiger approx 6 monthd ago...

-

1

1

-

-

- Popular Post

1 hour ago, it is what it is said:sounds sensible, if people want to stay longer get the appropriate visa.

When working in Singapore I used to visit Thailand several times per year (once did 5 different trips in 4 weeks) but rarely for more than 2-3 nights & still got stopped at DMK asking why I spent so long in Thailand... Ended up getting a Non-IMM O not really the right visa for me as I wasn't staying long-term.

The max 2 entries at Land Borders per calander year has been in place since around 2018 but the restriction on air travel (if true) is a new development.

-

1

1

-

1

1

-

1

1

-

1

1

-

- Popular Post

- Popular Post

Section 90 The following persons failing to comply with the provisions stated below shall be fined not more that 2,000 Baht-

(3) person liable to tax failing to file a tax return under Section 83/2;

(4) person liable to tax return filing failing to file a tax return under Section 83/3;

To me, Point 4 would seem to suggest that if you're liable to file a tax return (e.g. have assessable income over the 60,000/120,000/220,000 depending on your circumstances limit) then you can be fined for not filing one even if you have no tax to pay (i.e. if your assessable income was less than the total of your allowances +150K).

Example: If I remitted 140K in one year then I know there's no tax owed irrespective of whether the money was assessible income or not but it's still over the single persons 60,000 limit for income not arising from employment so techincally I should file a return.

For the sake of a 2K fine I'm not going to bother especially as if they make me file then they'd owe me money as the withheld tax that I'd reclaim would be greater than the fine.

-

1

1

-

2

2

-

15 hours ago, Dogmatix said:

Yes, your remittance to her Thai bank is a remittance and is assessable income for her, assuming you are not married. There is an RD case about exactly this. A Thai woman received remittances from her foreign boyfriend abroad and it was deemed taxable income because they were not married. If married the RD would have accepted that the remittances were gifts from a spouse which is tax exempt up to 20 million baht a year.

Interesting, I read somewhere that you could claim to have a "Moral Obligation" to provide support to your Thai Partner (Not Spouse) but am guessing what is classified as a "Moral Obligation" would be something like having a Child together & not supporting her because it was you who asked her to stop working 12 hour days, 6 days a week so you could spend time together.

Just in case, I'll tweak my plans...

- Remit a total of 210K for her (This would be her 60K tax free allowance + 150K which is taxed at nil rate) & she can start paying 1/2 the rent, utilities, groceries etc...

- Remit a total of 235K to me (Same 210K + an extra 25K for purchasing Health Insurance)

- Remit Birthday/Xmas gifts (thinking 100K each) which I've a strong feeling she'll be using to take me on holiday for my Birthday/Xmas presents 😉

Rest of my spends will come from savings already in Thailand so should be good for a couple of years until I can either get an LTR or confirmation that remitting my pension (starts in 2026) will not be taxed, either way I'll spend < 180 days in Thailand in 2026 so have an opportunity to top up my Thai Savings accounts as needed.

-

1

1

-

-

Alcatraz (https://www.imdb.com/title/tt1728102/) popped up in the "Recently added TV Shows" on my TV Box & I remember watching some of it but couldn't remember how it ended so set about re-watching from the start.

Got to the end & found out why I couldn't remember the story ending, Season 2 got canned so you're left with a lot of unanswered questions...

Quite an enjoyable show if you're happy to never find out the full story behind how the convicts disappeared/re-appeared 50 years later 😞

Do Not Watch if you need your TV Shows to have a satisfactory ending

-

- Popular Post

- Popular Post

6 hours ago, stat said:You are not required to get a TIN in TH and therefore the bank in your jurisdiction cannot force you to get a TIN.

I don't think that's true for the UK as some Banks put pressure on people to obtain a TIN under threat of closing the account (which is why I got one) & other banks just closed the accounts for not being tax/ordinarily resident in the UK.

-

4

4

-

I prefer South Philippines (Visayas) & always thought that Cebu (excluding Cebu City & Mactan as too busy ) would be a good place to stay a while…. Maybe CarCar or Moalboal or even Bohol Island.

Spent quite a bit of time visiting Davao/Kapalong with my Ex & thought Tagum or Carmen would be good places to live if you don’t mind not being near a beach.

-

31 minutes ago, Jingthing said:

It's possible that it was more of a ballad than a disco song. So if that's the case I doubt it would have been played in discos. I have some memories of places that I heard it that were not in discos but on the radio.

I recall there was a bit of a travelogue aspect to the song in the lyrics.

Not Disco, has a bit of a travelogue theme about it & was from 1979 (45 years ago)...

Logical Song Supertramp...

Edit: People often called the song "Breakfast in America" but that is album title

-

- Popular Post

- Popular Post

6 hours ago, JohnnyBD said:I think it would be best if you consulted with a Thai tax firm rather than relying on other peoples opinions, but I will give you my thoughts on your questions below:

a) Do you have to obtain a TIN? I do not know. I will not be getting a TIN.

b) Do you have to file a tax return? I do not know. I will not be filing a tax return since I'm not getting a TIN.

I will be here 11 months this year, so I will be considered a tax resident, but I won't be remitting any assessable income.

I guess if every tax resident is supposed to get a TIN, then they better start getting the tens of millions of Thais to sign up for a TIN.

Pretty sure that no Thai's will need to sign up for a TIN as their National ID is their TIN so they're given a Tax ID from birth (as it is in most countries).

FWIW,

a) I have a TIN (Needed to get one for one of my UK Bank accounts though ended up not giving it to them)

b) I will be "Self-Assessing" myself as No-Tax owed (I'll only be remitting 235K which is the limit at which I'd start to pay Tax) so not filing a return for 2024.

I'll be ignoring the >3,000B withholding tax on my FD accounts so technically they'd owe me money if they want me to file a return.

-

3

3

-

1

1

-

1

1

-

5 minutes ago, stat said:

No one knows currently if Lifo, Fifo or any other accounting method will be used. I would also love to know which method they intend to use but I think they are not even aware that they need to specify it.

No idea about Thailand but UK uses LIFO which would seem to be the sensible option for calculating Capital Gains/Losses

-

1

1

-

-

9 minutes ago, UKresonant said:

Is there not also a deductible of 50% of pension to a max of 100k baht ( not at PC currently to check the detail )

I believe there is a pension allowance of 50% up to a max of 100K so that’s probably the 100K I missed 👍🏻

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

32 minutes ago, UKresonant said:For myself I speculate;-

Under 65

60000THB (personal allowance)

150000THB (nil tax band)

70000THB (Taxed only in UK. Gov pension)

The above all net of tax, based on actual remittance, landing in the Thai Bank Account.

Above 65 can add 190000 old age allowance!

Then there is the 50% of pension deductible (amongst others ) up to 100k Baht.

So for me generally, I think

380k THB Under 65

570k THB Over 65.

Not nitpicking, just checking to see if I missed something... Did you mean 280K under 65 (60K PA +150K nil tax band + 70K from your government pension) & so 470K over 65?

For me the "Tax Free" number is 235K made up of:-

- 60,000 Personal Allowance

- 150,000 nil tax band

- 25K for Health Insurance

... which is exactly the amount I'll be xferring (to myself) this year 🙂

-

1

1

-

3

3

-

4 hours ago, JoseThailand said:

What about foreigners marrying ladyboys? Can they get a marriage visa?

I don't see how "Legally" there is any difference in a foreigner marrying a ladyboy & one marrying a Thai male as they're both "Legally" (i.e. what their official gender is on their Passport/ID etc...) Males.

-

1

1

-

1

1

-

-

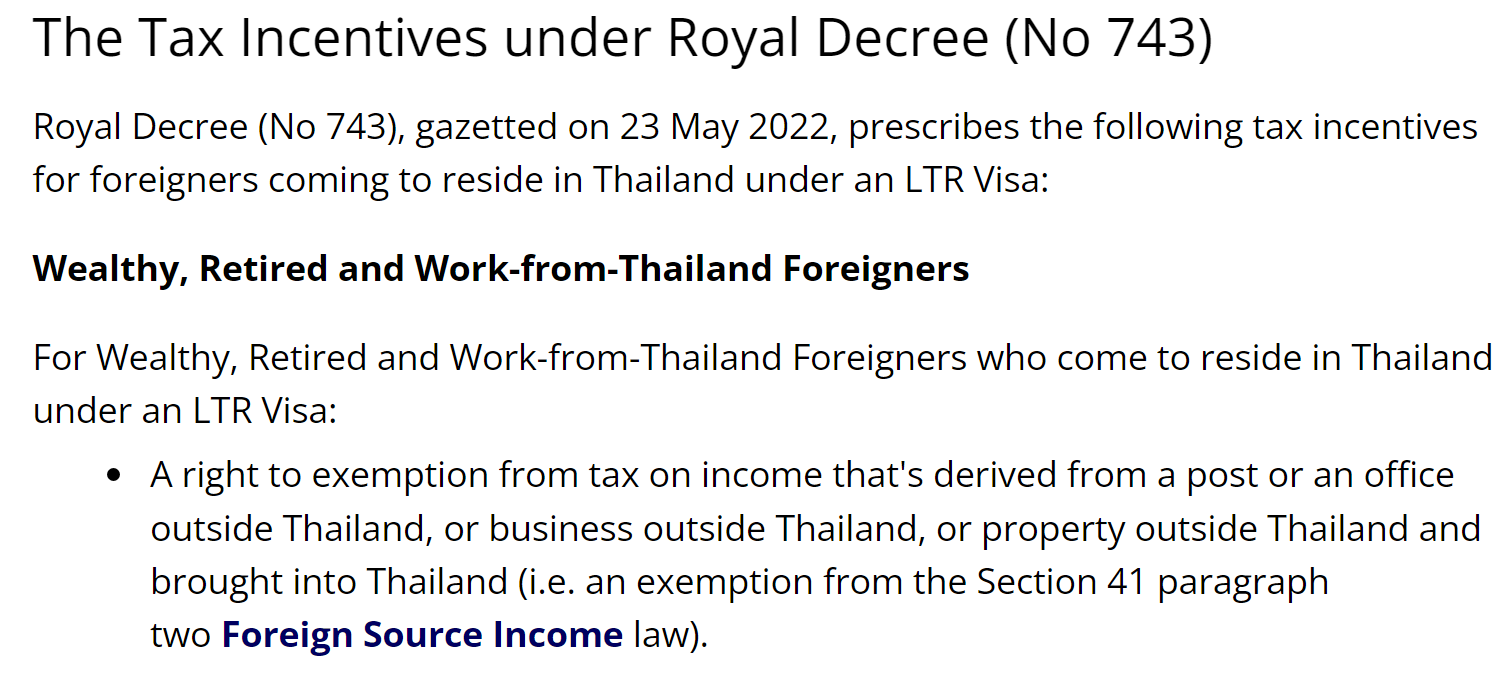

7 hours ago, Neeranam said:

Thanks, interesting,

Surely there will by an outcry by Thais, including myself, if rich foreigners don't have to pay tax on their foreign income and we do.

This would be unconstitutional.

A lot of (if not most) countries offer incentives so "Wealthy" people will live there. E.g. UK (currently being discussed/reviewed after Sunak's wife was shamed into paying tax on her Indian income even though she didn't need to) & Singapore.

-

1

1

-

1

1

-

-

5 hours ago, Neeranam said:

Why do long term visa holders get special treatment over Thais?

Are you sure about this?

The fact that some LTR Holders do not pay Tax on the Overseas Income has been published by many sources, but Sheerings seems to be the most quoted when it comes to Thailand's Tax rules so here's their take...

https://sherrings.com/long-term-resident-visa-tax-concessions-thailand.html

-

1

1

-

1

1

-

-

The Patient https://www.imdb.com/title/tt15574312/

A psychotherapist finds himself held prisoner by a serial killer who demands he help him curb his homicidal urges.

A couple of years old now, for some reason I missed it when it 1st came out.

-

2

2

-

-

57 minutes ago, Thaindrew said:

ATM withdrawals are reported as part of CRS to the country where you declare residency

Do you have a link which says this only that would be a very large number of records & matching them to an individual would be a nightmare (e.g. my UK Bank doesn't know about my TIN or even my passport number & matching against Name/Date of Birth isn't accurate enough).

I had a look at the CRS XML Schema (available here https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/schema-and-user-guide/) & it seems to be about reporting "Closing Balances", the period for which isn't clear, but the minimum standard seems to call for reporting at least once per year so it could just be your Bank reports to Thailand what your closing account balance is at the end of the year (Again, this is only of any use if they can match this information to you as an individual).

I believe they have no way of tracking ATM payments but could decide to look at an individual if they bring a lot of money into Thailand or have no visible means of supporting themselves (i.e. they don't bring any money into Thailand).

FWIW until things become clearer, I've decided to:-

- Bring in 235K THB pa which matches my tax free allowances (60K personal allowance, 25K towards Health Insurance & 150K at 0 Tax rate).

- Give the GF 360K pa (30K pm) to provide "Support" for her so she can now start paying 1/2 towards rent, utilities, groceries etc...

- Use savings I already have in-country for the rest of my expenses.

I'll also be bringing back £8,000 from my next UK Trip which will be used when I need to purchase foreign currency for trips outside of Thailand (all paid for on my UK Credit card)... I can't say this change has made me plan more international trips as I was going to do more anyway but it's certainly giving me a nudge to do so over domestic travel.

-

1

1

-

2

2

-

1

1

-

3 hours ago, mikebell said:

Sorry - you're correct. Wasn't there a Mr. T character in a long-running series?

“Mr T” was in the A-Team & I believe they made a TV series called “Mr T” in the 80s.

I quite like Professor T, easy watching.

-

29 minutes ago, mikebell said:

'Mr T' series 3. Complete.

Should that be Professor T?

https://www.imdb.com/title/tt11981644/

(If not, Professor T Series 3 dropped last week).

How to retire in Thailand

in Thai Visas, Residency, and Work Permits

Posted · Edited by Mike Teavee

I regularly ask myself the same question (NB it's more like 4.5 meals a day, I eat 3 times per day and she'll eat 1.5 times) & the 30K does include things like toiletries & house cleaning products etc... But >80% of it is food.

As I said I don't eat Chicken or Fish which tend to be much cheaper here, so a typical meal for me at home will probably cost 2-300B in ingredients, multiply that by say 4 & add in mineral water, coffee, milk etc... & you're looking at approx. 1000B per day.

To give a simple example, 6 times a week we use the Condo gym after which she'll cook me a Thai Omelette which I'd guesstimate costs 25B for 4 eggs, 75B for 200g of minced pork, 5B for 1/2 chopped onion, 25B for 30g of cheese = 130B, add on some salad & some beans cooked in a Korean sauce (to give it a bit of a kick) & you're looking at closer to 200B before you add in the 2-3lt of mineral water, 2 coffees & 1 protein shake.

NB I don't post this to "Brag" in anyway this is simply what I spend on groceries in Thailand & is why I probably couldn't live on the smaller budgets being mentioned here - Survive Yes, but I would probably turn vegetarian before I'd eat Chicken, Fish or the cheap Thai meats, but that's just me.

As always to each his own, there's no right or wrong answers on this we all just live to our means & prioritise what's important to us (E.g. I'd rather eat well than go out drinking but that's just me).