- Popular Post

Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

1 hour ago, chiang mai said:

The big one for me is the part about who must file and when

I've decided I'm going to File a return for this year (Have filed previously & already have a TIN so can do it all online).

My original thinking was that I have approx. 8K in withheld tax that I can claim back, but now I'm thinking I'll remit enough money so I'll break even or have a small (couple hundred THB max) Tax liability.

TBH I need the cash & taking it out of my fixed deposit accounts would cost me more so it makes sense to me.

-

1

1

-

1

1

-

-

On 10/4/2024 at 3:43 AM, thaitanic said:

I'm a 58-year-old Brit. For the past few years I have been mostly living in Thailand on a non-immigrant 'O' visa which I extend for a year every November at Samut Prakan. I am NOT drawing a UK state pension. I keep 800k Baht in an SCB account.

I am currently in the UK and due to return to Thailand in November, in time to renew the visa, but I am considering extending my UK trip past the renewal deadline date to January, and so will need to apply for a new non-immigrant visa.

I was thinking of applying in the UK before I return to Thailand, but the Royal Thai Embassy London page at https://london.thaiembassy.org/en/page/retirement-visa states the visa is for "pensioner aged 50 or above with state pension who wishes to stay in Thailand for no longer than 90 days". And the Hull consulate (http://www.thaiconsul-uk.com/non-immigrant-visa-cat-o-pensioner.php) states that the visa is for persons "who are receiving a UK State Pension".

So where can I get a non-immigrant 'O' visa just on the basis of being over 50, without the requirement of actually drawing a pension? I am happy to visit an embassy in a neighbouring S.E. Asian country in January if necessary, and actually have to go to Ho Chi Minh (where there is a consulate) anyway.

Or should I get a tourist visa in the UK and convert it to a non-immigrant 'O' visa at Samut Prakan? I think I probably did that last time (a few years ago), but can't really remember.

Although the Website says that you need to be drawing State Pension, you don't & there have been reports of people successfully applying for a Non-IMM O in similar circumstances to yours.

If it's no hassle for you to get it whilst in the UK I would just do it there to save messing around when you get back.

-

Just now, Surasak said:

Nationwide/Virgin Money. They asked for my UK Tax Identifier Number. What use is my NI number to a bank? Or if they did require the NI, it is on three of my pension remittances to my A/C.

My mortgage is with One Account (Was Virgin One) & a couple of years back they asked me for a Thai TIN (No idea how they knew I was in Thailand as I never use that account) but they've never asked me for my UK TIN, though they would have my NI Number as part of the registration so must be happy with either/or.

As an aside they're closing my account in March (Mortgage period is finished) and in their letter they offered to migrate me to a normal bank account (Natwest I believe) but I'm pretty sure that's just a standard letter and they won't let me do it because I live in Thailand.

-

16 minutes ago, Surasak said:

Just to add the mix. I received a letter from my UK bank on Thursday 03/10/24, asking for my UK TIN number. I was given alternate means of contact, and the easiest was to phone. The questions were, am I an American citizen, NO.

Do I have a TIN number from any other country, NO.

All fine and dandy, but we are being checked upon.

Just so you know.

Which Bank?

And I wonder why a UK Bank would ask for a UK TIN Number (None of mine have my UK Tax Identifier Number) - Did they mean your National Insurance Number?

Maybe they can be the same thing, but everybody who files a Tax Return is given a Unique Taxpayer Reference (UTR) which is what understand to be my UK Tax Identification Number.

https://osome.com/uk/blog/tax-identification-number-tin/

-

5 hours ago, BritManToo said:

Wrong, I used to watch Corry, Emmerdale and East Enders, yet here I am.

Yeah but you're more a Mike Baldwin than a Kevin Webster (Forced to sit through Corrie as a Kid).

Funny story in 2009 my parents made their 1st trip out to Singapore to come visit me & this was before the days of having any decent IP services so what's on Singaporean TV was what you watched... Up pops a promo for Coronation Street & Mum gets all excited so we had to stay in to watch it... Next thing, Ena Sharples pops up (She'd left the show 30 years earlier 😛) but it was good to see Stan & Hilda again 😄

It it wasn't for Crimewatch (Bicycle Stealing Gang) we'd have had nothing to watch 🤣

-

10 hours ago, anrcaccount said:

So, maybe, you can just use the remitted (net) value, and then 'not try to' offset any expenses incurred in Thailand ( of which, of course, there are none, for foreign rental income) .

Apologies I worded that part very badly, I was trying to say not claim any expenses you've incurred for your property so should have said something like "Not include any expenses you've incurred for the property on your Thai Tax Return"...

10 hours ago, anrcaccount said:This point is very valid and again highlights the complexity and uncertainty, again.

Agree which is why, even though I'm better off claiming my UK property expenses against Tax in Thailand, I wouldn't try to do it without professional assistance so will leave the money in the UK for now.

-

1

1

-

-

1 hour ago, anrcaccount said:

OK.

Seems difficult to apply your wording to reality. Let's try an example to see if I am understanding your opinion on this:

Foreign gross rental income - 20000

Foreign expenses deducted ( e.g. agent fees, maintenance, interest on mortgage, etc) - 10000

Net before tax - 10000

Tax paid in foreign country - 2000

Remaining- 8000

8000 is then remitted to Thailand.

How would you see that the TRD computes the assessable income, deductions, and tax credits (assume dta) in this scenario?

As I understand it you would either use the remitted value & not try to offset any expenses incurred in Thailand (I.E. Would be £8,000 from which you can claim a tax credit against the £2,000 tax you've already paid) OR you would pro-rata the Gross Income/Tax & claim 30% of the (Receipted) expenses in Thailand, something like:-

- Gross Income £20,000

- Amount Remitted £8,000

- Tax credit = £8,000/£20,000 * £2,000 = £800

- Expenses claimable = 30% of £10,000 = £3,000. *I'm not aware of any upper limit to the expense reclaimable.

Edit: As I'm using UK as an example it's worth mentioning that you cannot claim Mortgage interest as an expense in the UK, have no idea whether it would be an allowable expense in Thailand if you were using US as an example.

-

1

1

-

41 minutes ago, Liquorice said:

If you're not using the monthly overseas transfer method for annual extensions, then it's irrelevant, but if do use that method then it's important to regularly update your passbook.

Even if using the 800K in the bank method you need to be careful about not having consolidated entries... I nearly got caught out by them when extending at CW but my Agent caught it & took me to the bank to get a statement covering the period in question.

-

1

1

-

-

Just now, itsari said:

If you read the post I was answering to I am not wrong.

Most of not all social agreements the UK has started or stopped for that matter was before Brexit.

So how is the UK saving money

On pension payments to pay for asylum seekers hotel bills.

Ahhh got you, you were answering a post on BREXIT, I was just pointing out that prior to 1950s all overseas pensions were frozen & to the best of my knowledge the UK has never stopped paying increases once an agreement was in place.

-

3 hours ago, itsari said:

The UK Goverment began saving money on pension payments by discriminating what country a pensionist chose to live in the 1950s.

So not much help in covering the 2 billion a week shortfall from the Brexit blunder.

I think you've got that backwards, prior to the 1950s all overseas Pensions were frozen & it's only since then that some countries have entered into reciprocal social security agreements which include pension uplifts.

https://britishpensions.com/state-pension-history-timeline-1/

-

1

1

-

-

25 minutes ago, GammaGlobulin said:

There is also one other.....

One of them trashed a motorcycle for the fun of it.... not long ago.

Wait and see.....

Are you thinking of CB Media (Believe his name is Chad), he got blasted for wrecking that motorcycle and stopped making videos on Thailand per se to focus on motor related content.

Edit: This is the video I was referring to...

-

1

1

-

-

3 minutes ago, Hugh Jarse said:

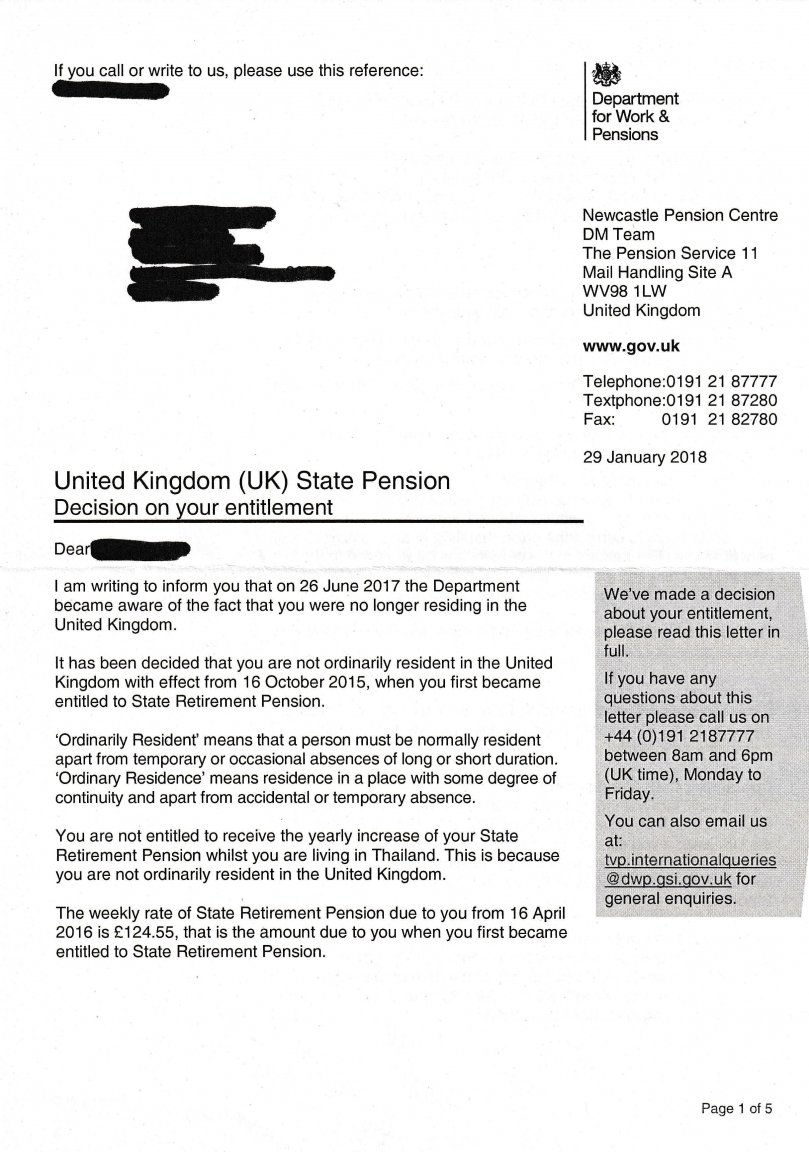

If the DWP find out your real abode, they simply stop your pension until you repay all overpayments. UK govts situation is dire now and likely to worsen. Let’s hope pensions are not conditional on UK residence.

State Pensions are not a “Sanctionable Benefit” so they can’t stop paying it, but they can stop paying any other benefits you might be claiming.

-

1

1

-

-

2 minutes ago, Blueman1 said:

35 years for full pension....30 Years in my case.....

40 in my case (was contracted out for a few years).

Thats assuming the rules don’t change between now & 2033 when eligible to collect it.

-

Delete - Duplicate post

-

47 minutes ago, Photoguy21 said:

No he doesnt I can assure you of that.

He absolutely should get it so well worth him querying it with DWP as they should back date any increases he’s missed so he might be in for a nice Payday 👍🏻

-

1

1

-

1

1

-

-

I'm not 100% convinced that it is a reduction in Health Insurance requirements as although the inpatient amount has been reduced, they've re-introduced the (IMHO Pointless ) Outpatients requirement.

Has anybody who has insurance covering the current requirements got a quote for changing to meet the new requirements?

FWIW If it were me, I wouldn't reduce my Inpatient cover below $100K anyway so would end up paying more to add on the Outpatients.

-

1

1

-

-

4 minutes ago, simon43 said:

From what I understand, if you stay in the Philippines for more than 180 days, (with bank account, visa etc to demonstrate your residence in the country), then you can move back to Thailand after 180 days and you will continue to receive that increased pension.

Rinse and repeat every 180 days - but I imagine most cannot flit between Thailand and the Philippines every 180 days....

Technically I don't think that's correct based on the fact that if you were to move to the UK for 180 days and then moved back to Thailand your SP would be reduced back to what it was frozen at before - However, practically I doubt they're able to pick up on this.

-

13 minutes ago, impulse said:

Question... If one moves to the PH, are the increases backdated, or do you start out at the number you had when you left TH?

You start at the rate you would get if you lived in the UK so would have caught up on all the increases since your pension was frozen but you wouldn't get any backdated payments

-

12 minutes ago, JonnyF said:

Another reason I never bothered topping up my National Insurance when I left the UK and took every step possible to pay as little into the government pension scheme as I could.

I would never trust the government to do the right thing by me. Better off with private investments where you can get to the money whenever you like, the goalposts aren't constantly moving to pay for government screwups on issues like illegal immigration, illegal wars etc.

I feel very sorry for people who paid in all their lives and then get stitched up. But in my opinion the writing has been on the wall for several years. The government simply doesn't care about old people who paid into the system all their lives.

It's basically a Ponzi scheme.

Everybody's circumstances are different but I topped up my NI contributions at Class 2 rates (Working Overseas) & the "Payback" is something like 7 months, so assuming I live to 68 I'll be quids in - IIRC Payback at Class 3 rates is something like 7.5 years, still not a bad deal.

-

11 minutes ago, proton said:

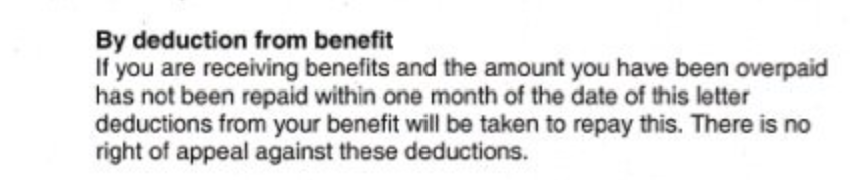

Seems this is not the case, here is a letter posted on here some time ago from a poster who had a letter not only claiming over paid pension back but also a penalty fine They do not say how they found out he was in Thailand but when they do the pension is not just reset to the original amount, they want the over payment back, but it's claimed on here they cannot or do not.

As discussed earlier in the thread, they cannot garnish your State Pension to reclaim what's owed but they can use any other benefits you may have (E.g. I would expect a lot of Pensioners relying on State Pension alone would also receive Pension Credits which they can reduce to pay back the debt).

-

Just now, jori123 said:

No State Pension

Sorry I should have been clearer, whilst your State Pension cannot be reduced, if you are receiving other Benefits (E.g. Pension Credits) these can so they can get the money back from you.

-

1

1

-

-

Just now, jori123 said:

This is State Pension

It is black and white, State Pension, no punishment, be specific tho,do not quote other benefits

Whilst the basic State Pension cannot be garnished to repay any (Fraudulent) overpayments, other "Benefits" (Including additional Pension Credits) can be:-

Sanctionable benefits

The following benefits can be reduced or stopped if you commit benefit fraud:

- Carer’s Allowance

- Employment and Support Allowance

- Housing Benefit

- Incapacity Benefit

- Income Support

- Industrial Death Benefit

- Industrial Injuries Disablement Benefit

- Industrial Injuries Reduced Earnings Allowance

- Industrial Injuries Retirement Allowance

- Industrial Injuries Unemployability Supplement

- Jobseeker’s Allowance

- Severe Disablement Allowance

- Pension Credit

- Universal Credit

- War Disablement Pension

- War Widow’s Pension

- War Pension Unemployability Supplement

- War Pension Allowance for Lower Standard of Occupation

- Widowed Mother’s/Parent’s Allowance

- Working Tax Credit

-

1

1

-

Just now, Expat68 said:

Final Salary exempt from Thai Tax. Is that everyone who was on Final Salary regardless whether it was government or not?

No, just Government Pensions, Private Sector Final Salary pensions are tax assessable if remitted to Thailand

-

1

1

-

1

1

-

-

- Popular Post

2 hours ago, webfact said:The End Frozen Pensions campaign warns that many pensioners, including ex-nurses, firefighters, and police officers, now live in poverty

Ex-nurses, firefighters & Police Officers all get “Final Salary” government pensions which are very generous & exempt from Tax in Thailand.

It’s the average Joe with little/no additional pension that feels this the most.

Should have moved to Philippines (where State Pension is not frozen).-

2

2

-

5

5

-

3

3

-

1

1

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part II

in Jobs, Economy, Banking, Business, Investments

Posted

You don't need AI you just need decent data...

It would take minutes to get a list of all Foreigners who have spent more than 180 days in Thailand assuming Thailand keeps track of passport numbers & length of time spent in country (which they do)

It would take minutes to get a list of all Foreigners who have remitted money to Thailand this year & their passport number (already provided to them by all of the Banks).

It would take seconds to do a "Union" query to match the 2 datasets & go after those who haven't filed, maybe for legit reasons like only have US Social Security coming in but I'm sure they'd catch enough to make the 2,000B fine for not filing worthwhile.

End of the day the data set would be limited to the approx. 300,000 Expats living in Thailand (& from that you could exclude guys who are working & are already filling returns), could do that using MS Access if not Excel.