-

Posts

1,138 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by UWEB

-

-

19 hours ago, JuanMatus said:

Hi.. I was used to infaliable LG fridge in US and mine went out (compressor) in 3 years! Now, after reading blogs, I will avoid LG and Samsung. Also, Hitachi seems to be hit/miss. Given that I need a 18cuft (560plus Liters) fridge... I was looking for input about Mitsubishi fridge. Also, I would appreciate specific model number recommendations if somebody bought a fridge in the last FIVE years and it has been problem-free. Additionally, based on my experience, it seems that HomePro has the best customer service. Feel free to comment

Have bought this one 3 years ago from a Home Pro Promotion, perfect for me and is running without any problems

-

-

45 minutes ago, paddypower said:

Ouch! I have been silly-busy on other stuff - just checked my 90 day. it was due on jan 8. Normally they send a reminder. this time they did not. any suggestions?: do i file online or do i rush to IO (250km trip) ? thanks

For Online it's to late. You have to do it latest tomorrow in person to avoid a fine or you just wait till your next Extension is due and get a fine of 2k THB.

-

1

1

-

-

14 hours ago, ujayujay said:

A typical checklist for a brand new car.....Funny🤪

So you never check anything when you buy a piece of high price Equipment? At least I do before I pay tens of thousands of Dollars.

-

27 minutes ago, brewsterbudgen said:

Does anyone know how to fix a Phillips Air Purifier that just does this when turned on?

When have you cleaned or replaced last time the Filter? You can push the Start Button for 3 seconds to reset the Purifier.

-

1

1

-

-

59 minutes ago, Rampant Rabbit said:

Taxed my pick up today in Pranburi has at least 2 speeding tickets, not mentioned, taxed ok.

Someone said a while back when taxing there car there that they had to pay fines before tax was given.

Anyway theres an update, didnt pay any fines. ps save me the menace on the roads crap replies......nah knock yerself out go for it after all one of them was 121kph in a 120kph gasppppppppppppppppppp poor

TimmySomchainever stood a chanceThe other was a 116kmh in a 100kmh when changing lanes from the 120 lane to the 100 lane ( what a dumb rule that is) when it was empty.

Im sure there's others but I file em in trash or maybe I should do as the Pataya guy did and eat them?

May be that's the reason

-

Nothing else than a Scam, better to write off the Money.

-

19 hours ago, driveout said:

Hi everyone,

I need some help clarifying a few things before heading to the DLT (Department of Land Transport) to get my Thai driving license.-

Driving License Requirements:

- Do I need to bring my original EU driving license together with my International Driving Permit (IDP), or will just the IDP be sufficient? Unfortunately, I only have my International Driving Permit with me, as I didn’t bring my original EU driving license. Will that cause any issues?

-

Health Check:

- Does the health check need to be done at a government hospital, or can it be done at a regular clinic?

-

Visa Requirements:

- Is there a specific visa required for applying for a Thai driving license, or can it be done with any type of visa?

-

Other Documents:

- Besides my passport, what else do I need to prepare? Are there any additional documents I should bring to avoid delays?

Thanks in advance for your help! I appreciate any advice you can offer.If you want to get Car and Motorbike License you need all Documents like CoR,Medical etc. double.

-

1

1

-

-

39 minutes ago, Yodarapper said:

As the day draws closer to me picking up my new car, hopefully if all goes well will be by the end of this month.

I wanted to ask for advice from people that have bought a new car in Thailand.

What do I need to check and make sure? How do I make sure I am not getting ripped off or basically what should I be checking?

I have decided on the Atto 3 Extended 2024 version - I am not sure whether to pick White or Black - I am currently thinking Black because the interior is darker and I have kids but is one better than the other? Those are the 2 colours I have been offered.

I am buying on finance and I am waiting to get approval. So when I pick up the car what should I make sure I do, check, etc?

Thank you for all your help!

Check Car inside and outside for any damage

Check Tires for any damage

Check all Door and Hatch Gaskets for damage

Check if all Equipment like V2L Adapter, Granny Charger and Tyre Repair Kit is available

Check if electric Windows opening and closing properly

Check if latest Software update is installed

Check Light System and Indicator if working

Check if Owners Manual is available, at least Soft Copy

Check Entertainment System and Dash Cam is working

Check which SIM Card is installed, Simtel or True

-

Just use Military Forces and copy Dutertes Concept for Drug Dealers, sorted. Within a week Thailand has the cleanest Air on Earth.

-

41 minutes ago, oporhatch said:

I have seen on the Siam legal website that it states a document requirement is a marriage certificate document (both versions).

I only have one a marriage certificate . So what is meant by both versions

any help would be appreciated

You need Kor Ror 2 ( if married outside Thailand Kor Ror22) and Kor Ror 3.

-

1

1

-

1

1

-

-

-

What's the difference, Zuckerberg and Fakebook was always bending facts

-

On 12/24/2024 at 6:04 PM, SunnyinBangrak said:

I think he recognizes the westwards creep of communism/socialism from China and the dangers such anti western democratic way of life poses. Denmark like the rest of western Europe is under the grip of commie/woke/self loathing/population replacement whackjobs, not a big stretch to see them aligning totally with Beijing when the population has been sufficiently "enriched" and then having red army bases all over Greenland with nukes pointing at the US from its backyard.

Far better just to annex Grernland and save the worry. Make Greenland Great Again, end of the day it's up to Greenland based voters if they want to be free or under the woke yoke.

Hard to beat such a nonsense.

-

1

1

-

1

1

-

-

-

On 12/21/2024 at 8:48 PM, Pib said:

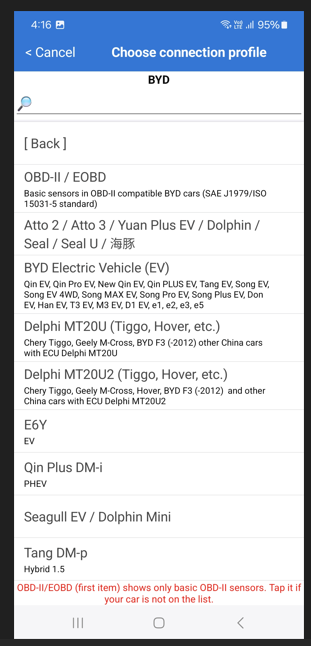

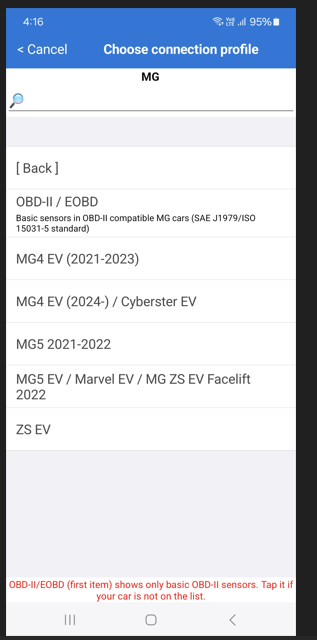

And one more thing. An OBD2 adapter is only half of the team...the other team member is the OBD2 app you use to connect to/interface with the adapter.....then this team can communicate with the car. And for the app and adapter to communicate with each other (and the car) the app has to have a specific "Connection Profile File" which is a fancy name for a device driver....a driver that will properly communicate with the adapter "and car." That Connection Profile File is VERY important.

The Car Scanner app talked earlier than LOTS of Connection Profile Files (i.e., drivers) for many different brands/models of cars...to include EVs. Below are a couple of snapshots of the Connection Profile File choices for BYD and MG cars.

For BYD Vehicles

For MG Vehicles

Does the Car Scanner PRO Version showing State of Health of the Battery?

-

- Popular Post

- Popular Post

29 minutes ago, agg211 said:I want to place an a/c in my room which measures 6 x 4 meters (24 square meters) which is about 260 square feet. The height of the room is 2.5 meter.

At a big specialized shop they recommended 18000 btu for this room.

When I did a calculation myself on a few websites, including the details of the room (sunlight etc.) it gave me a result between 10000 and 13000 btu.

What could cause this difference?

Big or small size Windows in, Ceiling Insulation, outside Walls exposed to Sunshine?

-

3

3

-

- Popular Post

- Popular Post

1 hour ago, cliveshep said:Update - I made the 3rd application for the 90-day on 27th December, it came back yesterday 2nd January. Remembering it expired on 10th January this one expires on 27th March. So it's a 90-day report that we must apply for between 15 days before expiry to 7 days before, I figure that it ought to say report again before expiry on 10th March but no, it dates from date of application. So if I apply 15 days before expiry on all 4 applications per year that is a total of 60 days I am being deprived of, it becomes a 75 day notice effectively. Glad I don't rent a car or a building from these guys! They are trickier than a Thai Lawyer!

It takes me always two minutes only to do my 90 days online, so if I have to report 5 times a year instead of four times makes no difference to me.

-

3

3

-

1 hour ago, Andrew Dwyer said:

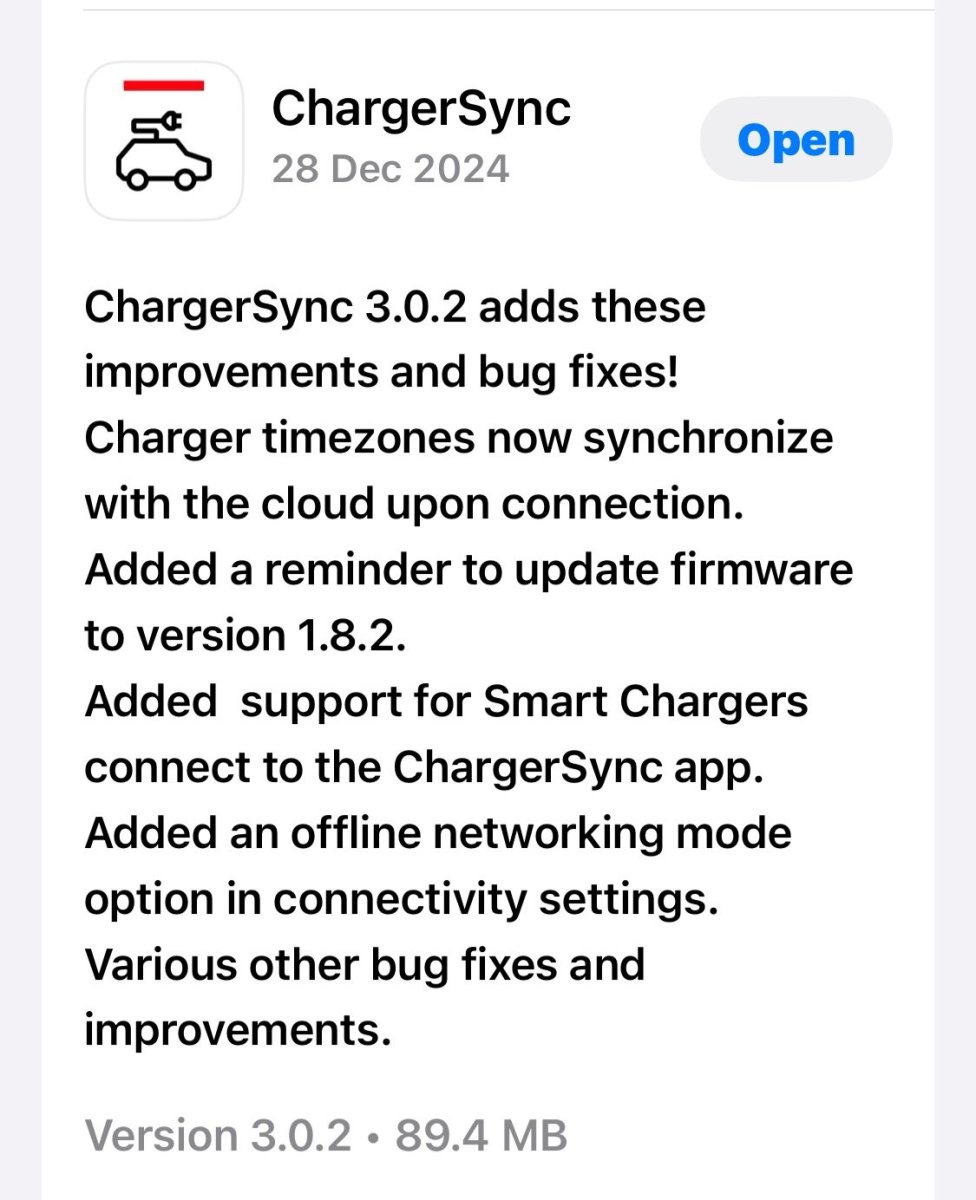

Thanks, I have version 1.8.2 installed, but it is may be causing the problem and not resolving.

-

2

2

-

-

I have an ABB Terra Wallbox installed and all was fine, but on 25. of December the Charger has stopped to record the Charger Sessions. Anybody else has the same problem?

Wallbox is still connected to Internet and the connection is working, may be the ABB Server has an outage?

-

- Popular Post

Just allow Big Bikes on the Express Ways like other Countries are doing, minimum Speed 60 km/h and at least 250 ccm.

-

3

3

-

1

1

-

- Popular Post

- Popular Post

As long they are not penalizing all the Farmers burning their Fields and trash nothing will change, even not 20.000 death or 10 million people suffering from Air Pollution.

-

1

1

-

2

2

-

5 hours ago, ScotlandtheBrave said:

I have just received my annual renewal paperwork and found that this year it has risen to 88,000 Baht!!!!! I am 66 and have had a policy with this company for thirteen years and made very few claims. What is going on? This is a huge increase. Can anyone explain why this is happening?

Here is an example when Health Insurances increasing the Premium, as you have written you are now 66 means Premiums going significantly up.

-

1

1

-

1

1

-

-

There are two branches in Ranong, which one you are using? One is in Town Center and the other one in Saphan Pla close to the Ferries.

-

1

1

-

Electric Vehicles in Thailand

in Thailand Motor Discussion

Posted

Just for Information

https://www.aboutamazon.eu/news/sustainability/amazon-places-its-largest-ever-order-of-electric-heavy-trucks