treetops

-

Posts

5,403 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by treetops

-

-

1 hour ago, jayboy said:

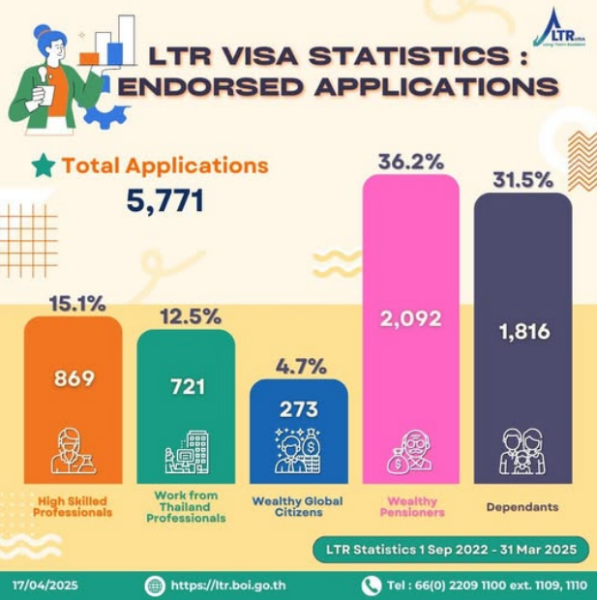

I would have thought the glaring flaw is that the target was 1,000,000 (in all categories) whereas the actual achievement is 6,000 . . . .

And around a third of applicants are as dependants so the actual number of people qualifying of their own right is even lower.

-

1 hour ago, Guderian said:

Or have I misunderstood what they're saying?

Yes, as have some others. These alerts come in the form of SMSs so as long as you're within range of a mast you can receive them even if you're connected to wifi rather than mobile data.

I seem to remember they could be switched off/disabled from your phone but looking at the menu options on mine now it doesn't seem so easy.

-

It may not apply to non-Thais if this is an issue for you. Discussed a couple of weeks ago on a post just down the page from yours.

-

2 minutes ago, bdenner said:

Without reading all of this:- I have just successfully completed the Digital Arrival and have the PDF and email copies transferred to my phone. No access to a printer. Will the QR code suffice?

Nobody has used one yet to find out immigration's interpretation, but if you read the email it mentions "You may choose to download or print a copy of this and retain it for the duration of your stay" which indicates to me it's not compulsory to have a print out.

-

1

1

-

1

1

-

-

10 hours ago, PingRoundTheWorld said:

I stand corrected. I guess being in the US on 9/11 permanently locked my mind to 100ml...

Even though the rule wasn't brought in until 5 years later as per the post on the previous page?

-

1

1

-

-

May not answer your specific question but there's some other discussion in this thread.

https://aseannow.com/topic/1355683-new-payment-system-tagthai/

-

Are you referring to the new TDAC?

It can only be done a maxiumum of 3 days before entry. Use the calendar box and you'll see dates beyond that are not selectable. Manually entering an ineligible date will give the Invalid format error message.

-

1

1

-

1

1

-

-

53 minutes ago, Sierra Tango said:

For as long as I can remember, after 9/11, LGA containers have always been limited to under 100ml. Whats the issue? Just stick to the regs and cruise on through.

The restriction was introduced following discovery of a terror plot in 2006. 9/11 was 2001.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

9 hours ago, Chelseafan said:it's the UK Goverments website so I would think it's correct but irrespective of that, I am more concerned with being able to board the aircraft in the first place, it only needs a "different" interpretation of the rules by some jobsworth to deny me boarding.

The airlines use the IATA system Timatic to check requirements and that shows your passport only needs to be valid for the period of stay. No 6 month rule.

-

2

2

-

1

1

-

5 hours ago, chickenslegs said:

Apparently there is one. At Sukhumvit/Klang junction ...

https://www.bangkokpost.com/life/tech/1679048/hi-tech-bridge-eases-disabled-crossing-woes-in-pattaya

Edit: Looking again at the article, the pedestrian bridge is quite a way north of the junction.

Yes, it's adjacent to the Father Ray Foundation building which houses disabled children and students so ideally placed for these users.

-

1

1

-

-

Lots of threads discussing this, both for USA users and others.

https://aseannow.com/topic/1358207-from-skype-to-lala-land/

https://aseannow.com/topic/1358572-what-is-your-go-to-provider-for-porting-skype

https://aseannow.com/topic/1353194-skype-to-be-shutdown-in-may/

https://aseannow.com/topic/1358275-google-voice-to-replace-skype/

https://aseannow.com/topic/1357551-alternative-to-skype/

-

1

1

-

-

- Popular Post

Thailand now available as the country of residence.

-

1

1

-

2

2

-

Just now, richard_smith237 said:

..those are your words and assumptions, not Mad's... .. you've used very a very poor 'Framing Effect' and a loaded question, which is a rather weak argumentative technique and highlights very simplified mental processing...

Don't overthink things, I'm not trying to argue with anyone and simplifying things (without distorting them) is quite suitable to get insight into a particular aspect of an issue.

Much has been made about the guys level of drunkenness but I'm pretty sure in the UK it wouldn't matter a jot if he failed the evidentiary test (2 chances are allowed) he'd be in the cells until sober (ie he could pass) or overnight if he was going to be in court in the morning. I'm trying to find out what the situation would be elsewhere and it seems more than fair to ask a guy who should know.

-

1

1

-

-

3 hours ago, MadAtMatrix said:

How do I know this, I was a Canadian police officer for 18 years . . . . . <snip>

So in your time on the job and with your experience of multiple cases, would you let a guy walk because he was only a little bit over the legal limit?

-

14 minutes ago, Agusts said:

Basically is the assignment of a condo as Thai quota or Foreign quota can change over time..., or once fixed, it never changes....?

It can change for exactly the reason you describe. Land Office don't keep records of this and that's why a letter from the Condo Office is needed at sale time to confirm the percentages permit such a sale.

-

1

1

-

-

7 hours ago, henryford1958 said:

Yes this was the basis of my question. My UK tax paid is also more than any Thai tax so i am also not going to submit a Thai tax return. If i did the Thai tax form would show that i owe Thai tax and i would then have to somehow argue the DTA negates that !

Agreed, keep records but keep a low profile.

7 hours ago, henryford1958 said:I was surprised to see OJAS saying that UK Government pensions were non assessable under the DTA. Is that really the case? If so then i need never submit a tax return here as my UK Government pension exceeds any amount that i might remit to Thailand.

UK Government pensions are pensions paid to civil servants, armed forces etc and it's correct that they can not be taxed in Thailand. The UK State Pension (or OAP) is often confused with these Government pensions but shouldn't be as it is classed as "assessable income" for Thai tax purposes. Have a look at the DTA and you'll see the exact language used.

-

2

2

-

-

23 minutes ago, OJAS said:

Are you referring specifically to the likes of UK government occupational pensions (as distinct from the State Pension) which are solely taxable in the UK by HMRC under the UK/Thailand DTA - and are, hence, not deemed to be assessable income for TRD taxation purposes? If so, then what purpose would be served by being upfront about any remitted non-assessable income in TRD returns? Why would the TRD need to know about such income in any case?

That said, if one were to receive a request out of the blue from the TRD for details of any non-assessable income remitted within their previous tax year (for whatever reason), it would probably not be a good idea to decline providing them with the necessary info. But I'm still waiting (with bated breath!) for any such request (principally in relation to my UK government occupational pension in my case in practice) to turn up following the 2024 tax return I filed with them in January!

I'm pretty sure he's asking how to take a credit for UK tax paid against any potential Thai tax bill. This can't be done using the current system and the post above yours presents a fudge or workaround for anyone determined to get on the system.

Personally my UK tax bill outweighs any potential Thai tax bill so nothing should be due to the TRD, so even more reason to keep a low profile and not volunteer any information unless asked.

-

4 minutes ago, GammaGlobulin said:

I would not waste my time eating a banana Shipped from Amazon.

BUT...the reason that bananas ripen more quickly when enclose in a bag is ETHYLENE GAS which is produced by the fruit itself

Therefore, I see no reason why one cannot just trap this gas using a plastic bag, rather than a paper bag.

Or, maybe experiment with other homemade enclosures, like a cardboard box which has been made fairly airtight, and which is small enough to fit the size of the fruit you are trying to ripen faster.

Let me know how this works.

I have no desire to ripen bananas, that was the OP and he has already been advised regarding ethylene.

My post was not to promote bananas from Amazon but to indicate that your claim they were plantains was somewhat dubious as the picture used was being used on Amazon (and many other places I might add) to show bananas.

-

5 minutes ago, GammaGlobulin said:

Those are not bananas.

Those appear to be plantains.

Tell Amazon.

https://www.amazon.com/FRESH-BANANAS-FRUIT-VEGETABLES-PRODUCE/dp/B01BZIQ3P6

-

Putting them in beside other fruits like avocados or apples will also help as they too give off ethylene.

Alternatively, putting them in the oven or microwave also ripens them much more quickly.

-

1

1

-

-

11 hours ago, Upnotover said:

Thanks for all the replies. I think my conclusion is that I'm OK with no further contributions. Exactly why I needed 33 years is somewhat of a mystery but I think it is because my 31 years of employee NI contributions were all paid under the old system, partially contracted out.

The 35 years requirement only fully applies to those starting employment post 2016. For those in the middle, as it were they could be lower. I've seen reports of as little as 26 or 27 years but still entitled to the full whack due to contributions made and the calculations done in 2016.

-

1

1

-

-

5 minutes ago, richard_smith237 said:

Thus: The Op hasn't been quite specific in his figures - I went with the % and BAC equivalent but may have been mistaken and his reading was actually 27 micrograms per 100 ml... in which case he was over even with a standard driving license (but still under the equivalent UK limits).

I think you were correct with your original assumptions, my point was that he could also have been locked up in parts of the UK at these levels as what you are quoting as a UK limit is much lower in Scotland.

-

16 hours ago, Hellfire said:

Still, I believe I was treated unfairly.

You weren't.

15 hours ago, richard_smith237 said:As a comparison - the DUI limit in the UK is 35 micrograms of alcohol per 100 millilitres of breath (0.08% BAC equivalent) - the Op was still under the UK DUI limit.

Only in parts of the UK. In others it's 22 micrograms or 0.05% BAC so the OP could have been locked up there too.

-

3 minutes ago, sikishrory said:

This is a government operated bus so should be first in line for checks.

Why do you say that? It was operated by 407 Pattana company who I've used many times from their location in Pattaya just north of Pattaya Klang.

Thailand to Verify 700,000 Foreigner-Registered Phone Numbers for Mobile Banking Use

in Thailand News

Posted

*161# for prepaid AIS numbers will get you a message showing the last 4 characters of your registered ID.