Etaoin Shrdlu

-

Posts

2,469 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Etaoin Shrdlu

-

-

35 minutes ago, kwilco said:

It sounds like your sole source of information is the internet. I think people should try to learn better research skills

I used to have subscriptions to print versions of newspapers and magazines, but nowadays that same content is available on the internet much quicker and cheaper. Not only that, but the paper doesn't get soggy if the delivery man leaves it on top of the mailbox during the rainy season.

I don't have access to a public or university library and I don't think major public figures would take my calls if I rang them up to do research. I guess I really don't have the resources, time, or connections to do primary research. I suppose I'll just have to rely on professional journalists to do that bit. I can sort out any bias on my own.

-

- Popular Post

Credible fact-checked journalism is often behind a paywall.

Conspiracy theory websites usually aren't.

-

2

2

-

2

2

-

1

1

-

2

2

-

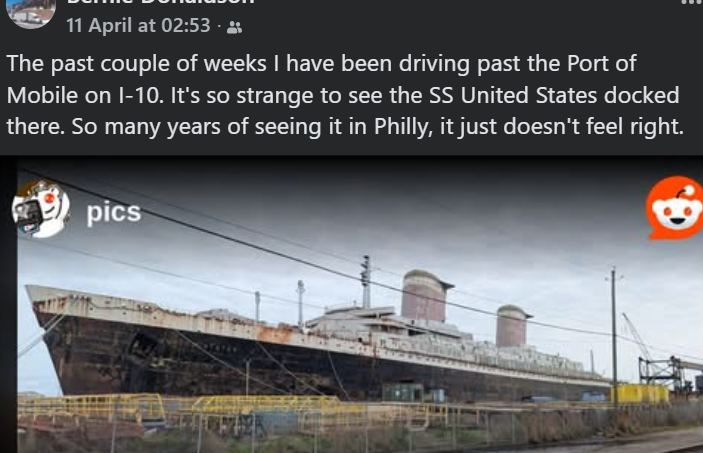

2 hours ago, radiochaser said:SS United States is a retired American ocean liner that was built during 1950 and 1951 for United States Lines.Address: Pier 82, Philadelphia, PA 19148If you go to Ikea in Philadelphia and eat in their restaurant, you can see the ship from there.

She's no longer in Philadelphia. She's been towed to Alabama awaiting scuttling to make an artificial reef.

-

1

1

-

-

-

Arrived at New York in February, 1957 on the SS United States. 68 years ago.

-

1 hour ago, Lacessit said:

IMO a degree from the National University of Samoa won't have the same cachet as Oxford.

But if the degree is from the University of American Samoa, then it Saul Goodman!

-

58 minutes ago, impulse said:

Good points.

Don't get me wrong. I'm not advocating that we stick US inmates in CECOT in El Salvador and let them rot. But if El Salvador was willing to build prisons that meet US (and international) requirements for humane treatment and could do it for a small fraction of the operating cost of a US prison, I wouldn't object to sending them there. Of course, they'd still have to have access to their attorneys, and libraries, and contact with relatives, but that could all be facilitated online. The US could probably also arrange visitation by relatives by air and still come out way cheaper than the expensive (and corrupt) contracted prison systems around the US.

Besides, if the inmate was from Florida, El Salvador is closer to home than being put in a SuperMax in Colorado or California.

This assumes that relations between the US and the "host" country remain amicable. Governments change and the prisoners could become pawns for a newly hostile foreign government to exploit.

-

9 hours ago, impulse said:

It's happened in the past when Nazis that escaped into the USA became naturalized citizens. They were stripped of citizenship and deported (or extradited, depending on the case).

Besides, what's wrong with housing inmates sentenced to death or life in prison in a country that is contracted to house them for a tiny fraction of the $$ 10's of thousands a year that it costs the US and the States to house inmates? Even if they're citizens... They will have gone through their due process and sentenced to incarceration. Seems like housing them in a cheaper country would save the taxpayers $$ billions.

The Nazis weren't US citizens when they were deported. They had been de-naturalized.

The problem, as we are seeing in real time, is that they would no longer be within US jurisdiction and they may become unable to return, even if new evidence arose that questions their conviction or were otherwise deserving of a new trial.

-

- Popular Post

- Popular Post

14 minutes ago, save the frogs said:Yes, she clearly states "heinous violent criminals who have broken laws repeatedly"

Still US citizens. Slippery slope.

-

1

1

-

2

2

-

- Popular Post

- Popular Post

Karoline Leavitt, Trump's press secretary, confirms that Trump is seeking a pathway to expel US citizens from the US:

-

1

1

-

1

1

-

1

1

-

I just completed this quiz.

-

My Score80/100

-

My Time92 seconds

-

-

According to Bill Maher, Trump was gracious and quite pleasant at the dinner he hosed in the White House. He even showed a sense of humor. Actually, I don't find this difficult to believe.

Trump is a very intelligent and talented man, otherwise he would not have managed to attract the following he has or get elected POTUS. It isn't his raw intelligence or his charisma that I doubt, it is his morals and character and, of course, his agenda and how he chooses to carry it out. He isn't dumb, but he knows that a large section of the public is, and he uses this to his advantage. Case in point being the calculation of tariff rates he claims are imposed by other countries on US-made goods. I'm sure he knew it was nonsense, but also that it would play in Peoria.

This brings me to the conclusion that either he was putting on an act at the dinner with Maher, or he's putting on an act when he's otherwise in public spewing hate and lies. It may well be both. Sociopaths can be charming, intelligent and witty, with a sense of humor and yet be completely manipulative and amoral. Some credible people who have worked closely with him have stated that he's not fit to be POTUS.

I wonder whether his ego would allow him to resign later in his term so as to give Vance the advantage of incumbency for 2028 with Trump running as VP. Vance would then resign in early 2029, making way for Trump to become an unelected president. I see an end-run like this as being more plausible than a frontal assault on the Twenty-Second Amendment.

-

1

1

-

-

Like the lawyers that had to agree to perform pro bono work for Trump's favorite causes, these tariffs are a shakedown but aimed at big tech. I wonder what Tim Cook had to promise to get this reprieve.

-

1

1

-

-

6 hours ago, ThreeCardMonte said:

You appear to be special needs so I’ll throw you a bone.Research the 14th amendment.

I can present it to you but you must be capable of comprehending.

If you’re still confused, no one can help you.

I'm not the person who is seeking a legal pathway to expelling US citizens from the US. That distinction belongs to Donald Trump and his Department of Justice. See what Karoline Leavitt says in the video embedded in the OP. She confirms that Trump is exploring the possibility.

If I am special needs because I don't fully understand the US Constitution as a layman, what does that make Trump and his DoJ who supposedly have both the legal training and resources to do so? Super special needs?

If the 14th Amendment is such an ironclad guarantee that a US citizen can't be expelled, why is Trump looking for a mechanism to do so?

-

1

1

-

1

1

-

-

6 hours ago, ThreeCardMonte said:

You appear to be special needs so I’ll throw you a bone.Research the 14th amendment.

I can present it to you but you must be capable of comprehending.

If you’re still confused, no one can help you.

Tell me in which section of the 14th Amendment it specifically states that a US citizen can't be expelled from the US.

While the 14th Amendment does guarantee due process, there's nothing there that says that after due process a US citizen couldn't be expelled. I suppose that would require another country to accept the US citizen, but perhaps a country like El Salvador might agree.

-

5 hours ago, ThreeCardMonte said:

So you’re saying there’s a specific law that says a U.S. citizen can be deported.Which law is that?

Deported to where exactly?

No, I'm saying that there isn't a law that states that a US citizen can't be expelled from the US.

-

10 minutes ago, Cat Boy said:

I'm much more concerned about bullying, violence and school shootings resulting in dead toddlers than normal childhood nookie let alone so-called pornography.

Better a safe, healthy live child than some trivial flirtation

Yes.

"Thoughts and prayers" just means that our representatives in congress have been bought by the gun lobby.

-

1

1

-

-

Do an internet search on "currency triangulation". It will explain why another currency may need to be exchanged for US dollars before being converted to Thai baht.

-

1 minute ago, NanLaew said:

Can you expand on this "Obama killing" premise, please?

I don't want to do my own research and run the risk of falking down any right wing rabbit holes.

Thanks.

i think he's referring to Anwar Awlaki.

-

25 minutes ago, ThreeCardMonte said:

Try harder. You’ll find it.

From Google’s AI:“There isn't a specific law that prevents U.S. citizens from being expelled from the country.”

-

31 minutes ago, ThreeCardMonte said:

Google is your friend.You’re the one claiming a US citizen can be deported.

And now you’re claiming a U.S. citizen has been deported in the past. Intentionally..you have proof of course Or probably not.

Where was this U. S. citizen deported Io?

I have searched and can’t find reference to any specific statute preventing a US citizen from being expelled from the US. Can you find one?I haven’t claimed that a US citizen has been deported in the past.

-

1

1

-

-

- Popular Post

3 hours ago, jvs said:How do you take pornography out of schools?

Turn off the pornograph.

-

1

1

-

1

1

-

12

12

-

4 minutes ago, NoDisplayName said:

Is there a law that prevents a US president and anointed leader of the free world, not to mention a nobel peace prize recipient, from executively ordering the drone strike execution of American citizens without trial?

That’s a problem, too.

Why don’t you start a separate thread on that one?

There seem to be a number of reasons why presidential power needs to be constrained.

-

3 minutes ago, PumpkinEater said:

I saw a story on US Citizens being scrutinized by not being within the US territories for more than 6 months (with no ties remaining in the USA).

This would apply to retirees overseas possibly.

They see this as abandoning US Citizenship. Thus the next step of course would be to stop Social Security/Medicare.

It is a new world of corruption that can include many “far fetched” ideas and instigations by a dictatorship.

Cheers

Are you sure it was about US citizens? I know this is a potential issue for green card holders.

New dual citizen & digital arrival card

in Thai Visas, Residency, and Work Permits

Posted

My daughter was asked to show her US passport when exiting Thailand on her Thai passport. I suspect the IO was just making sure she would be able to enter at her destination as she had no visas in her Thai passport.

When checking in at the airline counter, my kids always present both passports and the airline staff enter both passports' numbers in their computer.