Lorry

Advanced Member-

Posts

3,491 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Lorry

-

At the entrance of the government complex, at the main road, there are motorcycles to building B (20 baht), and also buses (cheaper). You will probably be able to find motorcycles at the station, too.

-

A friend is shopping for cataract surgery, in Bangkok. Highest quote I heard from him was almost 250,000 (Rutnin). So, yes, your quoted price looks a bit excessive. He found a place for 120,000, quality unknown.

-

I think you are very wrong, nationally doesn't matter for Thai taxes (as in many other countries). But I understand why you feel this way, you earlier gave an example: if you remit money into Thailand in a year you are not a tax resident, are you supposed to file taxes ? As a non-tax resident? In English, order 161/2566 reads "a tax resident who has foreign income AND later brings this money into Thailand". My English is very limited, maybe a native speaker can help: doesn't this wording assume that this person is a tax resident in both years/always? My Thai is even worse than my English, I have no way to judge what the Thai version means. But it really doesn't matter, it means what the RD will say it means.

-

So, what does "Tax residency status in the year of remittance is irrelevant. " mean? I am very confused now. I don't think it makes a difference whether a tax resident in Thailand is Thai or foreigner. What some people write here is: if you receive income abroad in a year you are tax resident, and you then remit this money to Thailand in a year you are not a tax resident, in this case you have to pay taxes for this money in the year you remit it to Thailand even you are not a tax resident. This leads to the consequence that you may be liable for taxes in a year even if you weren't in Thailand at all. Mike has given an example. I find this absurd, even if I understand the logic. This problem has been discussed earlier in this thread, I attach 2 early posts which convinced me that tax residency in the year of remittance IS relevant. Obviously, Baker McKenzie is not convinced.

-

“the libel capital of the world” No, it is not Thailand. Libel and defamation suits are a regular topic on AN. It is often stated that Thailand has very harsh libel laws, and I always got the impression that the posters thought libel law in their home country wasn't as harsh. So I found it interesting to read an article about libel law in another country. The country is Britain, where many posters are from, and the article really made me think. "the British libel industry has made it harder for people to subject the wealthy and powerful to legitimate scrutiny." "Britain’s libel lawyers are the most intimidating in the world. They are also among the most expensive. British libel cases routinely cost hundreds of thousands of pounds to defend, and London’s top libel lawyers command rates of more than £500 per hour." "If you have ever spoken out against one of the global super-rich with some link to Britain you are potentially in a London libel lawyer’s crosshairs, no matter how few followers you have or where you live." "the person claiming to have been defamed is the one presumed to be telling the truth" https://www.economist.com/1843/2023/12/01/britains-scariest-libel-firm-can-pursue-anyone-anywhere

-

That's possible, and not unusual at all. But of course, had he had travel insurance, the first thing the insurance would do they would try very hard to find proof that he already had this condition before he left home. If they are lucky the patient will die in the meantime. Leukemia is a worst case for a travel insurance. Treatment can be extremely expensive, repatriation - if possible at all - as well. Some policies really cover only emergency treatment. But nowadays, at least in rich continental European countries, coverage usually extends until the patient is fit for transport.

-

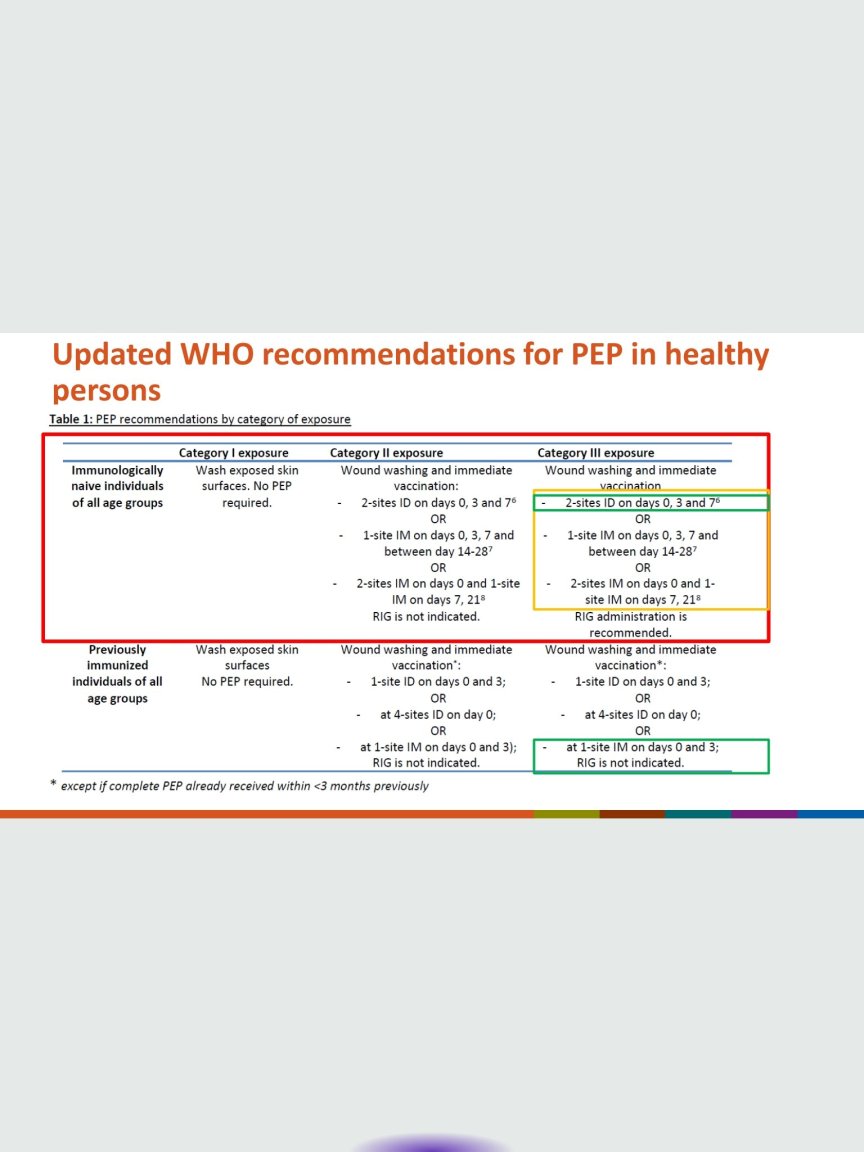

WHO recommends it even many days later. That's my personal experience, too. And that's what is done in Thailand, see the posts of Soisanuk, Fairynuff and Searunner

-

According to the NHS website, only Rabipur is available in the UK. But websites sometimes are not up to date or even plain wrong

-

I understand you were not previously vaccinated against rabies. In this case, the WHO recommends rabies immunoglobulin. It is very expensive - up to 1000 USD and more - that's why it's not routinely given here. Even so, there are few rabies deaths in Thailand. Bangkok Hospital in Udon probably has it. The big private hospitals in Bangkok have it. You can continue your vaccination, started with Speeda, in the UK. UK uses Rabipur, which is compatible with Speeda. https://immunisationhandbook.health.gov.au/recommendations/people-with-potential-rabies-exposure-who-started-post-exposure-prophylaxis-overseas-are-recommended-to-complete-the-rabies-vaccine-course-in-australia

-

Thai woman calls justice after Thai man attacks her Belgian husband

Lorry replied to snoop1130's topic in Thailand News

Correct. Thais speak or yell or curse towards persons. Farang speak or yell or curse towards things or situations If a Thai is present he/she will feel as the addressee. Because, how could someone talk/yell to a thing or situation? If I try to open the door and it doesn't open I may get angry at the door and utter some curses towards the door. Girfriend will feel she is being cursed, how can someone argue with a door?? Girlfriend will be very pissed of. BTW Thais don't kick the fridge if it doesn't work. How can someone get angry at a thing? If you shout "Fűck!" the only Thai person around will be insulted. Because he must be the addressee. -

It took me 2 years to get the new property tax sorted out. That was about a grand total of 1000 B. 100-200 hours work (includes reading up on it and includes getting the necessary house registration, which unexpectedly turned out to be useful for other things, too). Even Thais don't work for 5-10B/hr but I felt ignoring taxes wouldn't be a good idea. Income tax will be much worse, as the amounts are much higher.

-

This plan makes me plan to stay only 179 days a year. I can live with remittances taxed, it's not that much in my case (I am not going the DTA route, stat has explained why - too complicated, too much work for me, not worth it). But I am not going to - additionally to immigration and and and... - have another Thai bureaucracy to deal with. No more certified translations, trips to embassy, MFA, district office, whatever...no, thank you.

-

Not only assumptions. In the main thread, a guy actually went to his tax office and asked them, upcountry in Phitsanuloke. They confirmed the new procedure and did the obvious and very simple thing: they just taxed all his remittances. Neither he nor the tax official bothered about complicated things like DTA. BTW his remittances are 40k monthly iirc and tax was very little.

-

Contrary to what you write, the new regulation is a huge change - and is correctly viewed as such by lawyers and tax advisers. Yes, in theory a pensioner who had his pension credited to his Thai bank account, has always owed tax. Yes, in theory he should have filed a tax return. De facto, nobody ever cared. The RD didn't expect foreign pensioners to file a tax return (some pensioners who tried, report being told to forget about it). The RD didn't expect them to pay taxes , either. The law didn't change - but, as the poster "Thailand" had written - the practice seems to change. Today was the first time in over 20 years that I heard bank staff utter the word "RD". BTW don't forget, the rich Thais that some people write are targeted, they are Srettha's (and his master's) own flesh and blood. Why should he hurt them? And rich Thais will find other loopholes. Moderately well-off (according to Thai standards) foreigners are the softest target there is. They cannot defend themselves.

-

Typo. BTW this text understands the QnA, that "both conditions have to be met" to be taxable: 1. You must be tax resident here (i.e. 180 days a year or more) in the year you bring the income into Thailand 2. You also were a tax resident in Thailand in the year you earned that income. 1. is not 100% clear in the QnA, and some posters - me included - found that suspicious

-

That's correct. But I know of a private hospital, popular with foreigners, that only offers the second one (and obviously doesn't tell people they should get the first one, too). So better ask.

-

Never seen an English menu with higher prices than the Thai menu? Never seen Thai rates for accommodation? Sorry, I don't buy that. If you have been here so long, you should even be able to remember that Thai Airways used to have special rates for Thais. Even the BTS charges foreign retirees more than Thai retirees.