NoDisplayName

Advanced Member-

Posts

4,544 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

Don't be a spilling fascist.

-

I used this one when returning after the covids, but there are many others out there. https://onwardticket.com/ After booking, I was able to log into the airline website and confirm it was valid. Cathay Pacific ticket agent in Hong Kong required an onward flight out of Thailand to issue boarding pass. The reserved booking passed the test.

-

Not true! Ask any Chinese tourist. They love the buffet.

-

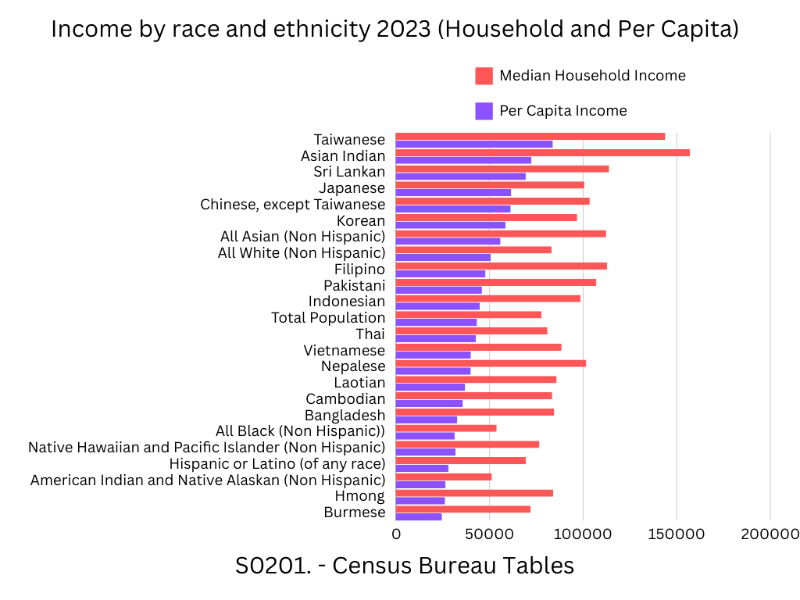

Super easy! Barely an inconvenience! Indians still practice good old-fashioned American values.....nukular fambly, male breadwinner, mom stays at home with the kidlets. Daddy's salary generally IS the household income. You're welcome!

-

220th post, eh? 😊 Have you heard of the googles? According to the latest US Census data, the Indians now have an average household earning of $123,700, i.e a little over ₹1 crore, PTI reported. The median earnings of the Indians there is nearly double the nationwide average of $63,922. https://www.hindustantimes.com/business/why-indians-are-the-highest-earning-community-in-us-harsh-goenka-explains-101673757990980.html If that's too many words, wikipedia has pitchers. 😊

-

That's insane! Contracts completed during the Bush regime, yet still being paid? Talk about waste, fraud and abuse! Who's a Good Doge!

-

A Visit to the Tax Office

NoDisplayName replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

-

You would use some standard document showing your Thai address. What is acceptable would be at discretion of each financial institution. Best to contact the bank you want to open an account with. Schwab will accept ID cards, utility bills, bank statements with your name and local address, and will have the document translated if not in English. With Schwab, my wifi used her Thai ID card, I used a bank statement from a US credit union.

-

Passenger Sat by Deceased Woman: Qatar Airways Offers Support

NoDisplayName replied to snoop1130's topic in Thailand News

Qatar doesn't fly Boeing. -

Make America third world country

NoDisplayName replied to Nomoneynohoney's topic in Political Soapbox

Better hope the Germans don't start getting uppity again, 'specially after being stabbed in the Nordstream again. -

A Visit to the Tax Office

NoDisplayName replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Them Weegers will be pleased to know they were simply temporarily "detained." ..........for eleven years. -

Going to Ukraine? Wear your swastika shirt. You'll be fine.

-

Quote-mining the Budapest Memorandum is like a creationist citing the Second Law of Thermodynamics to disprove science. They always leave out the bit about closed systems. Similar to those who cite the NATO charter and Article 5 believing a "boots on the ground and planes in the air" military response is guaranteed, ignoring that it merely "calls on" member nations to aid others "in the manner they deem suitable." The Budapest Memorandum doesn't simply provide security guarantees. It also incorporates the Helsinki Final Act and the UN charter. It certainly gets complicated when you throw regime-change and ethnic cleansing into the mix. https://policymemos.hks.harvard.edu/files/policymemos/files/2-23-22_ukraine-the_budapest_memo.pdf?m=1645824948

-

This is the spot where the editor says "citation needed."

-

Thailand Faces Backlash Over Secret Uyghur Deportation to China

NoDisplayName replied to snoop1130's topic in Thailand News

-

Shock discovery! Zelensky owns a suit!!

NoDisplayName replied to Hanaguma's topic in Political Soapbox

You can scroll on by my comments if you dont like them. Its an open forum. -

A Visit to the Tax Office

NoDisplayName replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

Not asking why you both don't have marriage extensions, but that's your business......Anyway, your wife has 800K in a bank earning interest. You have 80K brought into a bank monthly, earning interest. You both are paying 15% tax on that interest, withheld at the source. File a null return online and get your withholding tax refunded. Get the free statement from your bank, file online claiming zero assessable remitted income, and upload a photo of that document, download a receipt for filing tax. Takes a total of 15 minutes, and you'll likely get 4-5000 baht refunded. While you're at it, get bank withholding statements for 2022 and 2023, file late returns online (pay one 200 baht late fee), and get another 8-10 thousand baht refunded. If you can't figger out the online system, or haven't gotten your pink ID activated for use in tax filing, return to the empty TRD office and the ladies there will file your three tax returns. Take some banana muffins for the staff. -

Shock discovery! Zelensky owns a suit!!

NoDisplayName replied to Hanaguma's topic in Political Soapbox

Says random anonymous nobody on the innertubes about a billionaire, the president of the USA, and leader of the (relatively) free world. -

Shock discovery! Zelensky owns a suit!!

NoDisplayName replied to Hanaguma's topic in Political Soapbox

Yes, I can read. The topic is: Shock discovery! Zelensky owns a suit!! Absotively nothing to do with the orange-tinted squatter in your cranium. It's about Zelensky's wardrobe.....or lack thereof. -

Shock discovery! Zelensky owns a suit!!

NoDisplayName replied to Hanaguma's topic in Political Soapbox

........dress appropriately. No deflecting, please. Stay on topic. -

Shock discovery! Zelensky owns a suit!!

NoDisplayName replied to Hanaguma's topic in Political Soapbox

-

According to one government site, yes. If you live outside the U.S., you can apply for Social Security benefits online. https://www.usa.gov/social-security-abroad If this is true, then I do not need to go thru Manila Operations, and do not need to get a certified copy of my passport from the Bangkok embassy. I have my account at ssa.gov set up, I am able to log in using ID.me receiving a text to my Thai cell number. I logged on, downloaded my latest benefits statement. Just the basic package, wife not involved. Direct deposit to a US credit union. Am I correct? Apply online here? https://www.ssa.gov/apply