NoDisplayName

Advanced Member-

Posts

4,544 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

U.S. Rejects Thai Claims on Lack of Uyghur Resettlement Offers

NoDisplayName replied to webfact's topic in Thailand News

That's what I thought. You have a talking point. "Proposed" and "possible" is not definite. Why wouldn't the State Department mention even one of those real offers? -

The Great American Employment Collapse Has Commenced

NoDisplayName replied to Alpha84's topic in Political Soapbox

You say this like it's a bad thing. $36.5 Trillion in debt, plus another $120 Trillion or so in unfunded liabilities. Time to stop blowing $Millions turning frogs trans. https://www.usdebtclock.org/ -

U.S. Rejects Thai Claims on Lack of Uyghur Resettlement Offers

NoDisplayName replied to webfact's topic in Thailand News

Details, please. What offers? -

U.S. Rejects Thai Claims on Lack of Uyghur Resettlement Offers

NoDisplayName replied to webfact's topic in Thailand News

Parse the statement. The US never offered resettlement anywhere.....just vague proposed possibilities. You can be shirley, if there was a definite offer, it would have been mentioned. -

The Great American Employment Collapse Has Commenced

NoDisplayName replied to Alpha84's topic in Political Soapbox

Strange, you din't mention the elephant in the outhouse...... Government accounted for the bulk of layoffs, with Challenger tracking 62,242 announced job cuts by the federal government from 17 different agencies. The government has laid off about 62,530 workers in the first two months of the year, a whopping 41,311% increase compared to the same period in 2024. Keep up the good work! Who's a good Doge!!!!!- 139 replies

-

- 10

-

-

-

-

-

Oh, that old talking point. Budapest Memo (signed by Yeltsin) wasn't a forever get-out-of-jail-free card. It referenced Helsinki Act and UN charter. Ethnic cleansing has consequences. I promise if you don't kick my dog, I won't punch you in the nose. Raping my daughter voids all warranties, expressed or implied.

-

So Putin just woke up one morning and, just on a whim, decided to take Crimea? Completely unprovoked, naked aggression? Regime-changing the legitimately-elected Ukranian government had nothing to do with it? "We" weren't pushing Kiev to terminate the Russian lease on Sevastapol? "We" weren't going to put missiles on the Russian border? Putin isn't stupid, and isn't a silly comic-book super-villian. He's not Doctor Evil. Constant movement of NATO, bringing more bases up to Russia's borders, despite the assurances of "not an inch to the east" and a series of proxy wars, and we crossed a red line.

-

Apply for SocSec Benefits Online?

NoDisplayName replied to NoDisplayName's topic in US & Canada Topics and Events

Thank you for the reply. Did you enter your Thai address and cellphone number, or did you use an existing US address and phone? I'm hoping the file will be processed normally, and only be passed to Manilla in the event of some problem. Please update as the process continues. -

Thailand Eyes Banana Farming to Support Struggling Rice Farmers

NoDisplayName replied to webfact's topic in Thailand News

2025 Millions of rice farmers switch to bananas. 2026 Millions of banana farmers switch to catnip. 2027 Millions of catnip farmers switch to rice. 2028 Thailand crowned "Hub of Lather-Rinse-Repeat" -

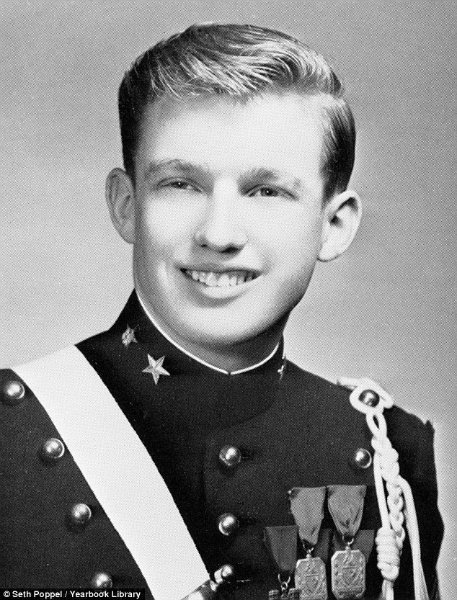

Didn't stop him from "serving" as a cadet captain in ROTC at New York Military Academy where he was on the Varsity baseball, soccer and football teams. Trump won the Proficient Cadet award for two years running and Honor Cadet for four years running too. For two years in a row he also won the Neatness and Order medal. Under the 'Popularity Poll' section of the yearbook, Trump was nominated as the 'Ladies Man' of the year "Chicks dig the uniform, man! They practically LET you do it!" For more entertaining photos, see https://www.dailymail.co.uk/news/article-3168648/Donald-Trump-pictured-uniform-cadet-captain-dodged-Vietnam-draft-four-deferments-bone-spur.html

-

If ethnic cleansing of the Donbass never begins, when will the Russian advance start? Gosh, we've been moving NATO closer and closer for decades, and Russia just sits there, minding its own business. "Not an inch to the east!~" Haha, silly Russians use metric, they don't know what an inch is. Hey! Let's overthrow Ukraine! Then we can get Russia thrown out of Sevastopol, and then Kiev can cleanse the eastern provinces. What could go wrong!

-

I'm fairly certain this is a fine charged when tax is due but unpaid. For late filing, there is a late filing (processing?) fee of 200 baht. This is only charged once per year. I filed 2021, 2022 and 2023 last year, all filed late in July. Online filings. I was charged a 200-baht late fee for 2023, paid by bank transfer in the system. I was NOT charged late fees for 2021 or 2022. Received refunds for all three years. Is there a difference between fines and fees? I would say yes, and I would expect someone filing late and owing tax would be charged the 200-baht processing fee AND the 1.5% interest surcharge AND the maximum 2000-baht penalty fine. We'll have to wait and see if anyone reports any application of surcharges or fines. As to the requirement for tax paperwork for immigration, there have been no reports of such, and statements by immigration that they have no intention of that.

-

I filed online in January, already received my refund. It's the same process as for the three late filings I did online last year (one 200-baht late filing fee), and a couple I did before the covids. For interest/dividend withholding tax refund, upload the bank/dividend withholding statement. For remittances, it's still self-determination. If NON-assessable, then not declared. Not included in PIT. No statements needed. If assessable,........................I haven't remitted any, but can't say.

-

Russia using donkeys to move ammo 555

NoDisplayName replied to 3NUMBAS's topic in The War in Ukraine