NoDisplayName

Advanced Member-

Posts

4,566 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

JFK assassination papers declassified !

NoDisplayName replied to dinsdale's topic in Off the beaten track

Gotta read the "news" carefully. Remember, it's written by infotainment staff, not actual old-style journalists. Headline says Trump is releasing records of three assassinations, leading the public to believe EVERYTHING will be released. Further into the short article, we learn that ALL the remaining records of MLK and RFK will be released, but as to JFK only that THOUSANDS of pages will be released. Thousands, out of possible tens of thousands. National security concerns still trump Trump. I doubt we're gonna see everything. Heck, I'm still waiting for Trump to release the Kracken! I've got my tree-fiddy ready. -

Will Tesla Cyber trucks be legal in Thailand

NoDisplayName replied to Rimmer's topic in Thailand Motor Discussion

"Hold my Bud Light" -

Our 2012 Hilux Champ, although still running fine now, is getting older, now with 400K on the clock. I'd like to find something similar, maybe even a bit smaller. Looked around the car lots, and everything is monster-sized with too many gadgets. Something similar to the Chevy S10 extended cab I had before migrating from the US. Like an older Ford Ranger, a Hilux Tiger, maybe an Isuzu SLX. I don't need power anything, don't want a GPS system, don't need a video screen in the dash, or more than 2 cupholders. If not for the wife, I could do without AC as well. Looked at the new, boxy Toyota Champ...........unfortunately the cab is too small. Seats are bolted directly to the floor with no slide and knees hit the steering wheel. Is there any hope?

-

So shall I put you down under "effectively no change, we will continue to self-determine assessablility of remittances as before"? It certainly seems that way in the absence of clear instructions, but I'd still like to have the purchase in one tax year, and the sale of said asset in the following year. IRS regulations easily cover this situation, but that isn't a remittance system with earning and remittances separated by potentially decades. What to do when your 2024 earnings have been through multiple cycles of invest, sell, re-invest over three or four years or ten years? Problem is that the regulations, and the overly -simplified explanations and examples we get from TRD and news articles don't take this into account. They all seem to expect that everyone keeps all their money in a single passbook savings account.

-

Riddle me this, Batman! You have capital gains from stock sales in the US of $25,000 in 2024. The original capital is reinvested, and the gain is put into a separate account to sit idle for two years. On December 30, 2026 you invest that idle $25,000 gain in a random mutual fund. On January 02, 2027 you sell that mutual fund for $24,950. You are continuously tax resident in Thailand over the entire period. None of that idle gain nestled in its isolated account was remitted during 2024-2026, no nothing assessable during that period. For your 2027 taxes, you have a sale resulting in receiving most of the original capital, and a short term capital loss of $50. No gain to be taxed, and the cash in your account is now considered capital, not capital gains. You have a 2027 1040 showing a sale resulting in a loss, with nothing taxable. Assuming you can point to this particular bag of money as that particular remittance, what is it? If it's the capital gains from 2024, then it's assessable, and must be declared as income in the year remitted. If it's the original capital from a fund sale, not resulting in a gain to pollute the calculations, then it's non-assessable and need not be reported in the year remitted. If audited, Is my 2027 1040 or 1099 satisfactory to show the funds are non-assessable? Is TRD going to demand to know when the fund sold in 2027 was purchased, with what funds, and where did those funds come from, and before that, and before that, with a clear path back to pre-2024? How many degrees to Kevin Bacon must I document? I suppose we'll have to bring in a truckload of invoices and receipts and tax statements.................unless TRD continue to have us self-determine assessablility of remittances. Otherwise they're gonna be frightfully busy.

-

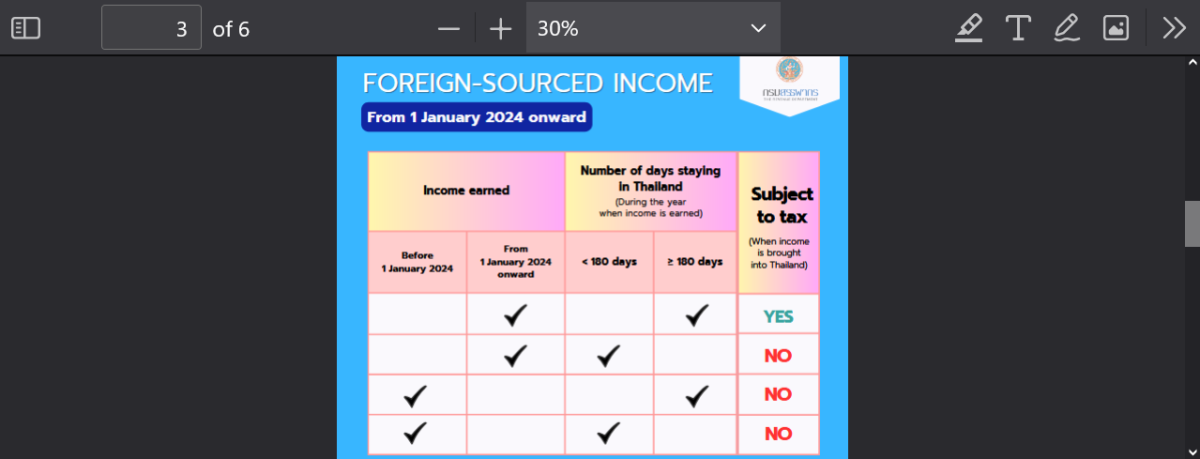

It's not rocket science! If a foreigner derives income from sources outside Thailand, such income is subject to income tax if the two following conditions are met: such income has been earned in any tax year starting from 1 January 2024 onward by a foreigner who stays in Thailand for 180 days or more in a tax (calendar) year, and; such income earned has been remitted to Thailand (wholly or partially), even if that remittance occurs in a later tax year FOREIGN-SOURCED INCOME NOT SUBJECT TO THAI TAX Foreign sourced income derived before 1st January 2024 and remitted into Thailand in a later tax year 1 January 2024 is not subject to Thai Tax. https://www.rd.go.th/fileadmin/user_upload/lorkhor/newspr/2024/FOREIGNERS_PAY_TAX2024.pdf

-

We have the DIY will signed by witnesses, which according to reports is valid. We have our marriage certificate. We will have one foreigner, expired, and the Thai certificate of passing "use by" date, plus the certificate from the embassy. That should be enough. Most of the accounts have small amounts. She'll have the ATM card or can go online and transfer. The only potential problem will be the 800K fixed account requiring in-person withdrawals. The will plus listed documents should cover it. I've read we could add her name to the fixed account in the black-light visible signature block, which shouldn't cause any problems with immigration but will give her access to the funds. I can't confirm this. Also set up a Schwab international account for her, and will be depositing annual gifts. She'll have plenty to live on during the year the IRS takes to produce the tax certificate.

-

NO, in my name only. That was the possible solution, open a joint account. Otherwise, from reading here and elsewhere online, the DIY will should suffice. Can't speak from personal experience. Yet. We've made a DIY will, two witnesses. Amphur refused to register with foreigner involved. No children, no ex'es for either of us. Thai assets shouldn't be a problem. House and car in her name, so only bank accounts. The tricky part will be getting the IRS certification for my US broker to release my accounts with her already designated as beneficiary.

-

Minsk. Minsk-2. Istanbul. Gosh, the Russians were even willing to leave Crimea in Ukraine and continue paying the lease on Sevastapol.

-

If it doesn't match your TIN or pink ID, then it's probably the bank's TIN. It should appear on any bank withholding statement you receive. For BKK Bank, it printed in the upper block, top right. Don't know about other documents. I checked a BKK Bank mutual fund confirmation/tax invoice without their TIN. Google it! I put that number in the search bar and got BKK Bank's general information page.

-

Tax files

NoDisplayName replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

Would you expect them to know? This is not the land of merit-based promotion. One wonders how many nephews are placed in management positions in podunk offices, or perhaps how many simply buy the government job. If that were the case, as is common knowledge with schools and police and military, who knows how someone happens to get positions of authority in other departments. Now with changes filtering down from above, those that may not have any real understanding of the tax code, yet whose decisions are final and unquestioned by the underlings in their petty fiefdom..............are being questioned. By foreigners! -

Tax files

NoDisplayName replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

Unclear. No, your DTA doesn't specify. or No, you won't read it. -

Options to start Non-O again

NoDisplayName replied to KaraokeMad's topic in Thai Visas, Residency, and Work Permits

I didn't want details. I was thinking to get a visa based on marriage requires photos and house visits, more than just the certificate. Just for a 60-day extension to visit wife, doesn't that have to be applied for in the same district? Not asking for the personal story, just pointing out that separate residences in different districts would be relevant. Appeared poster wanted to get another based on marriage visa. If I misread, please disregard. -

Joint account?

-

Tax files

NoDisplayName replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

You get 190K if 65 or over. You get 190K if disable, until you turn 65. You can have one, but not both at one time. -

Tax files

NoDisplayName replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

Read your DTA. Each one is different. It should specify all the pension types included - state, government, private, other. -

Tax files

NoDisplayName replied to newbee2022's topic in Jobs, Economy, Banking, Business, Investments

I'm almost certain the other mention was in the Tangled discussion, and also from Chiang Mai. Rogue office? -

Options to start Non-O again

NoDisplayName replied to KaraokeMad's topic in Thai Visas, Residency, and Work Permits

You said you and wife were in Chonburi, but now you live in Nakhon Phanom. Are you residing with your wife in Isaan? Not asking for details, but you must have a good reason for ending a perfectly good extension. I'm pretty sure there's more involved in getting a visa based on marriage than just presenting the marriage certificate. -

Oops! You caught me! I read ALL of his posts, and referenced the pertinent information. Try it. **EDIT** So here's a quote from his original post: my own Excel spreadsheet in English (with Google Translated Thai) showing MY calculations; a print-out from Gov UK HMRC web-site of UK tax deducted from all UK pensions for Tax Year 2024-25 My spreadsheet declared the two large payments brought into Thailand (with dates) and, on my own initiative, unilaterally deducted Baht equivalent of UK Tax paid, about 39,000 Baht (proof above) showing new reduced total of inward remittances. Then deducted 100,000 Baht 'expenses' allowed against income. She worked entirely from my figures on my Excel Spreadsheet, put all the information into her computer, then entered all the numbers (which I didn't fully understand and omitted or pencilled-in) on my Form 90. She knew nothing of the Thai/UK DTA, but accepted my 'evidence above' along with my figure for claiming credit for tax already paid in UK. Seems to be a lot you overlooked here.

-

O'tay! Let's! The pensions concerned and aggregated are: UK Teachers Pension (deemed private pension scheme by HMRC) a Prudential Annuity (private scheme) and a small UK State Pension. HMRC add all these sources of income and then deduct UK tax accordingly. It is the UK Tax assessment for 2024/25 which I printed out to present to the TRD as evidence, and, until told otherwise, claimed as Tax Credit which I unilaterally deducted from my total remittances. I declared the full total of two inward remittances on my spreadsheet, then deducted the Baht equivalent of UK PAYE tax deducted on my UK pensions (42.30 exchange rate). And his response to my questions, he deducted tax paid from inward assessable remittances on HIS spreadsheet, then TRD lady used that number as the base for calculating tax. She did not award him a tax credit. Could you explain how the foreign tax deduction was claimed on the tax form? It wasn't claimed on the form. Was this just the tax official acknowledging that you paid some tax (yes) but not used in the calculations, (No. It was used as the base for calculation. I declared I had deducted it) or was it actually deducted at some point from your tax due?

-

Never entered into the Thai system computer. He deducted the foreign tax paid from his assessable remittance prior to declaring the assessable remittance. As he was above the threshold for incoming assessable remittances, he had to file. As the amount of assessable income was below his TEDA and the 0% tax bracket, he owed no tax. Likely the TRD lady accepted his assessable income declaration amount, since it came out to the same result......and she wouldn't have to spend time correcting the error. Or perhaps she knew something we also know. There is no space on the tax return to deduct foreign tax paid as a direct credit against tax due. Actually claiming that tax credit would require manual intervention by the officer accepting the form. Too much trouble. You are making claims, giving incorrect advice to posters that somehow know less about this than you. Advice that can cost them. In this case, instead of reducing his potential tax due by the full 39,000 baht foreign tax paid, he would only see a potential 2,000 baht savings by removing the tax paid from the remittance amount prior to declaring. Something that, according to you, is illegal under CRS rules.

-

The post you responded to and quoted: In the absence of any clear ruling by TRD on this, and the lack of appropriate space on Form 90 to declare foreign tax paid, plus the fact that I am obliged by law to file for Thai Tax by the end of March, I unilaterally claimed a tax credit by deduction. Your reply: For what it is worth, I believe you have done the correct thing and used this correctly ( Even if the paperwork is a bit off )