samtam

-

Posts

3,108 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by samtam

-

-

8 hours ago, jerrymahoney said:

From Mazars as quoted prior:

According to the Revenue Department, it will seek opinions from the stakeholders affected by the new rule and issue guidelines to provide more clarity. The plan includes an amendment of the personal income tax return form to facilitate the foreign tax credit claim.

Thanks for the Mazars piece. I wish RD would get on with "seeking the opinions....and issuing guidelines to provide more clarity". Cart and horse etc.

This magnum opus thread has demonstrated the complexity of many people's individual income status, and I cannot imagine how RD propose to address that with any understanding, consistency or fairness, given the track record of Thai bureaucracy in every field. Obviously the confusion is not just confined to those who have contributed valuable and interesting pieces herein, but to all the major accounting firms, and legal firms that deal with Thai tax.

-

1

1

-

-

Yes, I think the variation is because of the recipe and dosage. Mine certainly gave me a mild case of 'flu the night of and the day after, mitigated by paracetamol. My doctor a BNH was also pushing Tetanus and Zostar vaccines, (shingles), but I decided to pause, because I get slightly irritated by the sales element that must play a part in these consultations. I think you could spend your senior years being vaccinated ad nauseam; certainly the number of vaccines some of my friends have had in UK, (one has had 8 Covid vaxes!), seems a bit excessive, but it is natural to react that way given the push by Pharma, and when it's free, what is there to lose? (Actually in the case of the Covid vax, perhaps we don't really know yet), but the 'flu one seems to be a proven remedy, and so I thought given the reports I mentioned, and I am now certainly eligible, (66), I have now had my first ever, recognising that my invincibility is a bit optimistic.

-

On 10/16/2023 at 3:56 PM, lelapin said:

Try a local clinic. Mine charges 600baht

12 hours ago, sandyf said:In April at Bang Saen I was 330 baht for the flu vaccine and 30 baht to be administered.

10 hours ago, jippytum said:690 baht Ram chaing mai last week

2 hours ago, Acharn said:Yeah, that's what my hospital in Nakhon Sawan charges me every September.

I'm delighted to read of these prices, and quite probably you have a longstanding relationship with the hospital or clinic that is giving you the vaccination, but do you know from them whether you are getting the quadrivalent vaccine for the 2023-2024 Northern Hemisphere, and if you're over 65, that you're getting the recommended larger dose, (4 times the normal dosage for those under 65)?

-

48 minutes ago, Drop the dead donkey said:

This only proves that Thailand’s politicians know diddly squat.

How does he, or his staff not know there is an international warrant out for War Crimes against Putin.

Also, Putin will now never leave Russia in fear (Russian trait that everybody is out to get them) of his plane being shot down.

He's in China.

-

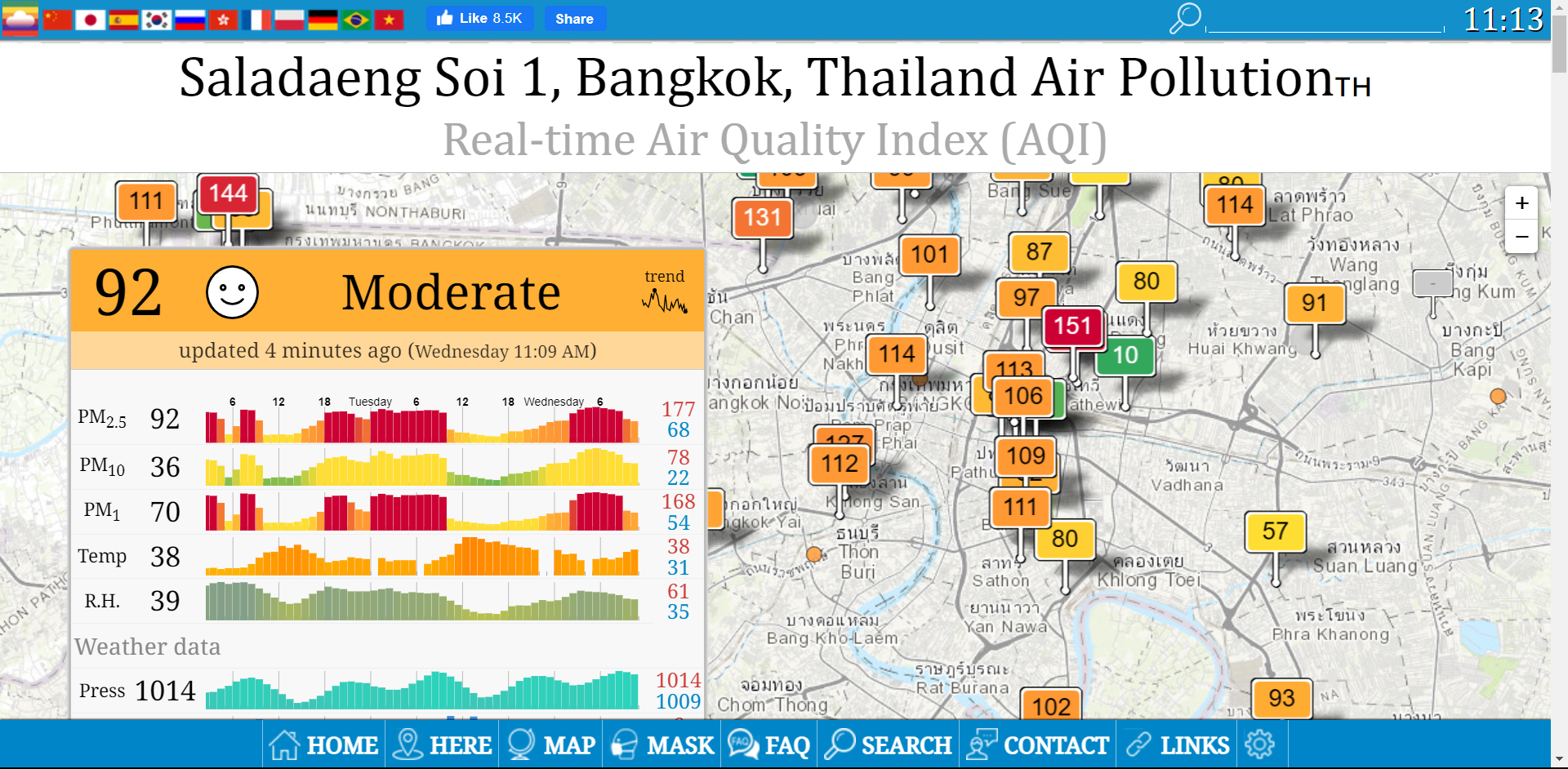

Perhaps they could invest a small part of the promotion in PM2.5 face masks.

-

The high AQI started already. Noticeable difference over the last week or so as the rains abated.

Simple solution: "stop burning things"...🙄

-

57 minutes ago, bbko said:

Where was this "fact" pulled out of?

https://www.japantimes.co.jp/news/2023/09/23/japan/science-health/influenza-japan-spreading/

-

From my friend in Vancouver this morning:

QuoteI also get the 4x normal dosage. It's the one for 65+. The convenient thing here is that flu shots are given at pharmacies with an appointment, and there are so many in the city. I just go online to the BC vaccination website, choose a nearby pharmacy, and book the date and time I want. The pharmacy then sends a text and email confirming it with a confirmation number. I also do it for the Covid vaccine. Simple and straightforward. Plus, the pharmacy is only a five minute walk.

If only.

-

On 10/16/2023 at 3:42 PM, samtam said:

I don't especially want another one, but covid vaccines are also doubtless very overpriced, and, as far as I can gather, not suited to the new variants BA.2.86 or EG.5 or XBB, take your pick.

I asked the doctor at BNH about the covid vaccines in Thailand, and he said there were none that are relevant to new variants. He also said that if one had previous vaccines for Omicron, there was no need to have further vaccinations until one was 80 years old. (Obviously this information might vary depending on the patient's state of health.)

-

On 10/16/2023 at 5:37 PM, samtam said:

Yes, thanks. This seemed the least expensive, and is inclusive of doctor, nurses, and all the add-ons. BNH was THB4,000 for the same. I've booked Bangkok Hospital. There are one or two clinics around, but they're at around THB1,500 plus the add-ons, and I'm slightly wary of knowing what I'm getting. The hospitals are a monopoly or if not directly associated, they control the market price.

Well, having made the booking with Bangkok Hospital (HQ), we turned up at the required time, ahead of the appointment, to register etc. Went through all the vital sign checks, and then waited to see the doctor. Once with him, he informed us that the hospital had run out of the new strains vaccine, (the Northern Hemisphere vaccine being administered there now* as below), and that they did not know when it would be available.

So we expressed our dismay as to why this information was not made available when the booking was made, and left the hospital. On the way back, contacted BNH and they confirmed they did have the new strains vax in stock (since mid September) @THB2,500 a shot, so we booked and went and had those administered. A slight sore arm likely.

The over 65 dosage is 4x the normal dosage, so that is why the price is higher.

Just now received a call from Bangkok Hospital that they actually do have the new strain vax in stock, and their stock record was not updated at the time of our appointment. Piss up and brewery.

A lovely 4 hour excursion in the medical hub of Thailand.

-

36 minutes ago, lopburi3 said:

OP is asking about high dosage (2,200 baht at Bangkok Hospital) flu vaccine - not the normal version (which is 990 baht at Bangkok Hospital). This is the first time have seen available.

https://www.bangkokhospital.com/en/package/a-high-dose-flu-vaccine-for-elderly-age-over-65

Yes, thanks. This seemed the least expensive, and is inclusive of doctor, nurses, and all the add-ons. BNH was THB4,000 for the same. I've booked Bangkok Hospital. There are one or two clinics around, but they're at around THB1,500 plus the add-ons, and I'm slightly wary of knowing what I'm getting. The hospitals are a monopoly or if not directly associated, they control the market price.

-

Thanks. I'm in Bangkok.

-

3 minutes ago, Mike Lister said:

You should be certain to write and tell them that it should be so.

Well my name is not Deloitte, Ernst, Young, Price, Waterhouse, Peat or Marwick, but I expect they are making those very same remonstrations, and my comment is simply to support their effort.

-

1

1

-

-

5 minutes ago, Mike Lister said:

Yes, 600 per dose for the standard flu vaccine is typical in the North.

This is a dose for over 65s, (apparently a higher dosage level).

-

2 minutes ago, Mike Lister said:

This is not an exercise designed to catch mafiosa, triad and general bad criminal elements in Thailand. This is an exercise to force otherwise law biding citizens to declare overseas income, force other residents to comply with the same ruling and to adopt common international practise. That some may continue to earn income from criminal activity is a different program of work.

My maid hardly falls into the mafioso, triad or criminal class, as far as I am aware.

She does fall into the income tax bracket of taxpayers living in Thailand, although she is not a Thai citizen. If the Thai RD wants to enforce the law, it should be across the board. And if the law is not appropriate, (thresholds etc), it should be amended by legislation.

-

8 minutes ago, Mike Lister said:

Yes, and?

The issue is imported funds from overseas and tax payable on that money by foreigners who are tax resident in Thailand. The issue is not the grey market economy here. The RD can't easily prove that maid got paid cash in hand but they can easily rove that Jonny Foreigner received 250k Baht from Nat West Bank in Croydon.

And...my point is the stupidity of the new interpretation.

Jonny Foreigner might also have imported money from several sources, many of them falling into the so-called grey market economy.

-

2

2

-

-

Given the reports of higher incidents of 'flu cases in some countries in the region, (e.g. Japan and Hong Kong), with recorded higher severity and deaths (primarily amongst the elderly), I decided to book a 'flu jab.

The various hospitals I checked with for over 65s "extra dosage" were quoting prices of THB2,200 to THB4,000 (including all the bells and whistles these establishments add on). This seems excessive, and another gripe related to the proposed taxation of retirees, many in this age group, who would be receiving this at reduced cost, or free in other countries.

I don't especially want another one, but covid vaccines are also doubtless very overpriced, and, as far as I can gather, not suited to the new variants BA.2.86 or EG.5 or XBB, take your pick.

-

1 hour ago, Mike Lister said:

Er, not really.

You cannot claim a deduction unless you file a tax return, you can't just say I would be allowed this deduction so there's no tax to pay hence I wont file.

Anyone who has assessible income over 60k Baht per year must file.

.

Except 90% who fall into this category, (say a maid who earns THB12,000 per month, or THB144,000 pa) does not pay a satang, because she gets it in cash.

-

1

1

-

-

On 10/13/2023 at 3:34 PM, KannikaP said:

Read my post again please.

This one?.....

On 10/12/2023 at 2:41 PM, KannikaP said:Just got back, with a Tax ID, same number as on my Pink Card. with assurance that, in my case, transferring 40k per month = 480k per annum, after 190k + 60k + 150k all at 0%, I shall have to pay Bht4000 for the year. There was some mention of 100k being deductible for expenses. As we are not married, I cannot claim 60k for my Mrs, but possibly some for the school fees I pay for my Mrs's son, he will let me know.

Where the money comes from, pension, interest, sister's immoral earnings, is of no matter. It is simply how much is/will be transferred from UK to Thailand in the specific tax year.

As I am only getting UK State Pension @ £170 per week = £8840 and a small one from Norway, my total UK income is £10400, below the Tax Free Allowance, so no tax due in UK either. I am happy with this.

-

21 hours ago, samtam said:

I don't know why, but I misread one of your earlier posts that seemed to suggest that over 65s had a threshold of THB150k PLUS THB190k PLUS THB60k.

This one?:

Just got back, with a Tax ID, same number as on my Pink Card. with assurance that, in my case, transferring 40k per month = 480k per annum, after 190k + 60k + 150k all at 0%, I shall have to pay Bht4000 for the year. There was some mention of 100k being deductible for expenses. As we are not married, I cannot claim 60k for my Mrs, but possibly some for the school fees I pay for my Mrs's son, he will let me know.

Where the money comes from, pension, interest, sister's immoral earnings, is of no matter. It is simply how much is/will be transferred from UK to Thailand in the specific tax year.

As I am only getting UK State Pension @ £170 per week = £8840 and a small one from Norway, my total UK income is £10400, below the Tax Free Allowance, so no tax due in UK either. I am happy with this.

-

3 minutes ago, KannikaP said:

480k in per year. Minus 190k + 60k. The first 150k @ 0%, the next 150k @ 5%, the next 200k @ 10%. There may be a 100k expenses allowance and 15k for my step son's school

That's it for me.

I don't know why, but I misread one of your earlier posts that seemed to suggest that over 65s had a threshold of THB150k PLUS THB190k PLUS THB60k.

-

2

2

-

-

1 hour ago, Dogmatix said:

You don't get the 150k threshold twice, if you file jointly with spouse. You have to file separately, if you want that. But you do get all the allowances for each. I have filed both jointly and separately. Filing jointly is advantageous if the spouse has little or no income of her own and thus has allowances that she couldn't use, if she filed alone. If her income is significant, it might be better for her to file separately to get the 150k threshold for herself.

I used the word "partner". We are not married. Overseas income is joint and in joint accounts. We would therefore have to file separately, but how co-mingling of funds on receipt overseas would be viewed is another hurdle that I expect is not addressed in the RD manual. We certainly don't make any distinction on who is the "owner" of the funds, however they came in.

-

1

1

-

-

10 minutes ago, KannikaP said:

Bang Rakam, Phitsanulok. Great tax office, great IO.

You experience, as I said, is very interesting. I presume you are a regular Thai taxpayer. My own situation is more complicated by the fact that although over 65 my partner is also a foreigner, over 65 too, but we share all our finances and any monies brought into Thailand are from a joint account overseas. Therefore we would get 2x times the allowances you breakdown, THB150k + THB190k +THB60k, or a total of THB460k @ 0%. Trying to go through that with an RD officer would be an excruciating experience, dividing up which income is from whom, and how that is assessable.

-

3 hours ago, deejai33 said:

I agree, but it can be done since every transaction has a date.

As you say, few people seperate out their money neatly into different accounts based on tax status, or year earned. I have a main account which money comes into and goes out of, and a 'savings' account that I transfer money to to gain interest.

So my main account has all sorts of transactions in it. But each transaction has an origin and date made. The account only has 1 balance maintained by the bank, which is the issue. There's a technical term for such accounts such as mixed/combination. (Not sure)

You need to add some columns manually to the bank statement to be able to prove what each transactions status is and what the balance of that status is.

For example, if you want to show that in 2023 all of the money you sent to thailand existed before 2023 and so was untaxable under the 'loophole' you would add 2 columns to statement. One called 2022 money, one called 2023 money.

Then look at end of 2022 balance and put it in 2022 column. This is money available for tax free transfer. Put zero in 2023 column.

Then examine each transaction starting jan 2023 and add or subtract it from either 2022, or 2023 column. If its a transfer to thailand, subtract from 2022. If its income in 2023 add it to 2023 column. If its a bill from home country subtract from 2023, to keep as much avaiable of 2022 money.

If you run out of 2022 money, then you'll have to pay tax, unless the 2023 money is under dta. You could have an extra column for that.

Not as complex as it sounds. Doable for me with about 100 annual transactions.

Fungible.

3 hours ago, newnative said:It is my understanding--so far--that only taxable income brought into Thailand is considered 'accessible' income, meaning income that can be got at by Thailand and subject to possible Thai taxes. Taxable, accessible income would be income sent to Thailand and not shielded by dual taxation agreements. So, if I brought in USA social security money, or Virginia state government pension money, both shielded by the USA dual tax agreement, the money is not considered 'accessible' income and not subject to Thai tax. There seems to be some uncertainty regarding pensions but I think state, not 'private', 'government' pensions are covered. Could be wrong, but that's my thinking at this point. One option I might consider is directly depositing my SS in a Thai bank, which now goes into my American bank. This would establish a verifiable paper trail of specific, shielded money.

Other income that I might bring in, such as dividend income, is 'accessible' for tax and I could be liable to pay that tax. There seems to be several ways around that. I could transfer the money in and designate it as a 'gift' to my Thai partner. Apparently 10MB a year is allowed for that. Could be one option I would consider if that is actually the case and allowed--and the paperwork is not too onerous.

There seems to be a number of deductions to use, should I decide to declare the taxable income brought in. It looks like I can deduct 190,000 baht right off the top since I am over 65. With the remaining amount, there seems to be another 150,000 baht deduction to lop off and that leaves you with a sum to be taxed on a sliding scale. Possibly some other deductions, as well, that I have not looked into. Once everything is figured in, the tax might be too much, depending on how much is brought in. But, I'm still liking the 'gift' thing.

Each year I earn approximately $11,000 in dividend income on stock I own, plus some interest income. It is my understanding that this money can be subject to tax. But, it is my further understanding that this money only becomes eligible for tax if it is remitted to Thailand, where it now becomes 'accessible'. Left in the US, it is my current understanding that I would never be responsible to pay any Thai tax on it. It remains inaccessible for Thai tax purposes. If this is, indeed the case, i will not be sending any of this money to Thailand.

I am one of the fortunate ones with a large chunk of cash already here in Thailand. I could theoretically probably live off this money for the rest of my life--or a good part of it--without bringing in any money from abroad. Left unanswered is whether the revenue department would come knocking on my door demanding an explanation on how I am supporting myself with no money coming in from broad--possibly with a deep dive into my finances; questioning when and where the money originally came from--and what type of money it was--interest, pension, social security, savings, etc. A lot of concerns like this are still up in the air.

Anyway, that's where I am at this point with my thinking, some 94 pages in on this thread. I welcome any corrections or misconceptions on my part that I have made--I am definitely still learning. I am still in the dark on what paperwork that might start to be required--whatever methods, schemes one chooses for their types of income and remittances. I imagine to be determined at a later point.

"Assessable", not accessible, I think.

3 hours ago, Dogmatix said:Nearly a month has past since Srettha promised there would be a focus group or focus groups to clarify the unlawful RD order reinterpreting an important part of the Revenue Code. No sign of that yet. Seems like that was another of his empty promises and those, for whom remittances are a key port of surviving, are hurtling towards a train wreck.

An excellent point. Any other country making such a dramatic change would have of course made the clarification before the extremely unclear new interpretation.

48 minutes ago, KannikaP said:Just got back, with a Tax ID, same number as on my Pink Card. with assurance that, in my case, transferring 40k per month = 480k per annum, after 190k + 60k + 150k all at 0%, I shall have to pay Bht4000 for the year. There was some mention of 100k being deductible for expenses. As we are not married, I cannot claim 60k for my Mrs, but possibly some for the school fees I pay for my Mrs's son, he will let me know.

Where the money comes from, pension, interest, sister's immoral earnings, is of no matter. It is simply how much is/will be transferred from UK to Thailand in the specific tax year.

As I am only getting UK State Pension @ £170 per week = £8840 and a small one from Norway, my total UK income is £10400, below the Tax Free Allowance, so no tax due in UK either. I am happy with this.

Thank you for letting us know of your experience; not sure whether this interpretation it will be universally applied across all RD offices. Where is yours?

-

1

1

-

Disappointment in Srettha’s Putin Phuket invitation

in Thailand News

Posted

Putin went to China, so clearly fear of being toppled whilst outside of Russia is not immediate.