samtam

-

Posts

3,108 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by samtam

-

-

1 hour ago, kevthailand said:

Going to the banks not easy, staff didn't even know their own products.

@kevthailand Thai banks' staff not knowing their product is a requisite for being employed by them.

-

1

1

-

2

2

-

-

1 hour ago, Morch said:

When is your baby due?

I actually gave up my seat on an airport bus to a woman with a large belly whom I assumed was pregnant. She said "thank you, but why?". I said, "because you're pregnant." She told me she was not! We both laughed.

-

2

2

-

-

I'd slap your face, but I'm allergic to leather.

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

When you hold the door open, or move out of someone's way, and they pass without a murmur, (a regular occurrence here sadly, where good manners seem to have slipped off the DNA, despite a contrary reputation for friendliness and politesse),

"You're most welcome. Please don't mention it."

(Irony is lost too.)

-

2

2

-

1

1

-

6 minutes ago, samtam said:

Itsy bitsy spider...

Thanks @Dogmatix. I hope this is the first nail in this coffin of stupidity. If however, Thailand tries to tax all worldwide income, like the USA, that would be an even more silly idea than the one currently being spouted, and unlike the IRS, I think their ability to enforce this is wildly optimistic. The article you reference also seems to emphasise the main target as (wealthy) Thais who invest overseas, and I suspect like previous attempts to alienate this segment of the electorate will end in tears.

I would add, this whole sewer show could easily have been avoided if a bit of simple critical thinking had been applied, (such as the major discussion on display on the 2 fora in AN, and doubtless from wise and savvy tax accountants and lawyers, and investment firms and private bankers). But until there is finality in clarification, they have done a great deal of damage to investment and the financial system of Thailand, and proven once again that risk is a major criterion of any dealings with Thailand.

-

2

2

-

-

6 minutes ago, Dogmatix said:

An article in yesterday's Prachachart Thurakit suggests the RD is starting to walk this back a bit but not giving up on it https://www.prachachat.net/finance/news-1432180?fbclid=IwAR0FtCbDVifNc-atDT8uHGklrCLP5PNOva3VrsaHFX9W_kjEm-bKQBnqEKc . It sounds like they are planning to exempt all foreign source income earned before 1 January 2024. It also sounds like they are thinking of moving to a global taxation model involving taxation of foreign source income in the year it arises, regardless of whether it is remitted to Thailand or not. They seem to have realised that that they need to amend the Revenue Code, which could take a couple of years, and not just let the RD issue a directive to staff that is not binding on taxpayers. However, they could still go for a stop gap solution to try to raise some more tax from income earned in 2024.

The whole thing smacks of stupidity and incompetence from politicians and civil servants alike. If you want to make major changes to the tax regime, it needs careful study beforehand and then proper legislation in parliament, not just let a bureaucrat blurt out a nonsensical unlawful order and threaten everyone. Huge damage has already been done by that. At least they are likely to give expats more time to make arrangements to sell up and get out of the country.

Here is a rough google translate.

Stocks-Finance

The Revenue Department delays "taxing" foreign income before 2024, adhering to the same criteria.

November 9, 2023 - 6:32 a.m.

levy taxes

The Revenue Department has called in the capital market department to understand the tax collection methods from people who earn money abroad. which when imported must be subject to tax inspection No matter what year it was imported. Previously, imports over a year would not be taxed. After the announcement was made Many parties are still concerned about the lack of clarity.

Permanent Secretary of the Treasury insists that loopholes must be closed.

Mr. Lawan Saengsanit, Permanent Secretary of the Ministry of Finance, said that the Ministry of Finance has confirmed that there will definitely be taxation of income from foreign countries. The law will be amended to allow collection as soon as the money is received. Only, amending the law must pass through Parliament, so it probably won't be done quickly. But insist that you have to do it. Because it meets international criteria

“People who have already paid taxes from abroad need not worry. Because you don't have to pay twice. But you must understand that In the past, there have been large companies that have used this channel to manage taxes. We have to close this gap.”

Investors complain about riding elephants to catch grasshoppers.

Mr. Anurak Bunsawaeng (Jo Luk Isaan), a major investor and former president of the Value Investors Association (Thailand), said that major investors Should be taxed at the personal income tax rate. The highest rate is 35%.

Therefore, I believe that no one will definitely accept being taxed. Therefore, you may see large investors 1. Stop investing abroad. 2. Do not take money back to the country and 3. Use gray methods to find various loopholes, which will make the opportunity for the government to collect a lot of revenue from this tax probably not be possible.

“It will definitely create a lot of problems. Because it will cause difficulties for investors. Including in practice through brokers Must collect documents for incoming and outgoing money. To separate profits to prove tax payments each year. which creates a lot of difficulties

So it is like riding an elephant to catch grasshoppers. This means that taxes cannot be collected. Because the chance that there will be very few people willing to pay But it creates many negative effects. It's not just big investors. but also private funds or a group of magnates who invest money abroad.”

Mr. Anurak said I want the government to change its perspective. Because it's not that investors don't want to pay taxes. But if taxes are collected at a reasonable rate or at the level of 10-15%, it is still acceptable.

“Tax collection should require people to act honestly. But if you keep it that high I believe that there will definitely be a lot of corruption. Right now, I mostly invest in China, Vietnam, and the United States, and have prepared several defensive plans.”

Begin to charge money from 2024.

However, recently there was a report from the Revenue Department that It has been concluded that In the first phase, there will be relief in the case of income generated abroad before 2024, if it is not imported within the same tax year as the year in which the income was generated. It will not have to be checked. Because finding document evidence will be difficult. It is considered to be releasing the ghost.

“Income generated before 2024 will use the old rules. That is, if it is not imported in the same tax year. The department will not collect it. As for imports across the year, they are no longer collected according to the original criteria. But income generated abroad from January 1, 2024 onwards, imported at any time will be subject to tax.

In the future, Section 41 of the Revenue Code will be amended to immediately calculate tax in the year in which income is earned abroad. Regardless of whether money is brought into the country or not, however, it may take 1-2 years to amend the law.”

Set "Pichai" to see private offers

Special Professor Kitipong Urapeepattanaphong, director of the Stock Exchange of Thailand (SET) and former chairman of the board of Baker & McKenzie Company Limited, told "Prachachat Turakij" that the collection of such taxes is being developed. Let's discuss in order for the government to postpone enforcement for now

Because I believe it's not worth it. It will affect the overall tax picture of Thailand as a whole. It is understood that now Mr. Settha Thavisin, Prime Minister and Minister of Finance, has assigned Mr. Pichai Chunhavajira, Advisor to the Prime Minister. is in charge of this matter

“And according to the Revenue Department Order No. 161/2023 that was issued, it is a practice. It cannot be interpreted outside of the law. Therefore, if such taxes are to be collected The tax structure must be restructured. which is a big deal The law must be amended, repealed Section 41, paragraph two, and issued a new law in its place. In the future, taxes will be collected similar to the United States. That is, all income in this world must be taxed. But in general, taxes should not exceed 15%.”

The Revenue Department announces income from abroad over the year must be taxed starting 1 Jan. 2024.

Revenue Department discusses new order “Income earned from abroad over the year” is subject to tax.

Is collecting foreign investment tax worth it? Question from "Kitipong Urapeepattanapong" tax law guru

Itsy bitsy spider...

Thanks @Dogmatix. I hope this is the first nail in this coffin of stupidity. If however, Thailand tries to tax all worldwide income, like the USA, that would be an even more silly idea than the one currently being spouted, and unlike the IRS, I think their ability to enforce this is wildly optimistic. The article you reference also seems to emphasise the main target as (wealthy) Thais who invest overseas, and I suspect like previous attempts to alienate this segment of the electorate will end in tears.

-

2

2

-

-

- Popular Post

- Popular Post

I have just gone into my UOB branch in Silom Complex to effect some minor banking operations, (updating my passbook and asking for a breakdown of an aggregated sum). One of the transactions had a narrative EFT, and I asked what that was, as it was not included in the transaction code list at the back of the passbook. They had to inquire in the back office. Twenty minutes later I tried to proceed with other inquiries, (adding a power of attorney, initially an unknown concept, and twenty minutes after that, deciding to abandon that for another day). If Thai RD are going to rely on banks to help them sift through customers' transactions, they are in for a very long slog. UOB is about average on the scale of ineptitude.

My recent registration for the facial ID facility was another exercise in the stimulation of high blood pressure, as despite numerous SMS notifications, the staff in another UOB branch seemed to know very little about how this worked, what an electronic chip was in a passport etc, and 50 minutes later, I limped out, exhausted by the ordeal.

Perhaps one little hurdle Thai RD need to consider for their cunning masterplan.

-

3

3

-

1

1

-

2 hours ago, beammeup said:

or you can buy condos, houses, cars, and Rolex's in Malaysia, Singapore or Hong Kong. and just not bother with Thailand. OK maybe not cars in Singapore.

Not condos or houses either. Singapore is now one of the most expensive property markets in the world. Ditto Hong Kong, (despite a recent downturn).

1 hour ago, Mike Lister said:It will never happen. The housing market here is dependent on foreign buyers, it would crash overnight if everyone knew they had to pay tax on the funds used to purchase the property.

Always difficult to get meaningful statistics here, but I think the foreign buyers' percentage of ownership of Thai properties is unlikely to be a major catalyst. TBN here suggests it will account for 15% of the market in the next 2 years.

1 hour ago, Enzian said:Since the condo I'm in is for sale (Bangkok, Nana station), I'm on a month-to-month rental agreement, which is fine with me. Last evening talked with the rental agent (owner is out of country) and she said there is almost no one interested in even looking at this unit, though it is priced at what until a few month ago at least seemed like market. Further, she said the big banks have repos they can't sell, and just finished condo buildings, ones coming on line, even older buildings can't find buyers. The market is dead. That's one agent's observation; anyone else hear anything like this? I wanted to ask her if the tax uncertainly entered in, but her English is not great, and I don't know how to describe such a big "IF" to her; I may try later.

"The market is dead" sounds about right to me. It was in a coma during the pandemic, and is still breathing, but barely. Any tax uncertainty or negativity will obviously have some impact (see above), and it will have relapse.

13 minutes ago, Mike Teavee said:Sorry, I seem to be struggling to get my point across....

There is a huge difference between paying no UK Tax because the income wasn't taxable (E.g. interest earned in an ISA) AND paying no UK Tax because the effective rate that applied to that income was 0%.

In the latter case you have been taxed & it could be argued you've paid the tax due (all £0.00p of it) which is where rule 5 of the RD Guidelines come in to play.

In this case UK State Pension has been "assessed", and it is zero. Whether Thai RD will consider that as the more favourable outcome to the UK expat, and one that should apply, is anybody's guess at the moment.

-

1

1

-

-

1 hour ago, Sheryl said:

It is worth noting that foreigners who were having old age pensions directly remitted to Thailand have in some cases (depending on type of pension and terms of the relevant Tax Treaty with Thailand) always owed tax on it, though most have not been filing tax returns or paying. Their situation remains unchanged.

When you state "their position remains unchanged", I'm not sure I follow you: their position surely changes, because now they will still owe taxes, and file a tax return?

-

4 hours ago, Bobthegimp said:

Leave, but to where?

Didn't we have some big global event around 3 years ago when the governments of the world, despite all of the language and cultural barriers, reached the same conclusions and took the exact same measures in almost perfect lockstep? Looks like we're getting another taste of it.

Colombia and Thailand are very disparate cultures on opposite sides of the world, yet are adopting the same tax measures as Western nations. Let me know if you find a bolt hole to escape this globalist madness and the first drinking binge is on me.

Colombia and Thailand are very disparate countries to each other, as indeed they are to Hong Kong SAR and Singapore (in terms of tax), and yet the latter 2 have very favourable tax regimes, (as noted by the lawyer in the OP).

3 hours ago, Karma80 said:I couldn't agree more. Being a tax resident of a place with the lowest tax obligations is a no-brainer and forms part of my own strategy, and thousands of others no doubt. The problem with the RDs new (forced) interpretation is it makes Thailand far less competitive. Nobody wants to live through a learning period in a country with a really poor reputation for bureaucracy, flip-flops, implementation, corruption and policy instability. Not when your tax liability is on the line.

Double taxation agreements or not, I choose not to have to dance through the hoops of fire to prove things to Somchai at the local RD. Anyone living in Thailand can attest that an active avoidance of anything official is the best policy.

I appreciate for many retirees, the impact is next to nothing. But for others who are at a more enterprising point in their life from a business sense, Hong Kong or Singapore are starting to look a lot more attractive from a tax perspective.

Unfortunately living in either Hong Kong or Singapore would cost you infinitely more in housing and cost of living, than any new tax in Thailand.

-

1

1

-

-

4 hours ago, Mike Teavee said:

Can I ask which country you guys are from & whether not being Tax Resident elsewhere means by default you are Tax Resident in your home country.

The reason I ask is that I plan on doing every 3rd year as a Non-Tax resident in Thailand during which I'll bring in enough money to support me for the next 3 years, BUT I don't want this to mean that I default to becoming tax resident in my home country (UK).

As an aside, the Tax Residency threshold in the UK operates on a sliding scale depending on how long you've been Non-UK Tax Resident & how many "Economic Ties" you have there. I can spend up to 89 days in the UK as I have 2 "Economic Ties" there, but if I had the full (4) "Economic Ties" it would be 45 days as I've been Non-UK Tax Resident for > 3 years & 16 days if I hadn't.

Can you expand on "economic ties" please?

-

AFAIK there are no boosters for the current new variants. When I had my 'flu jab at BNH in Bangkok the doctor said that there was no need to get any covid booster. This is a completely different response to that being given in the West, (USA & UK). In the latter, my cousin (same age as me, 66), has had his eighth covid shot, (a booster for the new variant). I last had my 3rd covid vax in 2021, caught covid in Spain last year, with minimal symptoms.

-

1

1

-

-

1 hour ago, Dogmatix said:

I think you are not far from the truth. The RD was placed under great pressure from PM and absentee finance minister Pink Sox to find some quick ways to boost revenue to show how he was going to fund the digital wallet. So they blurted out this little gem without giving it much thought and nor did the finance minster or deputy finance minister. They were unable to say how much incremental tax would be raised, if any, or what impact it might have on the economy but said they would form focus groups to assess it.

Much the same has happened with the digital wallet which is now dying a slow death of a thousand cuts, as they slowly realise that it is not fundable in its original form and start proposing bigger and bigger exclusion groups.

"OK, I'm ready for my clarification now Mr DeMille.", to paraphrase Gloria Swanson.

-

1

1

-

-

16 minutes ago, dontpanic said:

I guess that's my point, if it is earned in UAE it has been assessed, the assessment was that the rate of tax is 0% it's not like you're earning it there and not declaring it there, it's been through the tax system. So by rights you have paid all applicable taxes before it is remitted into Thailand which you would have a tax cert, accounts etc to show this. Just because UAE has a 0% tax shouldn't mean that you get taxed again in Thailand.

No ones getting anything for their tax payment, no easier road to residency, no ability to own land, nothing, zip a big fat zero. Honestly they must think we have marshmallows between our ears.

TIT!!!!

I think the key is "has the tax been assessed", (in Dubai)? It has been assessed, (at the zero rate). But Lord knows how Thai RD will interpret that. It would be nice if they could let us all know, and PDQ.

-

1 hour ago, novacova said:

The statement from the bank office is the I would use, I never compared the two. From my recollection, the printout at the bank is different. Also the banker puts some markings on the statement, mine does anyway.

Yes, it has to be signed/chopped by the bank.

-

1

1

-

-

47 minutes ago, bob smith said:

but have you ever taken a look inside a thais only Line group, say for a housing project or condo community group?

My god.

I've never seen such petty arguing/complaining/bickering in all my life!

They will literally complain about anything

the smaller the issue the bigger they blow it out of proportion it seems.

there was a woman on there this morning threatening to call the police over a banana skin that had been left outside her front door!

The language she was using was so colorful I had to reach for my shades!!

So it seems that Thais don't like it when farangs complain,

but for them they can complain to high heaven.

it also seems that complaints here are handled differently.

A Thai will never tell you straight to your face, but will talk about you all day belong behind your back..

They are the biggest grasses i've ever come across.

double standards much?

Yes, we have a group of 7 or 8 who are constantly whingeing about very minor details. I call it the Whine LINE. Their comments are rather like those I imagine are made by schoolgirls about their classmates, teachers etc, (and I'm probably being unkind to schoolgirls). I have discouraged our manager from participating, because however he responds, they are encouraged by those responses to double down. It is important that he follows the chatter, but not participate in it. Sure enough, ignoring it seems to make it die down. I am on the board of the condo, so I get informed. The magnificent 7 (or eight) wouldn't lift a finger to improve the condo for the good of ALL residents, but boy, they love to complain when the management makes changes designed to do just that. And these people are rich, (dare one call them HiSo?), but devoid of any grace or thoughtfulness.

-

1

1

-

-

@Murn Are you the TAT rep for Chiang Rai?!🤔

-

1

1

-

-

@pollyogI have had this problem in the past, but only if I've left the cans in a cupboard (that tends to get too hot). And I generally don't stock a lot of mixers for that reason, because we don't drink them, and friends visiting went into a hiatus during and post pandemic. I do buy Chang soda in a bottle, which seems to be OK, but is also drunk pretty quickly.

-

4 minutes ago, TallGuyJohninBKK said:

The aqicn.org website aggregates air quality reading from numerous sources, both government and private.

On any given page/source of theirs, if you scroll down a bit, you'll find a note of who/what is responsible for that particular sensor... such as the following for the main Bangkok one:

"Air Quality Data provided by the Division of Air Quality Data, Air Quality and Noise Management Bureau, Pollution Control Department. (aqmthai.com) "

https://aqicn.org/city/bangkok/

Thanks. It shows Chiang Mai University as the contributor. I have notified them, (I think). Have had correspondence with them over the last few days.

-

1

1

-

-

18 minutes ago, samtam said:

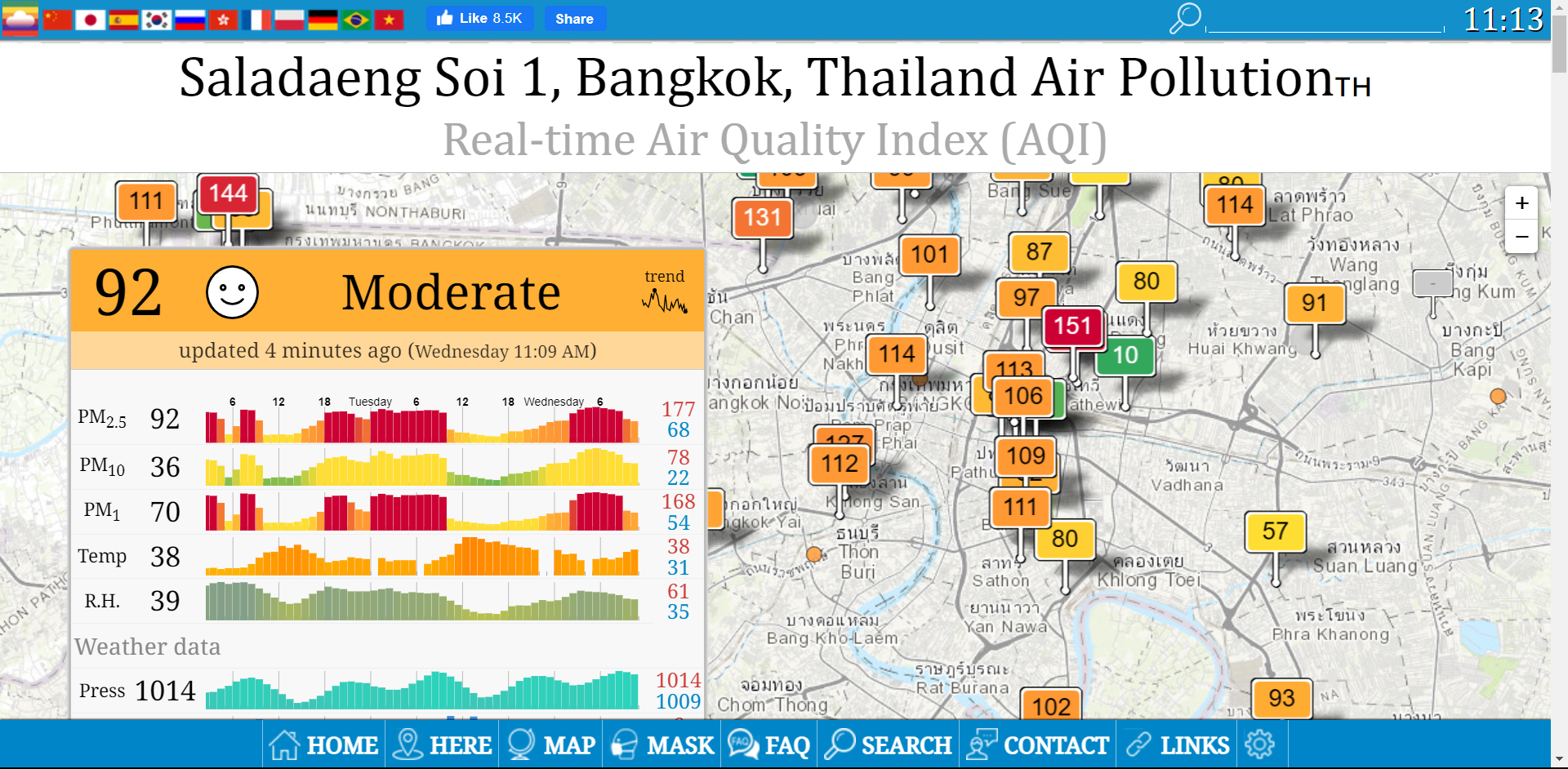

I've noticed that the AQI website that I use has quite a few non functioning data centres, and I have been in touch with them. They confirmed that this is the case, and have disabled the content on their website. The readings were excessively higher than those in the immediate vicinity, (such as the red 151 reading in the sample shown). Nonetheless, there still appear to be few that are clearly out of sync, and I'm wondering if there is a better monitoring website for Bangkok, or indeed Thailand.

Here is today's for

รร.โสตศึกษาทุ่งมหาเมฆ แขวงทุ่งมหาเมฆ เขตสาทร กรุงเทพฯ, Bangkok, Thailand Air Pollution:

which shows "no data", but 129 on the map. So it has presumably been disabled, but not removed from the map. I have notified them of this one too.

-

On 10/18/2023 at 11:16 AM, samtam said:

I've noticed that the AQI website that I use has quite a few non functioning data centres, and I have been in touch with them. They confirmed that this is the case, and have disabled the content on their website. The readings were excessively higher than those in the immediate vicinity, (such as the red 151 reading in the sample shown). Nonetheless, there still appear to be few that are clearly out of sync, and I'm wondering if there is a better monitoring website for Bangkok, or indeed Thailand.

-

@lopburi3 Yes, that is what my doctor told me. The Southern Hemisphere shots were administered in May to tie in with Thailand's 'flu season, and the Northern Hemisphere shots were rolled out in September. Personally I think once a year is sufficient, otherwise I'd be poor within a short space of time, and as you say, there is doubtless some benefit in the lesser dosage, and even those non specific to the season.

-

@lopburi3 ok, thanks. I'm obviously new to this, as it is my first 'flu vaccination, so I assumed what applies now, always applied. Doubtless there will be more tweaking to the protocols as time goes by.

-

2 hours ago, Acharn said:

No, as far as I know I'm only getting the regular, single dose. I'm 85 and don't worry that much about it.

So we're comparing apples with oranges. I'm no virologist, but I'd rather only put into my body that which might help me in the case of a new infection, and it's clear that there is a misconception about having a THB600 flu jab really being the solution, apart from "box ticking" in one's mind.

However, not worrying about it will undoubtedly help you. In which case, I'm wondering why it's worth bothering to have any vaccination at all?

Change in the tax law does target expats living in Thailand and extends reporting obligations

in Thailand News

Posted

They attend a course in the Tourist Authority of Thailand Magic School of Statistics and Wishful Thinking, (TATTMSSWT for short).