Nabbiex

Member-

Posts

76 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Nabbiex

-

In order to eliminate above : 1. Billionaires should not exist. 2. The poor needs the supports. 3. Common sense is only the one way. 4. Wars is enough: peace is best for everyone. 5. Improving the awareness & respecting to the nature environment. 6. Be in good health & continue bars, girls, whatever you wish. 🙂

-

Does anybody know who does miscellaneous home repairs here in Phuket please, I live in Phuket Wichit. For instance, the small holes in the ceiling, installing the electric socket, painting the doors, etc need to be done. Appreciate any responses. Thanks.

-

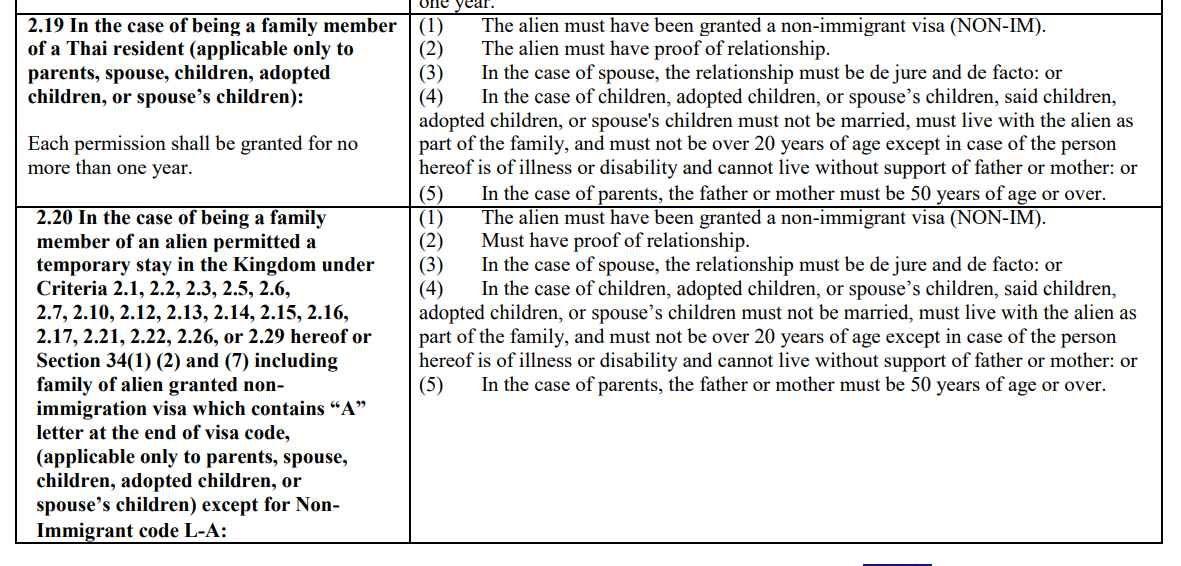

Thai Child Dependent Visa

Nabbiex replied to KruAlastair's topic in Thai Visas, Residency, and Work Permits

Yes you can. I also have my extension based on Thai daughter using khor ror 6. You need divorce certificate and khor ror 6 (or 2 or11?) stating you are 100% parenthood from Amphur. No need to go to court as long as your divorce is based on mutual agreement (simple and straightforward). All the Best. -

I just completed this quiz. My Score 60/100 My Time 113 seconds

-

Convict helps America or Prosecutor helps America?

-

Trump is devoted to listening his beautiful family & family business more than listening US citizens & national/state public services. Is that not practical for president's role?

-

Non O based on child.

Nabbiex replied to 248900_1469958220's topic in Thai Visas, Residency, and Work Permits

Quite similar to my situation - I have a current extension of NON O based on Thai daughter aged 18 this year. I have always in doubt whether I have the right to continue the same extension when she will reach at age of 20. I remember Thai officer at Phuket immigration keeps reminding me my extension will become invalidated after her age of 20 but I see your comments are quite contrary to that. I shall be curious to know if anyone based on Thai child aged over 20 have succeeded to extend the NON O extension - in Phuket or else in Thailand? Hence, should I re-check with Phuket Immigration regarding no Thai age limit? -

Divorcing at the same Amphoe as the marriage was registered

Nabbiex replied to Jo77's topic in Marriage and Divorce

Same for me - Phuket. -

Thai Maid Inherited Fortune from French Boss

Nabbiex replied to webfact's topic in Southern Thailand News

RIP to Catherine. It reminds me of one acquittance of mine. He passed away from natural cause and his Thai maid inherited everything including house. Yet, she seems to be frustrated because the will proceeding will take over 1 year or more. How will she cope with house maintenance, cost of running, etc while waiting. But...I hope she will already get it by now.... -

According to which statistics? reliable accuracy?

-

Simple question about Imm-O Retirement visa

Nabbiex replied to Nabbiex's topic in Thai Visas, Residency, and Work Permits

Thanks for your further responses above. Re: When Thai child reaching the age of 20, the extension will become invalid. The misinterpretation / wrong info can be confusing but I found the most accurate info called Order of The Immigration Bureau No 327/2557 (Not sure if this is most recent update). See the copy - Personally, it is very stupid because how can father & the biological Thai child be separated? Well, that is Thainess. :/ -

Simple question about Imm-O Retirement visa

Nabbiex replied to Nabbiex's topic in Thai Visas, Residency, and Work Permits

Thanks for useful info above. Actually I have a current one-year extension based on Thai child. When she will reach at the age of 20, I may be prepared to toggle to the retirement visa. From what I see your responses, it looks like the health insurance is not required for Non-O retirement visa. Also, I am trying to figure out whether opting additional OPD insurance is worth or not. -

I think this should be your last resort - If your hearing medical issue is complicated, how about learning sign language? My native language is British Sign Language (BSL). To grasp the basic knowledge of it needs about at least 10 lessons (each hourly). If interesting, please PM me.

-

SurfShark - very friendly & can answer many questions.

-

Out of curiosity, if we, expats, may be taxed, then will we be entitled to receive any Thai benefits such as Thai state pension, Thai personal tax income, family benefits, disability allowance, and so forth?

- 325 replies

-

- 22

-

-

-

-

-

-

My friend, Bard says.... Whether or not it is a good idea to tax expatriates is a complex question with no easy answer. There are both pros and cons to consider. Pros of taxing expatriates: It can generate revenue for the government, which can be used to fund public services and programs. It can discourage people from renouncing their citizenship or residency to avoid paying taxes. It can ensure that all citizens and residents contribute their fair share to the tax burden. Cons of taxing expatriates: It can discourage people from living and working abroad, which can harm the economy. It can be difficult to enforce, as expatriates may be living and working in countries with which the home country does not have tax treaties. It can be unfair to expatriates who are already paying taxes in the country where they live and work. Ultimately, the decision of whether or not to tax expatriates is a political one. Each country must weigh the pros and cons and decide what is best for its own citizens and economy. In the case of the United States, the government taxes its citizens and resident aliens worldwide, regardless of where they live or work. This is one of the few countries in the world that does so. The US government argues that this is necessary to ensure that all US citizens contribute their fair share to the tax burden, regardless of where they live. However, many US expats argue that this is unfair, as they are already paying taxes in the country where they live and work. In recent years, there has been some discussion in the US Congress about repealing the expatriation tax, but no concrete action has been taken. It is important to note that the tax rules for expatriates vary widely from country to country. Some countries, such as the United Kingdom and Australia, only tax expatriates on their income from domestic sources. Other countries, such as Germany and Japan, tax expatriates on their worldwide income for a certain number of years after they leave the country. If you are considering becoming an expatriate, it is important to consult with a tax advisor to understand the tax rules of your home country and the country where you plan to live and work.

-

Voted by height?

-

-

Juggling (yawn...), learning/teaching online (yawn...), exploring google (yawn...), cafe (yawn...), dating (yawn...), & fathering (yawn...)

-

Don Mueang airport’s escalator accident not caused by poor maintenance

Nabbiex replied to webfact's topic in Bangkok News

Apart from that frustrating above debates, please join me to give the unfortunate lady the very speedy recovery & to be able walking again super soon. -

2. Listen stupid advice 1. Ignore wise advice 3. Be reminded of me as human being.

-

Son with thai and EU passport??

Nabbiex replied to beammeup's topic in Thai Visas, Residency, and Work Permits

Yeah, because it is a typical Thai loophole. -

Will Thailand get a third prime minister with the Shinawatra name?

Nabbiex replied to webfact's topic in Thailand News

Pheu Thai has been touting some ambitious and eye-catching policies ahead of the country’s May 14 election, including giving digital money to all citizens above 16 years old. Should it be 18 years old instead 16 entitling to vote? -

UK Pension Service - Total Farse

Nabbiex replied to piston broke's topic in UK & Europe Topics and Events

Government gateway ID In the past I had some difficulties to make the access to it because it prompts for UK mobile number I do not have. All I have is Thai mobile number so I gave up to attempt it. Until recently, I am surprised that I got the access to it successfully after its system sends the code to my Thai mobile number automatically. I enter the code and it is somewhat working perfectly.