CharlesHolzhauer

Member-

Posts

279 -

Joined

-

Last visited

Profile Information

-

Location

Buriram near Suan Nok

Recent Profile Visitors

1,387 profile views

CharlesHolzhauer's Achievements

-

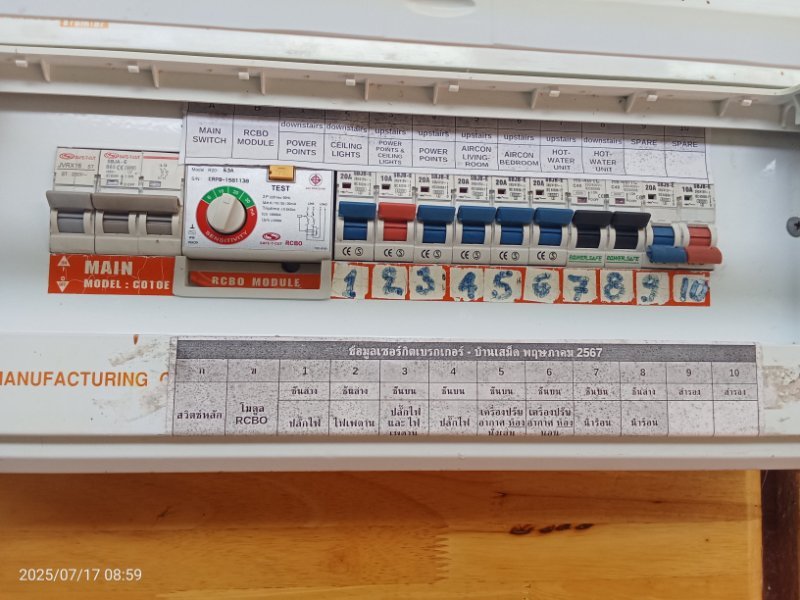

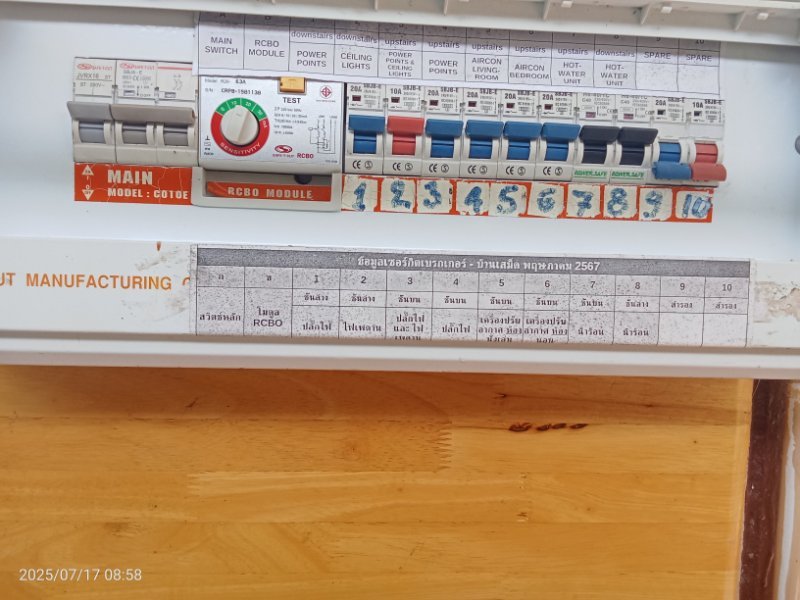

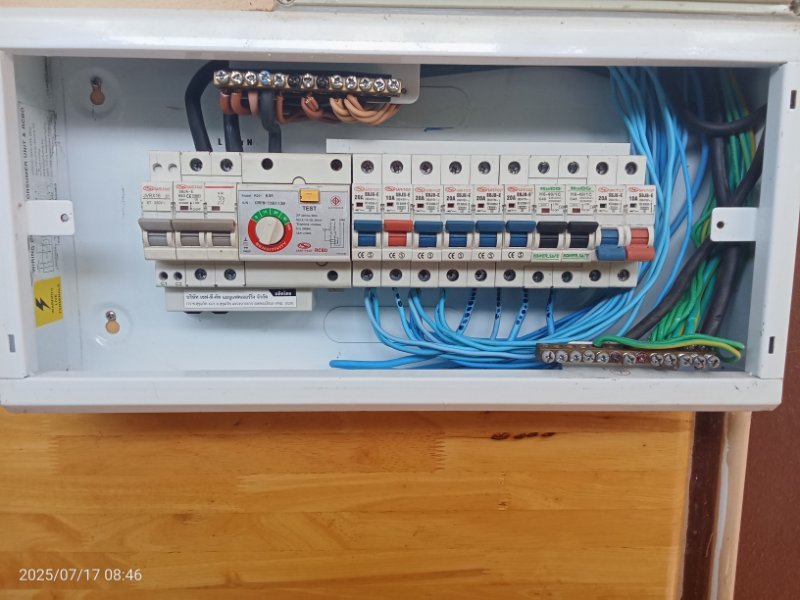

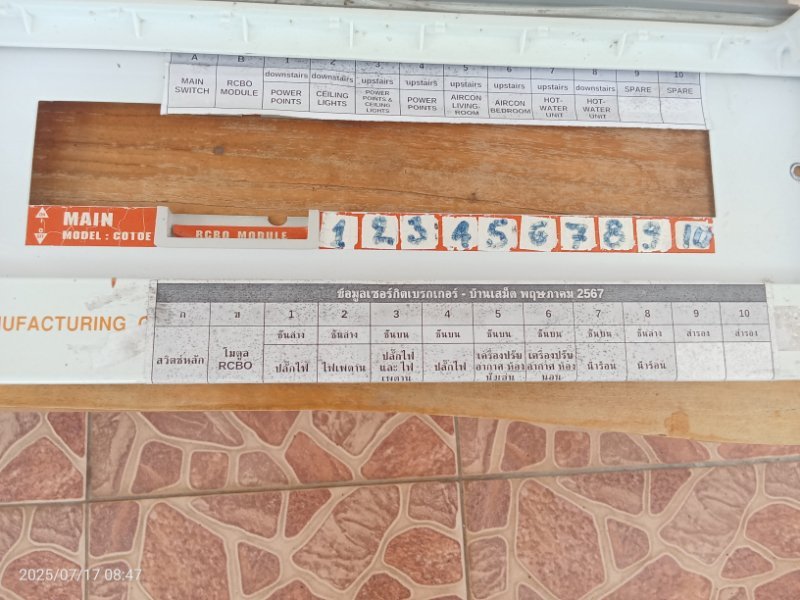

Here photos of my existing CU. The spare slots appear to be too small for fitting in an ABB, But I have sufficient space beneath the CU for adding a sub-unit.

-

Thanks. Is it possible installing an ABB 63A (SH203-C63) to an existing Safe-T-Cut Consumer box with not slots available?

-

I'd be interested for having a surge protection device (SPD) included into a consumer unit alas as far as I can determine the residential consumer units (CU) sold via Lazada or by Schneider Electric (Square D, Acti9 series) don't come pre-configured with slots or busbar accommodations for SPDs. Would you know a supplier of CU with SPD slots?

-

Hi Tas, I'm also searching for a spiral staircase. Have you found any Thai companies that manufacture and install this type of staircase?

-

I am currently planning my residential water supply system and would appreciate guidance on whether a booster pump is recommended for supplying adequate pressure to bathroom and kitchen outlets. Proposed Setup:- Water Source (very close to the town reservoir): Groundwater drawn from a 70-meter-deep well via a solar-operated pump, filling a 2,000-liter fiberglass DOS tank (referred to as the settling tank). Stage 1 Filtration: After allowing sufficient settling time (yet to be determined), relatively clear water will be pumped - again using solar power - through a filter bank with 2x5-micron filters, into a second 2,000-liter DOS tank (referred to as the clean water tank). Tank Placement: Both the settling and clean water tanks are located at ground level. Stage 2 Filtration & Delivery: Water from the clean water tank will be pumped - using solar power - through an additional filter bank with 2x1-micron filters into a 1,000-liter DOS tank (referred to as the supply tank) situated in the elevated section of the house (approximately 2.5 meters high). Usage: Water from the 1,000-liter elevated tank will supply the shower, toilet flusher, bathroom sink, washing machine and kitchen sink. Concern: Given the limited elevation and lack of gravity-fed pressure, I anticipate low water pressure at the taps and shower - particularly problematic when using an electric hot water unit during cooler months. Proposed Solution: I am considering installing an electric booster pump (e.g., a 40L/min model available via Lazada: [url=https://www.lazada.co.th/tag/booster-pump/?q=booster%20pump&_keyori=ss&sugg=booster%20pump_0_1&catalog_redirect_tag=true]BOOSTER PUMPS[/url]) at the outlet of the 1,000-liter tank. This pump would support: All water outlets (taps) in the elevated section of the house including a Stiebel Eltron DHC 8 EC electric shower heater, a Mazuma drinking water filter unit with UV lamp and a washing machine. Request for Feedback: I would greatly appreciate any recommendations on reliable booster pump brands that are well-suited for this type of application - particularly from individuals with similar water supply configurations. I also welcome suggestions from those who have adopted entirely different setups that have proven effective in delivering consistent water pressure for residential use. Thanks.

-

I recognize that BlueScope is a superior roofing option and have decided to install chicken wire fencing beneath the insulation for additional support, as it is a cost-effective measure during the roofing process. From my understanding, this practice is commonly used in Australia and New Zealand to help secure insulation in place. In light of the recent earthquake and the collapse of a tall building in Bangkok, I can only hope that the concrete mix delivered matches the specifications ordered by my contractor and that the rebars are meeting the required standards, and the code embossed to the bars [TPS DP16 SD40] is authentic.

-

I am in the process of building a new 81-square-meter, one-bedroom house elevated on 16 concrete columns, each measuring 2.20 meters in height. The drilling for 7-meter-deep concrete piles has been completed, with rebar inserted and CPAC delivering and pouring the concrete using a mixer truck. A backhoe has already excavated around the piles to prepare for the foundation setup. For the roof, I have opted for a single flat-sloped design, using hot-dipped galvanized single-skin sheets with thick insulation attached, manufactured by BlueScope. I would appreciate insights from those with experience using this roofing material. Specifically, I am curious whether the insulation remains securely attached over time or if detachment is a common issue. If so, would it be advisable to install a wire mesh support (e.g., chicken wire fencing) beneath the roofing before installation to prevent insulation from coming loose? The house walls will be built entirely from aerated concrete blocks, and the floor will be reinforced concrete. The ceiling will be constructed using 1-inch thick Shera panels, supported by metal beams. The attic, which will be internally accessible, will have a height of approximately 1.80 meters at the front and 1.50 meters at the back. Like the rest of the house, it will be enclosed with aerated concrete blocks and will feature large windows on all sides, which will remain open for most of the year to facilitate airflow. Given my current insulation plan, do you think these measures are sufficient to ensure a well-insulated and energy-efficient home? Or should I consider additional insulation strategies?

-

This might explain the actions of a single guy, short on funds, with hormones running wild. However, it’s completely irresponsible for those who are fathering children, building houses, or conducting business without a work permit. It’s not surprising that some of these individuals, who rely heavily on agents, may feel uneasy about new government (tax) regulations. In my view, it’s highly unlikely that agents would be equipped to handle matters effectively with the Thai Revenue Department (TRD). Only time will tell.

-

Thailand as a Future Destination for Relocation

CharlesHolzhauer replied to kevozman1's topic in General Topics

Refreshing to hear – you’re one of the few who carefully and critically consider their path. At least you’re using the right 'head.' As you would know, things in Thailand, as elsewhere, are dynamic and ever-changing. I first arrived in Thailand as a tourist in 1972, followed by many visits over the years, and eventually retired here 26 years ago with a fair understanding of what this place had to offer. I’m happy and content with my decision, but I always advise others to critically evaluate where they choose to settle. It’s a big decision that requires thoughtful consideration (especially tax related issues) 😀. Good luck. -

I have been living in Thailand on a retirement extension for quite some time, and I am genuinely amazed that anyone would pay a significant amount to an agent to bypass what is essentially a straightforward application and renewal process. In all my years of dealing with Immigration offices, I have never encountered any major issues during my annual renewals - occasional frustrations and long lines, of course, but nothing serious as long as your paperwork is in order. On a couple of occasions, I was asked to return with additional documents, but this was entirely my fault for not keeping up to date with the latest requirements at a particular location. Forums like this one and other Thailand-based platforms are excellent resources for obtaining advice and ensuring you meet the specific requirements of your local Immigration office. My positive experiences include the Immigration Office in Bangkok, the Jomtien Immigration Office (dating back to when it was still located on Pattaya’s Soi 8), and my current location. These days, even the 90-day reporting process is remarkably straightforward.

-

Enforcement would be straightforward if the Thai Revenue Department (TRD) works closely with the Thai Immigration Bureau (TIB), which I am confident will occur eventually. Implementing a tax clearance certificate to confirm that an individual’s Thai tax account is in good standing with their local TRD would be both simple and effective. The responsibility would rest on the individual to obtain this certificate, requiring minimal effort from TIB officers. It would merely become another document added to the individual's checklist. Efficient and hassle-free.

-

Slice it or dice it - whichever you prefer - the fact remains that as a tax resident of Thailand, you are obligated to pay your dues. Tax-Free Status in Australia: The fact that the pension payments are tax-free in Australia due to their nature (private pension earnings approved by the government as tax-free) does not change their treatment under the DTAA. The DTAA determines which country has taxing rights, not the domestic tax status. Taxation in Thailand: Article 18 states that pensions (not related to government service) paid to a resident of Thailand are taxable only in Thailand. This means that once the funds are remitted to Thailand, Thai tax laws will govern their taxation. Private Pension Clarification: While Article 18 does not explicitly differentiate between public and private pensions, it broadly covers pensions. Private pension payments are likely considered taxable in Thailand under Thai law, even if not taxed in Australia.

-

Your assumption is correct. ARTICLE 18 PENSIONS AND ANNUITIES 1. Subject to the provisions of Article 19, pensions and annuities paid to a resident of one of the Contracting States shall be taxable only in that State. 2. The term "annuity" means a stated sum payable periodically at stated times during life or during a specified or ascertainable period of time under an obligation to make the payments in return for adequate and full consideration in money or money's worth. ARTICLE 19 GOVERNMENT SERVICE 1. Remuneration (other than a pension) paid by one of the Contracting States or a political subdivision of that State or a local authority of that State to any individual in respect of services rendered in the discharge of governmental functions shall be taxable only in that State. However, such remuneration shall be taxable only in the other Contracting State if the services are rendered in that other State and the recipient is a resident of that other State who: (a) is a citizen or national of that other State; or (b) did not become a resident of that other State solely for the purpose of performing the services. 2. Any pension paid to an individual in respect of services rendered in the discharge of governmental functions to one of the Contracting States or a political subdivision of that State or a local authority of that State shall be taxable only in that State. Such pension shall, however, be taxable only in the other Contracting State if the recipient is a resident of, and a citizen or national of, that other State. 3. The provisions of paragraphs 1 and 2 shall not apply to remuneration or a pension in respect of services rendered in connection with any trade or business carried on by one of the Contracting States or a political subdivision of one of the States or a local authority of one of the States. In such a case, the provisions of Article 15, 16 or 18 as the case may be shall apply. ARTICLE 15 DEPENDENT PERSONAL SERVICES 1. Subject to the provisions of Article 16, 18, 19 and 20, salaries, wages and other similar remuneration derived by an individual who is a resident of one of the Contracting State in respect of an employment shall be taxable only in that State unless the employment is exercised in the other Contracting State. If the employment is so exercised, such remuneration as is derived from that exercise may be taxed in that other State. 2. Notwithstanding the provisions of paragraph 1, remuneration derives by an individual who is a resident of the Contracting State in respect of an employment exercised in the other Contracting State shall be taxable only in the first-mentioned State if : (a) the recipient is present in that other State for a period or periods not exceeding in the aggregate 183 days in the tax year or year of income, as the case may be, of that other State; (b) the remuneration is paid by, or on behalf of, an employer who is not a resident of that other State; and (c) the remuneration is not deductible in determining taxable profits of a permanent establishment or a fixed base which the employer has in that other State. 3. Notwithstanding the preceding provisions of this Article, remuneration in respect of an employment exercised aboard a ship or aircraft operated in international traffic by a resident of one of the Contracting States may be taxed in that Contracting State. ARTICLE 16 DIRECTORS' FEES Directors' fees and similar payments derived by a resident of one of the Contracting States in the the capacity of the resident as a member of the board of directors of a company which is a resident of the other Contracting State may be taxed in that other State. ARTICLE 20 PROFESSORS AND TEACHERS 1. A professor or teacher who is a resident of one of the Contracting States and who visits the other Contracting State, at the invitation of any university, college, school or other similar educational institution situated in the other Contracting State and which is recognized by the competent authority of that other State, for a period not exceeding two years solely for the purpose of teaching or research or both at such educational institution shall be taxable only in the first mentioned state on any remuneration for such teaching or research. 2. This Article shall not apply to remuneration which a professor or teacher receives for conducting research if the research is undertaken primarily for the private benefit of a specific person or persons. === Tax-Free Status in Australia: The fact that the pension payments are tax-free in Australia due to their nature (private pension earnings approved by the government as tax-free) does not change their treatment under the DTAA. The DTAA determines which country has taxing rights, not the domestic tax status. Taxation in Thailand: Article 18 states that pensions (not related to government service) paid to a resident of Thailand are taxable only in Thailand. This means that once the funds are remitted to Thailand, Thai tax laws will govern their taxation. Private Pension Clarification: While Article 18 does not explicitly differentiate between public and private pensions, it broadly covers pensions. Private pension payments are likely considered taxable in Thailand under Thai law, even if not taxed in Australia.