bingobongo

-

Posts

1,204 -

Joined

-

Last visited

Content Type

Forums

Downloads

Quizzes

Posts posted by bingobongo

-

-

-

The link has changed.

http://www.bangkokpost.com/080408_Business...r2008_biz76.php

pain is coming.......are you ready homdebtors?Bankers see hazy market

A decline in condominium rentals and low liquidity in the resale market are factors that point to signs of oversupply in the Bangkok condo market.

A decline in condominium rentals and low liquidity in the resale market are factors that point to signs of oversupply in the Bangkok condo market.

thanks

why are government and builder incentives needed if things are going well? i'll give you hint, becasue they are not

but who cares, keep building even if Bangkok ends up being a Potemkin village

Potemkin village noun: something that appears elaborate and impressive but in actual fact lacks substance

-

pain is coming.......are you ready homdebtors?

Bankers see hazy market

A decline in condominium rentals and low liquidity in the resale market are factors that point to signs of oversupply in the Bangkok condo market.

A decline in condominium rentals and low liquidity in the resale market are factors that point to signs of oversupply in the Bangkok condo market.

-

the stupid deserve to be separated from their dough........

An Utterly Predictable Bust

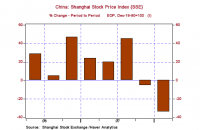

The Shanghai composite index has plunged 45% from its high, reached last October. The first quarter of this year, which ended with a huge sell-off, was the worst ever for the market.

-

so much for quality,is this really a surprise? and good luck getting repairs on a supposed "new home"

Some 5,000 housing estates in Bangkok will be inspected after developers failed to maintain infrastructure and facilities after the houses were bought.

http://nationmultimedia.com/breakingnews/r...newsid=30070373

-

if it is any consolation to the OP, i am sure the lactose intolerant will support your boycott

-

there are so many things wrong with this, i can't even begin.......

-

do you see a problem here? not just pork and rice in LOS...........the cat is out of the bag, raise rates or soon payment will be made in confetti

discontent is building

(Mon 7 Apr 2008)

Ukraine: Surging Food Prices Propel Ukrainian Inflation Beyond Government's Control

Cambodia: Cambodia's Opposition Party Leads Protests Against Rising Food Prices

South Korea: Consumer Sentiment Falls to 11-Month Low in South Korea

Taiwan: Inflation Accelerates in Taiwan as Food Prices Rise

Armenia: Central Bank of Armenia Lifts Interest Rate Further as Inflation Accelerates

Kazakhstan: Kazakhstan's Producer Prices Surge in March

Austria: Austrian Wholesale Price Inflation Jumps to New 27-Year High in March

Germany: German Manufacturing Orders Slip Modestly in February

Ireland: Irish Unemployment Benefit Claimants at Highest Level Since July 1999 in March

Lithuania: Lithuanian Producer Price Index Grows 21% Y/Y in March

Gulf States: GCC Trade Offences Rise Amid High Inflation

Iran: Economy Minister Claims Iranian Government Has Failed to Control Inflation

-

that is fantastic news

so what is poor som chai to do now with the confetti in his wallet? spend his earnings on gas? pork? rice? condo? how does he manage to utilize his money with rampant inflation? decisions decisions

-

Youtube video of guns and rice in LOS, is Youtube accessible?

-

only within the borders of thailand...out in the world they are just bratty little nobodys who'd get the crap kicked out of them in a heartbeat.

I coudn't agree with you more, who needs coping skills and maturity when simply acting like a spoiled child works just as well

-

i wonder how this will all turn out......the widening gap between the rich and poor

-

support for gold isnt until $850-$830 per ounce, silver is better play right now

$ has made short term bottom and should bounce

-

the circus of the absurd continues.........

Thai prime minister blasts fortuneteller for predicting political unrest

http://www.iht.com/articles/ap/2008/04/06/...Bad-Fortune.php

-

not sure of the tax structure in the Thailand, but plug the numbers into LOS and the numbers dont lie (this does not even account for the oversupply of property in LOS)

Over the course of a 30-year fixed mortgage you pay out 3x the purchase price. So... on a $100k house you pay $200k in interest. The average tax savings is 25% (in the US that is, plug in the appropriate tax rate for LOS) of that, or $50k, meaning you took a $150k loss. Doesn't make sense to me.A house is a place to live, sleep, eat, enjoy your life, raise a family. It is NOT a lottery ticket. If you want to invest in real estate, the vehicle is through rental/income properties (but not now given the glut of property in the LOS), not your own house.

The best investment always has been and always will be a business. That's where I put the money I'd otherwise be wasting on interest tribute to a bank.

-

regardless of what you decide to do, always remember that.....

Agreeing to pay a lender interest for the next 30 years, or 10,950 days (or whatever the terms of the mortgage are), in order to live in a home that is not yours does not make you a homeowner. It makes you a homedebtor.Putting little or nothing down and signing up for a loan does not make you a homeowner. It did not give you special status versus renters. It did not elevate you to a new class or socioeconomic status. It does not mean you have arrived.

HOMEDEBTORSHIP IS NOT HOMEOWNERSHIP

but if you own the property free and clear, then congratulations as you actually own it

-

Thailand's information oppression

While Thailand's current leadership has been telling the world community, notably investors, that "things are back to normal," the truth is anything but. Things are relatively quiet, to be sure, but not normal.

http://www.upiasiaonline.com/Society_Cultu...ppression/2793/

-

-

Knight Frank eh? of course a real estate consultancy would say things are peachy in Bangkok and Phuket, after all that is where they are "ready to assist"........have you ever heard a real estate agency say dont buy?

-

terrible pain is coming globally once the olympics are over (yes that includes LOS)........

China's Misery Index

The Chinese Shanghai stock market index fell 34% (not annualized) in the first quarter vs. the previous quarter (see chart below). Couple this with the "official" consumer inflation rate of 8.7% and you have the makings of some potentially surly Olympic hosts if things don't improve by August. You also have the makings of much slower Chinese GDP growth.

-

starve the people, and it all comes tumbling down.......

Rice prices expected to climb on speculation Thailand to cut exports

Domestic prices of the staple have surged 50 percent since January, and Thai farmers are reported to be hoarding rice on hopes of further increases, traders said Wednesday.

In recent weeks, escalating inflation fuelled by higher food and oil prices has triggered unrest and even riots in different parts of the world including Indonesia, India, Mexico, Mauritania, Mozambique and Cameroon.

http://www.forbes.com/afxnewslimited/feeds...afx4843606.html

-

-

how are prices for food staples in Thailand? i know pork is up 35%..........

High Rice Cost Creating Fears of Asia Unrest

http://www.nytimes.com/2008/03/29/business...amp;oref=slogin

-

oh well, i guess it is all relative...........

As dollar sinks, Thais struggle to keep economy afloat

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Watch The Tower Growing

in Real Estate, Housing, House and Land Ownership

Posted · Edited by bingobongo

come on cclub75, have you not yet realized that pkrv and backflip get emotionally involved with property? and we know that emotional decisions (when it comes to money) are the wrong ones, so leave them alone. the market will soon separate them from their money and equity