bingobongo

-

Posts

1,204 -

Joined

-

Last visited

Content Type

Forums

Downloads

Quizzes

Posts posted by bingobongo

-

-

But that's the price we are happy to pay so to maintain lifestyle of First World.

what is the exact definition of "lifestyle of first world"?

thats easy, not worrying about contracting dengue fever, getting robbed by the police, being able to own land, about another coup, and tripping over a soi dog for starters

-

"People are generally happier here in Thailand" I voted: YES.

2 years ago a BKK businessman told me "you Farang....you Westerners don't know HOW to enjoy life...how to relax". He was right.

However, 'relax' places are much more accessible than in the west; I'm talking foot, head and body massage to have the stress disappear, so to speak.

A lot of westerners, including myself, have to endure a lot of stress because of so many rules, taxes, laws and above all the weather. Thai people live more outdoors than Farang. It's a major advantage, being outdoors...

LaoPo

do not confuse "HOW to enjoy life.....how to relax" with laziness

if you have stress becasue of "so many rules, taxes, laws and above all the weather", it is because you have no coping skills to deal with your daily existence

by the way, how can "weather cause you stress", perhaps dressing more appropriately would help

homeless people live outdoors too, but i do not think they would consider it a "major advantage"

Written by a person has clearly never visited England. BTW, have you never heard of the condition where the body is deprived of adequate amounts of sunlight and the stresses that causes through vitamin D deficiency.

i lived in the UK for 2 years, visited Brighton,Bath, Cambridge, drove to the lake district (beautiful) and drove up to the scottish highlands and went to Inverness, and drove back thru Edinborough, Newcastle Upon Tyne, and thru Leeds, back to London. the UK is a beautiful county

-

why buy in LOS when you can get 40% off in Vietnam, besides Vietnam has a better education system, more vibrant economy and no impending coup.......so if Vietnam is deflating, what would keep LOS from doing the same? nothing

Investors flee freezing property market in Vietnam metro

http://www.thanhniennews.com/business/?cat...mp;newsid=38171

-

-

"People are generally happier here in Thailand" I voted: YES.

2 years ago a BKK businessman told me "you Farang....you Westerners don't know HOW to enjoy life...how to relax". He was right.

However, 'relax' places are much more accessible than in the west; I'm talking foot, head and body massage to have the stress disappear, so to speak.

A lot of westerners, including myself, have to endure a lot of stress because of so many rules, taxes, laws and above all the weather. Thai people live more outdoors than Farang. It's a major advantage, being outdoors...

LaoPo

do not confuse "HOW to enjoy life.....how to relax" with laziness

if you have stress becasue of "so many rules, taxes, laws and above all the weather", it is because you have no coping skills to deal with your daily existence

by the way, how can "weather cause you stress", perhaps dressing more appropriately would help

homeless people live outdoors too, but i do not think they would consider it a "major advantage"

-

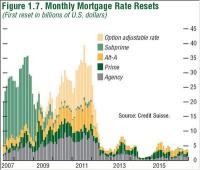

BB, thanks for the graph, it clearly shows what we in the states (and the markets here) already know and that is the worst of the subprime crisis is over as the subprime resets have begun a steep decline and will continue in that direction. I know you are still waiting for that 11,300 prediction of yours for the DOW, but you of all people should be able to read a graph and should have been able to see the double bottom that the DOW has already put in at around 12,000. I know that you are a true doomsday believer and prepetually see the glass of water as half empty, I am a little closer to the action over here and see the glass as half full and the forward looking markets seem to be on the same page as I am

I hope you are not too short in U.S. equities, because the second half of CY 2008 will be very strong for the U.S. markets as the dollar begins to strengthen, oil and gold begin a sustained slide and the chinese capitalist experiment continues to unravel and funds are repatriated from the BRIC countries back to the markets in the U.S., and the record ammount of cash on the sidelines reenters the game

I hope you are not too short in U.S. equities, because the second half of CY 2008 will be very strong for the U.S. markets as the dollar begins to strengthen, oil and gold begin a sustained slide and the chinese capitalist experiment continues to unravel and funds are repatriated from the BRIC countries back to the markets in the U.S., and the record ammount of cash on the sidelines reenters the game  Hopefully the U.S. will also drop its foolish ethynol program and corn, grain and soybean prices can return to normal, this shortsighted political boondogle out of Washington has created havoc in many poor nations across the globe as inflation is out of control in many areas of the globe that can least afford it.

Hopefully the U.S. will also drop its foolish ethynol program and corn, grain and soybean prices can return to normal, this shortsighted political boondogle out of Washington has created havoc in many poor nations across the globe as inflation is out of control in many areas of the globe that can least afford it.We are only in the 3rd inning of a 9 inning ball game

This chart from Credit Suisse shows the heavy subprime resets in 2008, plus it shows the reset problems with Alt-A and Option ARM loans in later years.

Although many of the homeowners in the 2009 to 2011 reset periods will refinance (if they can), this shows that the problems in housing will linger for several years. What is especially concerning is all these Option ARM resets in 2010 and 2011. Most of these homeowners are selecting the minimum payments (negatively amortizing) and many homeowners will be upside down when the ARM resets.

-

now now pkrv and backflip, it is time for today's lesson......are you ready?

Recall that a vacant house/condo in a declining market is not a rising asset--it's a capital trap.

as inflation rages, rates will eventually rise...and any investor worth his/her salt knows that there is an inverse relationship between interest rates and asset/commodity inflation

and i am sure this will not help investor/homedebtor sentiment

Thailand PM issues coup warning

http://newsinfo.inquirer.net/breakingnews/...es-coup-warning

-

the inflation #s are out for YOY (March 2007 to March 2008)

notice that inflation is higher for almost everything OTHER than housing?

Housing is at 0.0 and shelter at a paltry 0.3 whereas meat comes in at a whopping 18.7

Housing is at 0.0 and shelter at a paltry 0.3 whereas meat comes in at a whopping 18.7

3000 HOUSING AND FURNISHING 23.86 103.6 103.7 103.5 103.6 103.6 -0.1 0.1 0.0

http://www.indexpr.moc.go.th/price_present..._region=country

-

Bingobongo re: post #17 , I think you will find with the current credit crunch that is engulfing the world at the moment will show your point about cheap loans to developers has a few holes in it, there are no cheap loans at the moment and there won't be for some time, as for the rest I am unsure I am far from an expert on the Thai housing market.

sorry there sparky, but when inflation is running at 10+% YOY (check out the prices of oil, sugar, rice, transportation, etc) and not the governement BS reported 4 to 5%, and interest rates being below the level of inflation for both home loans and savings/bonds (in fact negative real rates of interest) that is considered a cheap loan

anyway, if things are going swimmingly, why the need for stimulus? this guy is dreaming, the debt bubble is bursting.........amazing what they will say for a sale

Property sector likely more active in latter half of 2008

It resulted in an unfavourable climate in property trading activities with the demand for housing and commercial building units growing at a slower pace since consumers' purchasing power had declined.

Simultaneously, potential homebuyers are now being more careful in committing themselves to debt obligations from housing purchases and investors are more selective in investment.

Simultaneously, potential homebuyers are now being more careful in committing themselves to debt obligations from housing purchases and investors are more selective in investment.

-

when outside thailand, most people think i'm referring to "taiwan" when i'm obviously saying "thailand"

they have no idea that the two countries are different from each other..

why are some people so ignorant? should i instead be saying "siam" instead of "thailand"?

why are most westerners ignorant to the differences between thailand and taiwan?

because taiwan is more important than thailand on the global stage

if china invades taiwan then the rest of the world will be worried, if samak gets overthrown nobody outside of LOS will even blink

-

oops, i forgot one.....

April 23 – Financial Times (David Pilling and Kathrin Hille): “Japanese export growth slowed to its lowest rate in three years… Export growth for Taiwan and Thailand also slowed under the influence of the weakening dollar and US economy. The 2.3% year-on-year rise in Japanese exports in March, coupled with an oil and commodity-led 11.1 per cent jump in the country’s import bill, sent its trade surplus down 30% to Y1,100bn ($10.6bn)…”

-

do not raise interest rates and people get poorer via rampant inflation, raise interest rates and the global house of debt comes tumbling down.......what do you do......

April 25 – The Wall Street Journal (Nguyen Pham Muoi and Stephen Wright): "Vietnam's inflation rate was the highest in more than a decade in April, despite a raft of government steps to damp rising prices, which threaten to undermine the increase in living standards brought about by the country's free-market economic reforms. The consumer price index is estimated to have risen 21.4% from a year earlier in April…"

April 23 – Associated Press: "Singapore's inflation hit a 26-year high in March as food and oil costs continued to surge… The consumer price index…rose 6.7% from a year earlier after rising 6.5% in February…"

-

paradise or parking lot?

Bangkok trumps Mexico City, Los Angeles and other megacities in its capacity to come to a standstill.

http://www.time.com/time/specials/2007/art...1722542,00.html

-

that really is great news if you do not eat, use oil, pay utilities and decide to live in a cave

otherwise, you are screwed

-

palm, how is the midlife crisis coming along?

anyway, this does illustrate the mindset of the bubble rather well. Any property is a good property when prices are going up. Quality doesn't matter because the property's desirability comes from increasing prices, not from the characteristics of the property itself.

-

given that inflation is ravaging economies across the globe, can any of the "donald trump" wannabes tell me what will happen to condo/property prices if either situation below presents itself in the LOS:

1) inflation is allowed to continue the upward spiral via the printing press, negative REAL interest rates, loose lending practices which results in cheap loans to developers and overindebted consumers (yes in the LOS)

or

2) the Bank of Thailand decides to reign in inflation via interest rate increases or not cutting rates (as the Bank of Thailand rate did this month)

i know the answer but i want to see if the property homedebtors in LOS are being logical or emotional when it comes to 4 walls and plaster

-

inflation sure is powerful but then reality sets in and the denial can no longer mask reality, dont get emotionally involved with 4 walls and plaster

anyway, to the dreamers (aka homedebtors) and realists, holding wheat, gold and oil (which are all easier to sell investments (unlike overbuilt Thai housing)) would have given you a better rate of return.....

oversupply of housing ....check

poor construction of housing....check

property loan defaults rising....check

loose property lending standards.....check

out of contol inflation.....check

builder complaints rising.....check

BOT holding rates steady and more likely to raise rates to stem inflation (rather than cut)......check

Gloomy Days Ahead for Asia's Housing Markets

Wheat was up 160% in March 2008 on a year earlier; soy bean oil by 104%, corn by 37%, and sugar by 26%.

Wheat was up 160% in March 2008 on a year earlier; soy bean oil by 104%, corn by 37%, and sugar by 26%.

The housing markets most likely to be affected by monetary tightening seem to be China, India, Singapore, Philippines and Thailand, which have experienced the largest increases in inflation.

The housing markets most likely to be affected by monetary tightening seem to be China, India, Singapore, Philippines and Thailand, which have experienced the largest increases in inflation.

-

is this really a surprise in an overbuilt overleveraged debt induced bubble? i think not

-

-

It seems that nobody cares if there are HUGE losses anymore....whether $ 3 Billion, 20 Billion, 40 Billion, 245 Billion...

who cares ?

Indeed. It's because of the new paradigm : "it's good when it's less worse than the forecasts".

People forecast let's say -10 billions. And if the result is -8, then, wizzz, euphoria !

Magic stick... people don't talk about the -8 billions. Voila.

Meanwhile : the real world is taking hits : real estate continues to fall in the US, foreclosures continue to grow, gasoline goes up, consummers are under pressure, the credit market is still frozen, etc.

The momentum is building. Slowly but surely.

Suckers rally in WS or in Europe won't change the situation.

agreed, if you look at the stats, this is nothing more than a short squeeze rally (shorts covering open positions), the trend is still down, with bounces along the way

also the anticpation of another fed rate cut on April 30

-

those who are stupid with their money deserve to be separated from it, it is the best way to learn financial responsibility

No, the best way to learn financial responsibility is to teach basic finances to young people in school. Knowingly giving out loans to people who clearly should not be taking on that debt is the irresponsible behavior.

so blame the lenders because adults are too stupid to think past today? give me a break

borrowers need to take responsibilty as well

-

those who are stupid with their money deserve to be separated from it, it is the best way to learn financial responsibility

-

well, the mighty dragon is starting to choke on its own smoke and fire......first the shang hai stock index takes a 45% haircut in 6 months, and now real estate will soon feel the pain, and once the olympics are over, it will get oh so much worse..........point being is that global malaise is coming and will acclerate, taking all bourses with it.....

BFA: China real estate sector likely at crossroads

China's four largest listed land developers, including Vanke, China Merchants Property Development, Gemdale and Poly, all reported a five-year low in cash flow from operating costs per share in their 2007 financial reports.

http://news.xinhuanet.com/english/2008-04/...ent_7967634.htm

-

The wide disparity in prices has little to do with the quality of the prices and much to do with the delusions of the sellers. The market is about to give them a cleansing dose of reality.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Do You Believe That Thai People Are Generally Happier Than People In Your Home Country?

in General Topics

Posted

they have time to wave at you becasue they have nothing else to do and no mental stimulation, if you need children to wave and smile at you, i suggest you see a therapist