bingobongo

-

Posts

1,204 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by bingobongo

-

-

Talking to a builder and he said construction cost are up 15 to 20% and with the price of oil and everything else rising the cost of construction will continue to rise.

Now normally when the price of new construction goes up the old also goes up because of replacement value.

But when you are in a near dead market what will happen to prices on old and new? Up, down or stay the same?

My guess is the price will stay the same of rise slightly on the old and go up on the new. The market here seems to hate to reduce the price.

Is it time to buy, sell or hide and watch?

- another coup possibilty

- oversupply

- rampant inflation on everything from som tham to condos (as a result interest rates will rise)

- do you actually believe a builder whose goal is to separate you from your dough?

what do you think?

-

now do you think this be in the glossy pullout proclaiming the "hi-so" lifestyle? i think not

Thai general hints at coup over alleged royal insult

http://ap.google.com/article/ALeqM5hVjWH4t...NcT02gD90V8NAG1

-

lol, amateur hour appears to be in full effect...........anyway

interest rates will rise.........and the genius of overbuilding continues

Thailand's Political Tensions Increase

A sudden rise in inflation driven by soaring food and fuel prices is adding to the political tension, as is an annual military reshuffle expected in September which has driven a wedge between Thailand's armed forces and civilian politicians in the past.

A sudden rise in inflation driven by soaring food and fuel prices is adding to the political tension, as is an annual military reshuffle expected in September which has driven a wedge between Thailand's armed forces and civilian politicians in the past.

Many Thais are already struggling with an inflationary spike which has affected economies around the world.

http://online.wsj.com/article/SB1211974631...=googlenews_wsj

-

lets see, inflation rampant, interest rates about to rise, and gvt instability, makes it a fantastic place to invest? i think not

how long does it take to warm up a military tank?

Thai Chamber, Trade chair warns of sinking investment prospects

BANGKOK: -- Investor confidence and subsequent foreign investment in Thailand could be eroded if the current political turmoil continues and the ongoing rally demanding that the coalition government of Prime Minister Samak Sundaravej scrap its plan to rewrite the constitution turns into violence, a senior Thai executive said Tuesday.

Pramon Suthiwong, chairman of both the Thai Chamber of Commerce and the Board of Trade of Thailand, said investment confidence would not be greatly impacted if the demonstration demanding the government to halt its plan to rewrite the charter ends soon without bloodshed.

Now foreign investors are worried about political strife in Thailand and have delayed a committing a considerable amount of investment in this country, Mr. Pramon said.

Now foreign investors are worried about political strife in Thailand and have delayed a committing a considerable amount of investment in this country, Mr. Pramon said.

Activists of the People's Alliance for Democracy held their protest for the third day Tuesday near the United Nations ESCAP (Economic and Social Commission for Asia and the Pacific) building on Rajadamnoen Avenue.

Pro-government demonstrators have camped nearby and both sides were locked in scuffles on Sunday in which about 20 protesters from both sides were injured.

On Monday, Mr. Samak said he was told by three Thai envoys stationed abroad that the present political troubles in Thailand would deter foreigners from investing in the kingdom.

On Monday, Mr. Samak said he was told by three Thai envoys stationed abroad that the present political troubles in Thailand would deter foreigners from investing in the kingdom.

Touching on Thai economic growth projections for 2008, Mr. Pramon said the Thai Chamber of Commerce had forecast since the beginning of this year that growth would not be less than 5 per cent but the economy in general could be affected due to volatility in global oil prices.

Thailand's economic growth in 2008 could fall below 5 per cent if world oil prices continue to increase like now and the government should urgently find measures to stimulate the economy to grow not less than 5 per cent, he added.

-- TNA 2008-05-27

-

pkrv, is this more LOS magic or a painful denial of what is happening?

it is ok to dream pkrv, but just make sure you know when it is time to wakeup

New streets protests in Thailand hurt stability

Fresh street protests in Thailand between supporters of former Prime Minister Thaksin Shinawatra and his opponents could drag the army back into the forefront of politics and scare off foreign investors, analysts said.

Fresh street protests in Thailand between supporters of former Prime Minister Thaksin Shinawatra and his opponents could drag the army back into the forefront of politics and scare off foreign investors, analysts said.

http://www.reuters.com/article/rbssFinanci...K17440920080526

-

come on palm and backlflip, you are going to have to do better than that

palm, has the midlife crisis subsided yet? do not destroy your son's life with your own selfish decisions

anyway, real estate bulls, inflation is rampant in LOS as well as globally, and interest rates will be increased before the year is up

but how do you propose to include this delicious morsel in the glossy brochures to those who refuse to believe the hype as LOS as a land of rainbows and lollipops?

will it be illegal to double park next to an armored Tank once they roll on the streets of Bangkok? maybe that can be a selling point, i can see it now in the glossy brochure "free parking next to any tank with the purchase of any condo"

Thai constitution changes spark coup fears

http://www.radioaustralia.net.au/news/stor....htm?tab=latest

-

the power of delusion truly is amazing, first it happened in Japan, now the US, UK, Spain, Vietnam, and now Taiwan..........what makes LOS immune from the pain? bar girls? coups? unstable gvt? inflation? i think not, taiwan has a stronger economy than LOS so get ready......

LOS is not "special" and will not be immune from real estate pain just becasue you want it to be.....................and soon the BOT will raise rates

Taiwan Real Estate Experts To Sound Alarm Over Housing

Some economists believe that the overheated market caused by speculation and the popularity of real estate as an investment has left residential property prices artifically inflated by about 30 per cent.

http://au.news.yahoo.com/080519/3/16wtk.html?ref=patrick.net

-

the average male midlife crisis begins in the age range of 35 to 50 with the average length of the crisis being between 2 and 7 years (some more, some less depending on the ability to cope with life circumstances), so based on some of the posts in this thread, i would say this sounds about right

-

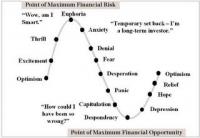

In today's lesson we will examine why it is so important to separate emotions from investing decisions, because if not, then poor decisions will be made and those who are emotional will be separated from their money.

People develop emotional attachments to their homes/condos. There is a wall in the bedroom where little Somchai's height has been measured for the last several years. There is the patio with the children's names etched into the concrete. There are the neighbors with whom people have shared meals. All of these little things create a sense of groundedness and a feeling of community. All of these things are lost when debt is unmanageable and the property is vacated.

When overpaying for a condo/home, there are also the elements of ego involved. There are feelings of failure, particularly for those who feel the duty to provide for their families. There is the disappearance of illusions of wealth and status, and adjusting to a significant reduction in buying power is very stressful. We have had many foolish bulls post on this thread.

There is a large amount of overbuilt, empty, overpriced and poorly constructed LOS domiciles. And with inflation raging and interest rates about to rise, the embarrassment of being so completely wrong and the shame of losing face is very difficult for many to accept.

So keep your powder dry, let the next coup and interest rate adjustment occur and pick over the bones of those that made emotional (and thus poor) real estate investments.

-

-

-

you didn't think this thread was dead did you, just dormant

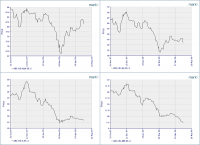

anyway, IF the AAA tranche is indeed rolling over (upper left box), then the global stock market rally is about to end and down we go as the subprime problems are returning........get ready.........remember that the bond market is smarter than the stock market

Top left Chart (AAA) shows an outstanding rally (and hence the global stock market rally since March). Now it is rolling over.

The BBB (bottom right) led the crises of last July, January and March.

The pressure worsens when the AA (top right) breaks down.

-

ah, backflip and pkrv........i hope you are doing well

It must be difficult for investors around the country (and around the world) who bought debt-traps that only rent out for a fraction of what it costs to "own".

Negative cash flow on a depreciating condo or house is the worst of both worlds.

-

i am sorry for all those affected by this tragedy..............but it was even felt in Bangkok, i hope the building specs are up to code if a bigger one hits closer to Bangkok

Tremor from China quake felt in Bangkok

Beijing (dpa) - An earthquake measuring 7.6 on the Richter scale hit Wenchuan county in south-western China's Sichuan province Monday, local officials said.

The earthquake struck at 2:28 pm (0628 GMT) and could be felt in cities hundreds of kilometres away, including Beijing, Shanghai and Bangkok.

"Major tremors" were felt by residents of cities closer to the epicentre, including Sichuan's capital, Chengdu, and nearby Chongqing, the official news agency Xinhua said.

Those in tall office buildings of Bangkok also reported that their building swayed.

Those in tall office buildings of Bangkok also reported that their building swayed.

The US Geological Survey measured the quake at 7.5 and said it struck 95 kilometres west-north-west of Chengdu at a depth of 10 kilometres. (dpa)

-

do you think this will be presented on the back of the shiny glossy brochures when trying to sell the .........thai condo high-so lifestyle?

raise interest rates and commodity prices will come down as will the lovely overbuilt condo market

'Half the country' fears another coup: Poll

More than 50 per cent of respondents to an Abac Poll fear there will be another coup within the next six months, the pollster said on Sunday.

Abac Poll by Assumption University said that of 3,404 people surveyed, 55.6 per cent said the military might launch another coup during the next six months, and 54.6 per cent expected some unexpected, violent event to occur.

Only 53.6 per cent of respondents surveyed from May 6-10 expect Samak Sundaravej to remain as prime minister.

There has not been a military coup since Sept 19, 2006, when the army unseated prime minister Thaksin Shinawatra.

Some 87.8 per cent of people said they expected to face more expensive commodity prices and 80.1 per cent were braced for increased crime.

Some 87.8 per cent of people said they expected to face more expensive commodity prices and 80.1 per cent were braced for increased crime.

http://www.bangkokpost.com/breaking_news/b...s.php?id=127604

-

-

-

patience is all you really need.......rates will rise

Thailand and the Philippines, face policy dilemmas of rising inflation and sluggish growth. FDI and domestic demand have been slow to pick up in Thailand since the coup's end, while the Philippines suffers the lowest FDI in the region due to crumbling infrastructure and corruption. Both countries are in need of stimulative monetary policy at a time when annual headline inflation has climbed above 5% in Thailand and 6% in the Philippines due to soaring food and fuel prices.

Nonetheless, their monetary authorities are considering rate hikes to dampen inflation – even if local rate hikes in these small countries are not likely to be very effective on inflationary problems with global roots.

Nonetheless, their monetary authorities are considering rate hikes to dampen inflation – even if local rate hikes in these small countries are not likely to be very effective on inflationary problems with global roots.  The risk is that food and fuel prices rise faster than the baht and peso appreciate as continued strong demand from commodity-hungry nations like China and India keep world prices high. Some argue though that policy rates have gone down far enough – real interest rates are already negative and nominal rates are below U.S. rates.

The risk is that food and fuel prices rise faster than the baht and peso appreciate as continued strong demand from commodity-hungry nations like China and India keep world prices high. Some argue though that policy rates have gone down far enough – real interest rates are already negative and nominal rates are below U.S. rates. -

Qwertz and Pepe- not succint and not true. Easy cynicism masquerading as wisdom.

I also have a Thai ex-wife, and have had many bad experiences with Thais over the years, even with some I've represented for free. But if I step back and assess the situation, then it's pretty clear to me I've had far more positive experiences with Thais.

Yes, of course, the wondrous joy one sees in Thais (generally speaking) as they live daily life can be cynically dismissed as blissfull ignorance. But I believe there's a lot more to it as I laid out in my previous post and you did not rebut.

It's sad when two people who obviously have had great lives (as discerned from their own posts) can only see the negative, and then loftily proclaim that to be the truth that the balance of us are not prepared to hear.

Again, easy cynicism that is a transparent plea to be accepted as wisdom.

easy delusion masquerading as wisdom, get over yourself

-

don't hate the player (bingobongo), hate the game (bloated debt and negative real interest rates)........ rates will be raised as folks need affordable food and oil, not overbuilt, overpriced 4 walls and plaster.....

May 1 – Bloomberg (Suttinee Yuvejwattana and Rattaphol Onsanit): "Thailand's inflation accelerated at the fastest pace since 2005 in April as food and oil prices surged to records… Consumer prices gained 6.2% last month from a year earlier…"

April 28 – Bloomberg (Shamim Adam): "Central bank officials in Indonesia, the Philippines and Thailand may raise interest rates this year as higher oil and commodity prices feed into inflation, according to JPMorgan…

-

-

well hello homedebtors....(aka those renting from the bank/builder/or other lending institution)

and hello homeowners....(aka those who own properties free and clear)

remember money tied up in a declining asset is a CAPITAL TRAP

anyway, i love pictures, dont you?

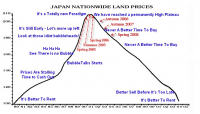

insert, Spain, UK, Vietnam, USA, and LOS (or any other country) for items in RED and you will get the point......why buy now when you can get the same for less later...... interest rate increases by the BOT this year (to control rampant inflation) wont help either.....

-

inflation rampant and interest rate hikes on the way....

as rates go up, house prices go down......

Thai Inflation Rises at Fastest Pace in Two Years

Higher Borrowing Costs

Bank of Thailand policy makers next meet on May 21 to decide on the benchmark interest rate, held at 3.25 percent at six straight meetings since August.

The board will boost borrowing costs to 3.5 percent next quarter, and by another 25 basis points by the end of 2008, JPMorgan economist Sin Beng Ong wrote in a report published on April 25.

The board will boost borrowing costs to 3.5 percent next quarter, and by another 25 basis points by the end of 2008, JPMorgan economist Sin Beng Ong wrote in a report published on April 25.

http://www.bloomberg.com/apps/news?pid=new...id=aPhkIzxg02Mw

-

soon the global house of debt will come tumbling down......

Asia Getting Fed Up With Bernanke's Rate Cuts

Officials in Indonesia, the Philippines and Thailand may raise interest rates as higher oil and commodity prices feed into inflation,

Officials in Indonesia, the Philippines and Thailand may raise interest rates as higher oil and commodity prices feed into inflation,  say economists such as Beng Ong at JPMorgan Chase & Co. in Singapore.

say economists such as Beng Ong at JPMorgan Chase & Co. in Singapore. http://www.bloomberg.com/apps/news?pid=206...id=acrUvNUAIYX4

Consrtuction Cost Up, Buyers Missing

in Real Estate, Housing, House and Land Ownership

Posted

maybe i missed the point because your OP was more about guessing and not about thinking, anyway.........

when interest rates rise, real estate prices go down

why do interest rates rise? to control inflation which is rampant in LOS and globally. if interest rates do not rise/are increased then somchai has to decide, do i buy condo or feed myself or walk to work as he can't do all

the BOT is done lowering interest rates unles of course there is another coup