bingobongo

-

Posts

1,204 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by bingobongo

-

-

i wonder how the real estate shills/homedebtors will spin this one........

so lets see, rates are at rock bottom levels and nothing is moving and they think things will improve in "as soon as three months hence"? genius i tell you, pure genius

Preuksa Real Estate recorded the highest growth of residences "in stock", with its

inventory rising by 55.55 per cent year on year

inventory rising by 55.55 per cent year on year  to a value of Bt12.6 billion at the end of 2008. Next came Supalai and Quality Houses, whose

to a value of Bt12.6 billion at the end of 2008. Next came Supalai and Quality Houses, whose  inventories grew 34.1 per cent and 33.1 per cent

inventories grew 34.1 per cent and 33.1 per cent  respectively, to finish 2008 with values of Bt11.4 billion and Bt19.3 billion

respectively, to finish 2008 with values of Bt11.4 billion and Bt19.3 billionhttp://www.nationmultimedia.com/2009/03/11...ss_30097587.php

-

who were the "geniuses" who said LOS was immune? oh yes, now i remember

shall we recap as to which areas are feeling the effects of the downturn and wil continue to do so as more oversupply comes on line?

Bangkok - check

Pattaya - check

Phuket - check

Samui - check

(insert other LOS area here) - check

http://www.property-report.com/property-ne...amp;date=020309

-

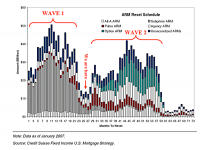

well well well, do i really need to say anything to the bagholders, and the funny thing is wave 2 has just started and wave 3 isn't even here yet

as far as asia is concerned...so much for decoupling etc. and as for LOS and the baht? i will continue to short the baht faster than an unemployed bargirl shortens her skirt in these turbulent times, and as for LOS? it is about to become a basket case

i can look back fondly to when i started this thread back in 2007, and can I happily say that my wallet and genius have been vindicated......

for those who listened, you have done well either by making money on the way down or by remaining unscathed and i congratulate you, for those who didn't (those folks are too many in number to mention by name), i won't rub it in, the market is doing that for you

Dow 6,804.55 -256.45

-

i guess this would only be a surprise to the idiots, right hhgz?

Sharp decline in Thailand economy

'Surprise to everyone'

'Surprise to everyone'

-

who were the "gurus" who said that asia was immune? oh yes, i remember, i ignored them.........

so many lost deposits......oh well, i guess that is how homedebtors learn

Asian developers delay projects in downturn

Pairote Sukjan, president of Buathong Property in Bangkok, told AFP the crisis prompted Thai banks to cut back on lending to both condominium developers and buyers.

"Several condominium projects were delayed or cancelled because developers could not get loans from banks easily," Pairote said.

"Several condominium projects were delayed or cancelled because developers could not get loans from banks easily," Pairote said.

http://www.google.com/hostednews/afp/artic...7bu6pcBcXx_MspA

-

this would only come as a surprise to those in denial or deeply delusional

Sharp rise in business failures

Twelve per cent of shutdowns were construction, land, property-development or related businesses.

Twelve per cent of shutdowns were construction, land, property-development or related businesses.

http://www.nationmultimedia.com/2009/02/23...ss_30096384.php

-

i guess they never found the unicorn that craps rainbows in LOS

Thailand’s economy shrank more than expected in the fourth quarter as exports and tourism slumped, pushing the country closer to its first recession in a decade

Thailand’s economy shrank more than expected in the fourth quarter as exports and tourism slumped, pushing the country closer to its first recession in a decade

-

this is in fact quite an easy question, but lets start out with this little morsel first...

The Bank of Thailand has said it may continue easing monetary policy at its next meeting on Feb. 25 after cutting its benchark interest rate

The Bank of Thailand has said it may continue easing monetary policy at its next meeting on Feb. 25 after cutting its benchark interest rateto 2 percent in two reductions since early December.

so here are some scenarios:

1) if property is not moving when rates are pratically zero (as they soon will be), then they will most assuredly will not sell or appreciate as interest rates rise in the future

2) if BOT does not raise interest rates or drops rates to zero, then the baht will continue to devalue, so the poor bagholder who bought his debt trap when the baht was say 35 to the dollar will have all his phantom 10% appreciation wiped away when the baht falls to 38 to the dollar

rates go up, prices come down, rates go down and you lose on currency devaluation

so to summarize, property will not rise in value (nominally or inflation adjusted) and the baht will continue to fall, and the homedebtor is in fact getting screwed twice

any questions?

-

who were the fools who said LOS was "immune", "special", "disconnected from the crisis","insert rainbow here"?........oh yes, now i remember

probably the same fools who rode the SET from 800 down to 400.........

Thailand may join neighbors Singapore, Taiwan, Hong Kong and Japan in recession as demand for the region's goods dries up amid the deepening global slump.

Thailand may join neighbors Singapore, Taiwan, Hong Kong and Japan in recession as demand for the region's goods dries up amid the deepening global slump.

-

-

monkeys i tell you, monkeys........naam what brand of adult diapers are popular? i am thinking of investing in a manufacturer

anyway, what a magical place.........

Thai Central Bank Says Crisis in 2009 Less Severe Than 1997

Thailand's benchmark equity SET Index posted its worst annual performance in 11 years in 2008, falling by almost 48 percent. This year, it has dropped another 2.1 percent.

Thailand's benchmark equity SET Index posted its worst annual performance in 11 years in 2008, falling by almost 48 percent. This year, it has dropped another 2.1 percent.

The baht currency has extended last year's 15 percent loss against the dollar on speculation a deepening economic slump will prompt foreigners to further trim their holdings.

-

-

The Nouveau Riche are supposed to have money, aren’t they? In Thailand, debt is a useful substitute because looking rich is all the matters. Perhaps it is the land of the Nouveau Dette…...

-

oh naam, i can only hope and pray "your" asian economic bank team can lead the sheeple to the promised land.......by the way did LOS ever find the unicorn that craps rainbows?

save us naam, save us .......

Chinese exports, imports plunge, fanning job loss worries; experts say outlook is 'grim'

-

An outstanding report Naam, where was the data generated?

Asia economic research team of one of my banks Ray.

your asian economic team at a bank? are these the same visionaries that said asia would decouple from the global mess?

let me guess, "your" asian economic research team consists of:

- fortune teller (general trends analyst)

- som tham seller (commodities analyst)

- tuk tuk driver (oil and gas analyst)

- your proctologist (health care analyst)

come on naam, i thought you trekkies/klingons were brilliant, and visionary.......

-

Just something to think about for what it's worth. My sister in the US has been in the mortgage business for years. She is now very busy doing re-financing as the rates have dropped so low. Many of these "re-sets" may never happen as people are locking in low rates now. Re-sets are always linked to something too. T-bill, libor or whatever. With rates so low, an interest rate adjustment may be very small.

that would be fine and dandy if rates were staying low, but they are rising again so the refinancing window is closing per the chart below

the 10 year bottomed at around 2.18% and now that the bond bubble is bursting, yields are around 3.04% and will continue to climb,

and given the that low was around Christmas time, most people were focusing on unwrapping gifts and not refinancing

-

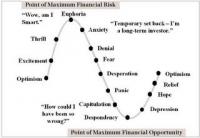

Many of those with kool-aid fantasies of the riches they were going to obtain from their houses are waking up to the reality of the market.

Reality must be very unpleasant for the typical homedebtor. I am sure more prefer the denial of beliefs such as: “prices will rebound when the economy picks up” or “this correction is only temporary” or “Thailand real estate has proven to be a good investment in the long term” or “we are closer to the bottom than to the top.”

All of these beliefs cause people to hold on to real estate that is draining all their cash each month and giving them nothing in return.

-

-

-

i wonder who loaned the money for these projects, and wonder how soon the impact of debt default will be felt, i wonder which bank will have large rights off's first......oh it will get interesting

http://www.nationmultimedia.com/2009/02/06...ss_30095109.php

-

There's a German word, schadenfreud, meaning finding pleasure at the misfortune of others, that expresses perfectly the attitutde of the OP here. Hard to see anything of value or constructive that they contribute here. All of us are quite capable to make our own decision as to what to do with our money, and nothing they say can influence us.

So to answer Gravelrash's question then, he's a schadenfreud <deleted>.

i am a <deleted> because others make bad choices?

come on now, dont hate because you are blind to what has and is happening, by the way how is the 3rd world these days?

-

oh the humanity, so many dreams and deposits about to disappear, well at least the birds will have new homes to move into

i wonder how the RE spin machine will turn this into a positive developement (that was a pun)........let me guess, the market is sill booming, healthy, etc(insert rainbow here)

fools deserve to be separated form their dough

BANGKOK SETBACK

Twelve condominium projects suspended

Normally, the market can absorb unsold residential stock within one-and-a-half years, Samma said, but now that the economy is reeling from the global recession, it will take twice as long.

Normally, the market can absorb unsold residential stock within one-and-a-half years, Samma said, but now that the economy is reeling from the global recession, it will take twice as long.

http://www.nationmultimedia.com/2009/02/05...ss_30095036.php

"fools deserve to be separated form their dough". Do they, why is that? They have probably worked long and hard for that money. What sort of <deleted> are you gloating over others misfortune? No doubt someone with nothing yourself, except a bar bill.

lol, i work for my money too, that is why i am not dumb enough to invest blindly and get emotional about investments, half these fools got greedy and got their <deleted> handed to them

anybody can make money, but it takes smarts not to be separted from it and manage it correctly

oh and to your last point, i do not drink

-

Report it immediately ............. to Ali Bingo Bongo oh the shame the humility, easily parted from their cash etc etc etc zzzz

come on yabaaaa, don't hate the player (me) hate the game (the declining market)

besides why hate me when it is clear that others have the financial acumen of day old som tham

peace

-

3 Years For Some Property To Clear

in Real Estate, Housing, House and Land Ownership

Posted

let me try and understand something, Preuksa Real Estate recorded the highest growth of residences "in stock", with its inventory rising by 55.55 per cent year on year per the original post, and now these "visionaries" want to build more? so in one article they have massive inventory, but in another they say, "He said the company was confident of the housing demand of its target group"

nothing like talking out both sides of one's own arse i guess, the spin machine is in full throttle

oh i smell some very large bank defaults coming to thai bank very soon, it will soon be time to go short again

Preuksa plans Yaowarat condo

http://www.bangkokpost.com/business/econom...-yaowarat-condo