-

Posts

14,375 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by ukrules

-

-

We all know there's a prescription for everything in the US, what surprises me is that there's both a Doctor and a pharmacy inside the Whitehouse.

-

1

1

-

-

1 hour ago, BenStark said:

Below is what my Embassy sent me today.

If you live in Thailand for more than 180 days a year, you will be considered a Thai tax resident. In that case you must indicate all foreign income that you bring in to Thailand. If the taxes that have already been paid in Belgium are not sufficient according to Thai tax legislation, you may have to pay an extra tax in Thailand.

Interesting.

The new 'memo' became effective on Jan 1.

Is everyone expected to go out and get tax id numbers before March which is the end of the tax year here?

-

3

3

-

1

1

-

-

48 minutes ago, BenStark said:

And I still wonder how you gonna prove that you paid any tax.

Normally they issue some kind of receipt / statement but I would imagine every country will do it differently.

In the UK it's called a P60.

-

1

1

-

1

1

-

-

3 minutes ago, pleple62 said:

thats bold skool buddy none of that stuff these days they scrapped it ages ago

I guess it's been a while since I left the country as I've still got one in my passport

-

2

2

-

1

1

-

-

- Popular Post

- Popular Post

I find these houses with huge rooms a bit off putting knowing that I will have to wait quite a while for the AirCon to do its job every time I turn it on.

-

2

2

-

1

1

-

My mother has this "perennial rhinitis" which causes a lot of runny nose on and off all year around.

As far as I'm concerned it's a diagnosis of last resort, you're allergic to many things all the time is what they told her.

As far as drying it up they banned the most useful non drowsy medication for OTC sale here in Thailand which was Pseudoephedrine but you can get it from a hospital with a prescription apparently - and this stuff really works if you take it at the right dose. I will add that I found the right dose for me to be something different to what was on the packet back in the UK.There are other decongestants but in my experience they don't work so well. Things like acrivastine but you've got to watch out for things that can make you really tired on the antihistamine side of things like 'CliniCold' which was a common brand around these parts a few years back.

They gave my mother Fexofenadine which doesn't really work too well.You can develop an allergy at any time and age, I went 40 years without any common allergies then one summer I started to get hayfever in the UK, when I came over here it disappeared. I blamed the huge tree outside the house I lived in.

-

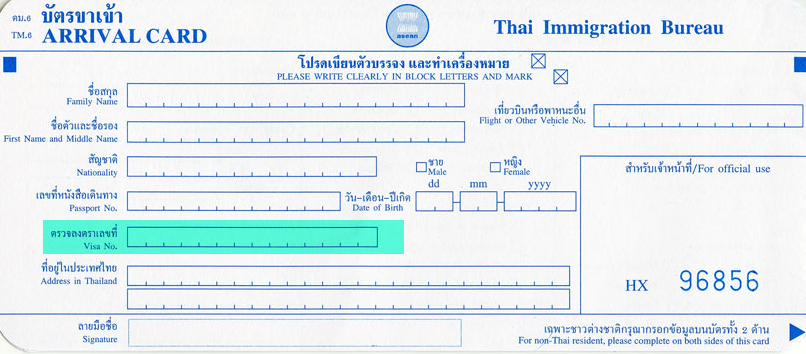

Did you fill out the visa number on the entry form ?

-

1

1

-

-

7 hours ago, still kicking said:

LOL, never. My name would then be on a list of foreign agitators. Keeping your head down in this place is essential.

-

1

1

-

-

I wonder what his position is on the recently announced tax reform.

-

2

2

-

-

There are plenty of options, I picked a set up from JIB.

It has a USB adapter on one end, and they are wireless without bluetooth.I used to have a fancy set of Panasonic wireless headphones which plugged into the headphone socket which I purchased at least 10 years ago but they seem to have stopped making them - they weren't cheap - maybe 4 or 5 thousand Baht.

But this new set I purchased from JIB was cheap, can't remember the price. Has a charging cable as well which the old panasonic model didn't so I was loading AAA batteries into that thing every couple of weeks.

-

- Popular Post

- Popular Post

17 minutes ago, richard_smith237 said:300,000 Million Baht a year

But that's 300 Billion Baht

-

1

1

-

1

1

-

2

2

-

The whole situation is an outrage.

-

- Popular Post

- Popular Post

Yeah, there were plenty of cctv and security companies around in 1999.

I had no idea a teacher was expected to fill in as a security guard overnight - were they also expected to work the following day?

I've never heard of anything so tarded in my life.

-

2

2

-

2

2

-

14 minutes ago, Bangkok Barry said:

I doubt that many tourists visit the immigration office. Most are here and gone within a couple of weeks. Why would they 'fill' immigration offices?

It's simple, I live in Hua Hin. They come here for months and pretty much all of them do extension of stays.

The immigration offices here are empty in the summer and packed full in high season, you know - when the tourists come.

-

1

1

-

-

36 minutes ago, Will B Good said:

Did you have to go to your 'own' branch to do that.....or will any branch do?

I did go to the local Hua Hin immigration office, the main one, not the satellite office in Bluport which was staffed only with 'deputies' which is how they described themselves.

Also, on the subject of 90 day reports I do believe I was issued a new one. Now in Hua Hin you don't need to fill ouy any kind of form to do a 90 day report - you just hand over the passport, say 90 day report and they print it out.

So I have no idea if it can be done at another branch.

-

1

1

-

-

Best to transfer it over to the new passport, based on what happened to me they transfer your extension and most recent entry stamp into the new passport.

Then you will need to go and do the new extension which should be straight forward. I did not do both of these things at the same time but maybe that's possible depending on where you are and how many hours you want to waste sitting in a tourist filled immigration department.

As for my driving license, I did nothing - I'm not going to that place until the full 6 years are up.

I did however update my bank with the new passport details as I had also moved address some 5 years prior and figured I could kill 2 birds with one stone.

-

1

1

-

1

1

-

-

Do it in June 2024.

-

- Popular Post

Maybe we should get an MP in the British parliament as well, I note that the French provide this for their expats in various places including the UK.

-

3

3

-

2

2

-

3

3

-

1 hour ago, richard_smith237 said:

The 5 year P.E. Visa is really yearly 12 month Visas / extensions up to 5 years, and with a further purchase of 5 year membership, those yearly 12 month extensions continue for a further 5 years.

(so yes - its possible to stay for 10 years without leaving).

Indeed, I'm on my second 5 year visa term and have extended my membership by an additional 15 years so I will receive another 3 of them when this second one expires next year.

One thing to note is that the visa never goes beyond your passport expiry date, so if you've got 2 years left on your passport it will expire on the same day as the passport and you need to go and get another one for your new passport by either leaving the country or going to one of the specially annointed places that handles these visas which may be 100's of miles away from where you live.

I also believe you can get the next visa sticker inserted during the last 6 months of the validity of the current one in your passport - this is the newest piece of information I've learned about the whole thing.

-

- Popular Post

1 minute ago, siwiek said:Out of curiosity what do you mean the writing was on the wall for this 10 years ago

Well simply put, about 10 years ago you could pop back to the UK once a year and get a 1 year visa by walking into one of several consulates around the UK, pay about 100 pounds and you would be good to go for 90 day trips up to a year.

The reason for visiting Thailand was 'Visiting friends' and that's all you needed, nothing more and it took 10 to 20 minutes to get the visa stamped in your passport, they didn't use stickers at consulates - it was just a big rubber stamp. I have a few of them in my older passports.

Then they stopped that completely and started issuing all sorts of edicts about the number of entrances in a year which were also never done before. That was the writing on the wall.

People routinely lived in Thailand for years on 30 day entrance stamps and / or back to back visa entries, they also overstayed for years and paid a fine when leaving the country every once in a while and nobody cared.

Then they decided to strap on the jackboots and put an end to it all.

So it used to be a free for all and each option was gradually removed and restricted. I couldn't believe it when they started auditing bank accounts for minimum balances in the prior 6 months - just for an extended winter holiday.

So I got an Elite visa and forgot about the whole thing.-

1

1

-

1

1

-

2

2

-

2

2

-

4 hours ago, MistyBlue said:

This seems an appropriate thread to raise discussion on the following scenario.

Looking in to the future, say one is a Thai tax resident for 2024 and 2025 but remit none of the income made overseas. In 2026 go traveling and only stay in Thailand for 5 months (under 180 days) and in that year remit the overseas income for 2024 and 2025, no return needed in 2026 as not tax resident for that year. Then in 2027 stay more than 180 days and become tax resident again, the unknown (to me) is whether there would there be a liability for past income remitted into the country that was made when one was a tax resident.

I raise this because all the information I've found so far discusses income made and remitted when resident, but not income made when resident but remitted when non-resident.

Maybe one to watch unfold in the future...

This exact scenario was discussed by a lawyer on a youtube video in a youtube channel named 'Canadian Working For You'

From memory he said that the money MUST be both 'made' or realised AND remitted in a year when you're not a tax resident to avoid being taxed on it. So sell your shares or house for tax free gains and send the money in the same year is the message but make sure you're not tax resident.

The idea was put forward that if you earn money after Jan 1, 2024 and are tax resident at the time of 'earning it' but in later years you remit it into Thailand then you will be taxed on it if it's not taxed at the same level already where it came from. If that's profit from a house sale where a lot of countries charge 0% then the difference between the home country and Thailand is going to be full income tax vs 0%

But maybe I don't remember 100% - so watch the video if you want.

The full video is 28 minutes long and is here :

-

1

1

-

-

12 hours ago, Ben Zioner said:

Well it is quite simple.

a) minimise the amount of money, earned after December 2023, you are sending to Thailand,

b) stay no more the 179 days in Thailand in a given year,

c) combine a & b,

d) get an LTR visa.

Don't you mean, spend 179 or less days in Thailand and MAXIMISE the amount of money earned and remitted during the years where you spend less than 179 days.

I haven't quite decided if I will be taking a couple of 'long holidays' this year myself but I will do so in the next couple of months.

Then if I take the long holiday as I won't be a tax resident I can submit as much money as I want knowing that it's

1 Earned in 2024

2 Remitted in 2024

3 I am non resident in 2024

No need to apply for a TIN as non resident.

Same applies to any subsequent year

-

1

1

-

-

45 minutes ago, richard_smith237 said:

I suspect the opposite and it was the visa that tipped the balance in securing his entry.

Almost certainly - without that visa he was probably facing outright denial of entry.

The writing was on the wall for this kind of thing 9 or 10 years ago which is why I started using the Thailand Elite visas.

-

1

1

-

-

- Popular Post

4 hours ago, shdmn said:Definitely some kind of wind up if this is what they have to say on their first post with a new account.

You're a wind up, I suggest you stop interfering with posts about other peoples experiences.

3 hours ago, shdmn said:Did it ever occur to you that this could be the same person that started both threads? Hence the skepticism of any account with little or no post history.

Did it ever occur to you that some elemnts in Thai immigration are doing anything they can to deny as many people as possible - like they often did before the pandemic. They were denying entry for all sorts on nonsense reasons, using laws that didn't exist.

Then they were humbled for a few years as the economy was crushed back to the stone age.

Now it's back to business as usual and the denying resumes.

-

2

2

-

4

4

-

1

1

-

1

1

-

3

3

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Free event aims to shed light on the new tax rules for foreign income brought into Thailand

in Hua Hin and Cha-Am News

Posted · Edited by ukrules

So there was no mention of filing a tax return this March?

I mean, if you go an get a tax number - they are going to expect you to use it aren't they?

And they are definitely used every March.....