alphason

-

Posts

471 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by alphason

-

-

On 5/5/2024 at 4:20 AM, Mike Lister said:

An update to Capital Gains:

49) One way to separate capital and gain may be to have an official valuation or statement that is dated 1 January 2024 (or earlier) since anything earned before that date, is not assessable. That is easier to do with investments but may not be possible with real estate. One usually reliable source has said that any gain begins the date the asset was first acquired and that it is not possible to reset the start date to January 2024. We can add with great certainty however that the date of your move to Thailand has no bearing on the valuation date of a capital asset. Also, if the profit has been the subject of a Capital Gains (CG) return in the home country, that also may be free of Thai tax because the gain would have been converted to savings, at that point.

50) We do not know at this time, exactly how the Thai Revenue will chose to distinguish between capital and gain, what is described above is only one approach. Another approach is apportionment, which is where every transfer from the combined capital and gain, contains a mix of capital and gain and this continues until the total amount is exhausted. Yet a third possibility is that the income is remitted first and that capital always follows. We are told by one of our sources of information that any remittance of a capital gain will contain both parts and that it is not possible to declare the remittance solely as one or the other. We will need to remain vigilant for news on this issue.

51) Lastly, It is clear from the Sherings Q&A link below that CG resulting from the sale of foreign assets, whilst not resident in Thailand, are free of Thai tax. As a stop gap measure and for planning purposes, selling the assets before moving to Thailand would appear tax efficient, as would remitting the proceeds whilst not Thai tax resident.

Thanks, Where is this Sherrings Q&A thats referred to?

According to Sherrings Thailand Capital Gains Income Personal Tax - SHERRINGS

For a resident of Thailand deriving capital gains income from a source outside of Thailand and bringing it into Thailand**.

Personal income tax on the amount of capital gains income (the amount of the proceeds exceeding the costs of the investment).**not including capital gains from immovable property which most double tax agreements prescribe the tax rights for the country in which the immovable property is situated.

and also List of assessable (taxable) income Thailand Personal Tax Assessable Income - SHERRINGS

(5) Income derived from rental of 1. Land, buildings, house

(8) Other income includes income derived from 1. Transfers of immovable property in Thailand.

Of the 30ish types of income listed this was only one that says 'In Thailand'.

I have mentioned this another topic, but here seems busier. Sherrings also confirmed this was correct under the UK / Thailand double tax agreement immovable property in the UK is subject to the Capital Gains Tax legislation in the UK, and not subject to Thailand's tax.

-

2 hours ago, OJAS said:

and it is (in the view of this particular cynic, at least) clearly in the interests of handsomely-remunerated tax consultants/advisers/agents/experts that they are not!

This could be it, explains why its so hard find information freely.

And I'm not sure how qualified some of these online experts actually are.

If we paid for tax consultations we could still end up with two differing views.

At the moment I am clinging to what Sherrings told me, he answered clearly and did not try to sell me anything even I asked what they might charge to handle the Thai side of things when it came to selling UK property.

-

1

1

-

-

1 hour ago, Mike Teavee said:

The videos I've seen from Expat Tax

Expat Tax Thailand, anyone tried the free consultation?

The Tax Director from Sherrings seems very well qualified and experienced from the website, I'd just like to hear it from more sources.

-

3 hours ago, OJAS said:

The "may be taxed" wording in Articles 7(1) and 14(1) does, however, appear to contrast with the more unambiguous "shall be taxable only" wording for Civil Service, etc pensions in Article 19(2).

Yes it makes the whole thing unclear. Keep looking and reading more articles mostly from experts who clearly aren't, the more I read the more confused I become.

I did find a useful list of assessable Income, section 40 of the revenue code, it lists all the types of income that are assessable including:

(5) Income derived from rental of 1. Land, buildings, house

(8) Other income includes income derived from 1. Transfers of immovable property in Thailand.

What I found interesting is for the whole list of 30ish types of income this was only one that said 'In Thailand' like it excludes property outside of Thailand?

Its worth a read of the Sherrings website.

Maybe foreign rental income is taxable, less 30% expenses without proof or actual expenses with proof - I don't know what is allowed as expenses, agent fees, mortgage interest, maintenance, insurance? This could be over 30% if allowed.

If tax is due on the gain from sale of foreign property are there allowances over the purchase price, for the time you may have lived in the property (equiv to PRR in UK), costs of buying/selling, mortgage interest fees?

When would Thailand count the gain from, (in UK its from when the law changed April 2015), gain from Jan 2024 when it became taxable in Thailand?So many questions and hard to find answers. Maybe Sherrings again. I did contact another tax adviser who asked for 12kish THB to detail how the DTA would override Thai tax laws.

Hoping it becomes clearer soon, no one want to be the guinea pig without having the facts first.

-

2

2

-

-

7 minutes ago, Mike Teavee said:

That's certainly looking a lot more positive though I'd like to see a few people go through the process before I sell my UK House & bring the money over, it's bad enough getting stung >18% in the UK!!!

The "May" wording for Article 7 Rental Income is the same so it would be great if we can get the same confirmation as since this whole thing kicked off, Rental Income has been used as an example of one of the things we might be taxed on.

Yes 18%/24% CGT in UK, but that could be 5-35% in Thailand as PIT, 25% Band 1mTHB is only £21K ish 30% band 2-5MTHB £42K, 35% band 5MTHB £105K. And UK non residents are only taxed on gain from April 2015.

I would feel happier to get more confirmation also, there is so much contradictory information and guess work. I dont expect there is anyone at HMRC or Thai RD who would be able to interpret the DTA, but This Tax Director at Sherrings should be a reliable resource though if you look at the website. Maybe the way is consult someone like this as a group.

-

1

1

-

-

9 hours ago, OJAS said:

Your first port of call in determining whether or not you have any tax liability in Thailand should be the Double Taxation Agreement (DTA) between the UK and Thailand:

Your UK rental income is (IMHO at any rate) covered by Article 7 of the DTA, meaning that it does not need to be included as assessable remitted income in any tax return you file with the Thai Revenue Department.

Thats what I have been told, see above reply

-

1

1

-

-

6 hours ago, Mike Teavee said:

The UK-TH DTA says "(1) Income from immovable property may be taxed in the Contracting State in which such property is situated." which only says that the UK can tax you on it, it does not say that only the UK can tax you on it so you might have to pay tax on it if you remit it to Thailand.

Either ways, Section 40, paragraph 5, point A of the Thai Revenue Code says that Rental Property is assessable income & so should be included in any tax return you file...

Section 40 Assessable income is income of the following categories including any amount of tax paid by the payer of income or by any other person on behalf of a taxpayer.

(5) Money or any other gain derived from:

(a) rent of property,

https://www.rd.go.th/english/37749.html

I've decided to err on the side of caution & not remit any rental income until it's made clear whether I will be taxed on it or not.

I've been looking into the same thing

I saw an article on Sherrings website regarding CGT on sale of a UK rented property but the wording used is the same 'may be taxed' ...

"(1) Capital gains from the alienation of immovable property, as defined in paragraph (2) Article 7, may be taxed in the Contracting State in which such property is situated."So I contacted Sherrings, and the International Tax Director confirmed to me this would not be subject to Thailand Tax law.

He said regarding Article 14, paragraph 1, of UK Thai DTA. The words "may be taxed" do not have the usual laymans meaning, instead the legal meaning of these words is that because the UK's tax law has Capital Gains Tax legislation, then the immovable property in the UK is subject to the Capital Gains Tax legislation in the UK, and not subject to Thailand's tax law.

-

1

1

-

-

Just now, topt said:

I agree it is definitely subject to the UK and hopefully he knows what he is referring to in that Thailand will ignore it........

I would think he does, this is the only person that seemed to answer the question and explain why. I thought a big company like this wouldn't be so helpful to an individual so I was impressed with the quick response from Sherrings.

-

7 minutes ago, topt said:

I don't think it does as the UK/Thai version of the DTA states in Article 14 -

Because it uses the word "may" it is potentially open to being taxed again and then requiring a credit requested against UK tax......or simply showing it has already been taxed may mean that the Thai RD leave it alone......

Has been argued about in the longer tax threads so someone else may have a more definitive view - which would still need to be tested with the relevant RD office........

Thats what I thought from reading the word "may" but, I have been in contact with Sherrings, and the International Tax Director confirmed to me this would not be subject to Thailand Tax law.

He said regarding Article 14, paragraph 1, of UK Thai DTA. The words "may be taxed" do not have the usual laymans meaning, instead the legal meaning of these words is that because the UK's tax law has Capital Gains Tax legislation, then the immovable property in the UK is subject to the Capital Gains Tax legislation in the UK, and not subject to Thailand's tax law.

-

5 minutes ago, Thaindrew said:

the property I sold was in Thailand so the DTA wasn't relevant.

I also recently sold a property in the UK and paid capital gains tax there but It only worked out as a low percentage (much less than Thai income tax rates) - I sold it last year just in case Thailand conspired to find a way to tax it !

Thanks, maybe should have sold earlier also.

UK CGT on property is 18%or24%, Thailand PIT could be as high as 35%. (£45k 30%, £110k 35%). How do they calculate gain, from when.

Also if you owned the property before April 2015, as a UK non resident you can rebase the valuation to April 2015, so taxed only on gain from April 2015.

-

49 minutes ago, Thaindrew said:

capital gains are now taxed in Thailand as income, make a profit on a property sale and it taxed at income tax rates. the land office is sending sales paperwork to the tax office, who contact you to pay the tax

I've been struggling to find out about this, but from found this on Sherrings Thai tax pages...

Taxation of Capital Gains Income.

Specific types of assessable (taxable) income, for a resident of Thailand* is taxed as follows:

* A resident is a person in Thailand for 180 days or more in a year

For a resident of Thailand deriving capital gains income from a source outside of Thailand and bringing it into Thailand**.

Personal income tax on the amount of capital gains income (the amount of the proceeds exceeding the costs of the investment).**not including capital gains from immovable property which most double tax agreements prescribe the tax rights for the country in which the immovable property is situated.

Is this saying the UK Thai DTA prevents Thailand charging CGT/PIT on the sale of a property in the UK ??

-

I found this on Sherrings Thai tax pages...

Taxation of Capital Gains Income.

Specific types of assessable (taxable) income, for a resident of Thailand* is taxed as follows:

* A resident is a person in Thailand for 180 days or more in a year

For a resident of Thailand deriving capital gains income from a source outside of Thailand and bringing it into Thailand**.

Personal income tax on the amount of capital gains income (the amount of the proceeds exceeding the costs of the investment).**not including capital gains from immovable property which most double tax agreements prescribe the tax rights for the country in which the immovable property is situated.

Is this saying the UK Thai DTA prevents Thailand charging CGT/PIT on the sale of a property in the UK ??

-

1 hour ago, sandrew33 said:

Those tax free thresholds are usually much lower if you have advised your UK/Aussie etc tax authorities that you are no longer tax resident there and are in fact tax resident in Thailand.

Regardless, the income would be taxable in Thailand if you are resident here with a credit allowed for any tax paid in the UK.

This is the issue for many.

If income in the UK in under the UK threshold of 12,570GBP you pay no UK tax, on 12,570GBP (around 565K baht) as an example tax is around 15% in Thailand (less some allowances).

Will Thailand look at your income, or your assessable income stated by HMRC (income less deductions, used to calculate your tax).

UK CGT on property is 18%/24%, Here there is no CGT so I think you pay tax on that at normal income tax rates (not 100% sure ??). So for example a UK property with a gain of around 100,000GBP would pay 24% tax in UK, but 35% in Thailand. (possibly??)

-

CGT on Sale of UK Property.

If a UK property is rented out, I am looking at what if any taxes may be due in Thailand in the future.

UK Nonresidents did not have to pay CGT in the past, but that changed. There is now an option to calculate gain from purchase date or rebased to 5 April 2015 (when the rules changed). So UK CGT is only payable on the gain from April 2015 until disposal.

Assuming a Thai tax resident at disposal, it looks like there is no CGT in Thailand it is just taxed as income, is that right?

Presuming tax would be due in Thailand for the difference between whatever is taxed CGT in the UK (18%/24%) and whatever is due in Thailand (5-35%?) - (assuming the money is remitted into Thailand, or Thailand decides to tax worldwide income).

How would Thailand calculate the gain, will they accept the gain that the UK HMRC says I have made which is the gain after they rebase to April 2015, less allowable expenses and the CGT exempt amount?Or would Thailand use the original purchase price and calculate the gain at disposal, are there any allowable deductions given by the Thai system?

Very confusing! -

Looks to me like you are not liable for Thai tax until you bring in over 210,000THB or possibly more?

Personal Allowance 60,000

(+ 60,000 if your spouse is not working and doesn't submit a tax return)

(+190,000 if you are over 65 years)

(+30,000 up to 3x if you have kids in education and your spouse not already claiming)

(+ up to 25,000 for health insurance)

++

then the first 0 - 150,000 THB is charged 0% Tax band.

So taxed only on what you bring in over at least 210,000THB? Right?

A much lower personal allowance though than some other countries, UK allows 12,570GBP (550,000THB ish).

On the UK SA302 annual tax calculation it shows 'Total Income Received', then it takes off allowances and shows 'Total Income', depending on which of these figures Thailand uses will make all the difference.

-

1

1

-

-

45 minutes ago, kingstonkid said:

Does he rent the house. There are so many different ways to read the article.

The one thing I am not clear on why were the news there and was it just coincidence that this reporter was there at the same time and had this issue.

I have to wonder if this was them giving the middle digit to a pain in the asset

I think the reporter and the applicant are one and the same person, or its the foreigner with a Thai employee to help? from the article... "the foreigner, who works in local media".

Maybe the IO is not a fan of the media outlet he works for "Col Thanet said It's back to the question of what job he [the foreigner] does... It is case by case"

-

I did marriage extension last month (still under consideration), on the day I went there was a ceremony outside as someone new had just arrived that day.

I knew beforehand that there were new photo requirements from the volunteers, an extra photo in bedroom and kitchen and the front house pic should be one close up so the house number is visible and one wider shot full body.

The video call was the same as we did last year, the IO showed me on his phone what he needed and its just recreating the photos you have supplied, not really a walkthrough. They take a screen shot from the video call with the small window of the IO in the photo - in lieu of a home visit (only had home visit once on the first extension) takes around 2 minutes no trouble at all. Polite and friendly IO

There was no mention of Chanote, just the usual house owners house book, id, rental agreement. He did pay more attention than usual to the documents, he noted our rent agreement was drawn up 10 years ago and had no end date, he accepted it as have done other times but said it would be better if it said unlimited or no expiry date on it.

-

Seems to have all come back to normal in last hour or so. I've done nothing new so it must have been TOT even though they said everything was Ok.

-

1

1

-

-

Tried also with 8.8.8.8 and 8.8.4.4

-

-

Thanks for the suggestions.

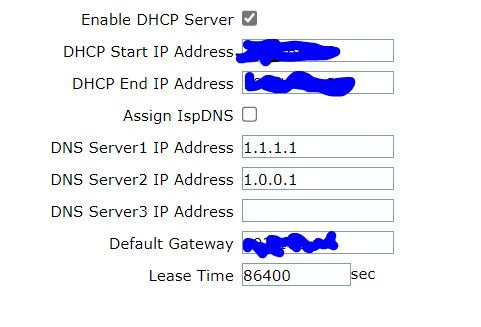

I can't seem find where to change this in the router ZTE F680, I've changed DNS before in my old router but this one I just can't find out, don't see anything in an online user manual either. I have seen how to do it on an F660 which looks like a very similar menu system but the assign DNS setting is not there on my F680.

-

Thanks,

Not sure whats going on its a weird fault, but I'm sure its not us as same on 2 different phones and everything works when switching to 4G.

Some apps seem to half work, like Grab loads up and works until you try to order something then it just times out or says no / slow connection (but occasionally works) Same with Lazada app works mostly until I look at an order that is expected to be delivered then it waits and says no connection.

Seems to be most noticable on android apps more than on pc, but eg Bangkok Bank loads about 50% of the time on pc and the app is not working at all on phones.

TOT/NT say they have checked everything and all looks ok.

-

Anyone else having TOT problems today?

Some sites/apps working some not

Bangkok Bank (on app and computer 80% of time), Lazada (app not work computer work), Line (won't send messages 80% of time).

Tried 2 different phones both same, switch to mobile data it works. On computer work better but not all the time.

Some sites seem fine, google for example.

Router reset 3 times, TOT have reset connection and are now having me do pings and tracert

-

Any recommended brokers?

I've seen 2 on here frequently mentioned, one the them that is mentioned a lot is who I got the policy from in the first place but I changed to buying direct after I lost confidence in them after making a mistake, the other one I have emailed twice now and they don't bother to reply.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Introduction to Personal Income Tax in Thailand

in Jobs, Economy, Banking, Business, Investments

Posted

Thanks, I shouldn't have used that original quote, Q5 is about foreign source assessable income in general and rightly says it's not taxed in Thailand when not a tax resident.

I'm referring to, the gain from sale of immovable property situated outside Thailand for a Thai tax resident is only assessable in the country where the immovable property is located, as per Sherrings website https://sherrings.com/capital-gains-personal-income-tax-thailand.html

(This has been confirmed to me as correct by Sherrings in the case of UK property not subject to Thai tax)