jojothai

Advanced Member-

Posts

1,255 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jojothai

-

Report Bangkok Building Collapse Blamed on Design Flaws, Says PM

jojothai replied to snoop1130's topic in Bangkok News

You are correct concerning the designs. Here, in all my experience the designs are required to checked by an independent registered engineer. Reason for posting is to add that the construction drawings have to checked and approved by the supervising engineer for compliance with the design. So, the supervising engineer has to be potentially accountable, as well as the design approver. The supervising engineer also has a responsibility for checking / verifying quality of materials. -

Report Bangkok Building Collapse Blamed on Design Flaws, Says PM

jojothai replied to snoop1130's topic in Bangkok News

Thanks and your points are understood. It was stated that they used SD reinforcing which is supposed to be better for seismic resistance. The design would have identified what type, and designs are checked by an independent registered professional engineer Steel and concrete testing records are not easy to falsify. It would be very deliberate, and easy to find out by later testing. Wrong type or grade could have been used, but then thats not substandard material, its using incorrect material. I expect that people here will be aware that the truth may not be told. However its no reason to post what could be seen as slanderous comments concerning the issue. Posters should be careful what they post so that they do not break any applicable laws. They should be aware of what can happen if you post criticism on social media, as a particular example what has happened concerning restaurants that has been well publicised. -

Report Bangkok Building Collapse Blamed on Design Flaws, Says PM

jojothai replied to snoop1130's topic in Bangkok News

The article states "highlighting that the disaster was not due to material quality." I am not criticising your opinion contradicting that, but would be grateful to know what information or test results you have to know whether the materials were ok or not? So this Pol Maj Gen understood the specifications and had the results? Or was stating an opinion on steel reinforcing rumours without the facts. How do you know. I personally think the fault was in design or not being constructed in accordance with requirements, or a combination of both. One of the videos shows clearly that the "concrete" in the bottom columns failed in shear well above the base which indicates something that should not be expected due to substandard reinforcing. IMHO, the reinforcing should have failed not the concrete and thats not what I see on the video. I am a chartered civil engineer and have done enough designs to seismic codes to have an opinion. I also know that steel reinforcing from the same contractor JV used on a high speed rail contract was sampled and tested independently within a number of days and found to meet standards. The concrete would have been from a Thai ready mix plant and records are all well documented as in any western country. So it would take a lot of effort to falsify them. I do not see any reason for the authorities to lie about the standard of materials, as being implied by some people. This may be Thailand, but testing records after the incident would have to be falsified, and i do not see people taking that risk when this is such a prominent case. This has yet to go to court for trials of the individuals and we may (or may not ) find out more then. -

Report Bangkok Building Collapse Blamed on Design Flaws, Says PM

jojothai replied to snoop1130's topic in Bangkok News

How do you know there was substandard steel used at the Project? Where were the test results published? Do not confuse rumour or suspected issues with fact. The article clearly states "Contrary to earlier reports suggesting substandard materials, the study confirmed that the steel and concrete used met necessary standards. " what knowledge do you have of the high speed train project to make any statements that the same "substandard steel" was used? I know for a fact that the reinforcing steel for the thai high speed rail contract by the same construction company was tested and all found to be within standards. Samples were taken and tested very shortly after the collapse. Credit to the Thai companies who acted quickly to alleviate any concerns. Unless you have facts, do not create fiction out of something you do not know. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

Now you explained thanks, its possible to understand your specific situation. I am not a professional tax advisor, but i consider that you should only be liable to tax on income after you became resident, and only if it is remitted to thailand ( as things currently stand) I trust things work out that way. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

If so, then it does not apply to offshore accounts. There are similar WHT rules in the UK, if you are resident. I had already stated that the USA has specific rules. And that i do not have any WHT on us investment funds because i have made declarations to my investment bank that i am not a us citizen and not subject to us taxes. They also know where i am resident (here) and my tax ID. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

You are correct, it is too good to be true. When necessary, You will be required to prove the income within the tax year period. So, you must ensure that the financial institution gives you clear records of amount held in accounts at the end of each tax year. For Thailand that is 31 december. For My outside accounts i have the information. The uk channel islands offshore bank gives me statements at 31 december for each account. Not the 5th april uk tax year. And if it is a large amount you hold then you may consider to create subaccounts to better separate it from other income. So it would be easier to prove. Added comment. Ensure that you have the full details for end of 2023 before the remittance rules changed. Thats where there could be big complexity. Try to figure out how you can show it is was income before then and not afterwards. To avoid remittance potentially being classed as income subject to tax. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

Not something i can ascertain. A good comment thanks, but where and how does this apply? Something appears to be missing in how it applies. I understand that it can be necessary at source in USA. They have specific rules. On investment accounts i have to declare that i am not a USA citizen or subject to US tax, then there is no WHT on US investments. In over 25 years overseas, i have never had any offshore bank or overseas investment account deduct any WHT or query it. - When i am not resident in their jurisdiction. Nor my UK bank. - They know i am non resident and just provide me with certificates of interest received. No WHT. It could in theory affect any UK tax i pay, but does not. I do have WHT on my accounts in Thailand. That is expected. Who are the overseas accounts going to pay any WHT to, if the account holder is not subject to their country's tax? And, especially if they do not have your tax details? My accounts always have the full residence and details for what they need and i have never had any WHT, except when i have been tax resident in the country of the account. That i regard as normal. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

It is a "must have" for the financial institutions. Thats why its on the form. And they must request it according to what will be in their own regulations otherwise they will be non- compliant with their requirements. If you can justify not having it and get them to accept your situation, then i do not consider it contradictory. For an offshore or overseas bank it is not related to whether you have taxable income within thailand. Its what may be taxable from within their account that is the reason for them needing to know if you are thai tax resident and TIN. They are required to exchange information and need the tax ID to do that, unless you have a very good reason for not declaring it. If you have no interest on savings or income on any of the accounts then perhaps you can argue that there cannot be any tax due so no need for the TIN. However many people will have accounts with interest paid on their savings. Then that is income within the account. You should also be aware that any pension income paid into the account would be classed as income under the thai tax system and is taxable unless your country DTA excludes it. Or, its not taxable here if it is not remitted to thailand as the laws currently stand. The offshore bank does not make any decisions on that. They should report information on income regardless. If there are any remittances to thailand, the individual would have to make any case for it not being taxable in Thailand. In relation to this if there is a change to worldwide income being taxable could have a serious impact on those with pension income outside the country. Unless their DTA covers the pension income. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

Thank you. It fits with what i just posted. You had a very good reason why you could not provide the tax ID. However, in my experience you should expect that they are going to be asking for it later. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

I said that there are some exceptions, but you need to study the requirements in detail to find what can be accepted. One i do know. If the bank / institution is in your home country where you are tax resident. That makes sense, since its only a tax issue in that country. The whole idea of the CRS is to stop people from tax avoidance across international borders. You will need a very good reason to explain why you have no tax residence anywhere. Its not going to work with some lame excuse. Perhaps somebody may be able to show that the local tax office will not issue them with one. As seems to be a problem reported in posts here. Maybe that would work. It is a requirement that you declare tax residence, and the forms include the requirement to also self declare tax ID. All the financial institutions i have used insist they must have the declarations including the tax ID. Since the CRS started. Its been a long time and its not just a few. Best of luck to anybody who may encounter the issue. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

NO, I have other offshore bank accounts, uk accounts, etc. I know for a fact what the CRS requirements are and what several institutions have required. The declaration of the Tax ID is always a must have. I had enough battles over what other information has to be given or not and had to read a lot of the CRS implementation requirements to reject the banks requests for extra personal information. If you want to know more about requirements and any exemptions then go and study the CRS requirements. you can start at https://www.oecd.org/en/networks/global-forum-tax-transparency.html and https://www.oecd.org/en/networks/global-forum-tax-transparency/resources/aeoi-implementation-portal.html -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

A tax ID. Under the CRS regulations it is a requirement for the banks to get it. I suppose if you give them a foreign tax ID they have to accept it, but i do not know. I have a Thai tax ID so I have no problem declaring it. As a related note, but not something that happened for Thai Banks, I had problems before from an offshore bank wanting two tax IDs when I was working in Israel and classed as living in Thailand. They were asking for a Thai tax ID. It took a few efforts to get them to understand that I was not (tax) resident in Thailand at the time and there was no reason for them to request it. Perhaps if you give a thai bank a foreign tax ID they may ask for a thai tax ID as well, in particular If you are resident and remitting money from overseas. Its something we wil not know until somebody reports such an issue. -

Offshore bank account

jojothai replied to salavan's topic in Jobs, Economy, Banking, Business, Investments

I think your original post was not clear. Its not Skipton asking whether you will be taxed. Its your question on the forum. Read the post from oldcpu. It currently primarily depends if you are resident and remit the interest amount to Thailand which will be considered as income and whether you need to complete a tax return. However, be aware that Skipton should require that you provide a Thailand Tax ID. It is mandatory under the CRS (Common Reporting Standard), but there are some specific exemptions. If you do not have a Thai tax ID, thats perhaps going to take some effort. If you read related posts on the forum you will see that many people, and tax offices, do not consider it necessary or applicable. You will have to go to your local tax office to request. Some Thai banks are now starting to ask for Tax ID, and it will eventually get implemented here under the CRS . So, IMHO its best you deal with getting one. Other people may disagree. If you have a Thai tax ID it does not mean that you have to submit a tax return every year. See oldcpu post item 2). -

You should prepare all the documents two copies with signatures and take them to the immigration to check first. You can leave the date until the day you apply. All documents have to be signed on both copies. Some signed by your wife. There is a form STM10, Affidavit of family relationship, partly completed by your wife and signed by her. It also requires the competent official and a witness. A recent post indicated that their immigration office required a witness, present at the office to sign. That is what happened to me in Hua hin last friday. Other people replying to the recent post said that somebody else in immigration could act as a witness, but Hua hin required me to have a witness who knows us. And they required to see witness house book and two copies of the witness house book signed. Check with your immigration office what they require for the witness and whether it can be somebody else at immigration.

-

Extension Based on Marriage

jojothai replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

Thanks Dr Jack54, that explains. I have used CW many times before and expected that the statement is the same day. Pleasantly surprised when Hua hin said that its vaild longer. -

Extension Based on Marriage

jojothai replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

and comment by liquorice Bangkok Bank can update your book to the current date without the need of a deposit. I am not aware of any requirement to deposit the same day. It is not on the lists of requirements i got from chaeng wattana and Hua hin and was not required recently at hua hin. You can update the bank book at an ATM on the day of application then get copies made but, in my experience two times, if doing it early in the morning it may not initially show the today's date. Make sure that you check it. I re-inserted in the ATM and it then added today's date with the same balance as the day earlier. Check how long the stamped bank statement is valid. I thought it had to be same day, but Hua hin immigration told me it is valid longer. i cannot remember precisely how long they said, i was not bothered at the time. Find out at your immigration offiice. -

Extension Based on Marriage

jojothai replied to MangoKorat's topic in Thai Visas, Residency, and Work Permits

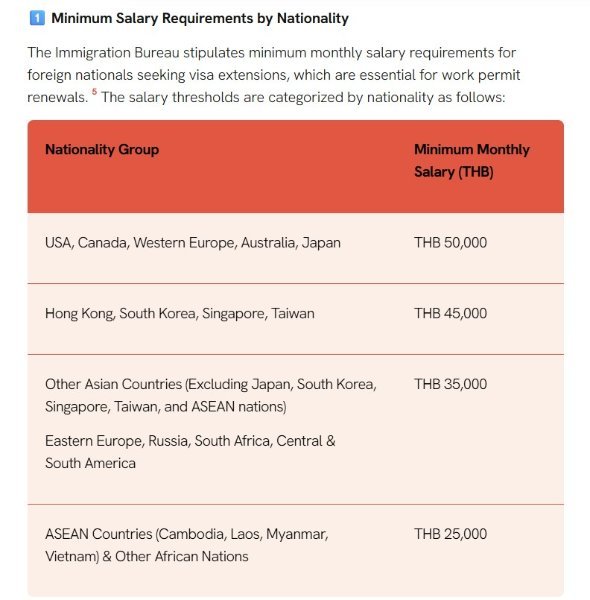

Grateful if you can clarify the 40k. I do not see it on minimum monthly salary requirements for foreign nationals. see attached. Likely to be something I am not aware of, teaching etc. Not challenging it, simply Interested to know. -

Thanks for clarifying. I perhaps should have asked at the thai embassy whether there are other methods of payment, etc. However, if people want to check, then try sending an email I had some queries and could not get through by telephone. Always busy. I sent an email with my queries and got a response within a day. All queries well answered clearly. Thats was very good.

-

Report Violent Outburst on Bangkok-Chiang Mai Train Sparks Outrage

jojothai replied to webfact's topic in Thailand News

I did the train ride from bangkok to hua hin, on an aircon carriage that was a sleeper. Never again without ear plugs. The constant noise from the phones and babble fron conversations was a nightmare even for a 3.5 hour journey. Mainly thais, next to nobody using earphones.