jojothai

Advanced Member-

Posts

1,224 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jojothai

-

Bangkok Tower Collapse: Watchdog Warned of Sub-Standard Steel

jojothai replied to webfact's topic in Bangkok News

Corruption everywhere is well known. The comment was not aimed to "fall back" on the brown envelopes, it was made to counter the "loss of face" which IMHO is not a main reason for the issue. -

Bangkok Tower Collapse: Watchdog Warned of Sub-Standard Steel

jojothai replied to webfact's topic in Bangkok News

-

Bangkok Tower Collapse: Watchdog Warned of Sub-Standard Steel

jojothai replied to webfact's topic in Bangkok News

There was a third party paid to supervise the work. But when there are extremely long delays in construction here (as there was) they rarely get paid any extra for the extension and cut the supervision work to the bare minimum. So this could possibly be part of any problem found in the supervision work. If there are problems found with construction / materials, on the other hand hazard a guess that its possibly down to brown envelopes rather than anything to do with loss of face. -

Thai PM fumes over delayed quake warnings; demands action

jojothai replied to webfact's topic in Thailand News

Only concerned about face saving in relation to the government and limited to a a few departments. How could you find out reliable information on what public transport was available? I was looking a few times especially the next morning and it seemed to be extremely diffificult. Mostly some inconsistent media reports. Perhaps others found thec same issue? -

There should be the need for qualification or a license for any inspections If any volunteers are a farang, what about the work permit?

-

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

Look on the bright side. At least we now have a good probability that a lot of buildings are built well, because they did not suffer any serious damage -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

And nobody is going to go in and properly protect the wires hanging down on the picture that were likely from a ceiling light, potentially live because a light is on in the background. Or switch off the lighting completely to avoid any fire risk. FFS. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

Perhaps they should now be called 'new' cowboy buildings. 😉 Not built well. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

FYI, no buildings are earthquake proof. Designs are done to specific levels of ground acceleration specified as horizontal "g" forces appllied to the buidling. The forces used depend on the zone and seismic risk. In more complex structures, finite element analysis is carried out to model behaviour in an earthquake and calculate streses caused. As stated in reports, the mynamar earthquake was near to ground surface and the horizontal movements were much higher than if it had been deeper underground., and perhaps higher than many standards specify. This may also be why the effects carried to distances so far away. -

Visa Options After Work Permit Cancellation

jojothai replied to JayLeno's topic in Thai Visas, Residency, and Work Permits

I did for clarity to you. The OP has already been told that so it was a wasate of my time. -

Visa Options After Work Permit Cancellation

jojothai replied to JayLeno's topic in Thai Visas, Residency, and Work Permits

Currently 60 days visa exempt. But they are considering changing back to 30 days. You can book an appointment outside to get the first non-o marriage, but because of the evisa system then you should expect to be outside country for at least a week if not 10 days. That would cost you for hotels etc. I went out and returned visa exempt, and will be going to try and get the non-o marriage next week. However its going to be in Hua Hin and I think they have extra requirements on a foreign marriage certificate, even though I have the Khor sor 22. I checked with Chaeng Wattana and would have been ok. I have to see how bad the requirements may be in Hua hin immigration. If they are OTT, then i am going for a visit to Uk in May and can get the non-o there if necessary. -

Visa Options After Work Permit Cancellation

jojothai replied to JayLeno's topic in Thai Visas, Residency, and Work Permits

True, but you can get a 7 day extension if you apply and pay for it before the final date. The OP stated that he got a 21 day extension., because it is BOI. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

Its very hard to find good workers in Hua Hin. A friend has a house buiulding and renovation company and curses the problems he gets with even the simplest of jobs. I find it hard to get somebody to do some small improvements, and even then end up doing most of it myself because they are usually bad at doing anything properly. FYI, there are faults in the supply of major building materials. I built my own house 15 years ago, i am a chartered engineer and checked things. Reinforcing bars have a system where you can buy below standard sizes that are factory rejects. Roof steel channels have wrong grading stamped on them, the standard size is stamped on the pieces but there are three grades of the standard code sizes sold, I found that the smallest is half the section area of what the code grade should be. Its not cheating, because at the main suppliers you pay for the weight. Unscruplous builders buy them and cheat becxause they appear to be the size stated on the design. No wonder you see roofs sagging. We bought all the concrete materials from consistent sources. I had some mixed initially and made cylinders that I got tested to confirm strength was ok. The local builders thought I was looney. Never seen a slump cone before or made test cylinders. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

Very Good point. Construction contracts normally include compliance with regulations such as this at the time of Contract. So, compliance with the new regulations would likely not apply. The design would have already been done and approved by building authorities prior to construction starting. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

You lose the deposit. But where else are you going to rent? Leave Thailand? Perhaps go as far east as you can. Say Pattaya? I recommend that you firstly go to the apartment and see the condition for yourself. Check there is no damage in the interior walls, in condo and particularly in corridors at ends of corridors or at external walls near columns. Its not superficial minor cracks in the wall finish that are a problem, many buildings may have them already. Concern should be any signs of structural damage to concrete frame, or damage in utility areas Look at adjacent buildings for any signs of damage. If they have a car park, usually on lower floors go there and look at the columns to see if there are any signs of recent cracking, cracks from movement quite often displace and should be obvious. Go to the swimming pool if they have one and see if that has any signs of damage. -

Earthquake Rocks Bangkok: Building Collapses with 40 people inside

jojothai replied to CharlieH's topic in Thailand News

Dont be silly or alarmist. if there is no quality or standards surely everything would have collapsed. Is that what happened? How many other buildings collapsed? BKK is not an earthquake prone zone and most buildings will not have design or detailng for earthquakes so it may actually be a very positive sign that there were no other major collapses. Edit, and correction, i have checked and latest regulations, introduced in 2021, mandate seismic-resistant designs for buildings in Bangkok. So there are design standards. However so many buildings in Bangkok are pre-2021 and did not have the regulations, yet the stood up to the quake ok. What do you know about building design? Unless you know what you are talking about, its wrong to criticise . Regardless of the poor standards of construction. Its wrong to paint verything with the same brush. For the building that collapsed it is hard to understand why it should have collapsed. it was nearly complete. Its possible there may be flaws in the design complying with standards, but not necessaraily no standards. Maybe poor standard of construction, or lack of adequate reinforcement detailing (that is normally done by the contractor not the designer). Then the review and supervision of the work needs to also be reviewed. -

Bangkok Gears Up for 2028 Formula One Grand Prix with New Plans

jojothai replied to snoop1130's topic in Thailand News

Its not the soi dogs that will be the biggest problem. The motorbikes coming the wrong way will be a major hazard. -

Visa Options After Work Permit Cancellation

jojothai replied to JayLeno's topic in Thai Visas, Residency, and Work Permits

JayLeno, FYI, You can expect that to transfer to a Non-O is an immigration issue and not BOI. So asking any query is likely to be an immigration question. I had a work permit through Thai company and the visa extension through one stop center. One stop advised that changing to a Non-O was nothing to do with them. Go to immigration. If you go to Chaeng Wattana you need to ask to see the approppriate officers for query on what can be done. They should give you a queue ticket and say one specific booth. I did not have to wait very long even though there were long queues for everything else. -

Visa Options After Work Permit Cancellation

jojothai replied to JayLeno's topic in Thai Visas, Residency, and Work Permits

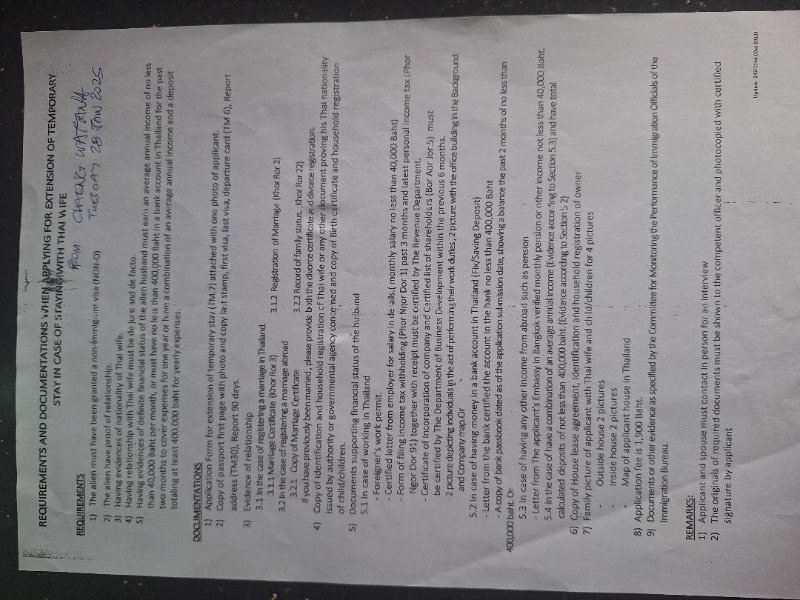

There are a number of posts that I could possibly reply to, however i think its best to just reply. At Chaeng Wattana late january i have been clearly told by the appropriate immigration staff that I cannot go to a Non-o based on marriage from a work permit. I have to go out and come back in visa exempt or with a Non-O already obtained outside. One of my friends wife knows chaeng wattana immigration well and has also checked. They say no also. Hua Hin immigration also definitely will not allow non-o marriage from a work permit. However, i do understand that in bangkok the switch can be done by an agent. A price stated earlier was 25,000 Baht. Therefore your decision may be whether you pay for an agent, or go outside country and return visa exempt. (And i think that should be cheaper than 25,000). From, visa exempt you apply for a non-O based on marriage that gives 90 days,wait for approval, and then within the last 30 days of the 90 you apply for a one year extension based on marriage. Be aware that for non-o marriage, you must ensure that you have all the necessary paperwork requirements for it as well as the 400,000, and have the marriage registered in Thailand, or if overseas marriage you must get the local registration Khor Ror 22. See attached list from Chaeng Wattana> -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

jojothai replied to webfact's topic in Thailand News

Read the post fully. Its not just about hua hin. -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

jojothai replied to webfact's topic in Thailand News

There is no probably. I quote fact. If your transfers are below the alliowances then there should be no need to file a tax return. -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

jojothai replied to webfact's topic in Thailand News

There seems to be a lot of opinion that nothing will happen. But the banks are now starting to ask for tax ID to satisfy CRS. ITs taken two years. Slow, yes. In uk it took about one year. One step at a time. For those who think the TRD will not get their act together, then things may prove to be a but quicker than some expect. There was a seminar in hua hin recently to discuss the tax issues with the TRD. See attached FYI. some points to note , but still questions yet to be answered. From the reports we see, its clear that many jurisdictions do not Understand what is started, however it may slowly become more consistent. Many people will hope it does not happen too quickly. Added comment. Sorry if the text is not very clear. I wil look at improving if i can later on my notebook. -

Thailand Yet to Finalise Policy on Taxing Expats’ Overseas Income

jojothai replied to webfact's topic in Thailand News

No, Read the first part above. Uk DTA has no provision against state or personal pension (unless government service). So there can be double tax on pensions. The UK seem to have deliberately left out the clause in most DTA's. The people responsible must have loved trying to screw pensioners. Just like no yearly inflation increases in state pension. -

As OJAS has commented, If you are resident in Thailand there should be no increases for you in UK state pension. From what you say, are you non resident. Then you have no reason for any Thai tax consideration. If you are resident in Thailand then you are subject to tax on what is remitted here since 2024 changes. The UK DTA has no provisions to avoid double taxation, unless it is a government service pension, not the state pension. The UK has no consideration of UK expats resident in Thailand. If you are retired and resident here, there is no increase in state pension, and no DTA coverage for pensions, although it is very different with other south east asian countries. Screw you old age UK citizens if you go to live somewhere else. Rachel reeves must love it.