-

Posts

2,971 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Sophon

-

Reading between the lines (and I may be misinterpreting what you wrote), it sounds like you: Moved into your place in Bangkok, and your landlord filed the required TM30. You subsequently obtained an extension using an agent. The agent have contacts in Chonburi, so they moved your address to Chonburi to get the extension. You now try to file a TM47 in Bangkok, which obviously is not going to work, since your official address is in Chonburi. In order to file the TM47, your landlord need to register, that "you moved back to Bangkok". Your landlord not unreasonably reluctant to do this, as from his point of view, you never moved away. If I am correct in the above assumptions, then the only way to get your TM47 done, is for you to persuade your landlord to update the TM30 (monetary incentive?). Immigration in Bangkok is correctly refusing to file the TM47, until your address has been updated via a TM30. I am afraid this is just one of the complications with cutting corners and using an agent to get your extension. Immigration have no problems with you moving between provinces, but it is a legal requirement to file a new TM30 every time you move.

-

There is a separate battery temperature sensor included, with a (as you suggest) much longer wire. I have asked Deye customer service what this little thing is for. It was quite the task for a solo installer (me) to lift the inverter into place, especially since there is a battery pack in the way that I had to lean in over. Not to mention that I cannot quite stand upright where the equipment is. I went from a PowMr 8.2 kW inverter weighing 14.2 kg, to the Deye 10 kW inverter weighing 35.6 kg. Hopefully this increase in weight is reflected in a similar increase in quality, especially in the inverters ability to keep cool and not overheat.

-

I decided to go for the Deye SUN-10K-SG02LP1-EU-AM3 inverter, so I ordered it on Shopee during the the 6.6. sale. The inverter was delivered about a week later, however they delivered the wrong model i.e. the SUN-10K-SG05LP1-EU. This model has inferior specs, most important for me was that it only has two MPPTs whereas the model I ordered have three. Return and refund went smoothly, the inverter was picked up on the same day as it was delivered and despite initially stating about two weeks for the refund to be completed, the money was in my account three days later. So I ordered another inverter on Shopee, this time from another shop. The new inverter (correct model) was delivered Wednesday by sellers own fleet, so I have been preparing for the install over these last two days. However, it turned out that was not the end of my shopping experience. An hour ago we received a call that they would deliver my inverter today with nothing to pay. This time the delivery was done by a transport company, but the inverter came from the same (second) seller as the inverter I received Wednesday. So it seems they decided to have an impromptu and unannounced "buy one get one free" sale. Obviously, we told the delivery guy that we already received the inverter, so he took it back with him .

-

I bought one of these MCCBs (200A version), primarily to function as an isolation switch: At a cost of 650 baht it was only a couple of hundred baht more than a similarly rated MCB. When it arrived I was quite surprised by the size and weight of the device, it has some serious heft to it weighing in at almost 1.3 kg.

-

As you state, the current tax free exemption for gifts is THB 10 million, but that is for gifts between people who are not related. For gifts to close relatives and spouses, the tax free exemption is THB 20 million. For inheritances, there is a tax free exemption of THB 100 million. Inheritances between spouses are exempt from tax irrespective of the value of the estate.

-

Establishing value of parcel of land

Sophon replied to isaanistical's topic in Real Estate, Housing, House and Land Ownership

I doubt you would be able to get that information over the phone, however you might be able to find the valuation on this website: https://landsmaps.dol.go.th/ Not all land parcels have a valuation registered on the site, though. -

Solar Hybrid System Costings

Sophon replied to wozzlegummich's topic in Alternative/Renewable Energy Forum

It's only for businesses, ordinary people are not allowed to visit. -

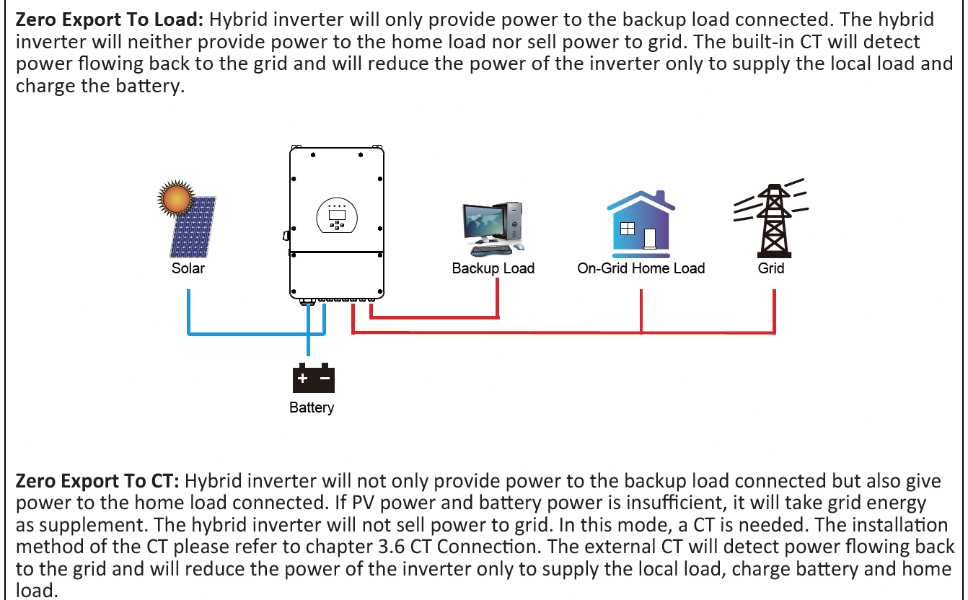

Thanks for the explanation. I will have no load between inverter and the CT, in fact the nearest load is 50m from the inverter location so it would be way after the CT. Given that, I think I will go with the "Zero Export To Load" setting. I will probably install the CT even if it is not needed, just in case I change my mind in the future (or if I for some reason would want to run my meter backwards, in which case I believe the CT is necessary).

-

Thanks for the reply. So for my setup, it doesn't really make any difference whether I select "Zero Export To Load" or "Zero Export To CT", other than I don't have to install the CT for the former setting? Any advantages in selecting one setting over the other? Keep in mind, that for 80% of the year when the sun is plentiful, I plan to have the breaker open between grid and inverter (so I will in reality be off grid). I do this partly to provide a little added protection from lightning surges coming over the incoming lines, but also because I have learned from other threads, that the Deye inverter have some ghost import/export even when set to zero export. I want to avoid this as much as possible.

-

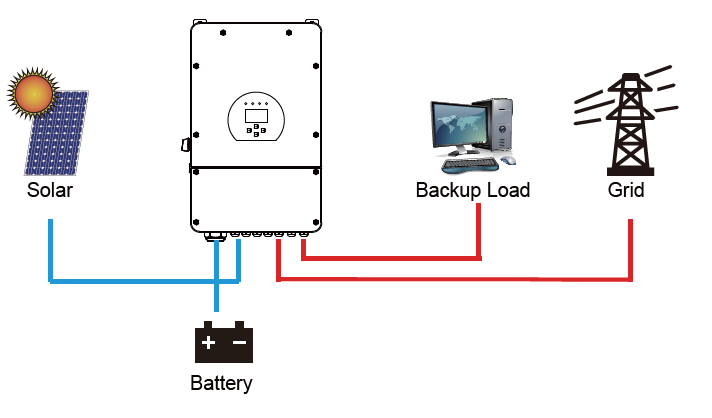

Does it matter if I set the inverter to "Zero Export To Load" or "Zero Export To CT"? I don't have a backup load, or to be more precise my whole house is the backup load. So my wiring will be like this: In both modes the inverter will provide power to the backup load, and will not export power to the grid. This is how I want it to work. However, I note that only under the "Zero Export To CT" mode does it say, that if PV and battery is insufficient to power the load, then the inverter will supplement with power from the grid. What happens under "Zero Export To Load" if my house draws more power than is available from PV + batteries?

-

Bangkok Bank Passbook Code "RIN" ??

Sophon replied to Dazinoz's topic in Jobs, Economy, Banking, Business, Investments

It sounds like you closed the fixed deposit account prematurely. The 469.72 is the interest you would have received had the deposit been fully matured. The 366.97 is returned interest because the account was closed prematurely. Net interest is 469.72 - 366.97 = 102.75 and 15% tax on that net interest is 15.41. -

Because of the location I will not have the inverter connected to WIFI, so if I want to see data/status I have to physically go down to my equipment. So seeing the batteries parameters in the inverter doesn't really give me any benefit, I can just check the batteries directly. There is one place in the house that I am able to pick up the bluetooth from my DIY battery pack, but not from my Liyuan pack.

-

I have no idea. I have two 280aH batteries connected in parallel without communication with the inverter, everything is controlled by voltage. One of my packs is a DIY job, while the other is the same Liyuan battery (with JK BMS) that you have. If the Deye inverter doesn't work without communication established, can I just connect the communication cable between the inverter and the Liyuan battery pack?

-

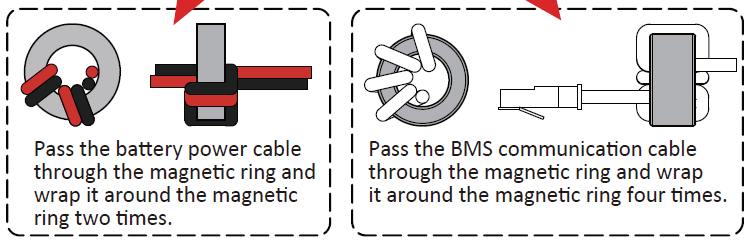

Another thing from the Deye manual, that I don't understand: This is something I haven't seen when watching people installing solar (professional or DIY). What's the purpose of wrapping the battery cable and BMS communication cable around a magnetic ring? The recommended cable size for the battery is 95-120 sq.mm. (for the 10KW and 12KW inverter respectively). I would imagine trying to wrap a 120 sq.mm. cable two times around a magnetic ring could prove quite a challenge). I am a bit worried that the Deye inverter won't work with my existing batteries, I am hoping that it is not an absolute requirement that communication is established between inverter and battery.

-

I do have MCB's between the panels and the inverter in the current set-up, so am able to turn them off when I want to. But my current inverter only have inputs for two MPPTs, so two strings are connected in parallel. The Deye inverter has three sets of inputs, so by running each of the three strings through one of those "combiner" boxes into a separate MPPT on the inverter I could optimize the production from each string. It would also free up space in my existing CU, as I would no longer need the MCBs to be in there.

-

The incoming supply to the house is buried underground, so connecting the two earths would mean digging up the NYY cable and run a wire between the two earths. Not really something I want to do if I can avoid it. With regards to the PV panel surge arresters, I was thinking of running each of the three strings through one of these so-called "combiner" boxes: If I were to do that, what MCB amperage should I go for? My current panels have open circuit amperages of 8.79 to 10.12A, but I would like to have the flexibility to easily connect future panels with different specs (maybe even connect two strings in parallel). Would 25A be a reasonable compromise between safety and flexibility?

-

Sorry, I'm not sure I understand what you are saying. You have the load and grid connection earths connected with your house earth, as well as connection between the house and inverter earth? Because of the distance (50m), I won't be able to do that. My current setup, and what I am planning to continue with the new Deye inverter, is to connect both the inverter metal enclosure as well as the load and grid earths to a local earth rod (I think you have earlier called this a TT island). Only live and neutral will run between inverter and the house wiring. Will wiring the Deye inverter like that work OK and be safe? Thanks for you reply.