-

Posts

37,239 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

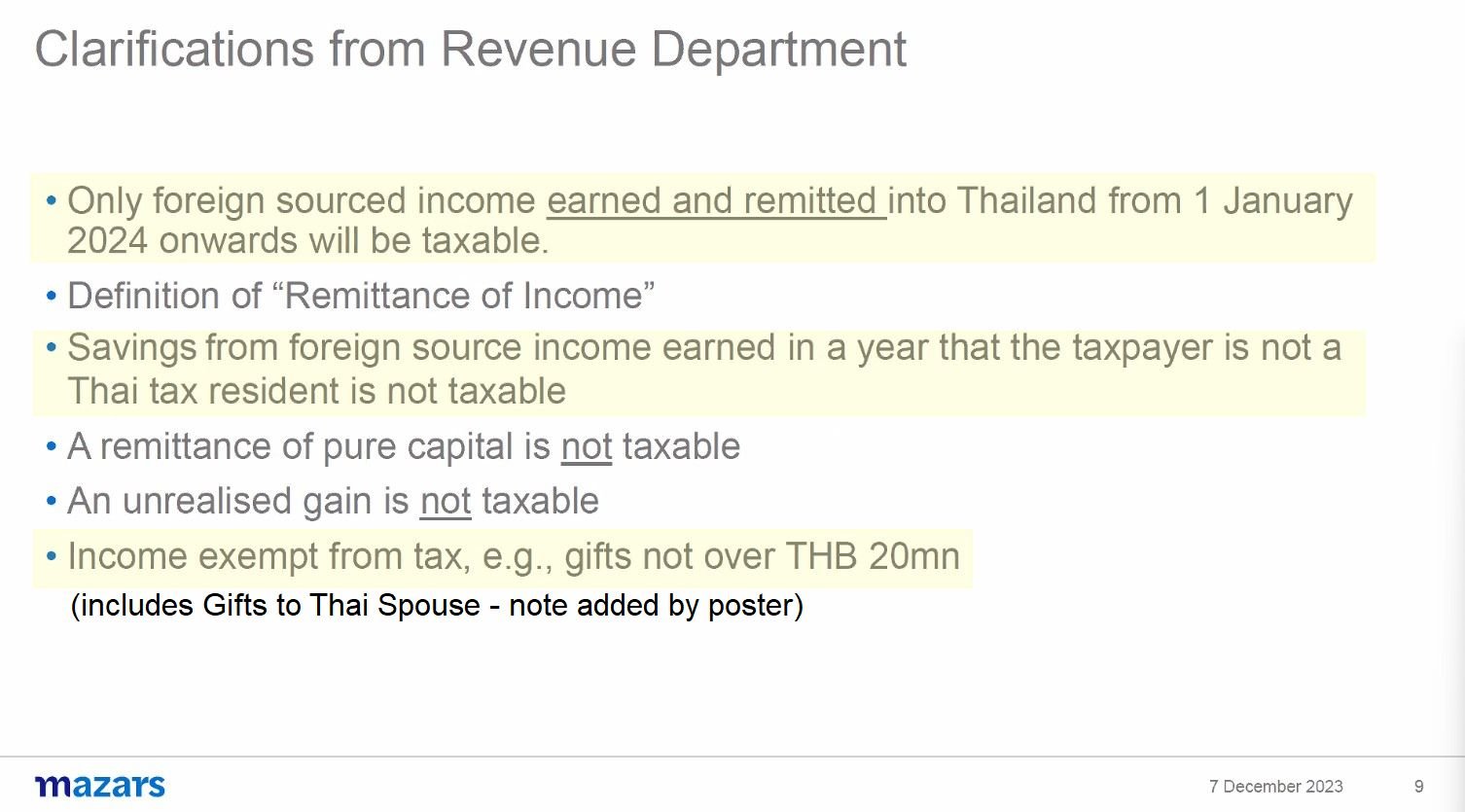

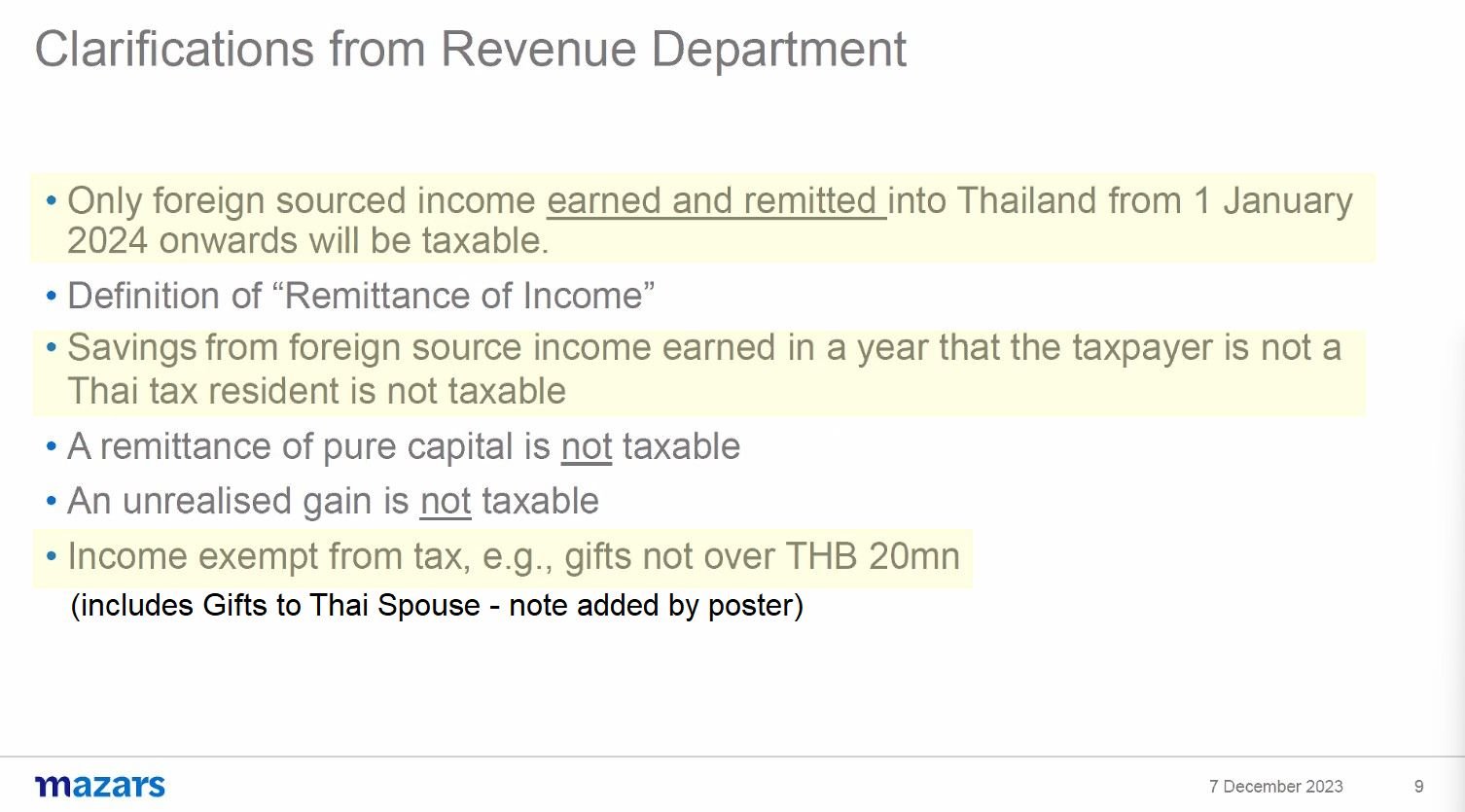

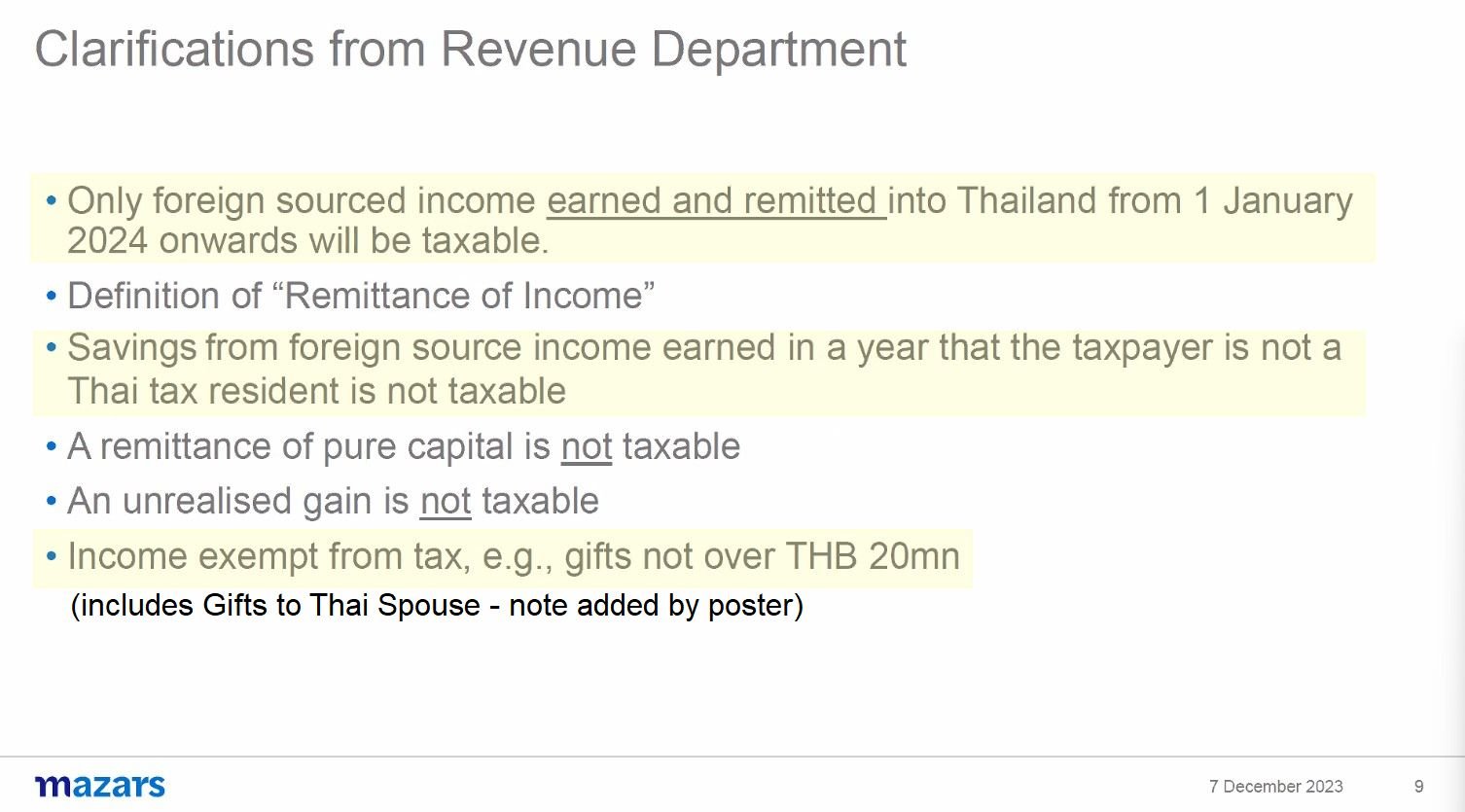

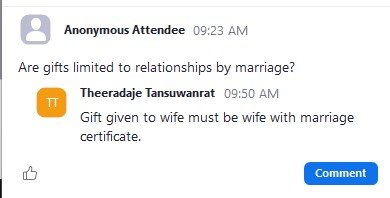

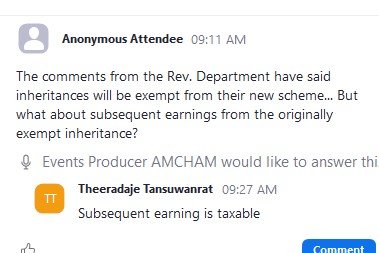

From this morning's American Chamber of Commerce webinar session on all this, one of the elements that got some discussion is the ability under Thai tax law for a foreign spouse to gift their Thai wife (legally married with a certificate) up to 20 million baht without having that count as foreign source taxable income. See the last item in the list below:

-

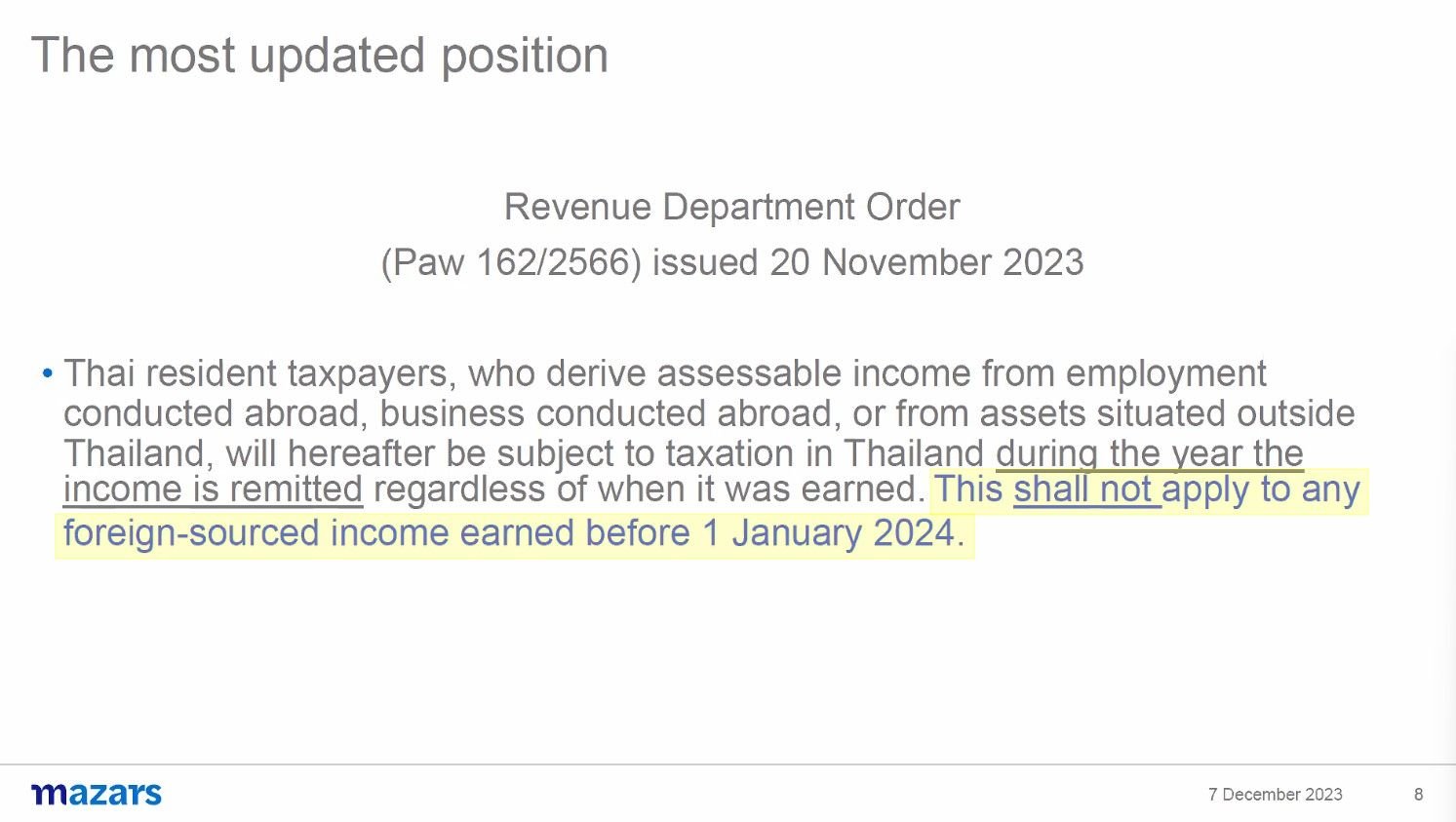

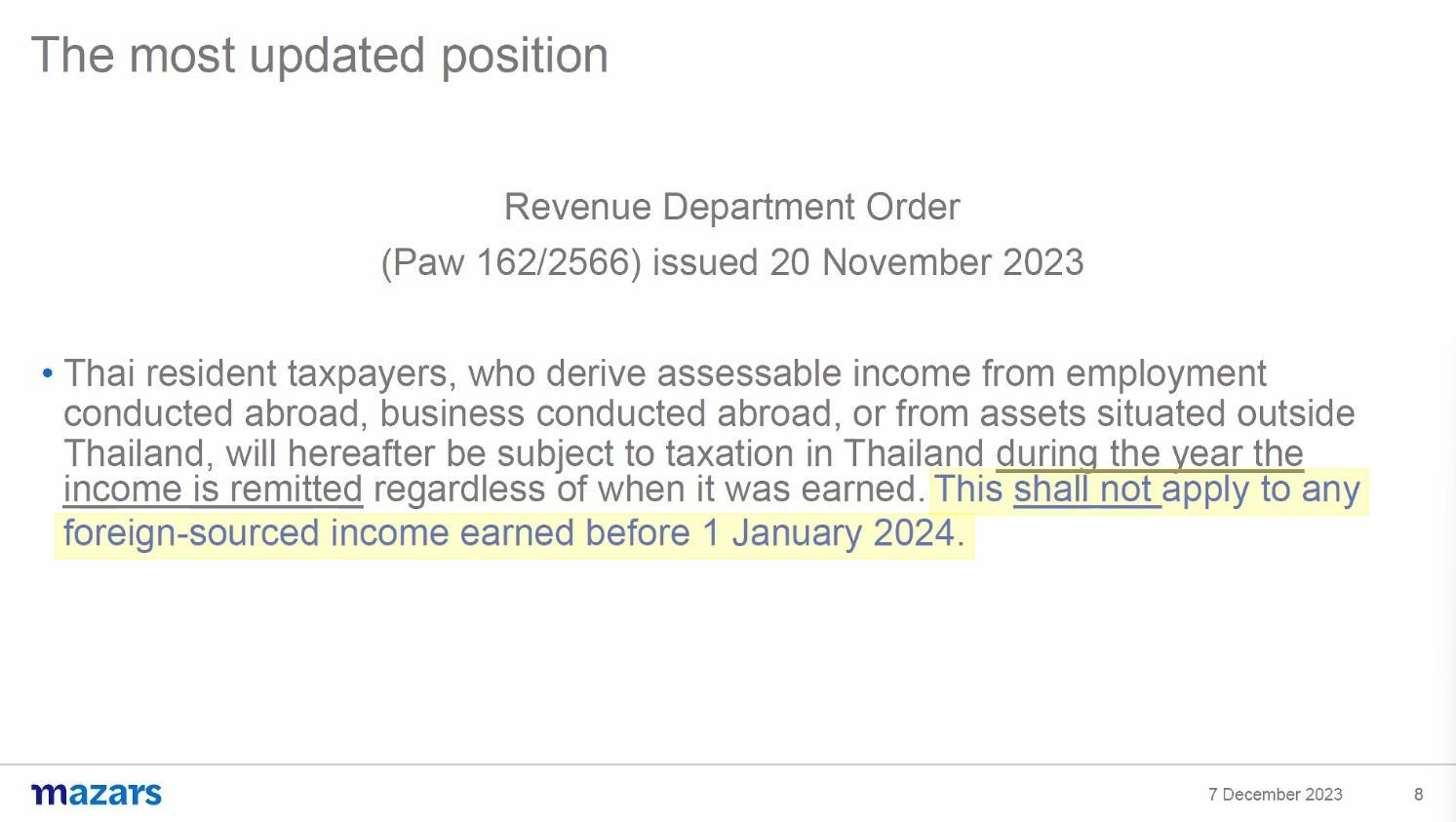

One of the Revenue Department clarifications passed along this morning during the Chamber online panel was they've now added a grandfathering provision, whereby only non-exempt foreign income earned AND remitted into Thailand from Jan. 1, 2024 onward will be subject to taxation. And not funds/income earned prior to that date. A slide from the morning's presentation: Separately, apart from the above provision, I'm not aware of any tax treaty or other provision that would exempt IRA fund remittances into Thailand -- except the grandfathering provision cited above.

-

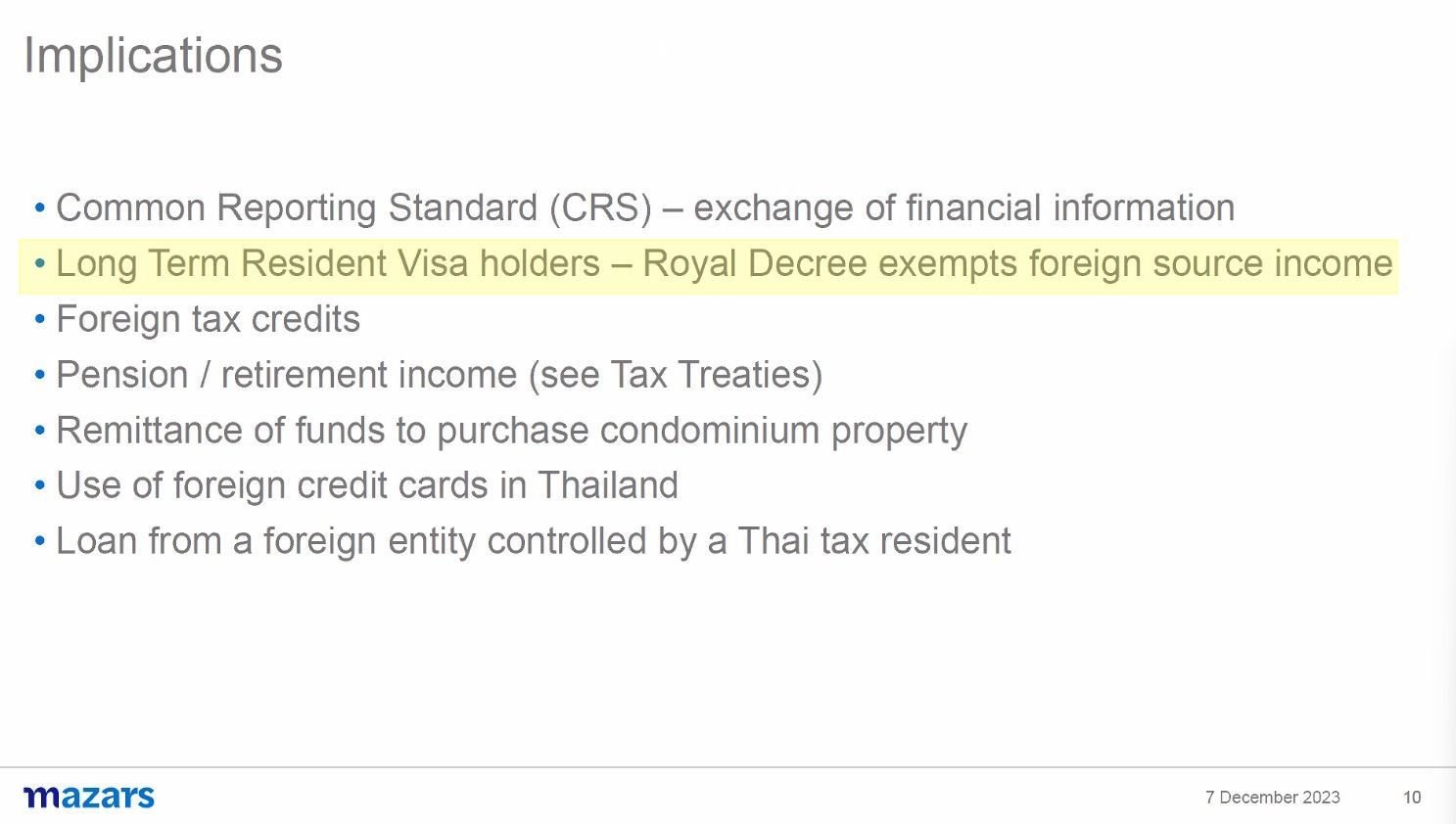

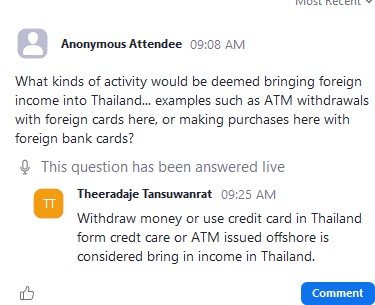

An online panel of expat tax advisors hosted by the American Chamber of Commerce here this morning basically opined that foreign card ATM withdrawals and purchases made here with foreign bank cards are likely to be considered foreign remittances into Thailand subject to local taxation. Although they added that the Thai Revenue Dept. hasn't yet specifically opined on that topic. However, potentially making that a declaration of their new taxation scheme and actually implementing it against many tens of thousands of expats living and spending in Thailand are probably two very different things.

-

I went back and re-read the US-Thai tax treaty document this afternoon. It does appear to indicate that U.S. government pensions and Social Security paid to U.S. nationals should only be taxed by the U.S. And the same notion likewise appears extended to pensions from subdivisions of the federal government, like states and such. But I'm not a tax attorney.... And it would be nice to hear one of them come out and confirm that.

-

Understand the issue you're raising... I'm just repeating what they opined during the session. Wherein they also said the onus will be on expats to self declare and file a Thai tax return if they have a tax liability here. There was also some discussion about an international financial info sharing network called the Common Reporting Standard (CRS), which they likened to an international version of FATCA. And basically said, the Thai Rev. Department could obtain bank account info on people here from their banks in their home countries. But saying they could, of course, is a different matter from the notion that the Thai Rev Department would actually go out and try to start tracking down foreign bank account and transaction details on many tens of thousands of expat foreigners residing in Thailand, and not just on their bank accounts, but then also delving a layer deeper in linking those bank accounts to specific bank card numbers and transactions. https://en.wikipedia.org/wiki/Common_Reporting_Standard Nothing here that seems to reach down to the level of bank card numbers: Information exchanged "The information and its exchange format are governed by a detailed standard, whose details are listed in a 44-page long document.[15] Each participating country will annually automatically exchange with the other country the below information in the case of Jurisdiction A with respect to each Jurisdiction B reportable account, and in the case of Jurisdiction B with respect to each Jurisdiction A reportable account:[16] Name, address, Taxpayer Identification Number (TIN) and date and place of birth of each Reportable Person. Account number Name and identifying number of the reporting financial institution; Account balance or value as of the end of the relevant calendar year (or other appropriate reporting period) or at its closure, if the account was closed. Distributions made to the account (dividends, interest, gross proceeds/redemptions, other)"

-

By the way, since some folks here have mentioned it in other related threads, the panelists also opined that foreigners in the future, from Jan. 1 2024 onward, carrying cash with them coming into Thailand also would be considered a form of bringing foreign income into the country. Just the same as the more traditional routes they also mentioned, such as wire transfers and online currency platforms like Wise.

-

Here are a couple of the slides presented, with highlights in yellow added by me to some important clarifications / considerations, and some additional advice given. The first highlight below is a major exemption/clarification. ------------------------------------------------------ And from a Chamber member / Thai tax attorney who was answering questions online, but was not part of the presenting panel: The panelists said they believed the above opinion will likely end up being the case, but that the Thai Revenue Dept hasn't specifically advised on this issue. ------------------------------------------------------- Thai tax exempt gifts to a Thai spouse would have to involve a legal marriage with a Thai marriage certificate. ----------------------------------------------------------- ------------------------------------- Lastly, there was a question asked about the status of U.S. Social Security payments, and how they would be treated under this new tax policy, including as addressed by the U.S.-Thai double taxation agreement. And, the status of that and the impact of the DTA on SS wasn't answered by the panelists.

-

Here's an MP3 audio of the AmCham Thai Tax webinar this morning... Some clarifications and answers, but a lot of questions/issues left unresolved, pending further clarification from the Thai Revenue Department. One of the disappointing things, for me at least, was I don't think the session at all addressed just how the specific provisions of the Thai-U.S. Double Taxation Agreement will in practical terms impact and operate for Americans here under the Thai government's new taxation scheme... Most of the practically useful info comes later in their initial presentation after a longish introduction and background briefing, and then during the ending Q&A session, starting at about the 43 minute mark, where they respond to specific questions asked online. One of the things the panelists specifically said was they BELIEVED, for now, that foreign debit and credit card transactions (purchases and cash withdrawals) done here in Thailand likely WOULD be considered tax assessable income, though they said the Revenue Department's specific guidance thus far hasn't addressed that exact question. AmCham TH tax brief 12-15-2023.mp3

-

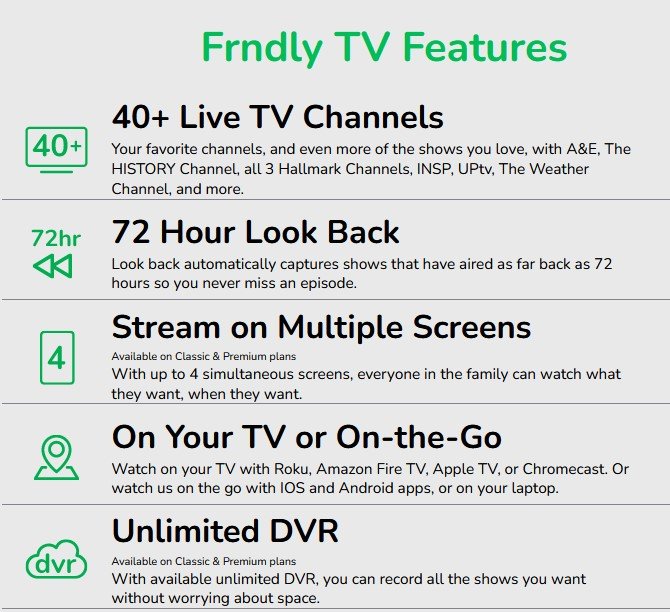

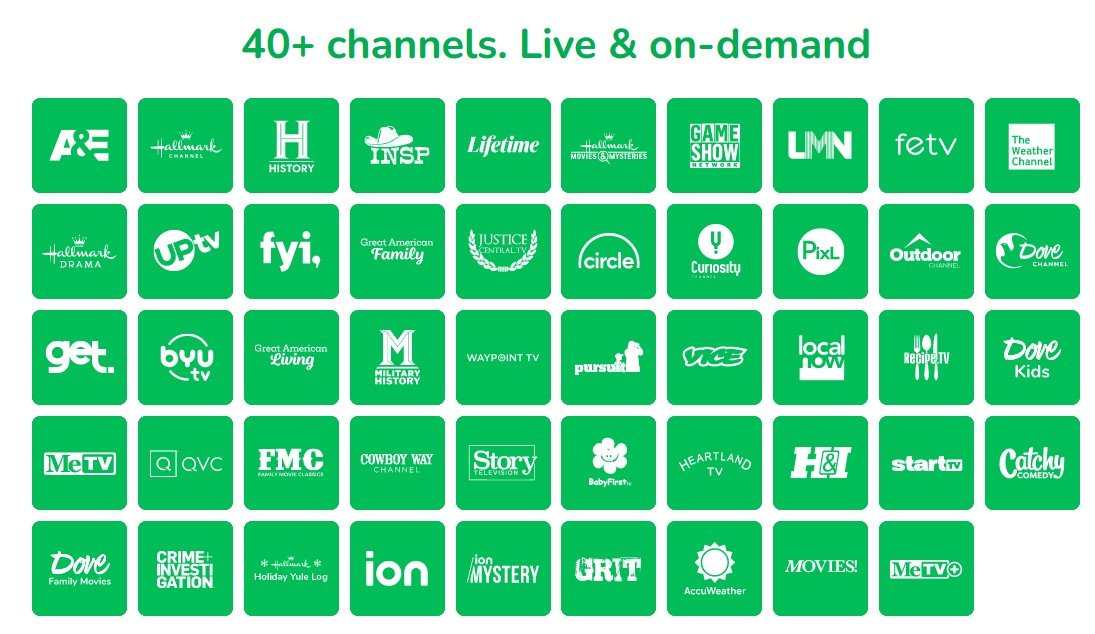

There's a cable network in the U.S. -- MeTV -- that carries reruns of most of the oldie shows that have been mentioned above. https://www.metv.com/about-us/ I don't think it's available as a standalone streaming service. But it is available as part of a broader and very affordable U.S. streaming service -- FrndlyTV -- that focuses on content from many similar channels. https://try.frndlytv.com/ FrndlyTV has some nice features, including a built-in cloud DVR that allows the user to select shows that their system will record and save for later viewing. I subscribed for a couple of years until I basically caught up on watching all the older shows that I wanted to rewatch.... and then didn't want to rewatch them again and again... So cancelled at that point. (Using the service does requiring having a U.S. IP address). A bunch of the included channels above are primarily oldies and western channels/shows, and other various "family friendly" type content.

-

Rural humour "The following week, on Oct. 3, 1960, The Andy Griffith Show (CBS, 1960–68) had its delayed premiere and was an immediate ratings success. During its entire run of eight seasons, the show ranked in the top 10 of the Nielsen ratings, leaving the air in 1968 as the highest-rated program on television. It also inspired two spin-offs, Gomer Pyle, U.S.M.C. (CBS, 1964–69) and Mayberry R.F.D. (CBS, 1968–71), both of which were also top-10 hits. The rural situation comedy had its foundation in a long American tradition of hayseed humour." https://www.britannica.com/art/television-in-the-United-States/Rural-humour I was never much of a fan of the rural / hayseed humor shows.... But, I also grew up in city areas, not out in the sticks. No "awe shucks" folks around in my youth.

-

Few of the shows of my youth, except for the original Star Trek, ended up being among the best TV series I've seen during my ensuing life... IMHO, those included from an American's perspective, in no order of ranking: --Hill Street Blues --The Shield --24 --MASH --Miami Vice --The West Wing --Brideshead Revisited (UK) --Line of Duty (UK) --Rumpole of the Bailey (UK)

-

From Brittanica on U.S. television in the 1960s: "Some of the best-remembered series in TV history were first aired in the 1960s. They established the reputation of the medium in the eyes of many, and, because they were on film rather than live, they would continue to be seen by successive generations in perpetual reruns. Unlike the dramatic anthologies of the 1950s, which are mostly unavailable to contemporary viewers, the long string of “classic” programs featuring not only genies and talking cars but millionaire hillbillies and talking dogs, island castaways and talking horses, Stone Age families and suburban witches continued to be frequently rerun into the 21st century. For many viewers these programs brought hours of escapist pleasure; to others they came to identify American TV as a cultural wasteland catering to the lowest common denominator of public taste." https://www.britannica.com/art/television-in-the-United-States/Rural-humour

-

I think one of the earliest memories I have of watching TV as a child was the Daniel Boone western TV series with Fess Parker, which started in 1964 and ran thru 1970 on NBC. And had a catchy theme song as well, though this early version below isn't the one I remember from my "yooth" This second, later version is the one I remember, starting at the 1:01 minute point: "Daniel Boone was a man. Yes a BIG man..."

-

PM Commits to Stamping Out Pork Smuggling

TallGuyJohninBKK replied to snoop1130's topic in Thailand News