-

Posts

37,019 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

Their first and primary position was that expats who are Thai tax residents who move foreign funds into Thailand should file, regardless. That's their base recommendation, and is advice they say they have confirmed with the TRD's legal staff.... But it was only later after much back and forth between myself and them, that our discussion later turned to the point that if you DON'T file, as long as the TRD never concludes you actually owed any Thai taxes, then the penalty for not filing a return that owed no taxes is very minimal. But if summoned somewhere down the road, you'd better have all your necessary documentation in order to show that your remittances were in fact non-assessable for whatever reasons, the pertinent DTA or the TRD's own policy about pre-2024 income. One of the interesting things they were very clear about, which was one of the important points I wanted to seek advice on, was whether pre-2024 savings would only be counted as CASH holdings, or also include the value of stock holdings, in other words, total account balances as of the end of 2023. And they were very clear without any waffling that any pre-2024 savings calculation would be based on TOTAL account balances, stock and cash balances inclusive.

-

Jim, it's just a matter of scheduling. My appointment with Carden's office happened to come first. My appointment with Expat Tax Thailand is later this week. I wanted to hear both their opinions and the basis for them, and ask about some specific details, before coming to any personal conclusions. I asked about A LOT of different related topics, one of those being TRD's stance toward Roth IRAs. Carden's office's main Thai attorney sat in on our conversation. And basically she said, they've had queries in with TRD on the subject of Roths, but haven't gotten any firm guidance back from TRD's legal staff as yet... They said they hoped for some update within perhaps a coming month. I recorded our conversation for my personal use, so I need to go back thru that later... But as best as I recall from this afternoon, when I pressed Carden's Thai tax attorney on the issue of Roths, I believe she said her current GUESS is that the TRD will end up treating Roth account remittances as TAXABLE, because they're not specifically exempted in the current U.S.-Thai DTA.

-

OP, so, are you saying that the ONLY funds you remitted into Thailand during 2024 were savings from pre-12/31/2023 sources? If so, those would be tax-exempt under the TRD's policy of exempting pre-2024 source income. If that's the only funds you remitted in calendar 2024, I would be surprised to hear the supervisor there telling you you needed to file a Thai tax return.... unless you had some other non-pre-2024 income remittances.

-

I believe it's correct that for the current 2024 tax year filing season, neither the Thai nor the English language versions of the Thai tax filing forms have any provision for reporting non-assessable foreign remittance income! One possible answer is that's they don't expect it to be reported. The other possible answer is they DO expect it to be reported, but are so slow in working thru the details of this whole new foreign remittances tax regime that they haven't updated their systems as required.

-

One of the other bottom lines of their advice, which I found reassuring was, if someones chooses to NOT file.... as long as when the dust settles they don't actually owe any taxes in the TRD's opinion if it ever comes to an audit or whatever... then there's no serious consequences involved. It's only if you don't file and then the TRD later concludes that you DID owe taxes and failed to report taxable remittances and failed to file the required return, that's when things could get very messy.

-

Thanks... Appreciate the update. Unfortunately, my wife, bless her soul, who's proficient in English and Thai, nonetheless would not be a person I'd expect to understand and correctly translate Thai Revenue Department advice about the implications of the Double Taxation Treaty between Thailand and my home country, and whether or not an actual tax filing is required to make use of its provisions....

-

Sheryl, I just came back this afternoon from a meeting with the tax staff at Thomas Carden's office in Bangkok. I'm not arguing or claiming their advice is correct, and other tax advisers have agreed with your position. But FWIW, Carden's office is claiming they have confirmed with the TRD legal staff the interpretation that for an expat to claim Thai tax exemptions for foreign remittances like U.S. Social Security & government pensions under the DTA or pre-2024 savings under the TRD policy, that the expat supposedly needs to file a zero income Thai tax return and then attach a statement specifically claiming the pertinent exemptions and the related amounts brought in. Again, I'm not saying that's correct or accurate. Just reporting the advice they're giving out. FWIW, another well-known expat tax advisory firm, Expat Tax Thailand, has the exactly opposite opinion matching yours -- that as long as the only income an expat brings in is non-assessable, that no Thai tax filing is required. Another member here also recently reported a conversation in Thai with the TRD help line that confirmed the same thing. It would be nice if they could all agree on such things and what the TRD really does or doesn't plan to enforce.

-

Bangkok Delays AI-Powered Speed Limit Cameras

TallGuyJohninBKK replied to webfact's topic in Bangkok News

Dunno about the cheaper part, considering what it really costs Thailand to implement and then keep operating anything requiring a modicum of technical knowledge expertise... The normal pattern is that such stuff quickly falls into disrepair and iffy operating status. Plus, and this is more to the point, when it comes to traffic/speeding enforcement, AI cameras are a thing that Thailand doesn't actually have up and running right now as we speak. Whereas they've got hundreds (thousands?) of traffic enforcement officers who COULD be deployed to enforce such things right now/today. But hey, it's better to wait around, do nothing, make delay excuses, and then spend a lot of public funds on fancy equipment that probably will mean good profits and perhaps kickbacks for some connected supplier vs. getting the traffic officers who are already getting paid now to go out and actually enforce the traffic laws! -

Clarence Thomas v District Judges

TallGuyJohninBKK replied to theblether's topic in Political Soapbox

If you want to learn about political court/judge shopping that occurs in federal courts, some of the worst abuses of that occurred by Republican/conservative groups during the Biden administration with a single U.S. District Court judge in Texas who was a Trump appointee, and before that, had worked for the conservative Christian legal organization First Liberty Institute from 2014 to 2019. Per Wikipedia: "Matthew Joseph Kacsmaryk ... is an American lawyer who serves as a United States district judge in the United States District Court for the Northern District of Texas. He was nominated to the position by President Donald Trump in 2017 and sworn in for the position in 2019. Conservative groups and the Texas Attorney General tend to file cases in Kacsmaryk's jurisdiction so that he is likely to hear those cases, as he reliably rules against Democratic policies and for Republican policies.[3][4] His court has been hospitable to conservative lawsuits that many lawyers consider meritless. ... Conservative groups have strategically chosen to file lawsuits challenging many Biden administration policies in Kacsmaryk's division. Kacsmaryk is the only federal judge in the Amarillo Division of the Northern District; 95% of lawsuits filed there are assigned to him.[34][3] By March 2023, the Texas Attorney General's Office under Ken Paxton filed 28 lawsuits against the Biden administration in federal district courts in Texas; of those, 18 were filed in single-judge divisions, including Kacsmaryk's division and a single-judge division held by another Trump appointee, Drew B. Tipton.[35] Kacsmaryk and Tipton have denied various Justice Department motions to change venues. https://en.wikipedia.org/wiki/Matthew_Kacsmaryk -

Bangkok Delays AI-Powered Speed Limit Cameras

TallGuyJohninBKK replied to webfact's topic in Bangkok News

What ever happened to that extremely high-tech method of having actual traffic police officers use speed guns to track and cite speeding motorists? On ya, that would mean they'd have to get off their arses and go out and actually do their jobs! Or, maybe they're having a problem because they decided to buy their traffic speed cameras from the same manufacturer who built their infamous bomb detector units.... -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Of course, BOI has a vested interest in making THEIR product as appealing to buy as possible. In the end, it's not what the BOI says, or what Siam Legal says, but what kind of tax regime the TRD puts forward and tries to enforce that will matter. Like so many things on this whole topic, there are many entities putting out many different details and interpretations of how this or that aspect of things is going to/supposed to work. No wonder, so many of us are confused and unsure of where we stand. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Interesting commentary from Siam Legal on the prospective legality of all this stuff TRD is putting forward, because it's largely based on regulatory statements not supported by underlying actual legislation. Sounds like Siam Legal is looking for a would-be client to challenge this whole new tax regime: 2024-08 Siam Legal Experts Answers 23.mp4 https://youtu.be/syQXa8gcVfE -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

I'll note, your excerpt above opens with the terminology of those being the "minimum" that FIs are required to report... I've been clipping the various tax advice opinions that the various local folks have been putting out. I'll try to go back and find the CRS-related post that I was recapping above... Of course, that doesn't mean that the advice/guidance they're giving is accurate/correct! -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Another niggly detail I've been coming across is the whole area of tax exemption for LTR visa holders. I've seen it described here and elsewhere as a blanket exemption for bringing in foreign source income. But now, both Siam Legal and another tax advisory firm have both been limiting that, advising that the tax exemption for LTR holders ONLY applies to remittance of foreign income earned from the PRIOR year... and not the current year, like if someone was transferring their salary every month as it was earned. Example, per Siam Legal: https://youtu.be/syQXa8gcVfE?t=1915 Meaning, the TRD seems to be interpretting the LTR exemption in the same, prior year way that they used to treat all foreign remittances, that they were tax-free as long as they were earned in the prior year (and not the current year). -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

What some of the expat tax consultants have been saying is that Thailand will have the ability to do an annual exchange of info with other CRS countries, and they've described that as potentially very far encompassing, going beyond just bank account stuff. But I'm just repeating what they've been saying. CRS is not my personal area of knowledge. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

And yet, he's been one of the most visible and active expat Thai tax figures opining on all this stuff, appearing before the Pattaya Expats Club and in various other presentations/interviews.... He's providing information, but he's also heavily pitching his company's paid services to prospective clients. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Thanks Jim... that's a good point! I probably should have used a CRS country instead of a FATCA country like the U.S. in that example. As I understand it, CRS countries like Thailand and various European ones also are/can be sharing data on a wide range of financial stuff, including foreign remittances and income, financial transactions, earnings, etc. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Re your 5 MB example, the tax advisor folks have been saying the same kind of thing about Thai property purchases. If you move in 5 MB THB of otherwise non-exempted foreign funds in a year where you're a Thai tax resident (180+ days of presence in the calendar year), you're gonna be on the hook for Thai tax on that amount. In the real estate example, their typical response/answer has been to say, leave Thailand so that you're NOT going to be present for 180+ days in that calendar year, then you can bring in all the foreign funds you want without Thai taxation. Of course, that notion doesn't work so well if one is sick and/or hospitalized, and not likely to be relocating countries for 6+ months!!! -

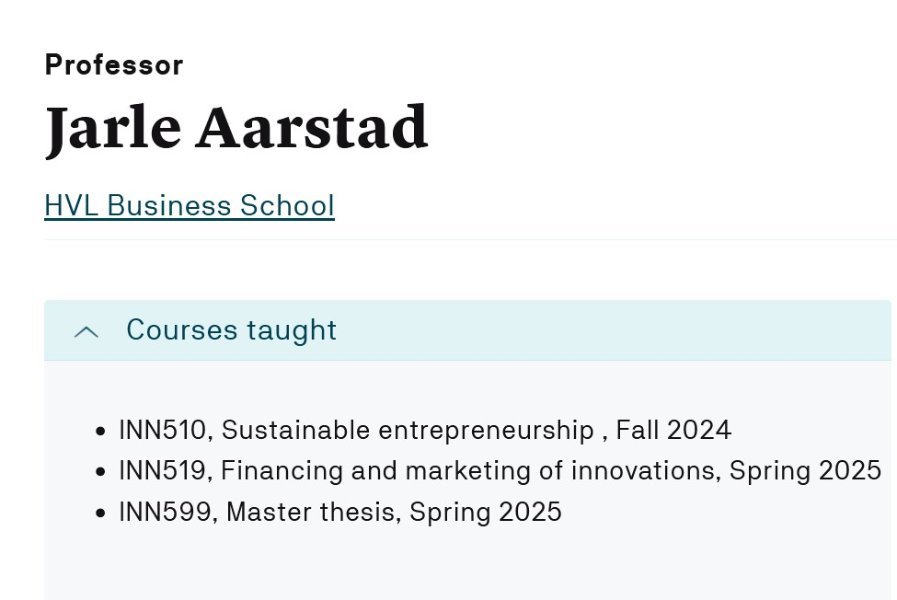

It's from a fringe researcher with no credentials in public health, epidemiology, medical issues, etc etc... The author here is actually a professor, not surprisingly, at his university's business school, which isn't exactly where you'd expect COVID-related research on mortality trends to be occurring. https://www.hvl.no/en/employee/?user=Jarle.Aarstad And, the claims of his paper re the UK have been contradicted by the UK government's own reporting. "By Reuters Fact Check February 7, 2024 ... " For example, ONS data show all-cause deaths in England were higher among the unvaccinated than those who had received at least one dose, for every month in its April 2021 to May 2023 dataset." [emphasis added, that timeframe being the exact same as the one used in the OP article]" These days, especially with issues related to COVID, peer review alone doesn't necessarily mean much. The anti-vax community has even set up their own professional sounding named journal run and overseen by anti-vaxers and anti-vax peer reviewers. So when their nonsense articles are refused by or eventually retracted by normally reasonably credible journals, they'll simply shop the same article or a similar version to a different journal hoping to get reviewers who aren't knowledgeable in the field, or ultimately go to their own anti-vax journal if all else fails.

-

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

The various tax advisors guidance that expats ought to play on the safe side and over-report and/or get a TIN and do a Thai tax filing even when it arguably isn't required just happens to nicely coincide with them charging 8K, 12K, 14K THB per expat tax filing that they do. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Carden just was talking about Thai tax filings that his firm will be doing this season for expats who have remitted TAX EXEMPT foreign funds into Thailand during 2024. Rather than simply omitting any mention of those, since the online Thai tax forms for 2024 reportedly provide no ability to report TAX EXEMPT remittances, he's been saying that his firm plans to attach a document file with the online filing reporting the TAX EXEMPT remittances and the basis for them being tax exempt. His argument has been that doing so protects the filer from the TRD coming along later and challenging the tax exempt status of the funds and claiming the filer failed to report the remittances.... Don't shoot the messenger. I'm just reporting what he's been saying in his various YT presentations/interviews. The above potentially becomes an issue, Carden says, because of the emerging cross-border financial info that Thailand's revenue department is obtaining from other countries, and sharing their data to other countries via the CRS agreements. Under CRS, the remittances of what Thailand would consider as tax exempt funds would be reported by the other countries to Thailand as merely foreign remittances, since those other countries sharing info with Thailand wouldn't know what Thailand does or does not consider tax exempt. For example, via FATCA, the U.S. might share to Thailand that I, hypothetically, did monthly wire transfers from my U.S. account to Thailand of $1000 each month. But, that FATCA reporting wouldn't necessarily say that the source of those funds was my Social Security benefit or that such remittances are by tax treaty exempt from Thai taxation. The U.S. would just report, and Thailand would be told, that I sent $1000 a month from the U.S. to Thailand. So then what's the TRD going todo with that kind of reporting. -

what money is taxed 2024 ?

TallGuyJohninBKK replied to Carver2's topic in Jobs, Economy, Banking, Business, Investments

Good points... ETT, on that point, has been advising expats to keep good financial statement records going back up to 5 years to document the sources and flows of funds that they want to claim as tax-exempt for whatever reason... with 5 years apparently being the back period that TRD can examine in the event they pursue an audit. There has been multitudes of opinions expressed by the various tax advisers saying that this whole thing has been rushed thru without adequate or clear rules and interpretations, and with RTD interpretations that have changed over time. Lately, for example, Thomas Carden has been claiming that originally TRD told them that foreign card ATM withdrawals would NOT be counted as taxable foreign remittances... But as of December, Carden has been saying TRD has changed their view on that and now says that ATM withdrawals WOULD be considered foreign remittances if the source funds were from non-exempt sources. Likewise, with the issue of using foreign credit cards to pay for things here, apparently, there's absolutely nothing in writing and no formal guidance at all from TRD on that subject even now. But the various advisers seem to be warning that expats shouldn't rely on that, and that some TRD opinion on that issue may well be forthcoming at some future point. E.g. -- they're kind of making things up as they go along. And from what the various advisor folks are saying, it sounds like the TRD online web forms for the 2024 TY still don't have any method for entering in actually remitted income that is/was legally tax exempt. So Carden has been talking about them having to append a written statement with the online filing disclosing the tax exempt remittances, so as to avoid the potential for TRD later claiming those remittances were made but not disclosed. -

Thanks for the report above.... So am I correctly understanding your report above to mean: 1. you felt the TRD rep confirmed your sense that cash balances held in brokerage accounts as of end 2023 SHOULD count as Thai tax exempt savings if later remitted into Thailand? 2. you didn't get a clear answer from the same TRD rep as to whether the stock holding balances held in the same brokerage account as of the end of 2023 would or would not be acceptable to be counted as Thai tax exempt if later remitted into Thailand???