-

Posts

37,231 -

Joined

-

Last visited

-

Days Won

6

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by TallGuyJohninBKK

-

Got news for you -- infectious diseases like COVID, the measles, avian flu, polio, malaria, etc etc DO NOT respect national borders. When the U.S. under Trump abandons its historically major role in supporting international public health initiatives and guts the U.S.'s own public health organizations, it makes the WHOLE world less healthy and less safe, including the United States.

-

Here's who Trump appointed to head the National Institutes of Health, what had been the U.S.'s preeminent government scientific organization: Re Bhattacharya and the study he co-authored along with John Ioannidis (both from Stanford) on the early days of COVID in Santa Clara County, Calif: "A Wall Street Journal editorial by Bhattacharya and Bendavid was entitled “Is the Coronavirus as Deadly as They Say?” Bhattacharya revisited that theme in the Hoover Institution and Fox Nation program “Questioning Conventional Wisdom.” When their preprint was published, its conclusions backed the trio’s policy arguments – and it was saddled with statistical problems. It failed to describe key calculations and made at least five material mistakes, according to Will Fithian, assistant professor in UC Berkeley’s Department of Statistics. The population-weighted intervals in a table were miscalculated. The authors plugged the wrong interval into a formula. They made two math errors in executing that formula. And, misreading their test kit’s manufacturer insert, they used the wrong numbers for the antibody test’s specificity." https://sciencebasedmedicine.org/what-the-heck-happened-to-john-ioannidis/ Scientists feud over hyped Stanford coronavirus antibody study: “The authors owe us all an apology” Study that says Silicon Valley cases were underestimated by 85x exemplifies "how NOT to do statistics", expert says April 26, 2020 "... a new study suggesting that Santa Clara County, home to Silicon Valley, had up to 85 times as many cases as it reported was deeply flawed and could give the public a false sense of security, researchers say. ... Many researchers around the country said the Santa Clara County study was simply flawed. The researchers used kits from the company Premier Biotech, which has one of the lower "false positive" rates but still shows "false positives" in two of every 371 true negative samples, according to the San Jose Mercury News. ... "I think the authors of the above-linked paper owe us all an apology," said Andrew Gelman, the director of the applied statistics center at Columbia University. "We wasted time and effort discussing this paper whose main selling point was some numbers that were essentially the product of a statistical error." (more) https://www.salon.com/2020/04/26/scientists-feud-over-hyped-stanford-coronavirus-antibody-study-the-authors-owe-us-all-an-apology/

-

Just because a bunch of purveyors of unscientific, partisan politics-driven nonsense have been appointed to senior federal health positions under Trump doesn't mean there will be any shortage of respected and credible public health and science figures who will call out their garbage for just what it is. And I won't have any problem finding and reporting those take-downs.

-

It was a sad and sorry spectacle recently... as I was watching news report videos of the earthquake recovery efforts in Myanmar... Tons of news video of rescue teams from China and various European countries digging into the rubble there trying to find and rescue those trapped... And amidst it all, the U.S. -- which historically would be the largest player in that kind of a international relief effort -- was a virtual non-entity because of Trump and his foreign aid cuts / freezes. USAID cuts put US on sidelines of Myanmar aid, former officials say 2 April 2025 "The US has been unable to meaningfully respond to the Myanmar earthquake due to the Trump administration's decision to slash foreign aid, according to three former senior US officials. One former US Agency for International Development (USAID) mission director for Myanmar told the BBC that "America has been on the sidelines" after the disaster. "The US basically was not there for the rescue-window period," said another official. All three suggested the deep cuts to aid probably cost lives." (more) https://www.bbc.com/news/articles/c4grl7nydyzo That's what Trump and MAGA stand for -- heartless, soulless, self-interested to the extreme. It's a disgrace for the U.S. and what it used to stand for...

-

Here's where Trump, Bhattacharya, RFK Jr. and their fellow anti-vaxers are steering the U.S. and the world to the extent they can influence it: Measles Surge in Southwest Is Now the Largest Single Outbreak Since 2000 Growing case numbers suggest that national total will surpass that seen during the last large outbreak in 2019. April 22, 2025 The spread of measles in the Southwest now constitutes the largest single outbreak since the United States declared the disease eliminated in 2000, federal scientists told state officials in a meeting on Monday. The New York Times obtained a recording of the meeting. Until now, the Centers for Disease Control and Prevention had not publicly described the outbreak in such stark terms. ... As of Thursday, the C.D.C. had reported 800 measles cases nationwide, but the current tally is likely to be higher because it takes time for the agency to collate state reports. More than 20 separate outbreaks brought the national case count in 2019 up to 1,249, a figure that the country is likely to surpass this year. (more) New York Times https://archive.ph/txXD0

-

Another non-credible COVID misinformation spreader, one among a legion of them that the Trump Admin has appointed to various govt. positions. Some examples below among many: "Bhattacharya was a lead author of a serology study released in April 2020 that suggested that as many as 80,000 residents of Santa Clara County, California, might have already been infected with SARS-CoV-2.[21] The study's design, conduct, statistical analysis, and conclusions were widely criticized as flawed.[22][23]"[24] " [emphasis added] [Explanatory note:The flawed overestimates of his study were aimed at trying to make case that COVID had a lower fatality rate than it actually had at the time, which had it been true, would have supported his arguments against COVID restrictions]. ... "In May 2021, Bhattacharya was called as an expert witness for ten applicants who filed a constitutional challenge against Manitoba's COVID-19 public health orders.[38] The judge determined that the public health restrictions did not violate charter rights, noting that most scientific and medical experts did not support Bhattacharya's views.[39]" [emphasis added] "In a 2021 case about masks in Tennessee schools, judge Waverly D. Crenshaw Jr. of the United States District Court for the Middle District of Tennessee criticized Bhattacharya's testimony as "troubling and problematic", said Bhattacharya had oversimplified conclusions of a study, and said he "offered opinions regarding the pediatric effects of masks on children, a discipline on which he admitted he was not qualified to speak".[47]" [emphasis added] In December 2022, Florida governor Ron DeSantis named Bhattacharya, Kulldorff and several others to his newly formed Public Health Integrity Committee to "offer critical assessments" of recommendations from federal health agencies.[51] Later in 2022, when COVID boosters for the Omicron variant were available, Bhattacharya made multiple misleading statements about them, including incorrectly describing how they were tested.[52] [emphasis added] https://en.wikipedia.org/wiki/Jay_Bhattacharya

- 121 replies

-

- 14

-

-

-

-

-

-

-

-

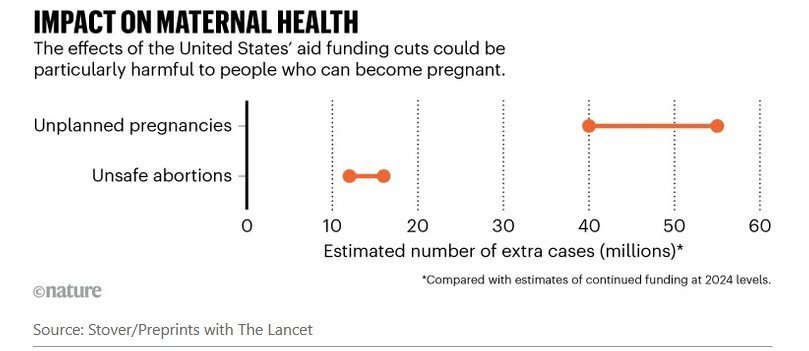

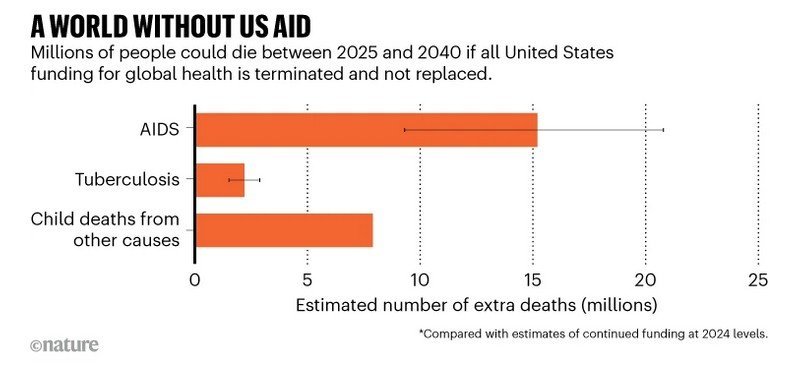

Models estimate the ginormous potential impact of foreign-aid cuts. The United States spent roughly US$12 billion on global health in 2024. Without that yearly spending, roughly 25 million people could die in the next 15 years, according to models that have estimated the impact of such cuts on programmes for tuberculosis, HIV, family planning and maternal and child health. The United States has long been the largest donor for health initiatives in poor countries, accounting for almost one-quarter of all global health assistance from donors. These investments have contributed to consistent public-health gains for more than a decade. HIV deaths, for example, dropped by 51% globally between 2010 and 2023, and deaths owing to tuberculosis dropped by 23% between 2015 and 2023. But the administration of US President Donald Trump has cut billions of dollars of spending for global health, including dismantling the US Agency for International Development (USAID) and freezing foreign-aid contributions — some of which has been temporarily restored. (more) https://www.nature.com/articles/d41586-025-01191-z

-

Increases in vaccine-preventable disease outbreaks threaten years of progress, warn WHO, UNICEF, Gavi Agencies call for sustained investments in immunization efforts amidst looming [U.S.] funding cuts 24 April 2025 Immunization efforts are under growing threat as misinformation, population growth, humanitarian crises and funding cuts jeopardize progress and leave millions of children, adolescents and adults at risk, warn WHO, UNICEF, and Gavi during World Immunization Week, 24–30 April. Outbreaks of vaccine-preventable diseases such as measles, meningitis and yellow fever are rising globally, and diseases like diphtheria, that have long been held at bay or virtually disappeared in many countries, are at risk of re-emerging. In response, the agencies are calling for urgent and sustained political attention and investment to strengthen immunization programmes and protect significant progress achieved in reducing child mortality over the past 50 years. “Vaccines have saved more than 150 million lives over the past five decades,” said WHO Director-General, Dr Tedros Adhanom Ghebreyesus. “Funding cuts to global health have put these hard-won gains in jeopardy. Outbreaks of vaccine-preventable diseases are increasing around the world, putting lives at risk and exposing countries to increased costs in treating diseases and responding to outbreaks. Countries with limited resources must invest in the highest-impact interventions – and that includes vaccines.” [emphasis added] (more) https://www.who.int/news/item/24-04-2025-increases-in-vaccine-preventable-disease-outbreaks-threaten-years-of-progress--warn-who--unicef--gavi

- 121 replies

-

- 11

-

-

-

-

-

-

Report IKEA Goes Cashless at Key Thai Stores Amid Mixed Reactions

TallGuyJohninBKK replied to snoop1130's topic in Thailand News

As a retailer in Thailand, land of spiraling consumer debts, IKEA ought to be happy to get consumers' business and money in whatever forms it's offered.... And beyond that, what's the sense of going to a policy that has 3 IKEA stores in Thailand now refusing cash purchases, but having 2 other still accepting them, including their Emsphere branch, which isn't exactly a slumming locale!!! And as referenced in the OP report, Thailand's mobile banking apps and systems aren't exactly known for being the most secure and reliable... I certainly wouldn't want to be putting all my purchasing eggs in THEIR basket! Another head-scratching move by a Thailand retailer..... -

I'm trying to follow what you're reporting above... but not entirely clear... Are you saying you have a BKK Bank Mastercard debit card, not credit card.... And that BKKB lately is telling you that you won't be able to use that debit card to make debit purchases/charges anymore involving foreign (non-Thai) merchants that don't accept OTP code confirmations as part of the purchase process???

-

Bird Flu Vaccines: Progress or Just More Panic?

TallGuyJohninBKK replied to Red Phoenix's topic in Covid/Vaccine

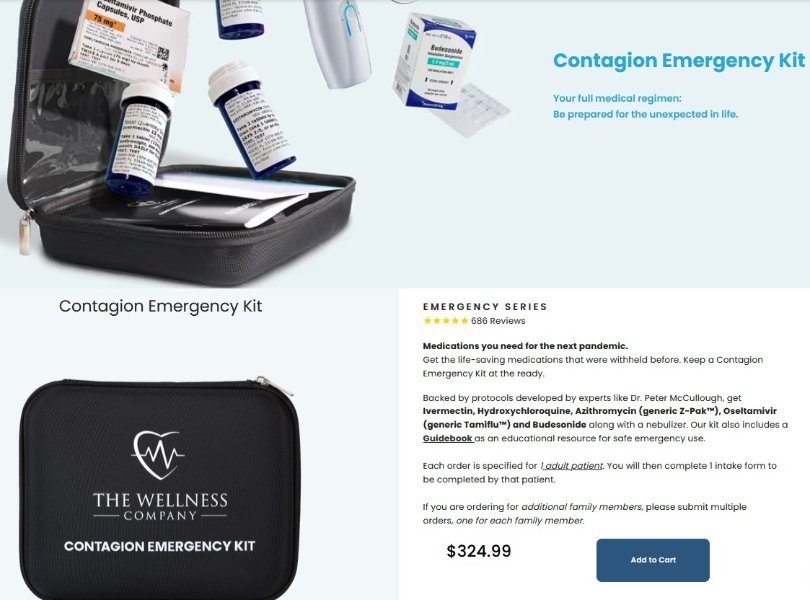

And of course, the board certification-revoked doctor in the OP, Peter McCullough, and his minions are already selling their own "Contagion Kit" for $325 a pop, complete with MAGA-favorites Ivermectin and hydroxychloroquine, for those who worry they might become infected with avian influenza: https://www.instagram.com/twc.health/reel/C8rfAqaRQmQ/ https://twitter.com/P_McCulloughMD/status/1876437720882466966 https://www.twc.health/pages/contagion-emergency-kit Perhaps by coming out against the culling of poultry for avian influenza, McCullough is hoping the disease will become a greater thread to humans and mean more of an opportunity for he and his hucksters to sell a bunch of unproven "treatments". The U.S. CDC, for its part, seems to mainly recommend Oseltamivir (generic Tamiflu) -- and not Ivermectin or Hydroxychloroquine, which already have been discredited as COVID treatments -- as its primary medication for human avian influenza: "This document provides guidance for antiviral treatment of human infection with novel influenza A viruses associated with severe human disease (examples include but are not limited to highly pathogenic avian influenza (HPAI) A(H5N1) and A(H5N6) viruses and avian influenza A(H7N9) virus). These recommendations are based on available data on the treatment of infections caused by influenza viruses, including seasonal, pandemic, and novel influenza A viruses, and expert opinion." Outpatients Initiation of antiviral treatment with oseltamivir is recommended as soon as possible for symptomatic outpatients who are confirmed, probable, or suspected cases of infection with a novel influenza A virus associated with severe human disease." https://www.cdc.gov/bird-flu/hcp/novel-av-treatment-guidance/index.html -

Bird Flu Vaccines: Progress or Just More Panic?

TallGuyJohninBKK replied to Red Phoenix's topic in Covid/Vaccine

Avian flu is not among my areas of particular familiarity... But in doing some reading, it seems as though there are several possible approaches to combating avian flu outbreaks -- each of which has its own set of risks: --Do nothing, and risk that the current outbreaks become more widespread and potentially wipe out some major portion of the U.S.'s huge and economically important poultry industry. And risk that further spread of avian influenza could spill over into becoming the next major human disease pandemic. --Continue culling poultry in the case of outbreaks, which evokes the ire of animal rights activists, and hasn't really fully prevented the continuing spread of avian flu among poultry in recent years, even though it has contained those outbreaks somewhat. --Follow the practice of some other countries and launch a poultry vaccination campaign against avian influenza, which would have to be approved and launched by the generally anti-vax Trump Admin, and which I'm sure would be heartily welcomed by all the anti-vaxers here on this part of the forum in lieu of poultry culling. 🙂 The publication Science had a report back in February offering some context on all of the above: U.S. conditionally approves vaccine to protect poultry from avian flu 14 Feb 2025 "...the U.S. Department of Agriculture (USDA) yesterday conditionally approved a vaccine to protect the birds. President Donald Trump’s administration may therefore soon face a fraught decision on whether to join the ranks of other nations—including China, France, Egypt, and Mexico—that vaccinate poultry against H5N1. Although many influenza researchers contend that vaccination can help control spread of the deadly virus, the U.S. government has long resisted allowing its use because of politics and trade concerns that many contend are unscientific. The USDA approval may signal a shift in policy linked to the Trump administration’s worries about egg prices... ... HPAI strains such as the current H5N1 have for decades been stamped out largely by culling affected flocks and enforcing strict biosecurity measures. But that strategy has failed since the February 2022 emergence in the U.S. of an H5N1 virus that belongs to a lineage known as clade 2.3.4.4b. Many scientists now worry the virus cannot be eradicated from the U.S. poultry flock, which means it has become endemic rather than epidemic." https://www.science.org/content/article/u-s-conditionally-approves-vaccine-protect-poultry-avian-flu Per the NY Times from 2024: "Since February 2022, more than 82 million farmed birds have been culled, according to the agency’s website. For context, the American poultry industry produces more than nine billion chickens and turkeys each year." https://archive.ph/Gnsiu Culling infected poultry in the absence of vaccination doesn't eradicate the disease, but instead allows it to continue spreading within some constrained limits -- which means a continuing risk that those outbreaks at some point could further spill over into more animal species and then humans on a wide scale. Are We on the Cusp of a Major Bird Flu Outbreak? March 7, 2025 "Bird flu, or H5N1 avian influenza, has been circulating across North America since 2022, infecting birds, livestock, wildlife, pets, and humans. Despite 70 documented human cases, there are no known instances of human-to-human transmission — but some scientists are starting to worry that it’s only a matter of time. ... Up until 2024, there have been almost 1,000 documented human cases of H5N1 in multiple countries, with a fatality rate of about 50 percent. In 2022, a new [for now milder] subtype of H5N1 clade 2.3.4.4b emerged in North America and spread to domestic poultry and many wild mammal species. Over the past year, this subtype of H5N1 has also been spreading in dairy cows. [emphasis added] ... HMNews: On a scale from one to ten, how worried are you about H5N1 becoming a major pandemic? [other responses omitted to comply with the forum's fair use quoting policy]... Lemieux: I would put it at a six or a seven. In infectious diseases, we have a saying that resistance is a function of time and titer, meaning that the ability for a pathogen to evolve depends on time under pressure and size of the reservoir. The virus has been with us for several years in multiple species, and the reservoir is large. I think we are living next to a volcano, and it may erupt or it may not. But we need to prepare for the possibility of a pandemic." https://hms.harvard.edu/news/are-we-cusp-major-bird-flu-outbreak -

And very oddly, no mention whatsoever in the OP about the recent government ministry public pronouncements about already planning to (or considering, depending on what day's report one reads) reduce the now-standard 60-day visa-free entry back to the prior, longstanding 30-day period that had existed until last year. Does the PM even remember / recall what visa-free entry policy this government had held for a long time prior to the change/extension last year?

-

Bird Flu Vaccines: Progress or Just More Panic?

TallGuyJohninBKK replied to Red Phoenix's topic in Covid/Vaccine

Consider the source re a discredited doctor, stripped of his medical board certifications, whose main business now is selling unproven and debunked supplement "cures" and "treatments": Per Wikipedia: "During the COVID-19 pandemic, [Peter] McCullough advocated for early treatment using the discredited treatments hydroxychloroquine and ivermectin,[25][26][24] criticized the response of the National Institutes of Health and the Food and Drug Administration,[25] dissented from public health recommendations,[27][24][28] and contributed to COVID-19 misinformation. ... McCullough has served as Chief Scientific Officer for The Wellness Company, a Florida-based dietary supplement and telehealth company, since its founding in June 2022.[53][54] In October 2022, the American Board of Internal Medicine recommended that McCullough's board certification be revoked due to his promotion of misinformation about COVID-19 vaccines. https://en.wikipedia.org/wiki/Peter_A._McCullough ABIM Revokes Certification of Another Doctor Who Made Controversial COVID Claims January 2, 2025 "The American Board of Internal Medicine (ABIM) revoked the board certification of Peter McCullough, MD, MPH, a cardiologist who promoted controversial views about COVID-19. ... McCullough is currently listed as chief science officer of The Wellness Company, the owner of which was recently reported as also investing in an anti-vaccine dating site and launching a coffee brand for "anti-woke" consumers. The Wellness Company sells supplements, one of which is called "Ultimate Spike Detox." It costs $89.99 for 120 capsules." https://www.medpagetoday.com/special-reports/features/113624 -

More anti-vax nonsense: Still No Evidence COVID-19 Vaccination Increases Cancer Risk, Despite Posts May 3, 2024 "It has not been shown that COVID-19 vaccines cause or accelerate cancer. Yet opponents of the vaccines say a new review article “has found that COVID-19 mRNA vaccines could aid cancer development.” The review conclusions are mainly based on the misinterpretation of a study on mRNA cancer vaccines in mice. [emphasis added] Clinical trials, involving thousands of people, and multiple studies have shown that the mRNA COVID-19 vaccines from Pfizer/BioNTech and Moderna are safe. Hundreds of millions of doses have been administered under close monitoring systems that have found serious side effects are rare. Studies have also shown that the vaccines work very well in preventing severe COVID-19 disease and death, saving millions of lives across the globe. There is no evidence to support a link between COVID-19 vaccines and cancer, as we’ve reported. Both the National Cancer Institute and the American Cancer Society have stated there’s no information that suggests COVID-19 vaccines cause cancer, make it more aggressive or lead to recurrence of cancer." https://www.factcheck.org/2024/05/still-no-evidence-covid-19-vaccination-increases-cancer-risk-despite-posts/

-

U.S. on track for worst measles season since 2019 "The Texas Department of State Health Services (TDSHS) today reported 27 more measles cases, pushing the number of cases in a large outbreak in West Texas to 624, as neighboring states also reported more related illnesses. The steady rise in cases puts the nation on track for the worst year since 2019, fueled by 10 outbreaks and rising numbers of travel-linked cases, part of a global surge in measles activity. ... Of the state’s cases, 602 were unvaccinated or had unknown vaccination status. So far, 64 people have been hospitalized, and the number of deaths remains at two. [emphasis added] (more) https://www.cidrap.umn.edu/measles/texas-measles-total-tops-600-cases

-

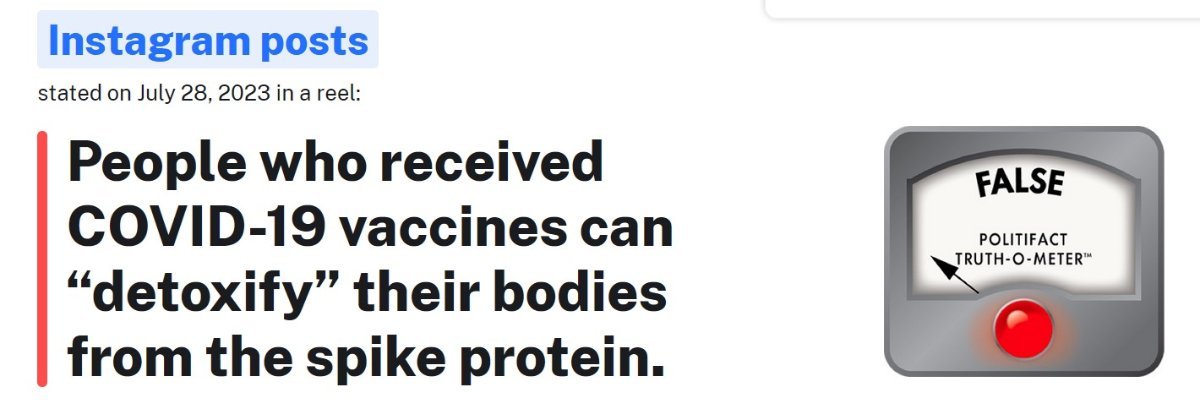

More discredited anti-vax nonsense: Ditch the detox. The spike proteins produced from COVID-19 vaccination aren’t toxins. August 2, 2023 "There is no scientific data showing that spike proteins produced from COVID-19 vaccination are toxic, a Food and Drug Administration spokesperson said. Rigorous testing and safety monitoring have found that the vaccines are safe and effective. ... PolitiFact has debunked several claims that spike proteins are harmful. We rate the claim that people who received COVID-19 vaccines can "detoxify" their bodies from the spike protein False. https://www.politifact.com/factchecks/2023/aug/02/instagram-posts/ditch-the-detox-the-spike-proteins-produced-from-c/

-

8 things doctors wish patients knew about flu vaccines American Medical Association Oct 4, 2024 ... Last year’s flu season resulted in at least 35 million illnesses, 390,000 hospitalizations and 25,000 deaths in the U.S. This included 187 pediatric deaths, according to the Centers for Disease Control and Prevention (CDC). For the 2022–2023 flu season, the CDC estimated that flu vaccination prevented 6 million flu-related illnesses in the U.S., 2.9 million medical visits, 65,000 hospitalizations and 3,700 deaths. [emphasis added] Can reduce flu risk by up to 60% “We typically don't know the effectiveness of the vaccine until we really get into flu season, and we can see what types of viruses actually end up circulating in the population,” said Dr. Kirley, adding that every year, the flu vaccine is adjusted to align with what is predicted to be the most likely strains circulating. “It typically falls somewhere between 40% and 60% effectiveness,” she said. “Even when the vaccine is only 30% effective at preventing flu, that is still very meaningful and crucial for preventing hospitalizations and deaths.” https://www.ama-assn.org/delivering-care/public-health/8-things-doctors-wish-patients-knew-about-flu-vaccines#

-

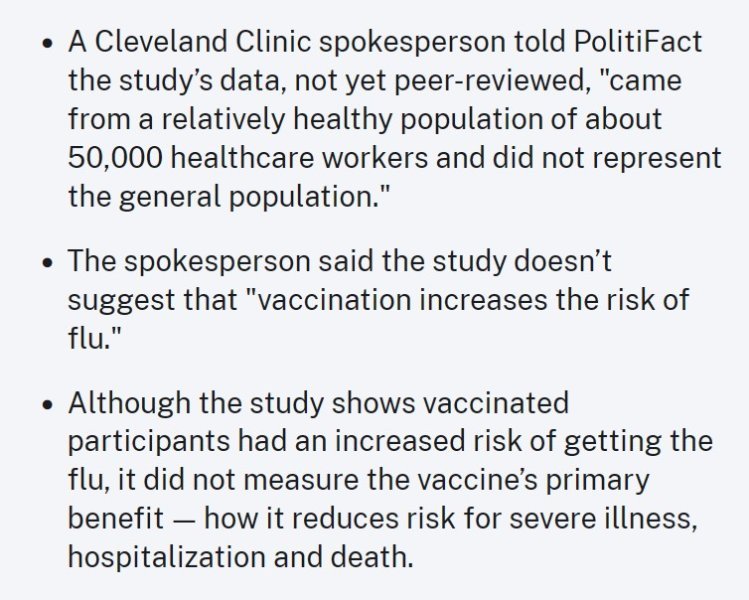

More anti-vax disinformation from the usual sources: What vaccine skeptics are getting wrong about a new Cleveland Clinic study on the flu vaccine April 11, 2025 "According to the CDC, during seasons when the flu vaccine strains and the circulating flu strains match, the vaccine "has been shown to reduce the risk of having to go to the doctor with flu by 40% to 60%. Robert H. Hopkins Jr., the National Foundation for Infectious Diseases’ medical director, said the Cleveland Clinic study does not evaluate the primary benefit for getting vaccinated against influenza: reducing one’s risk for severe illness, hospitalization and death. ... Nabin Shrestha, a physician and coauthor of the study, said that although the results found an increased risk of influenza among vaccinated participants, the authors understood that the increased risk "could have been from an unrecognized factor," and therefore did not conclude that the vaccine increases infection risk." https://www.politifact.com/article/2025/apr/11/cleveland-clinic-study-flu-vaccine-infection/

-

The latest COVID vaccine effectiveness data says the current version reduces adults' age 18 and above risk of COVID-caused emergency department or urgent care visits by about one-third, compared to those who have not received the latest version of the vaccine. Likewise, the latest version of the vaccine was found to achieve a 45-46% reduction in risk of COVID-related hospitalization for senior citizens age 65 and above, versus those who have not received the latest version of the vaccine. The U.S. Centers for Disease Control also found that COVID vaccines averted approximately 68,000 hospitalizations in the U.S. during the 2023–24 respiratory season. Interim Estimates of 2024–2025 COVID-19 Vaccine Effectiveness Among Adults Aged ≥18 Years — VISION and IVY Networks, September 2024–January 2025 U.S. Centers for Disease Control February 27, 2025 What is already known about this topic? In June 2024, CDC’s Advisory Committee on Immunization Practices (ACIP) recommended 2024–2025 COVID-19 vaccination for all persons aged ≥6 months to provide additional protection against severe COVID-19. What is added by this report? Vaccine effectiveness (VE) of 2024–2025 COVID-19 vaccine was 33% against COVID-19–associated emergency department (ED) or urgent care (UC) visits among adults aged ≥18 years and 45%–46% against hospitalizations among immunocompetent adults aged ≥65 years, compared with not receiving a 2024–2025 vaccine dose. VE against hospitalizations in immunocompromised adults aged ≥65 years was 40%. What are the implications for public health practice? These findings indicate that 2024–2025 COVID-19 vaccination provides additional protection against COVID-19–associated ED/UC encounters and hospitalization, versus no 2024–2025 vaccination and support CDC and ACIP recommendations that all persons aged ≥6 months receive 2024–2025 COVID-19 vaccination. https://www.cdc.gov/mmwr/volumes/74/wr/mm7406a1.htm

-

Memorial Sloan Kettering Cancer Center How effective is the 2024-2025 COVID-19 vaccine? Vaccination helps prevent severe COVID-19 and the risk of emergency room visits or hospitalization due to COVID-19. Studies also show that vaccination reduces the chances that you will develop long-term effects from COVID-19 infection. While vaccines may not always prevent catching COVID-19, they will protect you from getting severely ill. Are COVID-19 vaccines safe? Yes, the 2024-2025 COVID-19 vaccine is safe. It works in the same way as the original COVID-19 vaccines and all booster shots. They are made using the same process. For all versions of COVID-19 vaccines, serious side effects have been very rare, and they are treatable. [emphasis added] Can the COVID-19 vaccine cause cancer? No. None of the vaccines interact with or alter your DNA in any way. They cannot cause cancer. There is no truth to the myth that somehow the COVID-19 vaccine could inactivate the genes that suppress tumors. (more) https://www.mskcc.org/coronavirus/covid-19-vaccine

-

This IS in the Off the Beaten Track section, in its subforum for COVID & vaccine topics: And re your comment above, nothing here is "censored" anymore, as clearly evidenced by the tons of anti-vax nonsense from non-credible or even flatly no sources that regularly gets posted here with no adverse action taken.