JimGant

Advanced Member-

Posts

6,619 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by JimGant

-

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

OK, you're right -- only the USA can tax US income. Whew. No more worries about Thai taxation, as US income is all I have. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

I've already quoted the Thai-US DTA, giving primary taxation rights to Thailand on certain kinds of pensions, to include periodic payment pensions, and lump sum pensions. Believe I answered this question in my previous post. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Nope. For those UK folks subject to remittance tax, here's what is said about using a UK issued credit card to make purchases, either in the UK, or abroad. So, only if you pay off your UK credit card bill with foreign source income or gains, will it be considered a taxable remittance. Pay it off from your UK bank -- no remittance tax. Thus, only if I pay off my US credit card bill with, say, a check from my Bangkok Bank account -- or any other foreign source money, will the credit card charges being paid off be considered the equivalent of remitted foreign source income (using the UK example, which is the only one I can find). So, when I purchase something in Thailand with my US credit card -- and pay it off from my US checking account -- this is not the equivalent of treating the purchase value as a marker for foreign source remitted income. Even if the money I pay it off with would be considered assessable foreign source income -- had it been remitted to Thailand to make that purchase in lieu of my credit card. Thus, a credit card loan to buy a hamburger in Bangkok is treated the same as a bank loan to buy a condo in Bangkok. Both are loans, and both are paid back from a US source -- and are thus not treated as the equivalent of foreign source remitted income. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Bingo! -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

Of course it's nonsense. The Thai-US DTA is very clear on which US incomes are taxable by Thailand. As an example, private pensions, IRAs, and 401k distributions are primarily taxable by Thailand. Now, the treaty language actually says Thailand has "exclusive" taxation rights on this income. But the treaty's "saving clause," found in all US tax treaties, gives the US at least secondary taxation rights, "as if the treaty language did not exist." Thus, effectively Thailand has primary taxation rights on my IRA, meaning, they get to keep all the collected taxes; while the US, with secondary taxation rights, gets to tax my IRA -- but has to absorb a tax credit for the Thai taxes paid. And, yes, the US Tax Code does not allow a tax credit for foreign taxes paid on US income -- UNLESS an exception, via international tax treaty, can be shown. This is done by attaching a Form 8833 to your US tax return: "Treaty-Based Return Position Disclosure." Thus, the Internal Revenue Code is trumped by an international treaty. Thailand pockets my taxes in full; and the US pockets the difference, should the Thai tax credit be less than the US taxation. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

All pensions paid for prior govt service are EXCLUSIVELY taxable only by the US. Period. Makes no difference the amount of the pension, or whether or not it is exempt from US taxation. Social Security also exclusively taxable by the US. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

Actually, I think you nailed it in an earlier post, where you said ATM transactions could not be tracked, thus no data for TRD to make any tax evasion case -- unlike for transfers into your bank account, which, of course, would have data for TRD to ask about, "why no tax return?" Thus, just nonsensical to pursue ATM transactions. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

We still get all our bank statements hard copy, snail mail -- since the wife isn't computer literate for such retrievals. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

Right on! -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

I think the ruling that pre 2024 income is tax exempt from any remittance -- is on pretty solid ground. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

Not according to a tax professional from MTG associates, whose video was referenced here. Hey, when interpretations of all this new tax stuff is in such a state of flux -- pick the answer that best suits you, and your bottom line (and hope the matter is not later redefined, to your disadvantage). And, of course, record this source's bonafides, for possible use at a later chat with TRD. -

Foreigners and their overseas income: what next?

JimGant replied to webfact's topic in Thailand News

I've already sent 5M baht this year to Thailand, in four installments via Wise. Wise taps my savings account, which on Dec 31, 2023, was well north of 5M baht. And, for future wires, I'll have my IRA RMDs (or more, if needed) sent to my savings account -- up to the amount my IRA was valued at on Dec 31, 2023. I guess I could even have my Air Force pension (non assessable via DTA) direct deposited to my savings account. Thus, I'll have a savings account that could never run out of tax exempt remittances, at least in my lifetime. I guess if I sent many years' worth of large remittances -- and hadn't filed any tax returns 'cause remittances were non assessable income -- TRD might call me in for a chat. But, so what. I'll show them my bank statements and Wise transfer statements. Completely covered. That I keep good records is just my nature, and not for any deep worry about TRD inquests -- since plan A is my LTR visa. Good records, tho', would be there if plan B is needed. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Sounds like you're a perfect candidate for not moving. -

That makes no sense. If the worldwide taxation scenario is implemented, then the "remitted income" scenario is replaced, and goes away. There won't be any parallel taxation schemes. And if the 'powers that be' wanted LTR visa holders to have a special tax break, then there will have to be some rewording of the Royal Decree to accomodate such a tax break. Meanwhile, BoI is as clueless as the rest of us.

-

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Out of curiosity, what country are you from? And, how much will your taxes increase, under either the new remittance system, or under the potential worldwide income method? Or will they increase at all? -

New hope for men with delayed ejaculation

JimGant replied to CharlieH's topic in ASEAN NOW Community Pub

third cause -- ugly woman. -

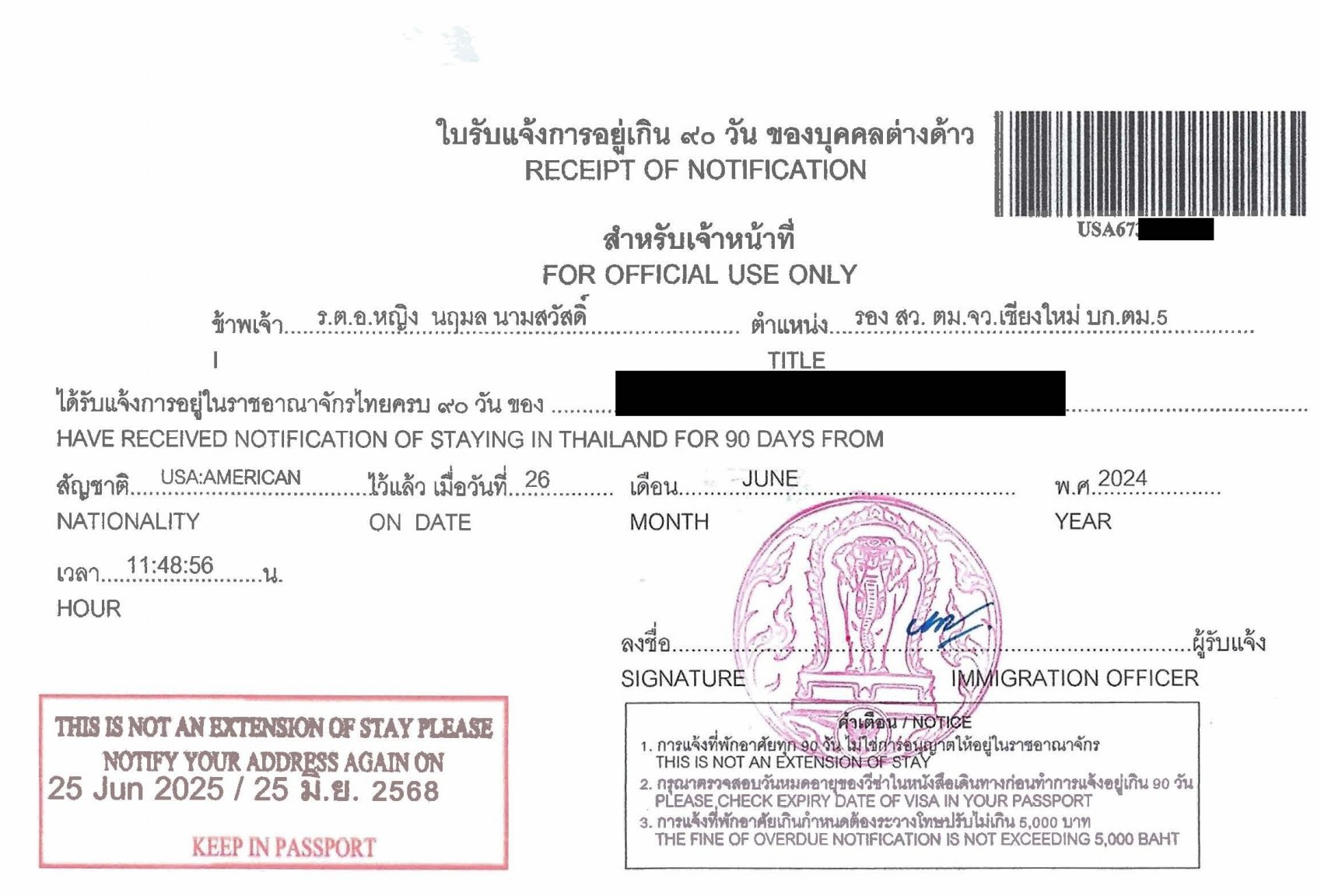

Did my one-year report in Chiang Mai, using the Star Visa agent. Asked them if I could have done this myself, using the 90-day report drive-thru window. They said, probably not, that I'd have to go inside and find someone who knew what a TM95 was. Anyway, nice to know the report can be done at CM Imm. Here's my receipt. Note they used the machine that spits out 90-day report receipts -- and my receipt is duly noted as a 90-day report receipt. But, the important annotation is: Next report is due in one year, not 90 days. So, all done for this year -- and didn't need to go to Bangkok, or hire an agent to go to Bangkok.

-

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

70-72. Her boyfriend then was Phil Mayhew, economics guy, then consul general for a year at Udorn, in 1972. He later returned to Thailand, and was DCM in, I believe, the years you mentioned. We attended his funeral at Arlington a few years back. Obviously, you were State Dept, which means you get no Social Security, which most readers probably don't understand. Also there in 72-73 was Victor Tomseth, who married another embassy worker, Wallapa. Victor was later DCM in Iran, when the hostage crisis hit. And later ambassador to Laos. Wife and Wallapa still keep in contact. Small world, eh? -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Did you then work in the US Embassy, as you alluded to in an earlier post? My wife worked there then, before PanAm hired her away, to serve coffee and give blow-job demos in life jackets. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

Reading many of your posts, I'm assuming you have a US govt pension, Social Security, and maybe some IRA drawdown. I'm in the same boat. And we're both over the $80k/pa to qualify for the LTR visa. And for me, and probably you, most of my income does not include capital gains. Thus, should the LTR tax exemption be cancelled, I'd still be in neutral taxation position, whereby, even now with Thai tax on my worldwide income, this is the same income I've been paying US income for years. And the US tax would now be reduced, dollar for dollar, by a Thai tax credit. Yes, there are outlier US taxpayers out there. The folks with large amounts of capital gain income, which, should Thailand go worldwide taxation, would now lose the US tax discount for long term cap gains. And pay a substantial taxation penalty, what with Thailand taxing at full, not discounted, rates. But I seriously doubt we're talking too many folks here. And then, the US folks, with poverty level income, that pay no US tax now. But, with Thai worldwide taxation, may now pay some (but not much tax) to Thailand. Oh well. My point: Most US taxpayers, I'd even say 90%, would not have a new tax obligation with the worldwide tax proposal -- since new Thai taxes would be credits absorbed in your US taxes. Yes, the added irritant of having to now file a Thai return is there -- but, hey, probably not too difficult a path to take. And, as an aside, a recent look at the Thai-Canada DTA shows that Canadians have an even better deal, as all their pensions -- govt, private, and IRA-like payouts -- are exclusively taxable by Canada. Maybe that's why we're not hearing a lot of complaints here from Canadians..... Anyway, all the screaming and shouting here from all those folks abandoning ship -- because they may have a future tax bill (increase) -- may be amusing, should the screamers be Americans or Canadians who can't do the math (with apologies to the few cap gain outliers). For Old World types, who now find themselves in a taxable position -- welcome to the world. As far as those besmirching Thailand, or the US -- for sure, both countries have serious problems. But, the glass is not half empty, as your negative remarks indicate. There are many compensating positives that should be emphasized. My roots became deep in Thailand, once we gave up moving into a retirement home planned on a North Carolina golf course; the wife and I loved Thailand, and analyzing long term care costs -- whose expense was shown by my folk's example -- showed Thailand trumped the golf course. And our home here was built single story, with extra rooms for long term care nurses. Now, being aged 80, golf in NC is out of the question. And future nurse occupation here in Thailand seems more certain. Fortunately, this new tax situation has no affect whatsoever on this scenario, as there will be no new taxes. Anyway, Yanks and Canucks -- make sure you do the math, before you head screaming for the borders. Others, well, adios -- may your lives remain tax free. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

"Eh" was said with a wink and a smile. Love Canadians. My finest five year tour in the Air Force was at McChord AFB, in Tacoma, Wash, in a NORAD unit, where 30% of us pilots and controllers were Canadians. Never met a bad egg Canadian. And they all played golf, and carried a jug of Rye in their bags -- meaning, by the time of the triple bet 18th hole, they were easy pickings. Good times, good memories. Hope to see more here in Chiang Mai. -

Thailand to tax residents’ foreign income irrespective of remittance

JimGant replied to snoop1130's topic in Thailand News

The Canada-Thai tax treaty does not have separate Articles for private and govt pensions -- unlike most treaties, including that of your cousins to the south. Thus, all your Canadian pensions, private and govt, are taxable ONLY by Canada. The "ONLY" word, per OECD definitions, gives exclusionary taxation rights to the referenced country. If "ONLY" was omitted from the language, then, in this example, Thailand would have secondary taxation rights. And if their taxation of these pensions was higher than Canada's -- then you pay full fare to Canada, plus the Thai taxes that exceed the Canada tax credit that Thailand has to absorb. But, this is not the case , as Thailand does not, per treaty language, have secondary taxation rights. I don't know if I can say congrats on this treaty language -- 'cause if the treaty gave exclusionary taxation rights of all Canada pensions (private and govt) to Thailand -- and Thailand tax rates were below Canada's, well, then, you'd be in a better position in this situation. I don't know -- you'd have to run the comparative numbers. But, for Canadians, nothing has changed when it comes to this new Thai taxation language -- you still file your Canadian taxes, with your pension data, per normal -- with no need to consider or file a Thai tax return. Eh?