-

Posts

17,970 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by nauseus

-

-

3 minutes ago, RayC said:

A completely separate and different issue to the one which we were discussing.

In any event, here are two examples where the UK judiciary have ruled against GCHQ (I have assumed that GCHQ was acting on the UK government's behalf).

https://www.channel4.com/news/gchq-nsa-broke-law-surveillance-prism-snowdown

Nice to be able to agree on something: Apparently Google and me do know better😉

No comparison - GCHQ is a government agency - it does not determine law.

-

1

1

-

1

1

-

-

1 hour ago, roo860 said:

I saw that interview, Michael Portillo was sat next to her, his reaction when she said this was epic!!

Yep. Choo Choo in fits.

-

1

1

-

-

2 hours ago, Geoff914 said:

Precidence was set after a group damaged Hawk trainers at Warton and got away scot free. Same when plane stupid broke into Heathrow. A bit late to say damaging aircraft at Brize Norton is a terrorist act.

Not really. These idiotic acts only encourage more, and those could be a lot worse. They need to stop.

-

2 hours ago, proton said:

Yes, the moron even says Mao helped to defeat the Japanese, when in reality it was the Nationalists who did.

Choo Choo in fits.

-

1

1

-

-

2 hours ago, transam said:

I think it's mandatory Tower of London and stretched on the rack............😯

That could be a bit controversial, the Station Commander's name is Claire. Or was, maybe?

-

1

1

-

-

2 hours ago, annotator said:

I think that there will be more good news in store for American expats in Thailand. President Trump just got Vietnam to agree to 20% tariffs on its exports to the USA. Probably something similar will happen in the case of Thailand. That means a fall in the baht in relation to the dollar. Probably deflation, too which will help American expats even more. But I think I better take down the American flag I have flying at my house.

Don't forget to salute!

-

1

1

-

-

6 minutes ago, WorriedNoodle said:

Ditto. You are cherry picking data. Why not look at the charts of the DXY from 2001 to 2008 when another Republican took control that the world laughed at.

Then you will see J/thing's bs for what it is - who won in 2008 anyway? Join the JA club.

-

1

1

-

3

3

-

2

2

-

-

1 hour ago, Jingthing said:

First things first.

I don't believe that voters should vote only based on self interest.

While that is an important factor, ideally responsible citizens should base their votes on much broader considerations.

For example, I would be happy to personally pay more tax to support Ukraine to the level where they could actually win against Russia.

But back to the topic -- U.S. expats and the Trump weak dollar policy.

From a pure self interest policy, the vast majority of expats would benefit from stronger rather than a weaker dollar.

Well the weak dollar policy is working. Weakest dollar globally since the early 1970's.

Against the baht, it would hardly be shocking to see it go to 30 or even God forbid 25.

Further economic shocks are more than possible now -- global recession, U.S. stagflation, global depression, bond market melt down, financial crises, etc.

It was indeed a much more stable economic situation under President Biden and it's fair to conclude a President Harris would not have introduced the wild risks and instability that Trump has.

So getting back the WEAK DOLLAR policy, maga fans -- did you realize before the election that was what you were voting for? If not, are you cool with it now?

To me it's kind of funny. Make America great again with a weak dollar and instigating a more serious risk of a rapid degradation of the dollar as the global reserve currency (which has been the "secret sauce" of U.S. wealth for decades).

More erroneous horsedoo. The dollar was far weaker than today from 2008-11.

Trump has been quite clear that he wants a weaker dollar and was so before the election.

-

1

1

-

3

3

-

-

3 hours ago, stevenl said:

It's ok if you don't follow. But if someone says 'he's untrustworthy ', that would be a good reason for that someone not to trust him.

Inside your very limited space, I suppose it would.

-

1

1

-

-

- Popular Post

- Popular Post

13 hours ago, Tug said:I think that’s a big part of it the uglier the better sadly……really tells you something about his supporters doesn’t it.

By far the ugliest part of this aid (old) story is that most of it quickly finds the pockets of corrupt African "officials.

-

2

2

-

1

1

-

2

2

-

-

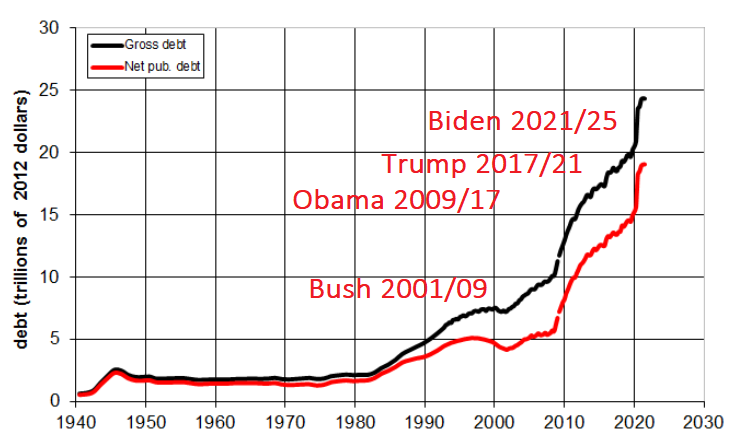

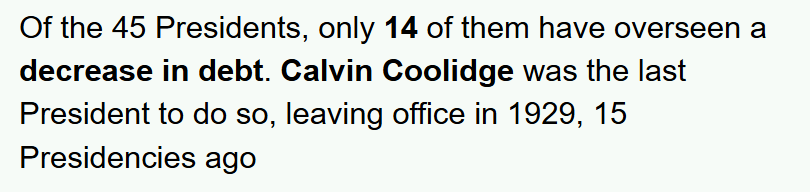

32 minutes ago, KhunLA said:

It's an requirement to be president. As seems every president has done the same thing, since 1929. They totally lost control around 1980, with constant increases onward ... especially the idiot presidents of the 21st Century.

https://www.self.inc/info/us-debt-by-president/

And what happened in 1929?

-

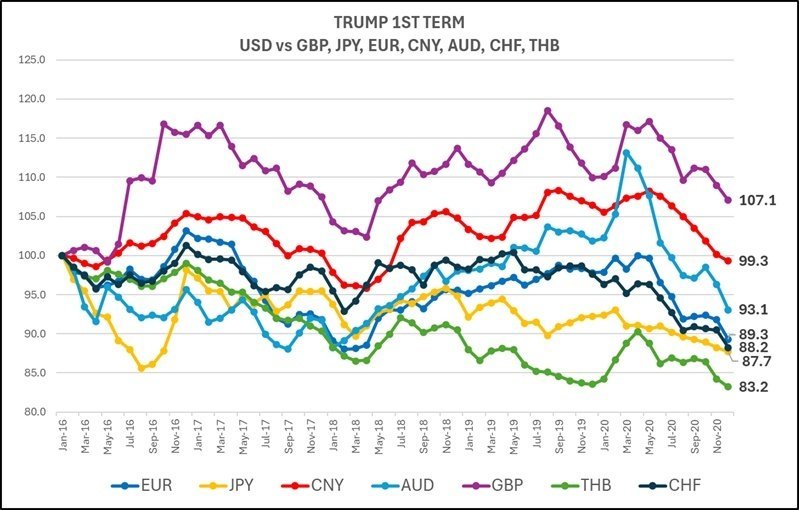

13 hours ago, AndreasHG said:

Maybe a little less than a crash, but still a significant depreciation. This is what happened during Trump's presidency. The dollar was indexed to 100 at the beginning of his presidency.

Only the pound of Brexit Britain, which was led in quick succession by Theresa “Brexit means Brexit” May, BoJo “oven ready deal” Johnson, Liz "Lettuce" Truss and, finally, the best of them all Rishi Sunak, did worse.

Off topic and even that came out of your hat.

And get some new crayons.

-

2 hours ago, stevenl said:

But it's a good reason not to trust him.

Because "people say"?

-

-

10 minutes ago, Harrisfan said:

Stocks up 20% since April

Yep. Watch out.

-

1

1

-

-

13 minutes ago, Felton Jarvis said:

If Trump is BREATHING.....he's the wrong man for the job. I never thought I would see such a monster living in the White House. A national emergency and no one seems to be aware of the danger. Stick a fork in the USA.....it's DONE!!!!

Do you like blue hair?

-

2

2

-

1

1

-

-

15 minutes ago, CallumWK said:

Trump wants a cheap dollar, as that is positive for exports.

During his first term he also crashed the dollar

Line1 yes, but not line 2. Actually The last significant dollar "crash" occurred about the time of the 2008 GFC until about 2011 (about 25% down from now). In early 2018 the Fed tried raising rates after years of zero but the stock market dipped and they gave that up immediately.

There was no real recovery after that. Just QE QE QE and NZIR's - easy money - that's why the markets are so obscenely overvalued now.

-

1 hour ago, DezLez said:

The poster's sources are certainly more reliable than the sources you seem to obtain your cr@p from that you use to spout forth on here!

Oooh...testy.

-

1

1

-

-

2 hours ago, JAG said:

There is much in what you say, although I find the thought that the creature is anybody's "wet dream" deeply disturbing!

Deeply indeed.

-

- Popular Post

- Popular Post

2 hours ago, Dan747 said:Well, here we go with more Anti-Trump "BS!" In the last week, I believe he has done more than any President in the USA, and I am looking forward for the next 3.5 years of a "GOLDEN ERA!!"

Hurrah!

-

1

1

-

1

1

-

1

1

-

3 hours ago, FolkGuitar said:

That didn't take long. 555!

Neither did Biden. 555

-

2

2

-

1

1

-

-

I just completed this quiz.

-

My Score57/100

-

My Time62 seconds

-

-

I just completed this quiz.

-

My Score10/100

-

My Time89 seconds

-

Diane Abbott Breaks Ranks Over Terror Law Targeting Palestine Action Group

in World News

Posted

It did not. You should read your own links.

Blair's monster seems to be making up it's own rules as it mutates.