LivinLOS

-

Posts

20,646 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by LivinLOS

-

-

Can anyone confirm the largest tires sizes on the stock 18 inch rims that dont rub at all ?? Or cause any issues.

Long Version. Trying to help my old man out who has just bought one in the UK, comes with stock 265-60-18s (775mm dia) which look VERY under tired in the arches.

I quick scan online says 275-65-18 is fine (815mm dia) and even one post of 265-70-18 (828mm dia) claiming no clipping but the pics he posted look awful close.

This is for my old man who wants a bit more tire but REALLY doesnt want to put up with rubbing or clipping. Speedo drift is ok but obviously dont want any ecu / computer error issues, I doubt it at the kind of change I am talking but modern cars not sure ??

Blackcircles has better choice in the 275-65's.. Geolander and cooper AT3's top of the list. -

13 hours ago, chiang mai said:

How many times do you have to be reminded that the Revenue rules require you to file a return, if you are tax resident and have assessable income of 60k baht or more? There is no TEDA calculation beforehand to see if you need to file or not and there is no calculation to see if tax is due or not.....it's very simply, tax residency and 60k baht, no more, no less and the TRD staff have confirmed that in an earlier post, as does the TRD Code.

"Every Thai tax resident, Thai or foreign, is required to file a tax return, but this does not mean that every Thai tax resident will pay income tax. Thailand’s income tax works on a bracket system, so taxpayers with higher incomes pay higher percentages of that income in tax. To meet the minimum threshold for taxation in Thailand, a taxpayer must earn a minimum income.

For unmarried individuals, they meet the minimum threshold of taxation if they:

- Have assessable income exceeding 60,000 THB.

- Have assessable income under Category 1 only that exceeds 120,000 THB".

https://www.siam-legal.com/Business-in-Thailand/thailand-income-tax-for-foreigners.php

I have been having this debate with denialists on FB over and over.. The 'I calculated my exemptions and believe I have no liability' crowd are very strong.

The Oz super guys are the heaviest in denial.. Pointing over and over to the 'soley' in the DTA without understanding (or rtaher refusing to) that if Oz chooses not to tax, that is then untaxed income.-

2

2

-

Currently have a very budget 8 x 4 fiber pool that was pumped by a .75hp chinese LX pump which I always felt was low flow but wasnt sure if it was just old / weak or not enough power spec. Pump has died and I cant get an impeller anywhere (even tho there are companies selling the pumps.. No parts !! and no reply from china HQ after many attempts.. Usual bad budget choice) so new pump time. Currently powering it with the spa pump which is noisy and higher hp.

Next year the whole lot is being pulled out and I hope to fit in a +- 10x5 overflow concrete pool and redo to a salt system and a few nicer features. None of it is properly specced out yet but assume a 1.5 deep end and a 1m shallow end, steps and features I am guessing 60 - 70 cube volume ??Makes sense to buy a pump now that will easily operate that kind of volume and healthy overflow. What hp / flow rate should I consider ?

Price is secondary (but not irrelevant) to lifespan, parts availability, efficiency.. So basically suggestions on a 'decent' brand without looking for the greatest. Theres stuff on lazada for 5k but I assume it will be chinesium junk.. Emaux seem well supported ??

Any advice or things I am unaware of ?? -

- Popular Post

1 hour ago, bigt3116 said:This will be for Thai nationals only, so why on earth would any expat worry?

This really is a non-news item.

It would be for all tax residents. Which most expats are..

Get ready for next years tax filings.-

2

2

-

2

2

-

On 10/13/2024 at 8:57 AM, sidjameson said:

Thank you Sheryl.

I'm in Exeter, south west England.

Father has had superb treatment at nuffield for prostate and under a (very fair priced) copay for bupa.-

1

1

-

1

1

-

-

- Popular Post

52 minutes ago, SAFETY FIRST said:Thailand does have a stupid law on some roads that motorbikes must be riden in the slow lane

Just to be pedantic as a rider who refuses to follow this.

Thailand doesnt have a law that says bikes must ride in the slow lane, but the police, lawyers, judges and courts seem to think it is the law and apportion blame accordingly.

Go through the road traffic act and code with a fine tooth comb and no such law exists. There is one line which applies equally to cars bikes and any other road user which says something like 'all vehicles should remain in the leftmost lane unless overtaking'.-

3

3

-

5

5

-

1

1

-

1

1

-

On 8/24/2024 at 9:23 PM, Rob Browder said:

His neighbors told the cops to get rid of him for them, so they dug up an antiquated law to use for convenience.

Possibly.. But that clearly shows you the law exists doesnt it ??

You cannot be charged for a crime that is not a crime.-

1

1

-

-

On 8/26/2024 at 8:18 AM, Tomtomtom69 said:

Nonsense.

Anyway, why revisit the past? It's legal now...

Only on a DTV (and possibly LTR tho it isnt clearly exempted in the Royal gazette publications for the LTR) it is not 'generally' legal.

Also what is nonsense.. These cases have been very public knowledge to anyone who looks. -

12 hours ago, maesariang said:

Paid her off no doubt. Video showed a kick.

No or she would have dropped the case not needing the judges involvement. She has pushed consistently for his punishment and deportation.

Considering the sheer volume of dodgy things on Phuket it seemed petty at a minimum. Only in any way news because she was a 'Dr' and enough status to push it. -

On 8/8/2024 at 6:32 AM, Tomtomtom69 said:

It is.

Sending an email that has nothing to do with Thailand is hugely different from selling jewelry presumably to clients within Thailand. The latter is clearly working from Thailand.

She got caught for making Thailand look bad. As you probably know, defamation is a criminal offense in Thailand and foreigners that make the country look bad are deported.

The easiest way to do so, is find something else to charge them with, because it's an automatic and quick deportation that way.

She was also blacklisted by the way. Essentially all for saying bad things about the Kingdom.

So how about the teacher working online ?? Not paid in Thailand no Thai clients. Arrested, processed through the IDC and deported.

-

1

1

-

-

On 8/8/2024 at 1:13 AM, Presnock said:

BOI specifically said I could get a work permit - they would assist - wealthy pensioner LTR holder. funny how all the folks that don't even have a particular visa want all to think that they are the experts for that particular visa. Have a good day.

Your not reading him..

The OP falls under the work from Thailand professional category and can't get a digital work permit for that category.

You can not obtain a work permit on the work from Thailand professional category, for your non Thai work. There has to be a Thai employer to obtain a work permit.

Which means someone who is on the wealthy pensioner who wishes to work in Thailand, can apply for a work permit for that work which they do for a Thai entity but not for work done for a non Thai entity. -

Just now, sandyf said:

It is against the rules to alter a post.

I was not aware of that rule.. However I hope the edit should make it clear why the statement works.. There is a conditional in the statement which you seem to seek to avoid.

-

1

1

-

-

The DTA states

"Any pension paid .. in respect of services of a governmental nature rendered to that State or subdivision or local authority thereof shall be taxable only in that State."

The caveat of 'in respect to' should also be clear ?-

1

1

-

-

2 minutes ago, Phulublub said:

Your quote is specifically about the UK State Pension which, I agree, is not taxed in the UK if you are non-tax resident. Other pensions ARE taxed in the UK. That they may not be taxed at source if you file a P85 is not the issue - there is still a tax liability.

PH

Private pensions absolutely should not be taxed at source in UK.What pensions are you claiming are UK taxable for a non resident ?

-

1 hour ago, NoDisplayName said:

A government pension is remitted, and under most DTA's not assessable.

Many, even most Gov pensions (western) are assessable..

N Americans are not in that.-

1

1

-

-

5 hours ago, sirineou said:

They better get their act together we only have 5 months remaining in the Year I am transfering funds to Thailand that I don't even know how they will taxed, or even if they will be taxed at all. My next door neighbor wants to sell the lot next to our house. I would love to buy it. But I an afraid to transfer the funds, because I don't know how it will be taxed. Once again they are shooting themselves on the foot.

You can gift your wife 20 million per year.. tax free...

Send it to her if she would be buying the land.-

1

1

-

-

18 hours ago, Phulublub said:

Would you like to quote a reputable source for that statment? It appears to be directly at odds wth this:

Your UK residence status affects whether you need to pay tax in the UK on your foreign income.

Non-residents only pay tax on their UK income - they do not pay UK tax on their foreign income.

Residents normally pay UK tax on all their income, whether it’s from the UK or abroad. But there are special rules for UK residents whose permanent home (‘domicile’) is abroad.

From:

and this:

You usually have to pay tax on your UK income even if you’re not a UK resident. Income includes things like:

- pension

- rental income

- savings interest

- wages

From:

https://www.gov.uk/tax-uk-income-live-abroad

Pensions 100% not, I used to supply SIPP pensions from a previous business and the process is file a P85, obtain an NT tax code, do not get taxed at source.

The only caveat for the UK is armed forces pensions and some senior civil servants which ARE always taxed at source.

https://www.gov.uk/tax-on-pension/tax-when-you-live-abroad#

Quote -

8 minutes ago, Mike Teavee said:

There's been at least 1 report of somebody going into their Tax Office and asking if they needed to File as all of their income was not taxable by Thailand under a DTA & they were told that they didn't have to.

I think a lot of people will be filing non-taxable reports if this guidance was wrong (Plus a lot of US guys who thought they didn't need to file are going to be very upset).

Local tax offices are frankly clueless.. I went to mine early in the year and they had so little understanding of the new rules, DTA's etc it was laughable.. Plus that WAS they way it was, now with the rule change, is that the way it is next year ?? I would liek them to put it in writing (I bet they resist that !!).

This was recently published but still crucially does not adress the point we are both discussing. I agree with you that at this point we dont know, I tend to be suspicious enough to thing they will demand it, maybe not year 1, but over time as the noose tightens.

https://drive.google.com/file/d/1l0uv2e9anPg9tgs9WzuBTQSETFQhzqJu/view?usp=drive_link-

2

2

-

-

I dont believe you should pay any UK taxation other than arising from a fixed domestic asset (rental returns, forestry income, that kind of thing). I would need to check dividends, its not on my radar, possibly from a REIT I could imagine it being domestic source.. .. But people frequently think you need to pay uk tax on pensions etc and thats 100% incorrect.

-

- Popular Post

- Popular Post

3 hours ago, Caldera said:While I take your post as saying that whether you extend or border hop potentially has an impact on tax enforcement, it's worth noting that it doesn't have an implication on your tax residency status.

In case of an audit (which could happen years later), you could be back-taxed and fined for those years you spent 180+ days in Thailand but they didn't know about you yet.

Of course..

But theres a 'where the rubber meets the road' consideration in this, and also in how Thailand tends to treat things. They cast a wide but leaky net in general.

Everyone should have a plan, If you have a spouse make use of the tax free gifting that is possible, if you have taxed at source income elsewhere, only bring in that much yourself each year as it then has a DTA protection.. Layers on layers of cover.One of my income streams is a very minimal directorship salary I have to take, IIRC its about 15k eur and it HAS to be taxed at source.. I send that 15k for my pocket money.. My wife gets money sent is as a gift for her use (bills etc). Those 2 things can cover my cost of living fully. Until theres clarity I wont be buyign any more land or other inward investments. Thailands loss.

-

1

1

-

2

2

-

1

1

-

2

2

-

6 minutes ago, Mike Teavee said:

The Tax is taken out before you get your Dividend and the rate/yield of the dividend is quoted as the after Tax amount but Withheld tax has been taken.

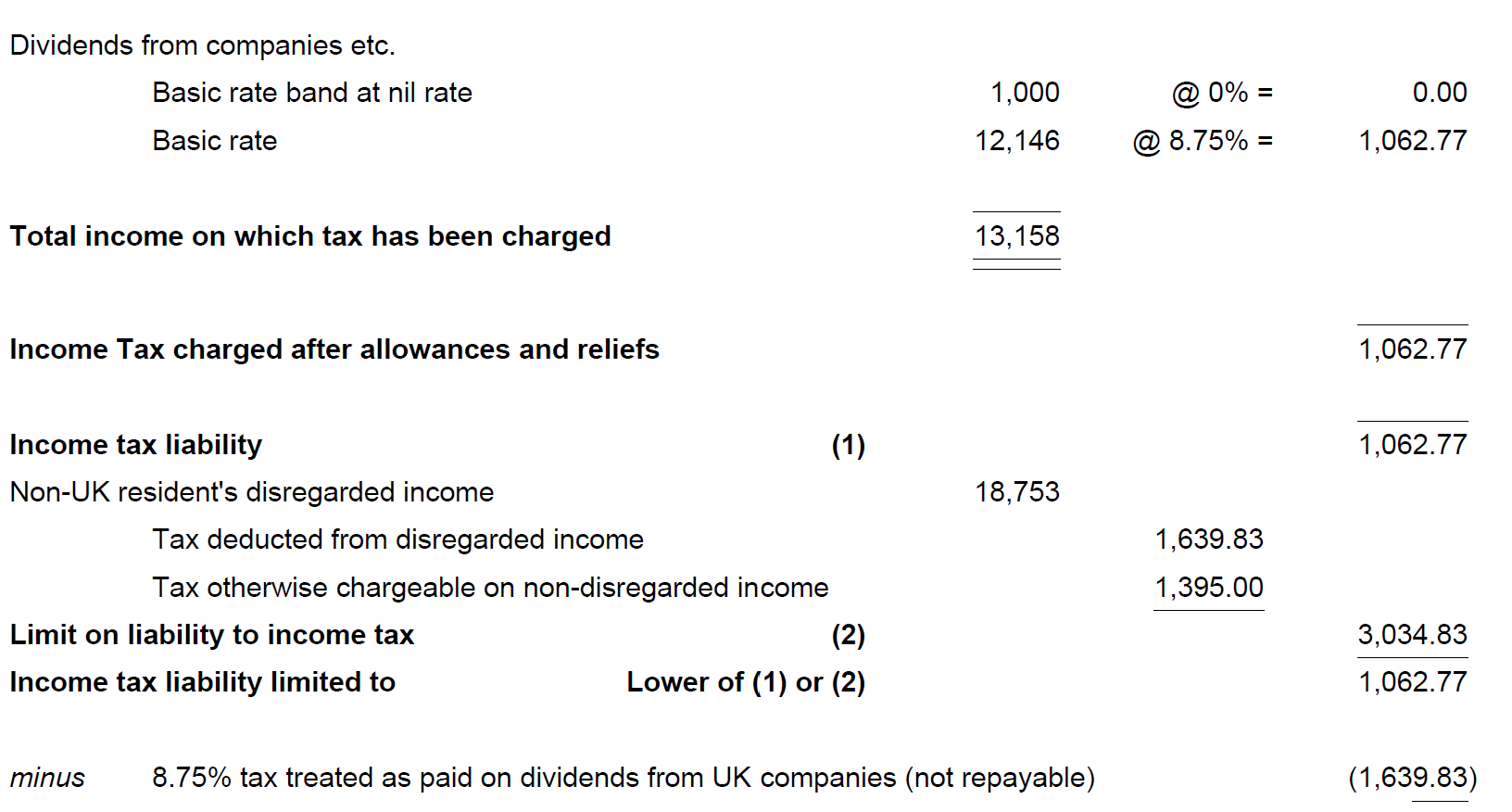

This is taken from my 2023/24 UK Tax return prepared by my accountant... NB the final line "8.75% tax treated as paid on dividends from UK companies (Not Repayable).

Have you filed a P85 and obtained an NT tax code ?? -

3 hours ago, Mike Teavee said:

I believe it's self assessment so it's up to the individual to judge whether it's assessable income or not & US SS is not so no need to report/file.

I think this is an easy determination.. 'Assessable' income is the amount sent in if you are tax resident, thats different from 'liability' to pay..

Do you need to file if not liable ? Or do you need to file asessable income anyway.. To be determined. -

16 minutes ago, Mike Teavee said:

Just to clarify it's 120K/220K of assessable income so somebody remitting 1Million THB pa of US Social Security "Income" would not have to file a return as they have no assessable income.

Your mixing up assessable income and liability.. Someone who remits 1 mil thb funds has a 1 mil assessable income they 'might' have to justify.. Of course if it is social security, or pre jan 1 savings, or otherwise protected under a DTA then it may have no liability, but it IS still assessable to determine that.

If they choose to go this hard on it is anyones guess, this is all too new to know.-

1

1

-

1

1

-

-

I assume this has already been postyed as its many weeks old ?? apologies if it has and this is a known thing. Roi Et immigration asking for banking balance, deposit type etc.

But here can really see how immigration can start looking at how much savings you have here, and how next year any difference from this year could need to be justified.

The vast majority of the expats I meet in the real world seem to just be in total denial that the systems are changing, they are adopting an ignore it plan of action..

Pool test strips ? Inkbird Plus useless ??

in Swimming Pool Forum

Posted

Anyone reccomend a good brand of these locally available ??

Just trying to check hardness and alkanility etc but the test kit I have appears totally useless ??

Top 2 are exposed / wet (tried a second one in case the first was a special dud) bottom is 100% dry..

Not exactly learning much from that !!