- Popular Post

LivinLOS

-

Posts

20,646 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by LivinLOS

-

-

On 7/22/2024 at 4:53 PM, stat said:

So is the majority of the UK guys still tax resident in UK as well as in TH? Thx!

But cruciually they should not be, the UK is a territorial tax regime and once you leave you should file a P85 and tell them so (and obtain an NT tax code for domestic income taxed at source like pensions).

That is how the DTA is to be looked at, now will Thailand say 'ok you paid it there.. thats pre taxed have a tax credit' which imo they are likely to, or will they say under the DTA you shoudlnt be paying it there, you should pay it where you are resident ie here, and you now should apply to the UK for a UK tax credit against your Thai bill which is xxxxx..

Thats entirely possible in law and even how it 'should' be done.. Any expat moving to eg portugal or another developed country with a properly applied tax system would operate like this.-

1

1

-

-

Just now, Lorry said:

Visa fees or extension fees are not published in the royal gazette, are they?

They are not however they are ALL 1900 thb.. If it was to be non standard you would think it would be stated, to not do so at the very least implies it is standard. This is now repeated by the Dep Dir of Min FA.. So multiple data points.

Really we will know next jan when its attempted.

CM immigration runs a really good chat that answers questions accurately (as cm policy) and they were not able to answer this liek they usually did. They gave me a name and number and told me to call it next week. -

2 hours ago, mania said:

The one thing they didn't mention that I was curious about is 90 day reports then? Likely not needed I guess? But would have been nice to hear it from the official

90 day reports are needed, but if you dont extend who and when will they police them ??

Same with TM30s tho with the new rules on TM30s being 'once per visa' and not to be redone after a hotel stay you can do one TM30 at the first day of entry and have that be valid for 5 years you remain at one address. -

23 minutes ago, wmlc said:

There is no one year reset of any clock of you never extend inside Thailand. You can simply leave at the end of each 180 day stay and then re enter to get another 180 days. You can do this for the entire 5 years without ever needing to extend the visa inside Thailand. The one year is only related to extensions meaning one extension only for every entry.

This also has a knock on implication, which is tax related.

If extensions are the point where revenue tries to link expats to inbound funds, possibly demanding a TTN, or even proof of returns etc.. Then by just border hopping and clock resetting of 180, you avoid all immigration interaction.

-

1

1

-

-

On 7/18/2024 at 8:17 AM, anrcaccount said:

Agree LivingLOS, it is quite simple.

Unlimited entries in a 5 year period. Each entry, 180 days stay,( unless you reach the end of the 5 years e.g. enter 30 days before the end of the 5 years, stay permission stamp only valid 30 days until end of the visa)

Each stay can be extended at local immigration(if required), for an additional 180 days. After 360 days consecutively, you would have to leave and re enter. However if you left after say 150 days, on re entry you get 180 days.

Cost of extension will be 1900 as per every other extension, but has been reported at 10000, I believe this will prove to be incorrect. BKK Immigration stated extensions at 1900.

Tax is a separate discussion, which should be had on separate threads.

Nailed it.. Back while it was still guesswork... Well done 😉

-

1

1

-

1

1

-

-

2 hours ago, Lorry said:

This is the only new point in Chris Parker's latest video.

The MFA official said, requirements for extension would probably be the same as when applying for the visa.

He was honest enough to say that he can only guess. It's not in the realm of MFA, it's immigration who will decide these requirements for extension.

Right but it does semi rule out the idea of it being 10k to extend. It ISNT in the royal gazette, and it isnt the belief of the MFA, so theres no authority for immigration to think it now.

It was mentioned in the initial cabinet meeting where the visa class was proposed, but a proposal isnt binding, we could have never got it.. The royal gazette is binding and makes no mention of 10k at all.-

1

1

-

-

5 hours ago, zzzzz said:

one thing no one has brought up

and one thing i am concerned with as this is very attractive

How will immigration look at issuing this new 5 year visa and seeing the applicant has been on a yearly retirement ( or marriage) extension for 1, 2, 5 years?

23 year resident.. Passport full of stamps.. marriage.. extensions.. visas..

First one posted online as issued 24h after it opened to evisa..-

1

1

-

1

1

-

-

14 hours ago, Sheryl said:

I would definitely not assume this. It is unspecified how long an interval is needed after leaving the country and returning but good bet IOs will often flag, question and even refuse entry to people whose entry history indicates long term (more than a year) residence in Thailand. Same as they now do for visa exempt entries. Of course possible some visa run companies will partner with a "flexible" remote border outpost, again like with visa except entries. But this will not be risk free.

That just doesnt happen with any other VISA though does it..

And now visa exempt entries have become unlimited also.. So that isnt even a risk without a visa.

You have to just come to terms with the idea they appear to have opened the floodgates.-

1

1

-

-

15 hours ago, Maestro said:

I see the requirement of documents for the 180-day extensions as the only important question remaining open with the DTV. The existing Police Order for extensions needs to be amended or replaced before the first applications are made at immigration offices.

Until then, it is a free for all for guesses, assumptions, speculations and expectations in this regard.

Perfect clarity.. Hat tip for being able to succinctly and accurately summarise the situation with zero ambiguity.. -

17 hours ago, TallGuyJohninBKK said:

About the issue of a DTV holder wanting to do subsequent 180-day in-country extensions at Thai Immigration (one per each new entry to Thailand allowed under the 5-year visa), one thing that the MFA official indicated in the video was that Thai Immigration, in addition to asking for the standard 1,900 baht extension fee each time, would also want to see documentation of eligibility for the visa extension itself each time. Even in years 2 or 3 or 4 or 5 of the original visa.

Unfortunately, the MFA official didn't go into any further detail about that issue... But for example, if someone gets a DTV visa in 2024 based on attending a Thai cooking class or for some medical procedure, it raises the question of whether Immigration in years 2-5 is going to be satisfied with the original DTV documentation OR whether they're then going to want to see some ongoing, then-still-current proof of eligibility. That question wasn't addressed.

But, if I were a guessing / betting man, assuming the MFA official was correct about how Immigration will handle DTV visa in-country extensions, my guess would be that in years 2-5 of the DTV visa, that they're going to want to see some then still-current proof of eligibility -- not just repeating proof of some activity done back in 2024 and then not continued into the ensuing years.

Presumably, for in-country DTV extensions, that also would include having to each time prove the DTV holder still has the required 500K baht on deposit in a bank account somewhere (in or out of Thailand).

If local immigration put up too many barriers, people will just border bounce.. Its self defeating because theres a super simple alternative.

-

1

1

-

-

18 hours ago, anrcaccount said:

While unintended, it also tempt many who already reside here on other visas to switch, due to the ease vs their yearly mountain of paperwork.

Already seen and had discussions with many different folks talkign about closing company or even BOI smart categories.. Some chatted with me about Hong kong corps and usa LLCs to be thier employer specifically to stop Thai incorporation and offshore themselves while living here.

Lower taxes, ability to keep funds offshore from Th and not pay corp taxes, thai internet sales tax, etc etc.. Businesses that were non viable for online incorp here due to Thailands costs, taxes and beaurocracy are now fully legal to do.-

1

1

-

-

On 7/27/2024 at 7:28 AM, Matt S said:

Are most people going down the workation route?

I’m wondering if the soft power route is better if we get tax questions at a later date.

would be good to hear of soft power dtv visas being issued and what documentation was required.

In tax terms it shouldnt make a difference, as the test is 180 days.. After that all inbound funds are 'potentially' taxable.. The workaction or soft power aspect means nothing in law, it might of course mean something in mindset and application of it later I do understand.-

1

1

-

-

On 7/27/2024 at 4:29 AM, racket said:

The key factor to consider is the income tax requirements. I believe an individual becomes liable for income tax in Thailand after staying in the country for 180 days or more, unless a tax treaty applies. However, it’s relatively easy to circumvent this by leaving Thailand and returning before reaching that threshold. It will be interesting to see how this situation evolves.

Here are more details on the tax requirements: https://www.expattaxthailand.com/wp-content/uploads/2024/07/FOREIGNERS_PAY_TAX2024.pdf

The situation doesnt go away of course, the days for tax residency is totally independant of what visa class, you could be tax resident and on 60 day visa exempt entries.

But it does mean you wouldnt have any real interaction with immigration, so how does it then get enforced.-

1

1

-

-

13 minutes ago, TallGuyJohninBKK said:

That's an interesting nuance... Do we know the underlying source for the claim that the 5-year DTV might be a one and done proposition?

I questioned it too but no reply.. Only 'his sources'..

I also heard from a trusted source that he went to cheang wattana and the officers there didnt agree.. IIRC he claimed 2 said unlimited 1 said 1 time 180 over the 5 years, so there is confusion at immigration level still.

Remember the video is dp dir of the MFA, they sell the visas, but arriving and handling here is immigration, totally different and does have its own understandings sometimes.-

1

1

-

-

- Popular Post

- Popular Post

On 7/26/2024 at 3:59 PM, anrcaccount said:They're giving it away like candy.

I don't think people realise this is the biggest relaxation in Thai visa rules in a very long time. Decades likely.

Game has radically changed, it's open season now.

Oh I think we do.. and exactly why the retirees and married are moaning..

LTR for wealthy folks with zero tax

DTV for younger folks, trivially easy to obtain.. years of come and go.

60 days +30 visa exempt entry, do nothing and get what a multiple entry TR used to get.

The floodgates have been opened, just as the tax laws change and close the savings loophole.-

4

4

-

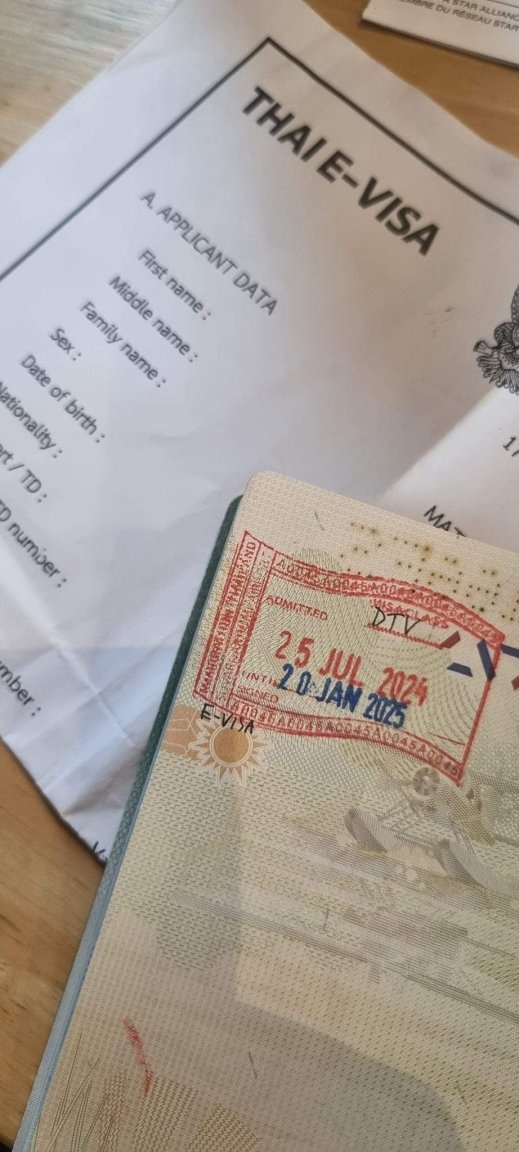

Great video.. fully confirming what I believed to be the case from the royal gazette. Unlimited entries and 1900 thb being the primary ones.

The only tiny caveat left is he is from the MFA, who issues the visa, NOT from immigration who process arrival and extensions. It 'should' all go that way now, but we know how variable it can be.-

1

1

-

-

Waking up in the UK and just saw the YT vid and came here to check it was already posted..

The multiple 180 cleared up (was obvious to anyone who read the Royal gazette is makes it very clear in art 3 4 and 5 repeating multiple entries and even 'infinite times use' depending on translation.

The extension fee of 1900 baht, tho he did semi defer that to immigration it seems totaly unlikley that its 10k now as it sint in the royal gazette either, it IS listed in the minutes of the cabinet meeting but that was at the concept stage.

He should have taken 5 minutes to emphasize the working rights, which are clearly stated in the gazette nd differentiate it from others with that.

Basically it is all wins.-

1

1

-

-

5 minutes ago, treetops said:

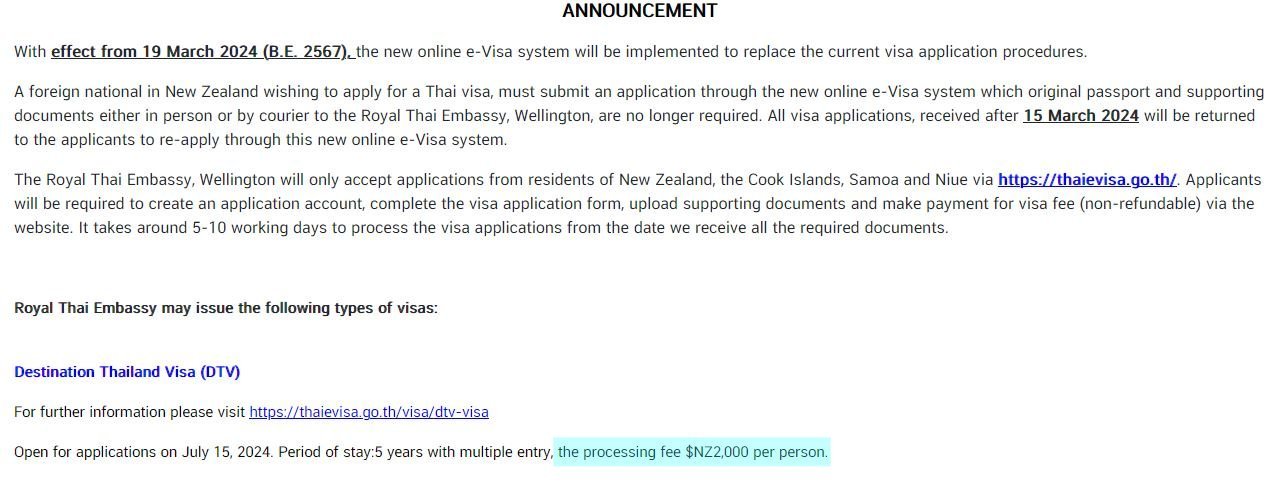

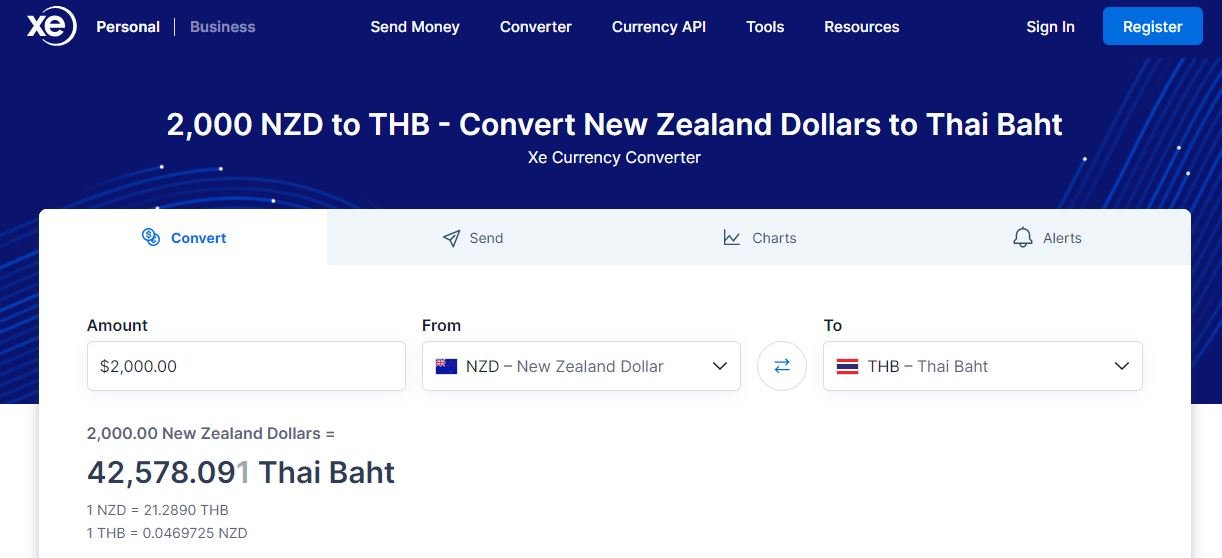

Pre-DTV days but this was discussed regarding other visa costs when it was first announced.

https://aseannow.com/topic/1320861-new-visa-fees-beginning-on-19th-march-2024/

Wild.. The NZ embassy does not want to be doing consular visa work !! -

- Popular Post

3 hours ago, lordgrinz said:Adding another vice to an already lawless society with out-of-control corruption, is the worst idea for the country.

and yet does it add another vice or allow people an option with a less damaging vice ??

How many heavy drinkers have cut down their alcohol use self medicating with cannabis ??-

3

3

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

-

3 hours ago, farang51 said:

@LivinLOS and others that got the DTV: How long before your stated travelling date did you apply?

I am going to Thailand October 2nd and I do not want to apply too early.

about 4 weeks ? 19 aug -

4 hours ago, Bandersnatch said:

Based upon your extensive experience owning EVs over the past few decades?or is that just your uniformed opinion?

Well the fact that current battery tech doesnt !!

-

- Popular Post

- Popular Post

34 minutes ago, Crossy said:

I have no dog in the fight.. you asked for data.. that had data..

What I see in the west is much steeper initial depretiation but also totall deprtetiation 8 - 10 years old..

I have a 18 year old truck and a 15 year old BMW.. Both doing fine.. as well as a 40 year old classic.. I cant imagine any electric battery holding up long term..-

1

1

-

2

2

DTV issued

in Thai Visas, Residency, and Work Permits

Posted

1) evisa

2) nothing that would stop it in the application process, however it is a known hot issue, and the passport would clearly show Thai entry stamps in it, during the time the evisa is issued.. Any IO for the duration of the passport and DTV can see that, shoudl any one of them notice you can be in a lot of hassle. I have even read text that as well as refusal of entry and invalidation of the visa you can be barred from applying for visa anywhere in the future !!

You would be seriously unwise to attempt that !! Even back in the old days where dodgy visa companies used to get 1 year visas from around the world for you, they stamped the passport out, got the visa and stamped the passport back in for you so the dates matched.