LivinLOS

Advanced Member-

Posts

20,646 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by LivinLOS

-

Will in august but I am not sure back fror a bit

-

http://www.news.com.au/travel/travel-updates/incidents/aussie-teacher-details-horrific-conditions-inside-thai-detention/news-story/d432a704bf0db1def6d79489ae1b830c I assume you will retract that and not make that claim again ?

-

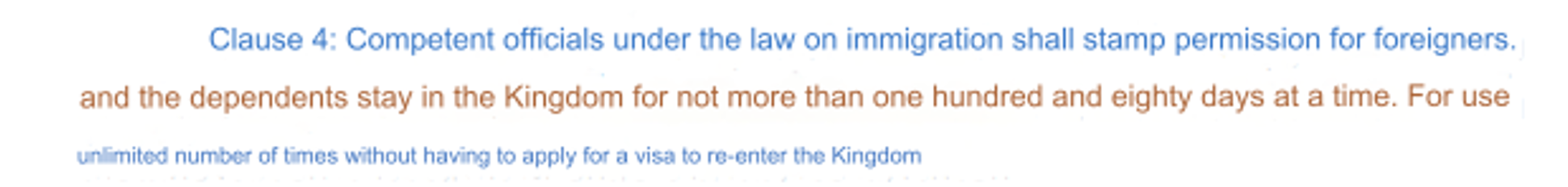

Combined with the new tax rules it would seem they will look for returns on all long stayers (info published last week) so opening the doors and opening the tax collection.

-

these will be required is my reading. Theres no reason why they would not be to apply to all non Thais irrespective of visa class.

-

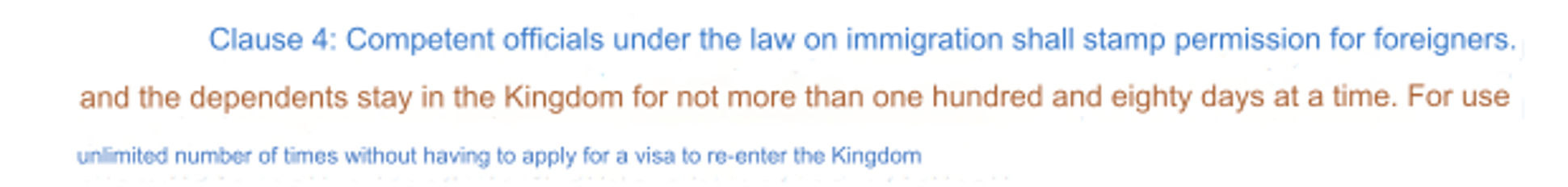

TAT is a mess tho.. This isnt stated in the royal gazette or the cabinet meeting minutes. In fact clause 4 clearly states 'unlimited number of times'

-

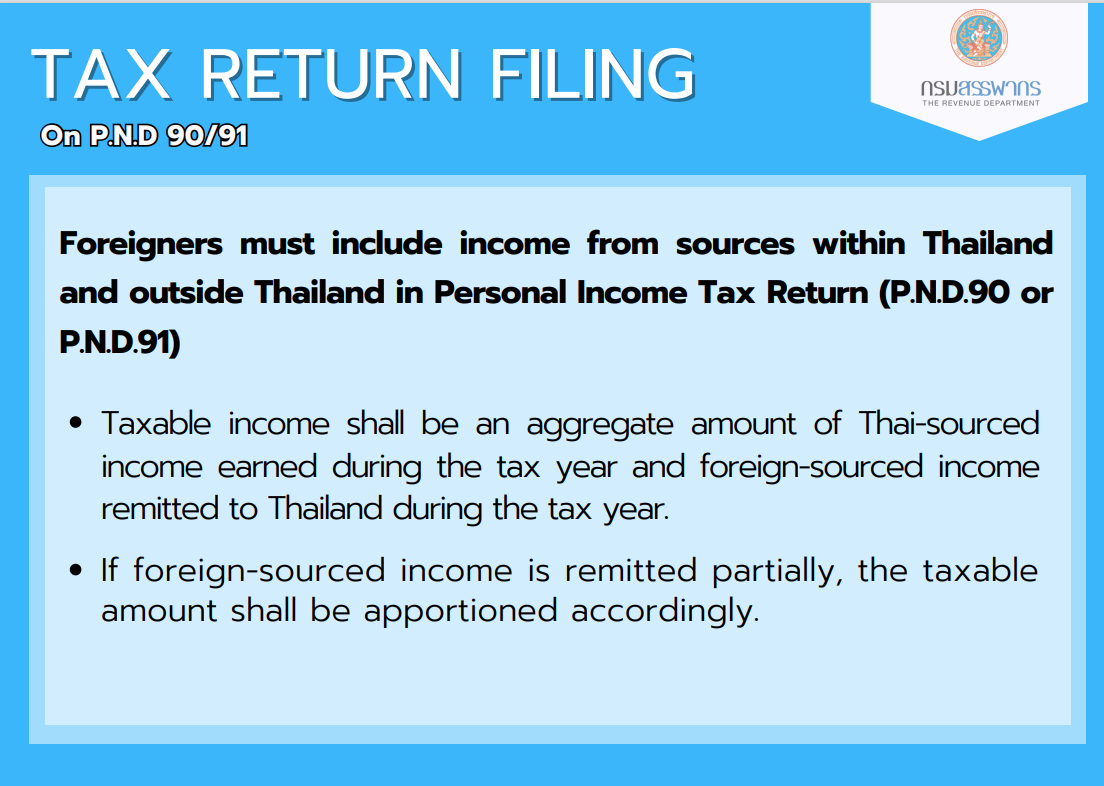

Actually theres some room for debate here.. In the minutes of the cabinet (IIRC I have read so many docs now) meeting theres the wording that 500k 'throughout the stay'.. but of course translation, interpretation etc. I can easily imagine 500k being needed to extend at 180 days being part of it.

-

Letter from one of my own companies (dir on letterhead) and a tax summary of last year (irish) I showed outside Thailand

-

Yes I had 500k in Thailand but uploaded a western bank (with a healthy balance) to the system

-

Without digging through pages of threads I am unsure if this guidance from the Revenue Dept has been shared before ?? If it has my apologies and ignore https://drive.google.com/file/d/1l0uv2e9anPg9tgs9WzuBTQSETFQhzqJu/view?usp=sharing Very simple guidance, but one part that jumped out is attached, which clearly implies that even if you do now have a tax liability, anyone who has an income will need to file, even if that income means your protected under DTA or other taxed at source earnings.

-

Officer Killed, Hostages Freed After 8-Hour Standoff in Bangkok Suburb

LivinLOS replied to webfact's topic in Bangkok News

But of course.. -

good question.. mine expires next year I think..

-

Another thing brought up this text translates as If literal 'throughout' implies you must maintain 500k thb for the duration of the visa. This makes less sense when you apply with offshore funds as 1) you dont have the funds in Thailand or THB and they cannot check the initial application account balances. In my case unbothered as I would have 500k in my offshore accounts always.. The bank demands 100k GBP depsosit for the relationship manager service level.

-

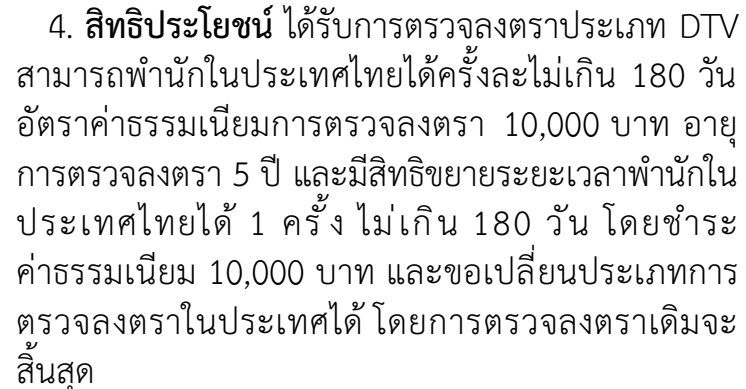

In the interests of full disclosure.. I was just sent this on FB.. Which would appear to indicate that yes, the 180 day extension also costs 10k THB. That makes little real world sense IMO as you can border bounce instead ?? If its a ME, this text reads more like a one time entry.

-

The BOI agent told me that the other 3 can also get a work permit too.. Wealthy global citizen, wealthy pensioner, or work from Thailand (in addition to not needing a work permit for remote work of course) IF they have a Thai sponsor company and wish to do work here. Also mentioned some benefits (2 staff, easier approval) but I wasnt giving it full attention. I didnt ask too much as I have no desire for any Thai employment, I like being well paid 😁 but he clearly said multiple times you can get one, and I was very clear in that wealthy pensioner was the route I would attempt.

-

I think you have comprehension problems.. Maybe english isnt your first language. Your replying to a comment that started with "Foreigners often think you need a work permit to work remotely, but you don't. " that is what is incorrect, you DO need a work permit to work online from Thailand unless on a DTV or (arguably imo) the LTR classes. I admit enforcement of this is poor but working online = work and needs a work permit or a legal exemption. NO ONE is saying you can get a work permit on a DTV.. No one.. So what are you are argueing exactly ??

-

Unidentified respiratory illness in Bangkok, what is it?

LivinLOS replied to rabas's topic in Health and Medicine

Those cheap covid tests are not entirely reliable.. A year back I tested neg for days when ill, and finally as I started to get better tested pos. -

Do nothing and fly in.. Zero effort.. Its 60 day (and+30) visa exempt unlimited now which makes applying for tourist visas a moot point.

-

OK thats a change I was not aware of (but still question as it makes ME TR visas oddly short) but understandable. Unconcerned really.. 300 quid for 5 years with working permission online is the deal of the decade. 0% income tax (with online work) being the only better thing out there. Theres really almost zero people can still complain about.. Rich people get no tax, young people get 5 year access, casual visitors can get 60+30 as much as they like.. Open door policies !!

-

Perfectly stated with the exception of at the end of the 5 years. Every other visa issued it is that you must enter before the end of the visa and you get the permission of stay stamp associated with that visa issued, same as a ME non imm 1 year giving 1 year and 90 days (89 if you count entry day) or ME TR giving 60 days entry past the end date of the visa valdity. It would be very strange (but not impossible) to see them adopt sopmething different, so logically this can be used with care for 5 years 179 days and possibly even another 180 extension for 5 years 360 days.

-

Thats not what immigration have said.. there is no 360 day limit anywhere mentioned (you have any source for that).. Also the extension is 1900 baht according to immigration sources. As I have been told it 180 days per entry, extendible once for 1900 thb, repeated as many times as you like over 5 years. We will see, I have a lot of visa options so wont cry about it if it as you say.

-

First full confirmation I have read on that.. Comments for sources I trust have been unclear.

-

Not what immigration are saying. Multiple entries as many as you arrive for over 5 years. And yes, tax residence is implied and no 0% tax rate as per LTR for non domestic sourced income.