-

Posts

1,304 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Smokin Joe

-

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

I disagree. My US credit cards would not work if stolen from the mail. They require activation by me before they will work. In over 20 years of receiving mail in Thailand I have never had anything go missing. Can't say the same for the US where I have had mail lost twice, one of these was a priority mail envelope (with tracking). -

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

Yes, everything. Social Security, Medicare, Military Pension, Credit Union. In Florida you can get a drivers's license and register a vehicle and they will let you use an out of state CMRA as a mailing address. I own a townhouse in Florida. I needed that to get the license and vehicle registration but any renewal notices are mailed to my Las Vegas mailing address. -

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

I have been using mail forwarding services as my primary address for 30 years. I have never had one refuse to send credit cards or anything else to an overseas address. The only issue I ever had was with Regions Bank. They wouldn't let me change my mailing address from one CMRA to another without proof of a residential address. I now use Navy Federal Credit Union (NFCU) for everything. Two credit cards, debit card, mortgage, and a line of credit. NFCU is the largest Credit Union in the US and they don't care if you openly use a CMRA. They also have branches overseas in places with military bases such as Korea, Japan, and Singapore. They have 24/7 phone support. I can call them at 3AM (Eastern US Time) and do a wire transfer to my Thai bank account over the phone. -

The Emotional Response to the Viral Tiktok Video

Smokin Joe replied to snoop1130's topic in Thailand News

Little Nicky (2000) starring Adam Sandler. That was my favorite part of the movie. -

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

It is a street address with a box# but it doesn't matter how you write your box number. #4782 Apt 4782 Unit 4782 All are ok, the mail service just wants the number. The address MailLink uses is: 848 N Rainbow Blvd Las Vegas, NV 89107 They are registered as a Commercial Mail Receiving Agency (CMRA) so anyone, such as your bank, could tell that it is not a residence regardless of how you write the box number. FYI, PO Box specifically refers to boxes at a US Post Office. Boxes at CMRA's are called Private Mail Box (PMB). -

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

I've been with MailLink in Las Vegas for about 10 years. They will forward anything that is not blatantly illegal. Lots of great features such as an email anytime new mail is received. Scans of mail is $1 per page. Forwarding mail is actual cost plus $2. Only issue with then is a recent change in ownership. All annual fees have increased recently. My annual fee for a "medium" size box was just increased 100% from $150 to $300 per year. They forward my meds with no problem but I don't get anything dodgy, just blood pressure meds, statins, metformin, flowmax, and eliquis. -

Mail forwarding services for Americans

Smokin Joe replied to wornoutcowboy's topic in General Topics

These mail receiving agents are called Commercial Mail Receiving Agency (CMRA) by the USPS. Each CMRA must register with the USPS. Using an Apt # , or just the street address, does not hide the fact that the address is a CMRA. There are some recent changes to the USPS regs about this made in July 2023. The USPS website: USPS CMRA Rules -

More details on Thai taxation of overseas income

Smokin Joe replied to webfact's topic in Thailand News

-

More details on Thai taxation of overseas income

Smokin Joe replied to webfact's topic in Thailand News

Didn't see the word savings mentioned in the section listing assessable income. And what did the man mean when he said "savings". Every dollar in my bank account is savings as soon as it is received. When my pension is deposited into my account anything I don't spend right away instantly becomes savings. -

More details on Thai taxation of overseas income

Smokin Joe replied to webfact's topic in Thailand News

The most interesting part of the linked article: "Savings is not classified as income"- 357 replies

-

- 18

-

-

-

-

-

-

Understanding Thailand’s New Tax Directive on Foreign Income

Smokin Joe replied to webfact's topic in Thailand News

Are you reading the official documents in Thai? I'm hoping you are as you seem much more knowledgeable than a lot of the other posters. Anyone reading Thai laws in English should be well aware that only the Thai version is official. Something that may be very clear in English could be ambiguous in Thai and vice versa. -

Statement from Revenue Department official was in the paper that shall not be named. A Revenue Dept statement "should" be much more reliable than any statement from other offices. Revenue Department Deputy Director-General and spokesperson Vinit Visessuvanapoom said the tax collection is to comply with international standards on the exchange of financial information to promote tax transparency... The collection of PIT on overseas income will be primarily based on the principle of self-declaration in conjunction with the use of digital technology and international information exchange systems … Therefore, if the government collected tax on income from abroad, the taxpayer would be subject to double taxation as tax must be paid to Thailand as well as paid to the country in which the income is being earned. However, Thailand currently has 61 double tax agreements which prevent individuals or companies operating in more than one country being taxed twice on the same income. The programme will begin on Jan 1, 2024 and apply only to tax residents in Thailand meaning tourists and short-term workers will be exempt. Also exempt will be those who have been taxed in a foreign country that has a standing double tax agreement with Thailand. No real breaking news but it shows that they are taking the tax treaties into account. And in my opinion the Thai govt doesn't have a single person that can read and understand 61 different treaties.

-

It is useful as a landmark when giving instructions to find the vehicle inspection station on the opposite side of the road.

-

New "Income" tax law 2024

Smokin Joe replied to Tom Vanderlay's topic in Jobs, Economy, Banking, Business, Investments

The change that goes into effect 1 Jan 2024 is not a new law. It is a new interpretation of the current law. It was released on 15 Sep 2023. The Revenue Departmental Instruction No. Por. 161/2566 15 September 2566 https://www.hlbthai.com/wp-content/uploads/2023/09/RD-Instruction-No.-Paw161-2566-Translation.pdf "Clause 3 This instruction shall apply to assessable income brought into Thailand from 1 January 2024 onwards." --------------------------------------------------------------------- The law only applies to assessable income https://www.rd.go.th/english/6045.html 2.1 Assessable Income Income chargeable to the PIT is called “assessable income”. The term covers income both in cash and in kind. Therefore, any benefits provided by an employer or other persons, such as a rent-free house or the amount of tax paid by the employer on behalf of the employee, is also treated as assessable income of the employee for the purpose of PIT. Assessable income is divided into 8 categories as follows : income from personal services rendered to employers; income by virtue of jobs, positions or services rendered; income from goodwill, copyright, franchise, other rights, annuity or income in the nature of yearly payments derived from a will or any other juristic Act or judgment of the Court; income in the nature of dividends, interest on deposits with banks in Thailand, shares of profits or other benefits from a juristic company, juristic partnership, or mutual fund, payments received as a result of the reduction of capital, a bonus, an increased capital holdings, gains from amalgamation, acquisition or dissolution of juristic companies or partnerships, and gains from transferring of shares or partnership holdings; income from letting of property and from breaches of contracts, installment sales or hire-purchase contracts; income from liberal professions; income from construction and other contracts of work; income from business, commerce, agriculture, industry, transport or any other activity not specified earlier. ------------------------------------------------------------------------- Any tax of assessable income is also subject to the terms of the Double Tax Agreement's that Thailand has with 61 different countries. This link has PDF copies of all the Tax Agreement's https://www.rd.go.th/english/766.html -------------------------------------------------------------------------- In my opinion the PM was just posturing and afterwards his advisors and govt lawyers explained that what he wants to do is not possible and that he should just go get himself a nice hot cup of shut the <deleted> up. I believe that the new interpretation of the law was just done to appease the PM but will will change nothing. Thailand has no way to determine if money brought in is assessable or not. And if they just start taxing people on everything and violate the terms of international treaties there would be a <deleted> storm. -

What is the real deal with proposed foreign income tax changes?

Smokin Joe replied to webfact's topic in Thailand News

A couple of other points. Thailand has Double Taxation Agreements with 61 countries. Violating any of these would be frowned upon. https://www.rd.go.th/english/766.html The tax laws only apply to income that is brought into Thailand. The main concern may be whether the money brought in is "Assessable Income". The Thai Revenue Department has an English language website with more info: https://www.rd.go.th/english/6045.html 2.1 Assessable Income Income chargeable to the PIT is called “assessable income”. The term covers income both in cash and in kind. Therefore, any benefits provided by an employer or other persons, such as a rent-free house or the amount of tax paid by the employer on behalf of the employee, is also treated as assessable income of the employee for the purpose of PIT. Assessable income is divided into 8 categories as follows : income from personal services rendered to employers; income by virtue of jobs, positions or services rendered; income from goodwill, copyright, franchise, other rights, annuity or income in the nature of yearly payments derived from a will or any other juristic Act or judgment of the Court; income in the nature of dividends, interest on deposits with banks in Thailand, shares of profits or other benefits from a juristic company, juristic partnership, or mutual fund, payments received as a result of the reduction of capital, a bonus, an increased capital holdings, gains from amalgamation, acquisition or dissolution of juristic companies or partnerships, and gains from transferring of shares or partnership holdings; income from letting of property and from breaches of contracts, installment sales or hire-purchase contracts; income from liberal professions; income from construction and other contracts of work; income from business, commerce, agriculture, industry, transport or any other activity not specified earlier. -

What is the real deal with proposed foreign income tax changes?

Smokin Joe replied to webfact's topic in Thailand News

This is the latest official info from The Thai Revenue Department. This is a new interpretation of the current tax laws The laws have not been changed (yet). This new interpretation makes assessable income taxable regardless of the year it was earned. https://www.hlbthai.com/wp-content/uploads/2023/09/RD-Instruction-No.-Paw161-2566-Translation.pdf The link is a 3rd party website but the document is the official Revenue Department Instruction dated 15 Sep 2023 -

Taco Bell opening new location in #Jomtien next week

Smokin Joe replied to redwood1's topic in Pattaya

Your link is to the Tigglebitties menu for those who would rather dine in. I'm outside the delivery area but eat there regularly -

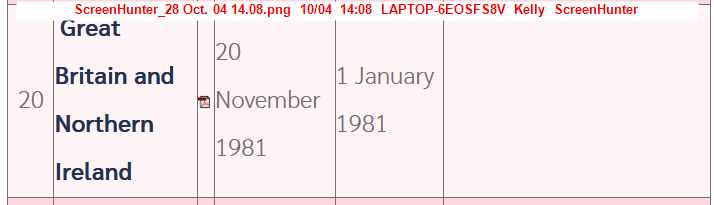

The UK can issue an IDP from both the 1949 treaty (one year validity) and the 1968 treaty (three year validity). The endorsements for motorcycles and scooters are different. The IDP (1949) has only one category for motorcycles and covers all sizes. The IDP (1968) has two categories. One for small bikes (scooters/mopeds) and a different category that covers bikes of any size. When Thailand ratified the 1968 treaty they registered a reservation that says they do not recognize the small bike category. https://treaties.un.org/pages/ViewDetailsIII.aspx?src=TREATY&mtdsg_no=XI-B-19&chapter=11 Thailand "Thailand will not be bound by article 52 of this Convention. "Thailand will consider mopeds as motor-cycles." Reservation and declaration made upon signature and confirmed upon ratification: “The Government of the Kingdom of Thailand […] declares that, in accordance with paragraph 1 of Article 54 of the Convention, the Kingdom of Thailand does not consider itself bound by Article 52 of this Convention.” “[I]n accordance with paragraph 2 of Article 54 of the Convention, the Kingdom of Thailand declares that, for the purposes of the application of this Convention, it treats mopeds as motor cycles (Article 1 (n))”.