Dollar/baht Don't Read Unless You Have A Interest

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

75

Thailand again?

Yes you lied about 3 things. We can see. It's funny you hate Thailand as well. Oh well. So much for that $240 Perth rental. Back to Thailand to be bored. -

1

-

64

USA UPenn ban trans athletes after probe involving swimmer Lia Thomas

I don’t know, but I would assume not, and rightfully so. What I meant by why can’t it be like in Thailand, is acceptance. In Thailand you can be whatever you want and no one bats an eyelid. Only in the west they get all bent out of shape over transsexuals and sexual orientation! -

75

Thailand again?

Yes, you are lying. This is a copy of my payments, so the Australian is lying to F off again I am sorry you get f off again -

55

Armpit rash?

Not scabies. The itch would be overwhelming. Then he would scratch and it would have spread by now to in between the knuckles on the hand and to the inner thighs. -

64

USA UPenn ban trans athletes after probe involving swimmer Lia Thomas

It’s pretty obvious! There are transgender people in this world who identify as the opposite sex of their biological sex.That’s a fact! And if you don’t want to believe that or think it’s abnormal or whatever then you’re the problem. Live and let die, mate!

-

-

Popular in The Pub

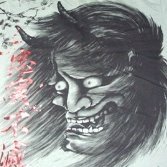

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now