-

Posts

12,540 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by khunPer

-

-

On 1/25/2025 at 3:44 PM, PomPolo said:

I will probably get this topic removed I've got a few on the go.

AN formerly ThaiVisa has been hugely helpful to me in the past and also currently.

I haven't used it for a few years with living in different parts of the world but more recently it is has become a community to turn to especially after moving way out into the sticks.

I still maintain a place in the city and am back there in a couple of weeks so there will probably be peace from my posts!

@ moderator huge respect to you guys and the community in general.

I have lived away from my home country a couple of decades nearly and having something like this where you can discuss things with like minded people and get advice even if it is harsh sometimes is a winner!

I don't work for AN just in case anyone is wondering 🙂

What do other people use it for especially the guys with thousands of posts?

AN-forums are extremely helpful in reply to questions and fgeneral knowledge about Thailand. Furthermore, the news-secrion keeps one updated with what happens when you stay/live in Thailand, some of the items are very important knowledge for expats.

-

1

1

-

1

1

-

-

1 hour ago, richard_smith237 said:

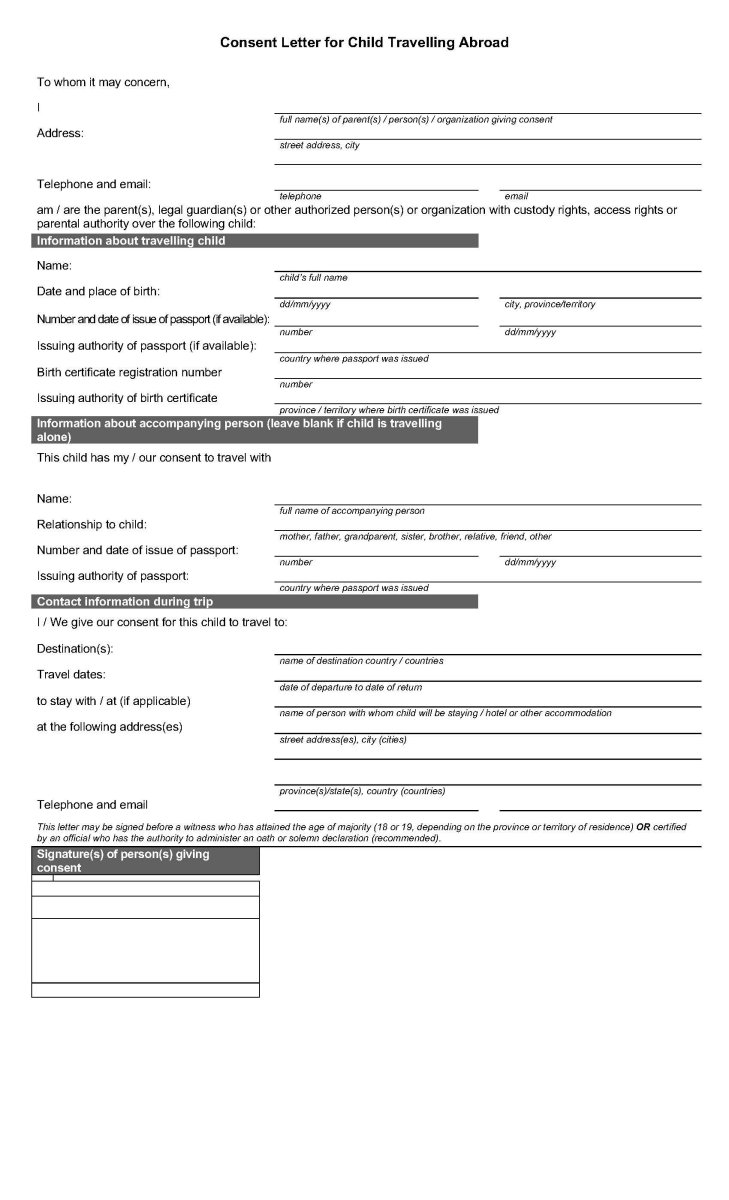

Attached is a format of the letter....

Its just something I made up - but covers they key information needed.

Theoretically it would need to be 'stamped / signed / notarised' by your local Amphur office but we never went as far as going that far.

We also travel with Digital copies of all documentation.

Note:

Our Son was 3 years old and 4 when I took him out of the country on or own.

He was about 6 and 8 on the times the Wife has taken him out alone.

Neither of us have ever been asked for any documentation - but we have friends who have been stopped and asked with travelling as a lone parent with a child.

Also note: Our surnames are all the same.

Another point:

IF taking a child out of the country, always show 'intent to return' as removing a child from the country with clear intent not to return 'could' be viewed upon unfavourably by Thai courts if any contest comes to that.

Best option remains: Get an uncontested divorce and sole custody from the mother.

Have you used this for travelling alone with a minor Thai child?

For Thai-immigration you might need the official Thai-document for travelling alone with a minor Thai citizen; se my above reply.

-

On 1/26/2025 at 3:15 AM, Leveraged said:

My daughter has both her Thai passport and her American passport already in hand. She is 4 years old. We are unfortunately having marriage problems and it looks like its settling on me taking custody of our daughter and in doing so that would mean I need to get back to the USA with her so I can work. I am the father, and it looks like the Thai mother wants to leave and give me the kid and take everything else.

So what exactly do I need to get out of the country? I know I need the obvious, but im talking specfically about a letter or some kind of document from the mother that gives me her permission to take our daughter out of thailand and into the USA? If this document is needed, does it need to be notorized or something? Witnessed somehow? Or can I just print out a standard template from the internet and have her sign it? This is what im trying to ask, what specifically is needed and done in what exact way so that there is no issue in thailand airport or on arrival in the american airport?

Obviously nobody needs to know this trip is due to marital problems, for all concerned its just a little father/daughter trip to see the other side of the family.

Can anyone help? Advise?

I would LOVE to hear any experiences people have who have brought their kid through the airport with only one parent present.Thanks so much to anyone who replies with help or whatever because im kind of having a crummy time at the moment and really need some help with this particular issue.

You will need a letter from the local Amphor-district office to prove that you have permission to take your daughter out of the country. The mother need to be present at the Amphor-office to confirm this.

The letter is an official standard document and looks like this (the document I used when travelling with my daughter)...

Upon check-in at the airline you should use your daughter's US-passport, which will make her eligible to travel without a visa.

Your daughter needs to exit the immigration on her Thai passport, if she has no entry stamp in her US-passport. Don't show her US-passport at immigration.

The immigration officer may ask for permission – i.e., the letter – very likely, when a father travels alone with a very young minor out of Thailand.

Me, I was never asked, but first time I travelled alone with my daughter she was 13 years old, but the immigration officer asked some questions in Thai language to my daughter.

-

1

1

-

-

On 1/25/2025 at 4:51 AM, karl2007 said:

I have a condo which I have bought some years back worth about 6 million. I'm not rich just worked hard and saved. Which I bought with my wife.

I am married to my wife and we have registered our marriage and have the marriage certificates and she has my last name in her passport and ID card.

Both of our names are on the title deed and I have my own yellow book.

We are still relativity young so haven't written any legal will as of yet. But by wife told her family member that she will leave everything to me. I think they didn't really appreciate that.

Some family members are opportunists because they don't have much themselves. But might feel its unfair that I own this.

That is the background. And my question is, if my wife was to pass away unexpectedly is there any way that they could somehow claim ownership of this property if there is no will? And try to remove me from the title deed?

What would normally happen in a case like this where both our names on the title deed. Would her name have to be removed and it will be just my name on the title deed?

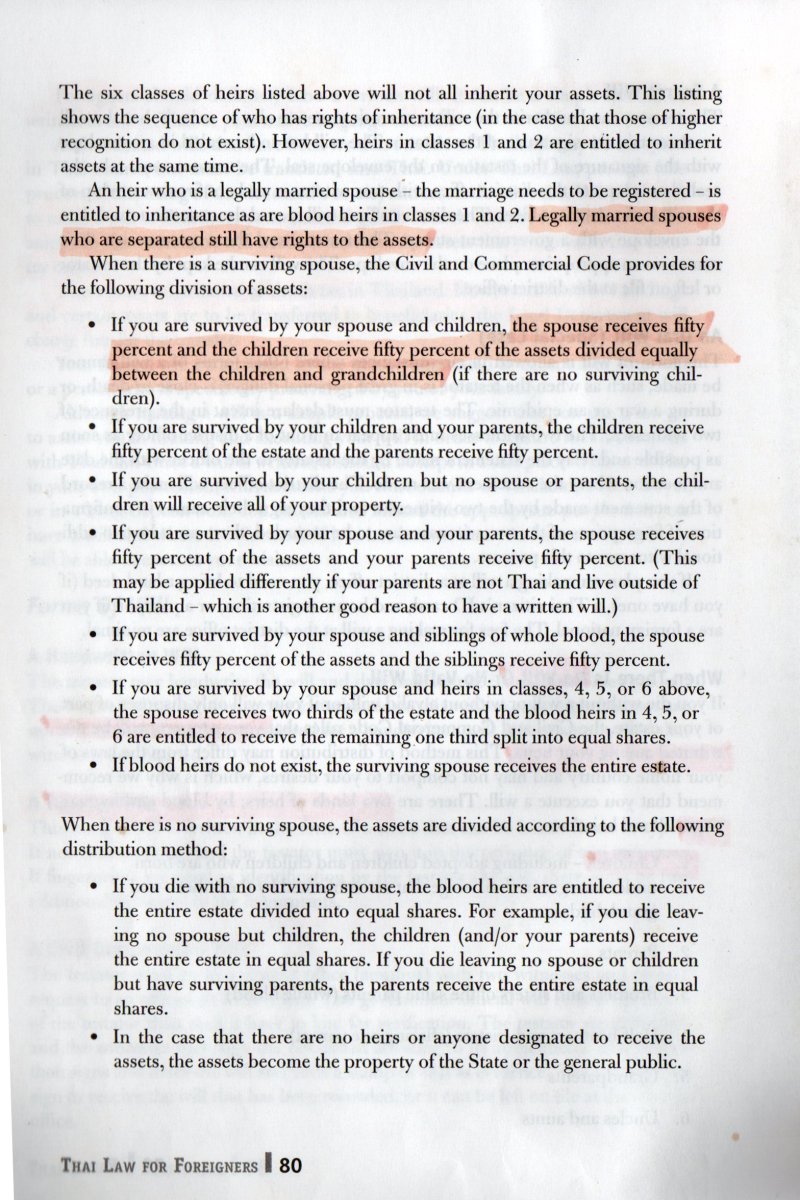

In short: If there is no will 50% will go to spouse and 50% to children, if any, or parents and other siblings...

-

1

1

-

-

A problem with government handouts is that somebody are going to pay for it. Right now that "somebody" doesn't seem to exist, so the government is looking for multiple fund-sources, among others casino-income and taxing foreigners...

-

1

1

-

-

This government is desperate to find income sources to pay for their election promises...

-

1

1

-

-

6 hours ago, brfsa2 said:

dude, that photo is so AI generated. try harder 😄

https://www.liftinternational.org/blog/2018/8/9/history-of-sex-trafficking-in-thailand

-

On 1/24/2025 at 2:45 AM, Joseph98765 said:

I live Chiang mai and I spent 3 days in Tak. The hotel changed my residence address...from there all ok.

Last week I had to do my TM47 and I put my address of Chiang mai doing the TM47 online and was rejected, because the address they have was still Tak Hotel, then I told my landlord to put me again in the system (TM30) and when she did after few hours later I did my TM 47 again...and was rejected again, but this time they told me come to immigration in person...WT*

So when I went to immigration looks like every time you book a night in a hotel, your next TM47 you must to go in person to do it... or at least that's what the officer told me (and not very convincing because he had to ask someone about that). This rule is new in Chiang mai? because I've here for 10 years traveling and staying in hotels and I never had a problem to put my condo address after staying in a hotel 1 month before.

I know every time you leave the country, yes is mandatory to go in person to immigration for your next TM47.......but even staying in a hotel in Chiang mai for 1 night I have to go?? they have a convenient online system and I don't have to waste one day of my work vacations for this sh*t..

Did anyone has the same situation here??

It's depending of the local immigration office.

There iss a police order (don't remember the number by hearth) stating that you don't need to re-register a TM30 when you are temporary staying in other domestic places/other provinces, and even when travelling abroad with a re-entry permit.However, the immigration office where I stay don't follow the police order (I've shown it to them) and claims a new TM30 if one has been out of the province.

-

1

1

-

-

On 1/24/2025 at 8:00 AM, Travi said:

We have a neighbour with Chicken, barking Dogs and noisy Birds. It drives me crazy.

Is this allowed, how are te rules?How can we solve this problem?

Thanks for you advice.1) I've had the same kind of neighbor – and even with a monkey screaming all day for a female to mate with...🙉 – I got used to it and even missed the monkey-sound after it died...😉

2) To my knowledge, no useful rules.

("Always look on the bright side of life", and be happy that you are not neighbor to a late open karaoke bar... )

)

3) Often mentioned advice is to move. If you own your home, get a Thai to politely talk with the neighbor – or just have some patience as me in #1.

-

1

1

-

-

10 hours ago, flyingtlger said:

With the hot climate and unsanitary kitchen conditions all over Thailand, I am not surprised......

Food poisoning can happen all over, even in countries with high food standard – in Denmark we call it "Roskilde disease" from a lager case in the city Roskilde in 1936...

"63 guests at the world's best restaurant, Noma in Copenhagen, have been affected by Roskilde disease after visiting the restaurant" (March 2013).-

1

1

-

-

- Popular Post

- Popular Post

Back to the good old days, when it all began in Pattaya...

-

1

1

-

4

4

-

21 hours ago, alanrchase said:

Not true if you are a Brit. He owns a house in the UK so HMRC will consider him domiciled in the UK and his worldwide assets will be used for inheritance tax calculations. The only good news is that you can get up to £175,000 tax free for the house making a total of £500,000.

Please note what I mentioned about property, which might/will be handled in the state where the property is and of course after that state's law. That is why two wills are suggested by Thai lawyers. Heirs resident in Britain might also be taxed after British law, even that inheritance comes from abroad.

-

Are you talking about being parent to a Thai child, or about a foreign child attended International school in Thailand?

For the first the needed bank deposit is 400k baht, for the latter you need 500k baht.

More useful information about guardian of a foreign minor (not more than 20 years old) studying in Thailand (copy link):

https://www.krabiinternationalschool.com/visa-information/ -

On 1/15/2025 at 2:03 PM, Jimmy B said:

I have property and assets in the UK and I'd like to will everything to my Thai wife so, when I croak it, there won't be loads of IHT to pay. My Thai wife doesn't have a British passport or connections in the UK. will my assets automatically pass to her as a non British citizen or do I need to do mountains of paper work to prevent UK government taking even more money. Has Anyone else dealt with this situation or can recommend a lawyer experienced in this field. Cheers.

An estate is handled by a court in the country of primary residence. So, id you live in Thailand, it will be a Thai court and follow Thai law.

Thai lawyers suggests to make two wills, if you have assets in both your home country and country of residence. Property might still follow law in the country where the property is places, even that the will is handled by a court in another country. -

5 hours ago, CaptainPeacock said:

@NoDisplayName I think in your case, if you do NOT have children in Thailand then my understanding is... (no Thai WILL, but legally married) EVERYTHING automatically goes to your Thai wife.

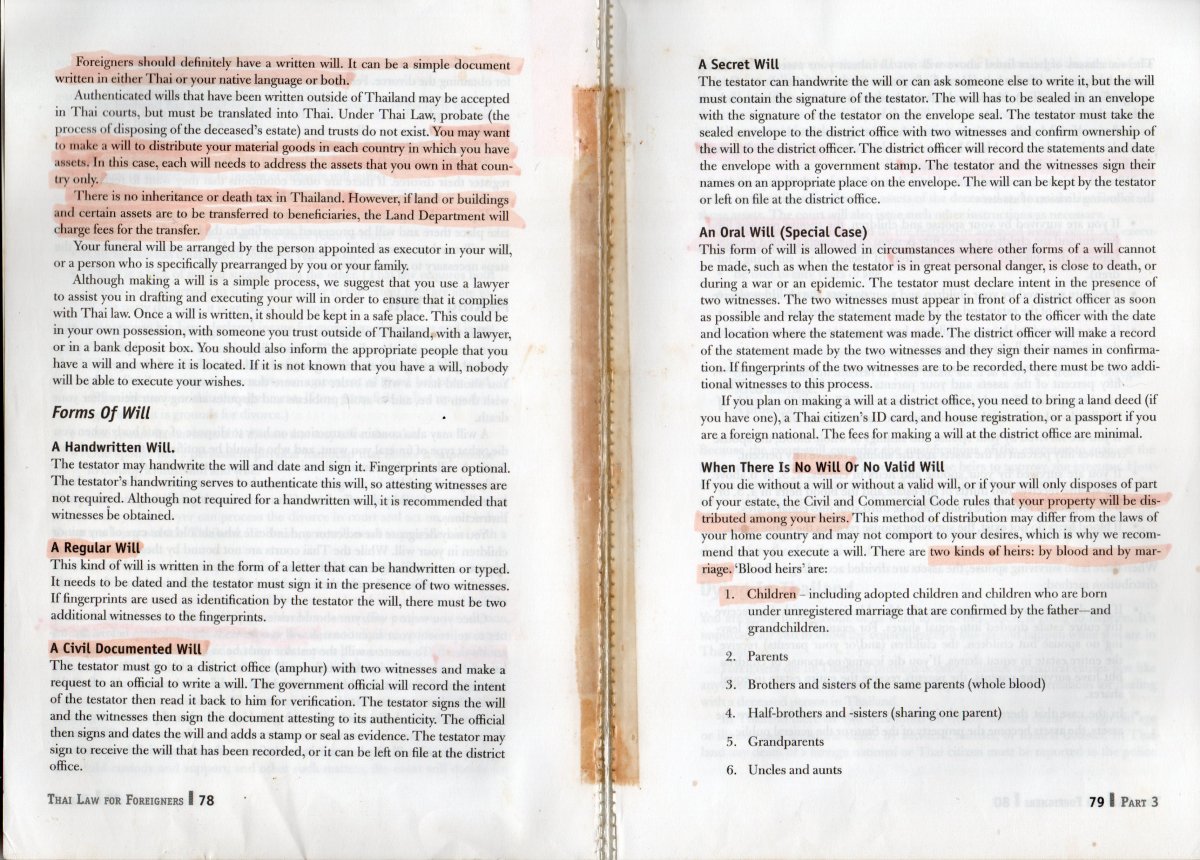

Don't "think", but read the last of page 78, "When There Is No Will Or No Valid Will".

If there are foreign assets, the two Thai lawyers that wrote the book, recommend to make two wills. One will in Thailand that covers Thai assets following Thai law, and another in the foreign country (one's home country) following that law. I mentioned in mine wills that I have a will in the other nation covering my assets there.

However, be aware of that the will will be handled by a court in the country of primary residence and will follow that nation's law (and taxes), but some assets might still follow national law, for example property.

-

1

1

-

-

7 hours ago, tomster said:

Thanks for all the replies.

However, it still leaves the original question unanswered.

If you are on the birth certificate but not married when the child is born, then marry afterwards do you get the same rights as you would get if you were married when the child was born, or do you need to either go to court or wait until they are 7 and do it at the local amphur.

This guy seems to imply that you do get full rights by marrying (the last sentence of the video), but I can't see where on the internet that backs this up:

https://www.facebook.com/watch/?extid=MSG-UNK-UNK-UNK-COM_GK0T-GK1C&v=395069283668798

There are a few people I know that are living with their girlfriend and kids but are not married (including myself), it would be interesting for them (and me) to know what the actual law is on this is.

Note this is not a visa related question, if you are living with the child and the mother and on the birth certificate immigration will give you a Non 0 extension.

This is about the legal status of guardianship and what happens if the marriage then goes South and you divorce - are you then the father in the eyes of the law or do you still need to go to court.

An example of how this might affect somebody in real life is putting a property in the child's name, if things went south and the relationship with the mother broke down after the remarry, if you were not registered properly as the father she could sell the property and you wouldn't be able to stop it, as far as I know.

Or applying for a passport for another country for the child would require documentation saying you are the legal father, but would you have it if you married after the child was born...?If you have joint custody – as married or legalized parenthood – both parents need to be present in a number of cases, herunder obtaining or renewing a Thai passport for a minor (until 21 years old). Same might be the case with a foreign passport, my country (Denmark) require both parents to be present when applying for passport, both first time and renewing, as long as the child is minor (under 18 years in Denmark).

To my knowledge sole-custody is a family court matter.When property is registered in the name of a minor, it is extremely difficult – if possible at all – to sell, transfer, morgate, or register any servitudes on the title deed. The common advise about using a minor as land holder is that ane registrations (loan, habitation rights etc.) shall be done before the land is transferred to a minor. It would be rare if a guardian can sell or transfer a minor's land.

For banks it was in my case the by bank registered guardian that could handle the account. Some were registered with my girlfriend – the mother – as guardian, and she needed to sign. Other accounts were registered with me as guardian, and I could dispose. Both my banks could only register one guardian. The minor can have his/her own ATM-card at a certain age.

A minor can hold shares – for example in a Thai company limited – but could in my case not get a trading account for SET equities; presumably because it a matter of buying and selling done by the guardian.

In reply to the legal rights, here is an English translation of the articles in question in the "Thailand Civil and Commercial Code (part III)", which also answers you OP-question...

Section 1546. A child born of a woman who is not married to a man is deemed to be the legitimate child of such woman.

Section 1547. A child born of the parents who are not married to each other is legitimate by the subsequent marriage of the parents, or by the registration made on application by the father, or by a judgment of the Court.

Section 1548. When legitimation is applied for by the father, the child and the mother must give consent to the applicant.

In case where the child and the mother do not appear before the Registrar for giving the consent, the Registrar shall notify the child and the mother of the father’s application for registration. If the child or the mother raises no objection or does not give the consent within sixty days after the acceptance of the notification by the child or mother, it is presumed that the child or the mother does not give consent. The period of time shall be extended to one hundred and eighty days in case where the child or the mother has been outside Thailand.

In case where the child or the mother raises an objection that the applicant is not the father, or does not give the consent, or is unable to give the consent, the registration for legitimation must be effected by a judgment of the Court.

After the Court had pronounced a judgment effecting the registration of the legitimation and the judgment has been produced to the registrar for registration, the Registrar shall effect the registration.

Source link for English Translation of the full law (copy the URL-address):

https://www.samuiforsale.com/law-texts/thailand-civil-code-part-3.html#1535 -

16 hours ago, Forseman said:

i have passed court and legalised my child in 2023, there was no a DNA test requirement (Bangkok)

Sounds positive, normally DNA is always mentioned – how old was your child?

-

16 hours ago, Forseman said:

Due to my experience, birth certificate is enough for farang-country citizenship obtaining

Might depend on country.

-

On 6/7/2024 at 5:36 AM, LuckyG said:

Does anyone know, FOR SURE, how to properly "finalize" a DIY Will in Thailand?

I am told by lawyers that wills are not filed or recorded with Courts in Thailand and I understand that a Will needs only 2 witness signatures, of the Testator's signature to be valid.....

but, for example, If the will is 7 pages and page 7 is for Testator and witness signatures, what could prevent an executor from changing anything in pages 1-6?

What puts the Will "in stone" or keeps it Final, once signed and witnessed? is Notarising the will a proper solution? If so, can this be done after the Witnesses have signed? Thanks!

You can place a signature on each page.

You don'y need natarization, even a handwritten will without witnesses can be valid. The importance is that someone can find your will, when you have moved on; that's the benefit of having a will notarized at the local amphor-district office and kept in file there.

Your can read about Thai wills here, from the book Thai Law for Foreigners...

-

1

1

-

-

3 hours ago, tomster said:

No, he is not, he does not know I have posted it - I am doing so because I am in a similar situation with my second child and was wondering if anybody on here had done something similar.

And as usual, he is asking different lawyers and getting different answers.

In reply to your situation.

I was not married to the Thai mother of my daughter. However, we had and still have an excellent relationship – we are living together as family – so nothing to worry about in my case, wherefore no DNA-test and court approval.At the child's age of 7 years you can apply for a fathership certificate at the local amphor-district office. Child and mother needs to be present and both confirm the fathership. This certificate was in my case thereafter legalized and used for my daughter's citizenship in my European home country.

-

1

1

-

1

1

-

-

8 hours ago, KhunLA said:

He's on the birth certificate, he IS the father, and has full parental rights. Whether he'll be able to exercise them may be a different story

Unfortunately not. Your need a DNA test and court approval if not married to the mother.

-

- Popular Post

12 hours ago, parafareno said:i dont need visa... i am from eu so I get 2 months plus extension right? total 3 months?

Without visa you need a return ticket or a ticket out of Thailand, both within your allowed 60-days visa exempt stay. The airline might check your return- or onward flight upon check-in, if you don't have a ticket, you risk being denied boarding.

-

2

2

-

1

1

-

Too many narrow studies, just one multi-vitamin per day is also fatal, according to a study. I agree with the scientists saying that 80-90 percent of all studies are junk-studies. Lots of other scientific studies state that a reasonable small amount – two glass/units per day for males, one for women – of alcohol is healthy. Probably, the most important for health and longevity is being happy...👍

-

1

1

-

-

Same kind of story again and again; there seems to be something with Indian men wearing heavy gold necklace and kathoeys...

British woman jailed after collecting debt from Thai millionaire

in Thailand News

Posted

If someone don't pay business debt, you use a lawyer and court system – or write if off, if the debtor is from a foreign country, where there might be a doubtful debt collection...