jeffandgop

-

Posts

810 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by jeffandgop

-

-

8 hours ago, JimGant said:

If Direct Debit somehow evaporates, those receiving their Social Security (and/or other Federal payments) via the BB NY ACH system will have two options: Receive their direct debit into a US financial institution; or receive their payments as credits to a Treasury issued ATM/Debit card -- the Direct Express card (DEC). For those without a US financial institution, it will have to be a DEC, as the option to receive a paper check (no great option in itself) requires a waiver to explain why a DEC won't work, e.g., because you live in a world without ATM machines or banks (but maybe some parts of the NE would qualify.....dunno). Anyway, the following link explains the DEC:

https://www.usdirectexpress.com/faq.html

(Note the 3% foreign transaction fee, plus $3 ATM fee.)

As an example of fees, let's compare a monthly SS of $1,600, either direct deposited into a US financial account, then sent to Thailand via TransferWise (TW); or credited against a DEC, then removed in two pulls from an ATM machine.

Today, a TW bank debit (or debit card) transfer would cost $17.85 to send $1,600 to your bank in Thailand. And the cost to remove that money from your Thai bank account would be zip ( unless you figure in the token 200 baht, or whatever, ATM card cost).

With a DEC, two 25,000 pulls from a Thai ATM machine -- using a 33 FX rate -- would debit your DEC for $1,528 -- which includes $13 for the two 220 baht owner ATM fees. But, it ain't over yet: Add two $3 each DEC ATM fees, plus 3% of the $1,528, or $46. So, the total cost to get 50,000 baht, or $1,515 equivalent, is a whopping $65! And even if you could do an over-the-counter, you're still stuck with the 3% fee, which would amount to $45 -- cheaper, but no bargain.............

......when compared to the $17.85 TW cost.

Sadly, many of the folks now getting a Direct Deposit via BB NY no longer have a US financial account, nor an easy means to reestablish one. So, for them, it looks like DEC is in their future. Sucks.

Re "nor an easy means to reestablish" a US financial account...quite true but it still can be done...new accounts can be applied for an opened online (my credit union for example does). Just need to spend time researching for these institutions.....

-

34 minutes ago, EricTh said:

I think land transport dept prefer residence certificate because it is in Thai alphabet issued by the Thai government which is more authentic whereas residence affidavit could be in English which the Thai civil servant don't understand fully or forged because each country has a different design for the affidavit and Thai government staff wouldn't know whether they are authentic or not.

I might be wrong..

You are wrong. I’ve used both before. Transport Office is quite familiar with the US Consulate form

-

Only one is required. If the residency affidavit is the notarized doc obtained from the Consulate, it is acceptable to the authorities for the driver license renewal so long as it is less than one year since obtained. The residency certificate from Thai immigration is valid only for up to 30 days.

-

19 minutes ago, Pib said:

OK, here's what I think happened since we can't get any exchange rate...the Bangkok Bank Note, Sight Bill, or TT rates...or the MC "full" rate to match the charge that hit your credit union account.

When you went to Bangkok Bank and asked for a $100 withdrawal versus say asking for a particular baht amount, what the bank rep first does is just use their Note rate to convert to a baht amount. The bank is "not" using this Note rate as the actual exchange rate to be charged to your account; they are just using it to determine the baht amount to accomplish the transaction in.

The transaction is then processed in baht and the card-network exchange rate (Visa or Mastercard depending on your card) minus any foreign transaction fee charged (or not absorbed) by your card-issuing bank. And like we've discussed already the actual settlement date may be different from the actual transaction date but I found for a cash withdrawal it usually turns out to be the actual transaction date.

Above I mentioned "....minus any foreign transaction (or not absorbed) by your card-issuing bank." I think what is happening here is your card-issuing credit union is indeed not charging any foreign transaction fee, however, they are not absorbing the Mastercard "transaction fee" which can range for 0.2% to 1% depending on the currency and the contract they have with your credit union. This transaction fee is not bill directly to you by MC/Visa but to your card-issuing bank; however, since it's linked to your card your card-issuing bank can just relay that fee to you instead of absorbing it....it dosn't show up as a separate line item charged...it's just integrated into the total amount/exchange rate used.

So, when your credit union told you "they" do not charge any additional foreign fee they are technically telling the truth but at the same time they are not absorbing all related card transaction fees which means their card is not a true no foreign transaction fee card like the Schwab debit card routinely talked about on ThaiVisa. The Schwab debit does not charge any foreign transaction fee and it absorbs the card-network transaction fee....not to be confused with also rebating any ATM Use fee.

A story talking card-network transaction fee: Several years back when Capital One acquired ING they also revamped their debit and credit card fee structures....CapOne debt cards use to be true no foreign transaction fee cards, but in their fee restructure they said they do not charge any foreign transaction fee however there may be some Visa/Mastercard card-network transaction fees. It was bankster weasel/vague wording for saying there still may be a small currency conversion related fee by Mastercard/Visa that will be passed on to you in the form of a lower exchange rate. At that time the MC transaction fee could range from 0.2 to 1% and Visa 0.15 to 1.05%....the specific amount depended on the contract they had with the card issuing bank. I fully expect the MC/Visa transaction fee structure is still very, very similar.

Anyway, about this time there began to be quite a few posts on ThaiVisa by people with Cap1 debit cards who could never get the exchange rate to match any exchange rate....not Visa rate...not MC rate...not any Thai bank rate....etc. They use to be able to get the exchange rate to match, but no longer could. Other MC card holders from other card-issuing banks were getting the exact MC rate. But Cap1 customers were coming up 0.2% short on the exchange rate.

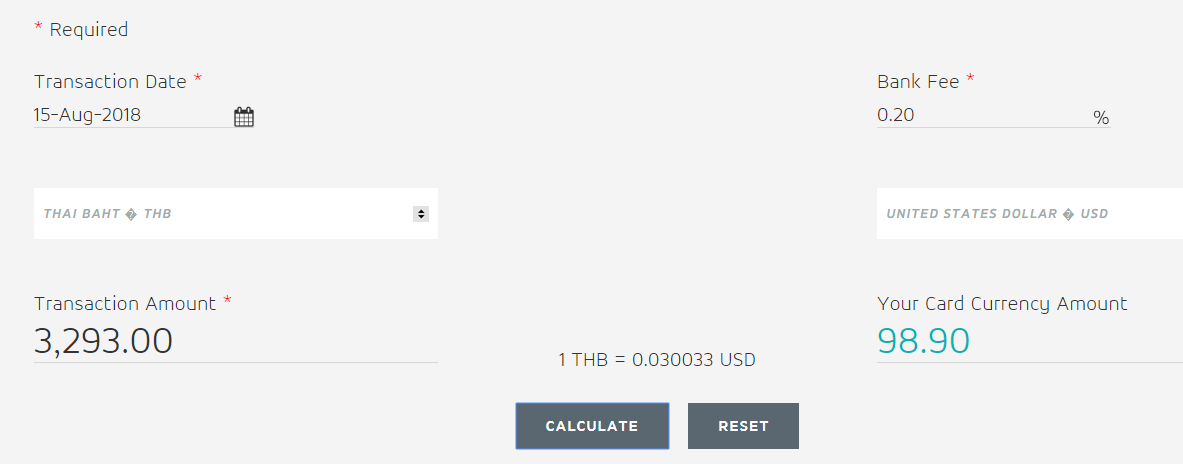

Just like you experienced with your latest counter withdrawal. When you crank in a 0.2% fee in the MC exchange rate page you will then get the exact amount that hit your credit union account. See snapshot 1 at the bottom.

And this actually become a bigger complaint with all Cap1 customers. In response to the complaints Cap1 began to also absorb the card-network transaction fee and turned their debit card back into a true no foreign transaction fee debit card by not adding an fee "and absorbing" the card-network transaction fee. Like I did a Bt150K counter withdrawal on 3 Aug...got the MC exchange rate for 3 Aug...and charging hitting my bank account was $4,515.59 which matched exactly the MC exchange rate page....matched to the penny since the Cap1 MC debit card is now a true no foreign transaction fee card which also absorb the MC transaction fee.

Since it's purely up to the card-issuing bank, your credit union in your case, whether they charge any foreign transaction fee or what related fees they also absorb it appears your credit union is not absorbing the MC transaction fee of 0.2% On your next counter withdrawal see if you come up 0.2% short again on the exchange rate. And you might want to look at the written terms of agreement for your debit card to see if there is some weasel/vague working in their regarding foreign transactions.

Below website does a pretty good job of talking some the foreign transaction fees you might incur with your card....it's talking credit cards but it applies to debit cards also. Note the reference to the 0.2 to 1% MC transaction fee...I think this is the fee your CU is not absorbing which is effectively lowering the exchange rate by 0.2% resulting in a slightly higher charge hitting your account.

Webpage that talks various foreign transaction fees

https://blog.moneysmart.sg/credit-cards/credit-card-fees-you-probably-dont-know-youre-paying/

Snapshot 1: with a 0.2% fee the charge matches exactly hitting your CU account.

I agree totally with your explanation. That explains the ever so slight difference in the final debit amount and the MC rate. I suspected that my credit union was charging me some transaction cost. Glad it’s so small. And still ends up for me financially an overall better deal than ACH or SWIFT transfers.

-

16 minutes ago, Pib said:

One more question to confirm. I know you said "final settlement" but I would just like to confirm that is what "Posted" to your CU account as final, final and was not actually in the Pending transaction category displaying on your CU account. A counter withdrawal will hit your account immediately but still should be in the Pending transaction category until it's Posts/Goes Final.

From my experience of doing counter withdrawals since it's processed as a Point of Sale transaction this means it will usually take several business days for the transaction to go from Pending to Posted at which time the Posted amount can change from what was displayed when it was still in Pending transaction status.

The "Pending" - specifically posted on the statement as "Purchase PreAuthorization"- amount was $98.65. The Final amount posted as being the actual debit from my account was $98.90.

-

18 hours ago, Pib said:

First, you did not withdraw $100; you withdrew X-amount of Thai baht...how much Thai baht did you ask to withdraw?

ANSWER: I asked to withdraw $100 from my US credit union via MC Debitcard. Teller provided 3,293THB which, based on the Buying Rate of 32.93 per $1 posted by Bangkok Bank, equaled $100USD.

Based on what you said was your final charge it appears you asked to withdrew 3,300 baht.

REPLY: NO, I did not request any baht amount. I requested Thai currency in exchange for me providing $100USD from my US Bank.

Did the receipt for signature you signed have reflect both USD and THB?

ANSWER: NO. Just the Thai Baht amount of 3,293.

And how do you know they applied their TT Buying Rate?

ANSWER: I did not say that the TT rate was applied.

Or maybe you asked for $100 and the rep then did some personal math using their TT Buying Rate as a ballpark figure just to determine you were asking for 3,300 and that 3,300 baht is what the bank rep then entered into the POS machine. And maybe the bank rep even ask/said at one point 3,300 baht?

REPLY: NO & NO

-

On 8/15/2018 at 5:17 AM, jeffandgop said:

Today I'll do a debit withdrawal from my US Credit Union account from the Bangkok Bank counter. What we understand the Bangkok Bank rep to say is when I do the withdrawal, the Thai Baht exchange rate will be the Bank Notes Buying Rate for the USD $50 in effect at the time- in the above chart that would be 32.84 netting me 3,284THB for a $100 US debit withdrawal (again, no fees on either bank side). Then, at some point, my US Credit Union will post the amount withdrawn from that account based on the MC exchange rate...so presuming that the MC exchange rate is consistently more favorable than the Bangkok Bank Buying Rate, what will be debited will be less than $100 from my US bank...

I'll let you know the results...

Around 10:30 AM 15 August I did a Bangkok Bank Counter debit withdrawal of $100 from my US credit union. The bank applied their Buying Rate of 32.93 for the USD Currency (see att). Note that the TT rate at that time was 33.20.

My final settlement amount applied to my credit union account was a withdrawal of $98.90. That equates to an exchange rate applied of 33.296- higher than the TT rate. Interestingly enough, the MasterCard conversion website had as the exchange rate to be 33.366 for the 15th and 33.161 for the 16th; the 16th being the date back in the US when the Final settlement was posted to my credit union account. I can't deduce where the credit union exchange rate came from and could ask, but at this point really don't care.Again, NO FEES from either banking institution is charged.

So, for me, counter debit withdrawals are the way to go. I've already requested and received approval from my credit union to raise my daily debit withdrawal limit to basically equate to the amount of money I received from my pension via ACH every month. Only one trip to the bank will be required each month to get my monthly expense money. And I am saving the equivalent of $25 per month in Bangkok Bank fees from using ACH AND obtaining a better rate than the TT rate.

-

Top designed and built our home. He did a good job throughout and I’d recommend him. You need to ask him what his fees are. What I may have paid could be different than what Top’s financials/costs are today.

-

On 8/13/2018 at 9:59 AM, Pib said:

I'm sure there was a miscommunication...or the Bangkok Bank rep was just wrong. I've done so many counter withdrawals at Bangkok Bank and Krungsri Bank branches I've lost track. You will get the the card-network (i.e, Visa, Mastercard) exchange rate minus an foreign transaction fee your card-issuing bank may apply. TT Buying and Selling Rate is used for international incoming and outgoing, respectively, wire transfers.

And please note the counter withdrawal will be processed as a Point of Sale (POS) transaction like when you buy an item. This means the initial transaction should appear as a "Pending Purchase" on your CU account and you will not know the know the final card network exchange rate received until the transaction "posts final" to your account. The date used for the exchange rate will be the card-network "settlement" date which may be different that the actual transaction date...different from the Tranaction, Purchase, or Post dates which you may see on you CU account. And you may see the transaction date change when the transaction goes from Pending to Posted.

For a debit card cash withdrawal transaction when all the Pending, Purchase, Post, Settlement dates dust settles associated with a POS transaction do not assume the Post date is the exchange rate date used. It may be any date between the actual transaction and the posting date. But for a cash withdrawal I've found it to usually be the actual transaction date but for purchase of goods/services it may not be.

Once the transaction posts look at the exchange rates on the Visa/Mastercard exchange rate page and you will find an exchange rate somewhere between the actual transaction date and posting date that exactly matches the exchange rate you received. Once again, this assumes no fees were applied by anyone which effectively lowers the exchange rate.

Today I'll do a debit withdrawal from my US Credit Union account from the Bangkok Bank counter. What we understand the Bangkok Bank rep to say is when I do the withdrawal, the Thai Baht exchange rate will be the Bank Notes Buying Rate for the USD $50 in effect at the time- in the above chart that would be 32.84 netting me 3,284THB for a $100 US debit withdrawal (again, no fees on either bank side). Then, at some point, my US Credit Union will post the amount withdrawn from that account based on the MC exchange rate...so presuming that the MC exchange rate is consistently more favorable than the Bangkok Bank Buying Rate, what will be debited will be less than $100 from my US bank...

I'll let you know the results...

-

21 hours ago, Pib said:

I use to do counter withdrawals at a Bangkok Bank branch....they did not charge any fee for a counter withdrawal. But as for exchange rate you get the exchange rate of the card-network....that is, if your card is a Visa card you get the Visa exchange rate....if a Mastercard you get the Mastercard exchange rate. Go to their exchange rate webpages to see their rates.

Now the TT Buying Rate used for "incoming international transfers" just happens to be close to the card network rate, but the TT Buying Rate is "not" used for ATM/counter withdrawals.

Whey you use your card in a bank ATM or at the counter you get the card-network rate "except if the bank tries to pull a Dynamic Currency Conversion (DCC) exchange transaction" which will be approx 3% lower than the full card network rate. DO NOT accept a DCC....great profit for the bank at your expense.

And don't forget any fee your "card-issuing" bank/credit union may apply to the card. Since you said you CU card reimbursed X-amount of fees it's unlikely they charge a foreign transaction, but be sure to confirm with them which can usually be easily done by reviewing the card's disclosure at your CU website.

I appreciate all of your posts I've read on this topic.

As I said above, my CU will charge 0 fees for a foreign debit withdrawal (I have a MasterCard debit card)- I've already confirmed that.

Yesterday I went to Bangkok Bank where my account is held and they said the exchange rate used for a debit withdrawal is the bank's selling rate that day. That was great news since it is better than the TT rate...but then they later changed/corrected that to say the exchange rate used for a debit withdrawal is the bank's BUYING rate that day- which is less than the TT rate. See the file att for details of what all these rates were as of Friday. They also stated that they do not use the MasterCard or the VisaCard exchange rate for foreign debit withdrawals. Bangkok Bank's ATM withdrawal fee is 220B per transaction for up to 25,000 B & the daily limit is your debit card daily limit. Counter withdrawals are 0 fees & the daily limit is your debit card daily limit as well.

At this stage I'm going to do a test debit withdrawal at Bangkok Bank's counter to find out what whether the exchange rate matches anything they've told me....I'll let you know later. this week.

-

On 8/9/2018 at 7:51 PM, Pib said:

Yea...since they haven't changed the wording about a pension from a "private organization" that implies to me they should still flow. And they can flow to a regular savings account; a special Direct Deposit account is not needed.

From looking at the different pensions from U.S. govt organizations it easy to see they are from U.S. govt organizations and have my name in the transfer. And I expect there is underlying coding that further identifies them as a government organization. All kinds of underlying coding in an ACH transfer. This make it easy for Bangkok Bank NY to see they coming from a U.S. govt organization.

But with so, so many different companies that pay out pensions or maybe a person has a monthly distribution flowing from an IRA or some other investment will Bangkok Bank be able to determine those are "pensions" versus just another financial transfer. But such a payment is basically a "Direct Deposit" and is suppose to have special coding which identifies it as a Direct Deposit vs just another transfer. Will be interesting to see what really happens come Apr 19 with private organization payments.

And I wonder if a person was just doing a ibanking transfer into his Bangkok Bank Direct Deposit account if the NY branch might let that go through....probably not...but you never know. I've done ibanking transfer into my Bangkok Bank Direct Deposit account (which I still have but don't have my pension payments going to it) simply because of some FATCA reasons to keep the wife from needing to submit a separate FACTA report. Come Apr 19 I might try an ibanking transfer to my Direct Deposit acct to see if it rejects...it probably will but I won't know for sure until trying.

Yea, I'm sure Bangkok Bank has a headache over this issue and know where some loopholes that might still exist but they are not going to tell us...or they are working to close them...or maybe just leave them open. Well, just have to wait until Apr 19 and see what some TV poster report.

Edit: and maybe it's worth a question to the NY branch to ask about civilian pensions and IRA/Investment type monthly/quarterly/periodic payments coming from companies say such as Fidelity, etc. Ask if they can continue to flow as before or do they now need to be in IAT format also. If they say such payment have to be in IAT format also, then say, well that's not what our website says....your website implies they can continue to flow because the wording remains unchanged.

I read early on the bank notice about private pensions would be unaffected but I don't believe that is the intent of that piece of instruction. If there is any transfer via ACH that is other than US Government furnished funds, Bangkok Bank will not process it. That's what I believe.

This change benefits me financially. If Bangkok Bank hadn't terminate ACH transfer I would have continued paying the fees for my monthly pension and additional fees for the soon-to-be-initiated social security payments (& the headaches to have to have those deposited in a special account and the hassle to appear personally to withdraw any money). This caused me to check how my credit union deals with foreign debit card withdrawals. I will pay 0 credit union fees for any withdrawals, they'll reimburse up to $6 for any Bangkok Bank fees, and at a branch I visited of Bangkok Bank they said that they use the TT rate for the currency exchange and there is no fee for counter debit withdrawals...I will go to my home branch to validate these statements. If true, I'll be able to avoid all fees on both the sending and receiving ends.

-

18 hours ago, Belzybob said:

Great idea, but in my case it doesn't work. The number is actually imprinted/embossed in the card.

No the CCV ## is not embossed on all CC or Debit cards- the CC ##'s certainly are. I just scratched off the CCV ## on all my cards and there is no evidence of the number that once was there.

-

In terms of receiving international mail, it sucks. I rarely receive my monthly pension statement from the US. I haven't received any social security correspondence as well.

-

29 minutes ago, Kohsamida said:

Just for clarity, ScottieJohn was in fact correct about the bank account aging; it is 60 days for the first Extension application, and then 90 days for subsequent ones. As for other "errors", I'd appreciate knowing what they might be. So if in fact there are any, I hope somebody will be helpful and point them out.

30 minutes ago, Kohsamida said:Just for clarity, ScottieJohn was in fact correct about the bank account aging; it is 60 days for the first Extension application, and then 90 days for subsequent ones. As for other "errors", I'd appreciate knowing what they might be. So if in fact there are any, I hope somebody will be helpful and point them out.

No need to repeat where he provided that one clarification. And his information was not correcting an error- he just correctly expanded on the difference in funds seasoning. My message was pointedly directed at the unspecified other errors.

-

1 minute ago, NancyL said:

Oh, yes, you're right. It's no aging for the conversion, 60 days for the first extension and 90 days for subsequent extensions.

The term "renewal" isn't appropriate. What you're doing is "extending your permission to stay" due to retirement.

Agree with Nancy

-

1 hour ago, scottiejohn said:

Just one of the many errors. The money only needs to be in for 60 days for first App and not 90. 90 days applies to renewals.

You think there are many other errors? I note you provide no specifics. No specifics= no basis for believing your comments. Not a contributor I’d ever rely upon for facts.

-

Tried a couple weeks ago. Absolutely no problems inputting data, with drop down menus, captcha, etc and no delays in the speed of the processing. Use my Safari browser. Got my notice of approval 2 business days later.

-

In re to: "Copy of "updated" bank book. The bank book must be updated by the bank no more than one (1) business day prior to the date you intend to file your TM.7 application, showing that 800,000 baht has been on deposit with the bank for at least 90 days; all funds must be from outside of Thailand (this is indicated by a 3-digit code in most bank books deposit entries).

This is not entirely true. There are 2 parts to submitting the verification of funds in the amount of 800K or more. One is the bankbook and the other is the letter obtained from the bank verifying the account information. The letter MUST match the amount shown at the very last bankbook entry.

Nancy's info (always great!), in this case (if I read here statements correctly), I'm not entirely sure that NOT updating the bankbook just prior to submitting the application, is correct. If that last bankbook transaction entry is 45 days old, or 3 months old, etc.- in any event not recent- the IO may suspect that the amount of funds that have been held in the account may have fallen below the 800K minimum sometime within the 3 month seasoning period.

In this case, the IO will not accept the application for the extension. I ran into this myself when I had a savings account I had deposited funds in 6 months prior to applying for the extension, and had not touched any of the funds until applying for the extension- the I/O required bank proof for each of the prior months that I had not withdrawn any monies.Further, my personal experience, and as based on IO instructions I have received before, the bankbook update and bank letter are allowed to have "7 days validity period" so being required to have a bank letter and bankbook update no later than the day before applying has NEVER been my experience.

Finally, there is no requirement "that all funds must be from outside Thailand" as shown in the bankbook. Nancy uses the word "term account"; they are also called fixed accounts. Nancy is correct that these types of accounts are valid for fulfilling the 800K deposit evidence so long as the applicant is not prohibited from withdrawing any funds during the term of the deposit. As a matter of fact, I have (until this year) always set up a fixed account to hold my 800K for the minimum 3 months period and the funds for that account were cash from withdrawing the monies I had in other Thai bank accounts. Therefore the fixed account showed no code for a deposit from a foreign source.

-

1 hour ago, jeffandgop said:

My question is asking SOLELY about the currency exchange rate- how the use of an ATM card to withdraw money from my savings and not being a cash advance from a credit card- how do those exchange rates compare with say, the bank’s TT rate.

I believe what the answer I read above is that the exchange rate is approximate to or uses the same rate a foreign credit cards rate may be, and that is also approximate to the bank’s TT rate. If correct, for me that is not bad because the TT rate is what my ACH transfers get today. So long as my US bank- which is a credit union- doesn’t charge fees for foreign ATM withdrawals- then that would work fine for me as I still would be enjoying the TT rate (nearly). Seems cheaper and more conveniemnt than SWIFT transfers.

I’ll be contacting my credit union to review and confirm what they can and can’t actually do.

BTW Pib. I just realized my original post reply did specify credit card and not ATM card. So I apologize for constructing the original question incorrectly

-

6 hours ago, Pib said:

When you withdraw funds from an ATM (or at a counter) you get the Visa/Mastercard exchange rate "minus any foreign transaction fee" your card-issuing bank may apply." And this assumes you do not get sucked into accepting a DCC transaction then you get the local bank rate for a DCC transaction which is going to be around 3% lower than the full Visa/Mastercard rate. By full rate, I mean if your card-issuing bank does not charge a foreign transaction fee like the Schwab card does not plus a few others. But most U.S. bank cards charge a 1 to 3% foreign transaction fee.

And you do "not" get the FX mid market rate like reported at XE.com as that rate is what the big banks/currency traders get when doing wholesale currency trading. Yes, some money transfers services like Transferwise give you the mid market rate but those companies also then apply fees which effectively lowers their exchange rate.

Both the Thai bank TT Buying Rate and Visa/Mastercard exchange rates are pretty close to each other...usually give or take approx 0.25% when the FX markets are stable. And both the Thai bank TT Buying Rate and Visa/Mastercard rate are approx 0.5% below the FX mid market rate. Those slight lower rates than the FX mid market rate is where banks make their currency exchange profits....ditto for most money transfers services where their fees might be low to nothing but their exchange rate will be X-percent lower that the mid market rate as that is where they make their profit.

My question is asking SOLELY about the currency exchange rate- how the use of an ATM card to withdraw money from my savings and not being a cash advance from a credit card- how do those exchange rates compare with say, the bank’s TT rate.

I believe what the answer I read above is that the exchange rate is approximate to or uses the same rate a foreign credit cards rate may be, and that is also approximate to the bank’s TT rate. If correct, for me that is not bad because the TT rate is what my ACH transfers get today. So long as my US bank- which is a credit union- doesn’t charge fees for foreign ATM withdrawals- then that would work fine for me as I still would be enjoying the TT rate (nearly). Seems cheaper and more conveniemnt than SWIFT transfers.

I’ll be contacting my credit union to review and confirm what they can and can’t actually do.

-

The ATM method is convenient but I've always stayed away from that method believing that the exchange rate is quite dis favorable. When I transfer funds from the US to BKK Bank I enjoy the "TT" rate and assumably if I am forced to use the SWIFT process I'd still get from BKK Bank that TT rate.

Who has recent experience with what the exchange rates were when withdrawing from a Thailand ATM using a US bank credit card?

(If you don't know what "TT" rate is, call up the BKK rate page to see.....

http://www.bangkokbank.com/BangkokBank/WebServices/Rates/Pages/FX_Rates.aspx)

-

-

14 minutes ago, Suradit69 said:

Click on the tab that says "advice to senders using US bank internet services."

Thank you very much....

-

I was not able to find the link to the Bangkok Bank webpage detailing their change.

Could someone please post the link?-

1

1

-

Online banking today

in Jobs, Economy, Banking, Business, Investments

Posted

Still seems to be a problem. I can’t login to Bangkok Bank on my cell phone. Tried iBanking and their newly designed website.