mran66

-

Posts

880 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by mran66

-

-

17 hours ago, xtrnuno41 said:

IS the fan of the motor still really tight attached to the motor?

Took off the cowling and fan to check - it is good, no damage and solid in place. Also, pump/motor rotates easily, only minor friction from seal, no bearing sound/feeling, no issues there.

4 hours ago, Muhendis said:Sounds to me like a motor problem.

If you can check the running current (electric that is) and compare it with the rating plate power this will give a good indication of state of the motor. It is quite possible that a 10 year old pump will suffer from stiff bearings and so will be working harder.

Measured the current of my pump and also measured my neighbor's pump current (same model but newer). I guess I am getting to the tails of the issue.

When water flow is low, just below pressure switch cutting off, my pump runs around 2.8-2.9 amps. Same test for my neighbor shows about 2.4-2.5 amps, i.e both about double the 'nominal' level. It appears the nominal value indeed is just nominal, basically pump running without much load, just pumping water out with low pressure and no load for motor to pump against pressure.

What is different between my pump as my neighbor's pump though is that I have tuned the pressure switch a bit, basically adjusted the cut-off closer to the max level that the pump can make (to get higher pressure to 3rd floor). I think the std cut-off is 3bar, mine is around 3.5 according to the gauge I have. When tuning it, I recall the pump was able to make close to 4bar, however obviously needed to work hard to get there, so set a bit down from max level.

Now, when using my long 1/2 inch garden hose, with or without the sprayer, the pressure remains in 3+ bar range, keeping the pump running at 2+ times current vs the nominal level. I believe this is the explanation for the heating - the motor is simply not designed to run extended times at this load level, and the thermal protection just cuts it off if used like that. The pump does it job OK to deliver water at 3+ bar load level for normal household use though, no cutoffs from that use as usage times are normally fairly short.

So I guess nothing can do, it is what it is. Would be interesting to hear if someone is actually using this pump model with long run times at low pressure level without the thermal tripping - or alternatively having the same behavior as I have with higher pressure and extended runtime

-

2 hours ago, lopburi3 said:

You are drawing water from a storage tank as required? Keeping that tank in shade will greatly reduce water temp in pump (which cools by water-not by air). Is this a time of the year with direct sunlight on storage tank perhaps? Pump itself is designed for outside use with just the cover for protection.

Underground tank. The pump actually is cool even when the thermal will trip and stop the motor, only motor is hot. Pump has only weak thermal connection to the motor and thus dont cool the motor much.

-

39 minutes ago, xtrnuno41 said:

IS the fan of the motor still really tight attached to the motor?

If the fan is somehow loose, it can turn, but not efficiently, it slips and then not cooling well, the motor.

You mentioned weak airflow.

A pin maybe be broken or the glued connection of the fan is out of order.

Motor gets heated and has thermal trip at some point.

Good point, need to check that. That could explain.

-

1

1

-

-

1 hour ago, VocalNeal said:

Are you spraying or drip-feeding them.🤔

Usually using the rotation-adjustable sprayer. Pressure probably remains close to the 3bar cut limit as flow is relatively small. But I recall the heating also happened without the sprayer, just using 1/2 inch garden house with open end

-

2 hours ago, MJCM said:

+1

As I read it he doesn't!

@mran66 If you have connected the pump directly to the mains and the mains don't have enough pressure (less water) then your pump is sucking air which would cause it to overheat.

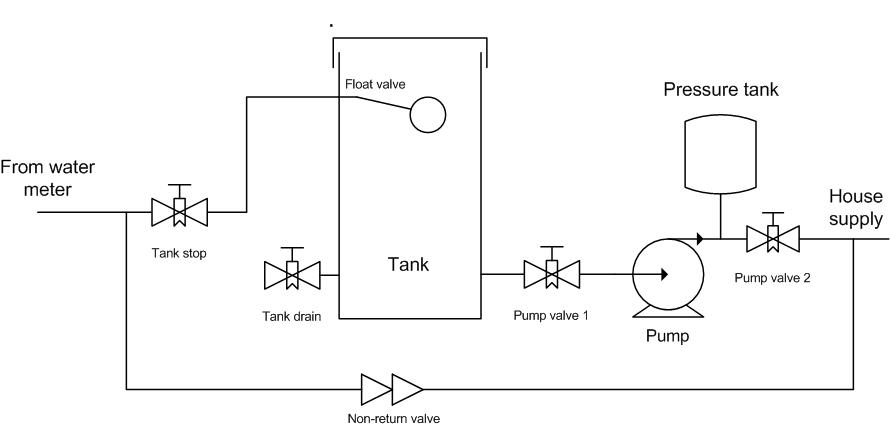

Normal working method for a Pump is have the Mains connect (fill) to a Water tank and then the Pump will draw water from that tank (and not directly from the mains)

@Crossy has a great diagram for it on how to connect it, but I can't find it right now.

Edit: Found it

Pump is being supplied from tank, without any direct connection to city water. Tank is filled from city water. No air in system. Connection is properly done, that is not the issue.

-

I have about 10yrs old Mitsu WP-305 water pump that has been working good feeding water to my house with fairly limited on-time as pump only runs when water used in te house.

Due to reduced city water pressure, I have lately I used water supplied by the pump also for watering plants, and noticed that after a while (5-10min or so) of continuous running, the pump stops. It appears that this is due to motor heat protection stopping it. After waiting a while it just starts on its own, and faster if cool it by spraying water on it. The motor actually gets fairly hot, though not sure what exactly the temp is but feels pretty hot by fingers, thus I would guess the temp sensor that cuts the power works at about right temp

In my neighbors garden have similar type of pump, though smaller size, used for watering the garden, sometimes running for hours without cutting. And that has the plastic cover on top, limiting airflow

Pump does not have the plastic over on rather is in a ventilated cabinet with decent space for air. The fan at the end of the motor is ok, though the airflow produced by it is fairly weak. Turning it from the fan it rotates without any big force, though has some friction (guess due to sealing) and does not run freely like a standalone motor would.

Anyone else experienced the same with similar pump? Any idea why like that and especially anything that could be done to keep it running?

-

On 12/25/2023 at 12:15 PM, Wandr said:

Water flows through my water pump even when it is not running. I have confirmed it by turning the valve on/off.

I don't think it was always like this.

Does it need to be repaired? Or is there some (simple) adjustment I can make.

For the usual house water pump (like my Mitsubishi WP-305), water for sure flows thru if the water in tank is higher than the outlet of the pump (or if supply pressure is higher than the outlet pressure). If the motor is not running, the pump simply acts as check valve (one directional valve). Water will not flow in reverse direction even if pressure in outlets side is higher than supply side (i.e water fill not flow from 3rd floor of your house to underground tank even if pump is off). The actual valve element and load spring is under the cap on suction side.

Actually, if city water pressure is high enough, the pump will not even turn on when you use water in the house (as long as the pressure does not drop below the pressure switch threshold). Where I live, used to be like that at times until couple of years ago (pressure sometimes 4-5bars), though seems the pressure level in the system has been reduced to around 2bars so that pump always kicks in if use water nowadays

Then it is a separate question where and why the water flows, esp if it should not flow. If all taps closed on pressure side and water still flowing, there is a leak somewhere. But pump works as it should

-

11 hours ago, still kicking said:

So why do I need a VPN like many other users have? I am in my home country and not overseas what does a VPN do for me? Where I live, I can access any website with no problems. So, if I install a VPN does that mean I don't need a virus protection anymore (which is free on most sites) I do know it helps to access certain websites when you are overseas but why do I need my messages or website encrypted? As you all know I am a computer illiterate (76 years of age) So give me a simple explanation why I need it?

If you live in developed world and use pirated content esp torrents, use VPN to hide your ip and avoid lawyers going after you

-

1

1

-

1

1

-

-

24 minutes ago, Nemises said:

I use a VPN to book CHEAPER airfares from a “third world” country. Works every time, normally saving me around 12%.

Which countries you have found to work best for this purpose?

-

9 hours ago, Mike Lister said:

Both 60k and 120k are correct, it depends on whether you have assessable income only from employment or income from other courses as well, eg bank interest on savings.

RD Forms: PND.90 = 60,000 single and 120,000 married; PND.91 = 120,000 single and 220,000 married

... Okay... So for a single farang without any other local income than interest on local bank account, the filing limit is?

-

Have a walk around the Arab bars in the area behind marine Plaza hotel.

After just walking around all farang focused bars in Pattaya are quiet!

And I doubt they serve Guinness, possibly under the counter.

-

12 hours ago, Danderman123 said:

Nope.

Staying more than 179 days requires filing a tax return, even if nothing is owed.

However, this is the case now. Lots of tax residents in Pattaya never file a tax return, because, until this new regulation, nothing was owed.

As some posters have said on the thread, no need to file tax return if no income even if you tax resident. Some say the threshold is 120k, some say 60k, not sure what is correct. And the announced new regulation does not say anything about changing the threshold for tax return filing as far as I understand.

Then the other issue is whether having or not having a tax ID makes any difference for likelyhood of possible audit if no filing. I never filed so far as no taxable income but got my tax ID last year, not for filing tax return, but was required by US bank.

But yes, I will also join the 179 day camp if taxes become real and meanhingful, however the current announcement does not look like that necessarily being the case.

-

1

1

-

-

47 minutes ago, Expat68 said:

my tax return from the UK is proof of my income

That's obviously good for you if you can use that to make taxes paid to UK to credit against the income you would send to Thailand and assessed to be taxable income here. Likely your taxes paid to UK are more than what the tax here is anyway.

Fortunately or unfortunately - depending on the point of view - that is not the case for some of us who do not need to file tax return anywhere (until possibly to Thailand in 2026) and would need to use transaction statements to explain where the income is coming from.

-

9 hours ago, Villapete said:

I saw on a Pattaya news channel yesterday on Youtube that immigration have apparently been asking for evidence of tax paid on income as part of visa processing.

I would guess this would be for people on work visa?

-

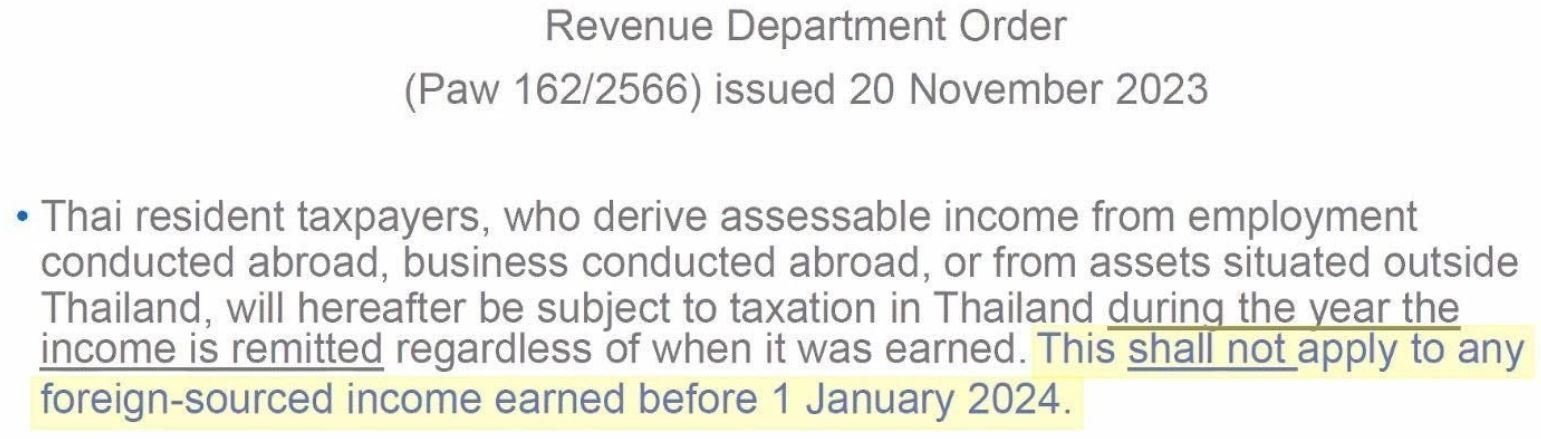

6 hours ago, deejai33 said:

It's my interpretation of the Paw/162 clarification. See attached image. Was from Mazar's apparently.

Posted in the main thread on this tax issue. It's only my interprettation. Do you think I'm a bit too hopeful, mistaken ?

It talks of rules on income from foreign sources and assets not apply to pre-2024 income.

In the bitcoin case, those assets existed pre-2024. Similar to cash you had in a bank pre-2024. I'm hoping that makes both the cash and bitcoins not liable to tax when transferred.

Maybe there's a gain made when converting bitcoins, and that occurs post 1-1-2024. Is that what you think about ? Similar to interest earned in 2024 on pre-2024 money. I think the interest would be taxable.

Is one option to change the bitcoins to cash before 2024, and next day change the cash back to bitcoin ? So the gain was clearly made in 2023.

I'm no expert.

Okay... This clarifies one issue. Profits realised by end of 2023 are not taxable, even if realised in 2023 and sent to thailand in 2024 - which is a good thing.

However if you own anything that has appreciated since purchase (eg bitcoin, stock, fund etc) and you don't sell it by 31dec23 rather after, the whole appreciation is taxable if you send it to thailand.

-

I recall another poster telling he had found similar studios on walking street, with similar moves. Several of them actually, though no windows, had to go inside the curtain doors to observe the moves.

He gone there after hearing lobsters available in seafood restaurants, but also found out them overpriced - just like the meat moving around the poles.

But beer was presumably cheap so at the end he was not too disappointed.

-

10 hours ago, deejai33 said:

My reading of the announcements by RD is that any type of money, pension, savings etc, that exists in a foreign account before 1st jan 2024 is untaxable.

A pension deposit from 2022 ( last year) would be untaxable.

Where did you read such definition?

In your understanding, a bitcoin I held since 5 years ago, and convert to thb at hefty profit in thb terms in 2024 (but with a thb value less than in Dec 31 2023) is not taxable for the thb profit as it is just 2023 money that I convert to some other currency? Currency trade profits are not taxable income?

-

Not targeted for westerners for sure. Who with sane mind would trust thai govt promised insurance with very low coverage so that they would decide not to take their own insurance?

Oh maybe some Indians and Chinese

-

2

2

-

-

Lately smugglers have been into pork smuggling. Alcohol, cigarettes, drugs, fuels and even luxury cars in the past.

Human legs maybe the new growth area for smugglers.

-

2

2

-

-

10 hours ago, Danderman123 said:

One big thing everyone is overlooking: even if you don't owe anything, you will have to fill out a tax form to prove it. At that point, you are trapped in the tax system.

I am taking 2 precautionary measures right now, in the unlikely event that this is implemented in 2024:

1) Transferring in money from the US to my Thai bank before January 1.

2) I will spend the first 2 months of the year abroad. If this tax thing has crashed and burned by then, no problem. If it is still a threat after February 1, I will plan further trips overseas (out of Thailand).

Looks like two rubbers for extra safety!

If you send enough this year to cover for expenses for next year, no need to limit stay next year as it is not about global tax liability, only to what is sent here. Nothing sent, no issue

-

To me depends on bank. If I send to Bangkok bank, it is usually next day at 2pm when funds land my account. If I send to krungsri, it is 1-3 minutes from click the send.

I guess this is due to bkk bank being their local partner for the actual forex trade (visible as overseas source in bank book) whereas krungsri is just a local transfer.

-

1 hour ago, jaywalker2 said:

I agree but one thing I've learned over the years is never underestimate the stupidity of the Thai government.

that's where the answers to my scenarios become relevant for some people, though probably majority of new condo buying farangs are not tax residents (yet), so the issue not relevant for them

but for some people (like me) who have investments for couple of decades without tax on earnings, you could interprete the announcement also so that all earnings on top of the original seed investment 20-some years ago could be considered taxable income.

thus the guidelines for definitions and rules is kind of important for some people, though maybe not majority

-

1 hour ago, scottiejohn said:

I understand that but some posters are suggesting that money already put in bank accounts prior to 2024, not interest, could be taxed!

I know it sounds like scaremongering but is there any basis to their claims?

well, depends on how and where your funds in your bank account have come. If they are non-taxable during current tax policies, they will not be taxed based on this change.

but yes if the funds are taxable income sent to thailand during the year they were earned, they are taxable income in the tax year they are sent here. If you have not reported that income as taxable in the past even if you should have, you have violated tax law.

but that is kind of outside of the scope of this thread which is about the announced change for 2024

-

1 hour ago, connda said:

I have to admit, the government lockdown of Thailand actually appealed to me. I liked it. Nobody around. Easy to drive. No pediatricians. It was great.

So I think in would be great if Thailand hammers all expats who bring foreign currencies into Thailand.

Honestly - if fun to watch them whack-off there own willies with a sharp instrument of financial terror.

Yeah - taxes aimed right out foreigners.

Cheap-Charlie Expats aren't worth a hill of beans.

Cheap-Charlie Expats aren't worth a hill of beans.

Excellent - Let's kick as many out of the country as possible and see how life goes from those whom they support?...fortunately or unfortunately, most of the expats stayed here, it was the tourists that were missing - even if all expats would be gone, you would not notice it if tourist numbers back up as the tourists are not impacted at all by any income tax laws...

-

1

1

-

1

1

-

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Mitsubishi water pump getting hot

in DIY Forum

Posted · Edited by mran66

the pump motor nominal power in label is 300w.

pressure switch spec for wp-305 is 2.4 start and 3.0 stop, and this is how my neighbor new pump actually works.

as said, few years ago I actually tested how much pressure the pump can do, and as result set the cut off to about 3.5. I recall he pump itself can make close to 4 however not obviously with any meaniful flow. With small flow like house tap or shower, it keeps at 3+

But it is obvious that the power motor takes within the switch start-stop range is way more than the 'nominal' - I guess the motor nominal power is defined in state when pump just moves water from inlet to outlet without having any (or at least much) pressure. Maybe can test some day out of curiosity