-

Posts

6,831 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Dogmatix

-

PM Reassures Digital Wallet Project Will Be Implemented

Dogmatix replied to webfact's topic in Thailand News

He has a new boss now, recently returned to Thailand who can get rid of him, if he doesn't listen. -

This dispute where the Yubamrungs clearly claim Thaksin is the decision maker about cabinet appointments should provide some interesting material for someone to petition to have PT dissolved on the grounds it allows an external person to have significant influence over it. Lucky for PT they are now part of the elite and courts will take their side.

-

It’s already officially announced in 161/2566 a directive to RD officers to reinterpret the Tax Code to mean something other than what was intended. Binding on RD officers but not on the public. That is how this government wants to operate. Thaksin is back in power from his “prison cell” and it’s back to the Thaksinite authoritarian ways of rule by decree. There may be no further announcement and no effort to amend the law by lawful means.

-

I resumed filing after a few years between jobs and there was no question about the missing years. There is no obligation to file if you have no incone. Filing to reclaim tax on interest and dividends is optional. If they do ask, tell them you had no assessable income or file late returns claiming tax refunds which might offset late fines..

-

TAT considers actions needed to restore tourist confidence in Thailand

Dogmatix replied to snoop1130's topic in Thailand News

I see a lot of knee jerk stuff from Anutin and others grandstanding on TV. Many stricter controls for registered guns which are already strictly controlled. How will this help prevent 90% of Thai violence committed with illegal guns and by soldiers and police like the Korat massacre and the massacre of innocent little children. How about getting rid of illegal guns and only letting soldiers and police have guns on duty and hand them back when they go off duty? -

Worth pointing out that the Korat murders were started using guns bought from the Interior MInistry's Civil Service Welfare scheme; the firearm used in the the murder of the little children at the day care centre and in the murder in the Kamnan Nok case were also sold to he murderers by the Interior Ministry. The Siam Paragon murders were committed with a modified replica gun. None of these murders were committed with guns bought by regular citizens for full price at gunshops. Most other gun murders are also committed with unregistered guns.

-

That looks like a more detailed write up of the same press briefing by Anutin. Odd that he proposed that only people with carry permits could bring their guns to the range after saying he would not allow any more carry permits to be issued. Since they are only valid for one year at a time, there will no one left with carry permits to go ranges after a year. Ranges will obviously not be able to store guns for all their members and whatever storage they could offer would be steel cabinets in non-aircon spaces where guns would rust in the humid Thai climate. This would kill private ranges and sports shooting and create a large number of guns people want to sell without any legitimate buyers. Many who need cash would attempt to file off serial numbers and sell the guns on the black market, which already happens with guns fraudulently reported lost or stolen and with orphaned inherited guns that don't get transferred to heirs. I think that would happen to the large numbers guns bought through Thai nominees for wealthy Chinese sports shooters who come to Thailand to shoot because they are not allowed even BB guns in China. Another interesting issue is the Civil Service Welfare Scheme which is the largest gun importing and retail business in the country run by the Interior Ministry itself. The Interior Ministry is on both sides of the fence as the licensing authority for buyers, sellers and importers. This is a business, which is exempted from the 30% import duty on guns and is worth multi billions of baht annually, managed in an unaccountable, non-transparent way with plenty of opportunities for graft. Having only just seized control of the ministry and its purse strings, will Anutin be willing to regulate this prized business out of existence? Without permits to buy and ranges to practice at, the revenue, profits and commissions of this scheme would shrink dramatically. It is notable that government never responds to calls from the public to rationalize or cancel this scheme.

-

What he actually said in Thai was he had instructed the DG of DOPA to cease issuing Por 12 carry permits to the general public. Presumably ministers, MPs, senators and other worthies will still get them. He didn't say he would cease issuance of Por 4 permits to own firearms. It makes sense that this will not happen. Otherwise the Ministry of the Interior, the largest importer and distributor of guns for civilians, will likely be left with a lot of unsold stock on its hands.

-

Mall Shooting Could Lead to Increased Gun Control

Dogmatix replied to snoop1130's topic in Thailand News

This gun should still be OK, shouldn't it? -

They won't because the government is the main importer and seller of guns to private citizens through the civil service welfare scheme that imports a couple of hundred thousand guns of all types to be sold to civil servants and state enterprise employees. We are talking about a sales value of about 10 billion baht here. This is a huge money spinner for senior Interior Ministry officials. The issue of other import and other permits is also very lucrative for individuals.

-

Unfortunately the OP is an inaccurate summary of the linked INN press release. In that, Anutin is quoted both in the headline and para 3 saying he has ordered the DG of DOPA to immediately cease issuing permits to carry guns (i.e. Por 12 permits) . The wording ใบอนุญาตพกพาอาวุธ is very specific and can only refer to a Por 12 permit, which is already extremely difficult to obtain, needs to be renewed annually and is processed by the police not DOPA, although the actual piece of paper is issued by DOPA. Regular licenses to own and use a firearm are referred to as ใบอนุญาตมีและใช้วุธ (Por 4). This doesn't mean that Anutin will not crack down on issuance of ordinary Por 4 permits. A crack down was actually already in place under the Prayut government making It much harder and requiring far more documents and evidence of assets. But ceasing to issue permits altogether is not what Anutin said.

-

Thailand’s firearm frenzy: Tops ASEAN in guns, 13th in global tragedy

Dogmatix replied to webfact's topic in Thailand News

The UK and NZ paid the market price for licensed guns seized by the government? Will Thailand do the same? I don’t think so. They would have to find a budget of around 500 billion to do that, similar to the cost of their digital wallet and we know that many of guns would not be destroyed but would be sold on the black market by crooked officials. We also need to consider the main importer of the guns that makes the most money from them is Anutin’s very own Interior Ministry through the Civil Service welfare scheme that imports more guns to sell at a discount than that the meagre import quotas it assigns to all of Thailand’s gunshops put together. Finally let’s not lose sight of the fact that the Siam Paragon shooter used a home made gun, not a licensed weapon. A quick win for Anutin would be to ban the import and sale of blank firing replica guns like the one modified by the Paragon shooter. There is no need for them in any sports. And how about doing something about the army range in Bangkok where he trained with an army instructor visible in the video. The range is only supposed to be for members who should be over 20 years old. Ranges should be restricted to members and permits should be checked for personal guns taken to ranges. As it is Thai firing ranges are filled with wealthy Chinese tourists shooting guns bought for them by Thai nominees. We know already that none of the simple, cheap fixes my last para will be even looked at. -

What is not being mentioned is the allegation that was around in Thai social media before Srettha was voted in that Thaksin was involved in bargaining the price of votes for Srettha. Numbers like 20 mil were being bandied around. Perhaps these rumours helped get Ari fired up against the senators in general, as there no specific corruption allegations against Pornthip. However she retired under a cloud regarding her support for the fake bomb detectors that she ordered for her department and also endorsed the army’s much larger purchase of them under Prayut’s watch. Hard to believe that she, as a scientist, had found any professional reasons to endorse the bomb detectors which were just lumps of plastic with nothing in them. it seems odd that the 14 million voters whose votes got dissed by the senate are being so silent. If this were Kenya or somewhere like that, there would be hundreds of folk dead in the streets by now. Trumps Proud boys would be out at the barricades in their most fashionable tactical gear ARs dangling off their necks. Lucky for us that things haven’t boiled over like that. Perhaps the orange masses are keeping dry powder for the dissolution of MFP and imprisonment of Pita. It has usually taken a catalyst of that order to stoke things up enough to bubble over like the dissolution of FF and the banning of Thanathorn on allegedly Trumped up charges. For the red shirts in 2010 the catalyst was the confiscation of Thaksin’s 36 billion by the court.

-

Once the government starts messing about like this, nothing is safe. The wording is odd anyway. The Revenue Department has no authority to issue Royal Decrees, only Revenue Dept orders like RD Order P 166/2566 which is only binding on its own staff, not the general public. The Royal Decree was issued not by the RD but by Prayut. It is now a policy of the previous government which current government may not like much and might not feel very bound by it. A Royal Decree can easily be junked by issuing another Royal Decree.

-

More details on Thai taxation of overseas income

Dogmatix replied to webfact's topic in Thailand News

Elite visa holders, who are also tax residents, should be prepared to pay tax on the 500k to 5 mil they remit to renew their Elite cards. -

The main problem is the civil service welfare scheme that floods the country with a couple of hundred thousand discounted guns every year imported and sold by the Interior Ministry through proxies. Anyone who is a civil servant or works for a state enterprise is eligible including people like village defence volunteers. Many of them attempt to file off of the serial numbers and sell their guns on the black market. Then file a lost gun report and buy another. Guns imported through this scheme were used to start the killing spree of the soldier in Korat, by the ex-cop who went on the rampage in a kindergarten and the murder of the police major on behalf of Kamnan Nok. That's all the recent notorious murder cases except the one in Siam Paragon. These guns also leak out into neighbouring countries and are found used in crimes there. Just shut it down. But Anutin is not going to consider this because of the huge profits involved which must leak in several directions since proxies are used in the distribution. Since the boy didn't even use a licensed gun at Siam Paragon, why not crack down on illegal firearms and ban the import and sale of those blank firing replica guns that can be do easily modified?

-

But the exemption doesn't cover income earned abroad before an LTR visa has been issued. So the RD inspectors could still go after LTRs who bring in larger amounts to buy condos and ask them to prove they earned the money after they got LTR visas. Since Srettha has said they need to get more tax from foreign sourced income in the interests of fairness and equality, he might decide that maintaining the exemption for one group of expats who are already richer than the others is neither fair nor equal. A Royal Decree can easily be reversed with another Royal Decree without the need for any parliamentary process.

-

Tourism confidence in Thailand plummets amid economic jitters

Dogmatix replied to webfact's topic in Thailand News

It will make more sense to holiday outside Thailand particularly if prices are comparable and you have a foreign credit or debit card you can use to access your overseas savings tax free. -

Tourism confidence in Thailand plummets amid economic jitters

Dogmatix replied to webfact's topic in Thailand News

Pheua Thai always promotes an image of being very effective in promoting GDP growth, although there is little evidence for this and the flagship policy of the previous PT government under Yingluck, the rice pledging scam, was an utter disaster, as were her primary school tablets. So Srettha is desperate to boost growth to perpetuate this false image and counter accusations of spending large amounts on wasteful projects like digital wallets and subsidizing fuel prices. Unfortunately relying solely on low end chinese tourism is unlikely to work for Srettha. -

Local shoppers and foreigners are still in fright and they have been expressing their concerns over the country’s law of gun ownership and safety protection in general. It was not a real gun. It was a blank firing starting pistol freely available on Lazarda and Shopee for 5,000-7,000 baht, modified to fire real bullets.

-

More details on Thai taxation of overseas income

Dogmatix replied to webfact's topic in Thailand News

Thailand does have itemized deductions in addition to the standard deduction. There are a lot: for elderly parents, kids, childbirth expenses, charitable donations, life and health insurance premiums, investing in retirement funds, sometimes a special promotion for buying consumer goods. There is also big 190k deduction for over 65s. -

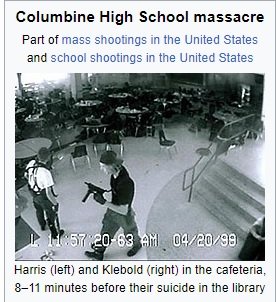

There is a lot overlooked by Tim Newton who I guess cannot read Thai and is, therefore, restricted to the limited amount of news available in English. The gun was a blank firing starting pistol modified to fire live ammunition. The shooter was not only addicted to shooting games but to shooting live ammo. The cops found a clip on his phone of him shooting his illegal gun at an army range in Bangkok, supervised by an army instructor. They found a box of 9mm "practice" ammo in his room of a type commonly sold at gun ranges. The shooting seems to be a copycat of the Columbine massacre. He dressed almost exactly the same way as Kleber.