cliveshep

Advanced Member-

Posts

937 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by cliveshep

-

Anybody got Bill Gates' 'phone number?

cliveshep replied to Zaphod Priest's topic in IT and Computers

Or find a hot and horny girl? -

Make your own like we do - dead easy! Example: 1kg of Brooke Bond Red Label loose tea is thb345 plus thb35 delivery on Lazada - comes in a re-sealable zip lock bag. Empty drawstring fabric tea bags also from Lazada cost a paltry thb14.67 for 60 of the 6cm x 8cm size. We buy 500 at a time and beloved spends a hour or so doing a couple of hundred or so in her spare time. One heaped teaspoon of loose tea is difficult to tip into a smaller bag so don't be tempted to get smaller. I get 2 mugs out of one bag but I don't like strong tea, others will use 1 bag per cup and infuse longer. If you want the links they are https://www.lazada.co.th/products/orna-100-string-teabag-i4673799049-s19246793328.html? and https://www.lazada.co.th/products/brooke-bond-red-label-tea-1kg-zip-lock-pack-i2722785042-s9860441030.html? Red Label is the same as the Tesco Value Red Label we always used in the UK, same taste as PG tips but cheaper. For the last 10 years we got used to finding the work-arounds one needs in LOS!

-

Ref wife's visa, you are aware of the UK's draconian financial requirements for a foreign wife and child? Income Support rules say £8500 p/a is adequate for a husband to live on with a wife UNLESS she is foreign because foreign wives are, apparently, far more expensive to keep. The child goes free but seeing what finances are needed for a foreign spouse that is hardly magnanimous of them. This is the list of onerous and shameful rules our wonderful Labour Government have now amended. Those who pray Keir Starmer et al fall under a bus are on the right track - please pray harder! Below from Google:- To bring a foreign spouse to the UK, the UK-based sponsor generally needs to demonstrate an annual income of at least £29,000. This is known as the minimum income requirement and applies to those applying for a family visa as a partner or spouse on or after April 11, 2024. The financial requirement can also be met through a combination of income and savings, or through other permitted sources like pensions. Here's a more detailed breakdown: Minimum Income Requirement: £29,000 per year: This is the standard minimum income requirement for most first-time applicants applying for a family visa as a partner or spouse on or after April 11, 2024. Different rules for those applying before April 11, 2024: If the application was submitted before this date, the minimum income requirement might be different, potentially £18,600. No separate child element for new applicants: For those applying on or after April 11, 2024, the minimum income requirement does not increase if there are dependent children included in the application. Potential increases to the minimum income threshold: The government has indicated potential future increases to the minimum income requirement, possibly to £34,500 and then to £38,700. Meeting the Financial Requirement: Income from employment or self-employment: The sponsor's gross annual income from UK employment or self-employment can be used to meet the requirement. Pension income: Pension income can also be included. Cash savings: Savings above £16,000 can be combined with income to meet the requirement. Other permitted sources: Income from other sources like dividends or rental income may also be considered. Combining income and savings: It's possible to combine cash savings with income from employment, pensions, or other sources to meet the financial requirement. Evidence of savings: Savings must be held for a continuous six-month period before the application date and must continue to be held at the time of application. Other considerations: Healthcare surcharge: You will likely need to pay the healthcare surcharge as part of the visa application. Specific rules and conditions: There are specific rules and conditions that apply to the financial requirement, and it's crucial to review these carefully to ensure you meet the requirements. So if you are on a State Pension as I was, on retirement in order to stay married you get to leave the UK or see your wife deported. Good game good game!

-

I've just got my renewed UK passport back after considerable stress with HMPO, by the time the fools finally agreed to issue my 5th passport renewal I had received a total of 27 emails. Out of those some were from VFS Global, subject ranging from confirmation of initial appointment through to notice to collect passport, confirmation I had collected passport, then the day after collected passport one to say my original birth certificate could be collected, then one saying I had collected it, then one saying all my document photocopies the next day could be collected. Told them 3 times driving into BKK was enough, just bin them. They did not originally want the birth certificate but asked for it after costing my a whopping £38 to send it by DHL as they wanted an original. BUT they did return it after passport collection. VFS Global were fine, they wanted photocopies of everything, even blank passport pages, but HMPO send everything back on consecutive days it seems meaning you got to travel in repeatedly which is a pain if you live far out. You only need photocopies of parent's passports as HMPO are fully aware of the legal requirement in Thailand for you to have your passport in your possession. But VFS Global will want to see the originals to compare with photocopies. Be aware you will need a translation of any Thai birth certificate to go with copies of original Thai, whether they accept photocopies of original Thai papers I don't know, certainly they only want photocopies of everything else but be aware - they (HMPO) are jobsworth pedants requiring every i to be dotted and every T to be crossed.

-

Because that was also a published story. What is wrong with you? Let it go!

-

WTH is a 'sooking'. And no flip-flop, dopy, I was correct from the Bangkok Post's 2 articles, even if one of them was wrong. So it was 300m, but according to another BP article it was 5km. And I remember clearly the first published story was 5km, not 300m which they presumably published later as a correction.

-

True and as I said to the other guy you are right. Ok now? I mis-spoke from faulty memory although I'm pretty sure one article I read a year or more ago did mention rail in the order of kms long but the article I quoted does say only 300m although that is more than enough. And I did not mis-speak - here is the original article clearly saying 5km of rail fell off: Line conductor rail collapses in Nonthaburi Bangkok Post https://www.bangkokpost.com › Thailand › General Dec 24, 2566 BE — A 5km stretch of the metal rail fell from the elevated structure of the Pink Line from Chon Prathan market to Khae Rai intersection. So - would you like to apologise now?

-

You are right. 300m of rail fell damaging 3 cars on Christmas Eve 2023 in Nonthaburi. Bangkok Post reported it here: https://www.bangkokpost.com/thailand/general/2711978/pink-line-conductor-rail-collapses-in-nonthaburi So who did not fix this rail that fell off? Fairies? Of course it was the construction crew, or do you have another culprit? Where were you on Dec. 34, 2023?

-

My wife listens to and reads news that not being a Thai speaker or reader I don't get to see. Apparently today on Ramkhamhaeng in Bkk another large lump of concrete fell off the overhead railway. No one was hurt and no vehicle damaged which was a mercy. Seems like hardly a week goes by without something heavy coming adrift from one of those railways in the sky, be it bridge beams, kilometers of rail, train wheels, falling cranes - the list over the years seems endless. When are the relevant authorities going to wake up and 'smell the coffee' and get to grips with construction's appalling safety record. indeed with construction safety generally because quite often it is members of the public who get killed and injured as well as workers? The Expressway Authority of Thailand (Exat) has reported over 2,500 construction-related incidents on Rama II Road since 2019. I do not think worker injuries are counted, these figures seem to refer to more major things than slips, trips or falls to workers but to incidents involving heavy plant and heavy objects, like liquid concrete falling onto a passing car and injuring a child or beams falling etc.

-

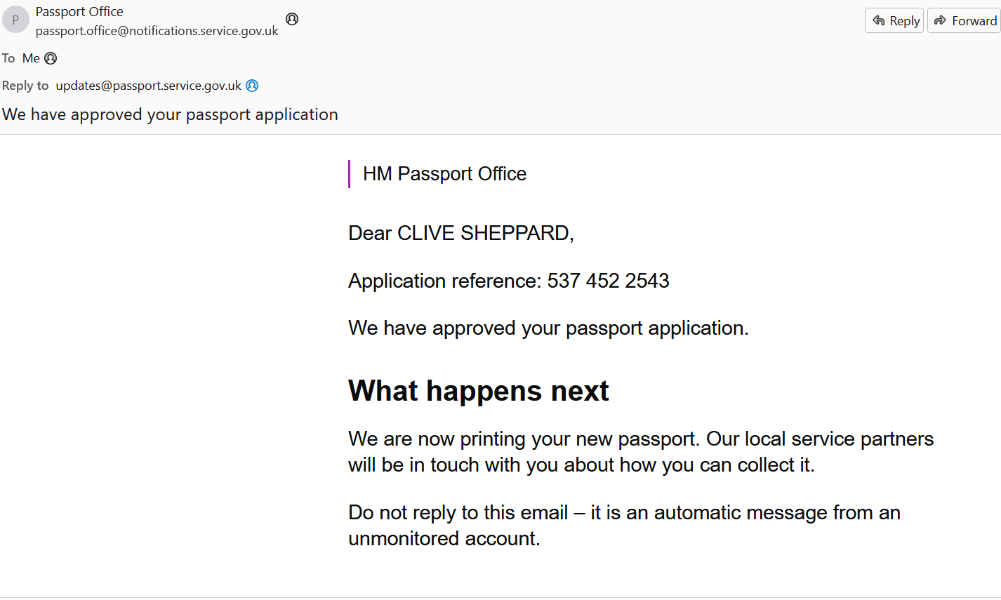

I'm sure this topic has been covered elsewhere but I can't find it. After all the unnecessary drama caused by the clots at HMPO I'm finally approved for my 5th British passport renewal that should arrive sooner or later with VFS Global in Bangkok. The old passport expired next January 16th which is the date my Marriage extension runs out. Here is my probably-done-to-death-elsewhere question:- Do I turn up for my usual interview a few weeks before expiry of my 10th marriage extension as was my normal habit with the old maroon EU/British passport containing all the stamps and now my new virgin blue British Passport with no stamps whatsoever and let the I.O's in CW sort out the stamp transfer issue? Chuffed now - "we Brexiteers have waited years, changing red to blue without the tears", sorry about that, it's my age you know!

-

UPDATE - A really nice Yorkshire guy phoned me just now from HMPO in Hemel Hempstead, UK to ask about my passport application. According to him because I put Herts UK as place of birth that apparently differed from a previous application and all he wanted to ask was did I mind if he changed that to England? So I laughed and said of course not, Herts is in England anyway isn't it. He said he thought given my age and circumstances it was better to call me on a private phone than yet more emails and he would changed the place of birth to England and the passport would then be sent for printing and issuing and posting back. So we had a little chat about - the weather of course being English, and he asked me to confirm my Thai postcode - no problem - and date of birth. Told him we only came here because of Theresa May - he didn't seem to know about her so I had to explain why we got forced to leave the UK. All in all a really good phone call with a nice guy and bearing good news in the end. All I got to do now is wait for it to arrive in Bangkok, hopefully in a few days.

-

Thank you for your concern, as I said elsewhere my current passport doesn't expire until next January so there is no immediate urgency but googling before the advice was to apply 6 months before expiry in case of c**k-ups. Clearly good advice. Phoned them this morning - automated check line which said they are looking at the application. I confess the waiting is very stressful. I don't think the issue is one of identity and given the fact I have had 4 passports to date the only thing they queried was my address now we fled here to avoid my wife being deported under Theresa May's pogrom it is not as before - in the UK. I explained all that and even gave them the old UK address since when it has gone quiet.

-

Update - there is none. Over a week since they received the original birth certificate from DHL, not a peep from them. I'm going to call their phone line to check progress later today when they open. Looking back over the last 40 years and noting the milestones in my life when I did foreign travel this application is almost certainly for my 5th passport which makes HMPO's behaviour even more stupid and unnecessary. If only someone with a brain could see that.

-

Just checked if I can get pre-adoption details and came up with the answer which is yes but as I was adopted at 6 months old (presumably the papers were submitted a whole lot earlier) the law says if the adoption was before 1976 which if course it was, before the details can be released I have to attend a counselling session in the UK which is mandatory. So I would need around £1000 air fares, pay for hotel accommodation and attend this counselling all to satisfy the little minds in HMPO that I am British and was born in xxx town or village if the gnomes insist on that detail. At that point it is official complaint time and probably have to go the ombudsman route if I am still alive. No way can I on a fixed tiny pension afford that, we struggle to survive now. Catch 22 - left or right I'm screwed over by mindless moron jobs-worths perhaps.

-

This is the next to last mail I got from them, the last one promises to return documents. Of concern is the insistence I prove what town or village I was born in. No problem, I'll track down the midwife via a seance. I hope and pray the original birth certificate that gives details of adopted parents suffices else I'll be in deep dodo. There is no way I can prove that almost 80 years later especially in the chaos so close to the end of the war. https://static-logos.notifications.service.gov.uk/bc9eb012-fd36-4bf0-a201-b915f203ddec-homeofficecrest.png HM Passport Office Dear CLIVE SHEPPARD, Application reference: 537 452 2543 We need you to send us more documents We cannot continue with your passport application because we need more documents. Send evidence that confirms your place of birth We need you to confirm your place of birth before we can continue and print your passport. Unfortunately we cannot accept Herts as your place of birth because it is a County name. We need to know the village, city, or town you were born, so we can add this to your new Passport. Not doing so when issuing your previous passports has been an oversight on our part, please accept our apologies for this. Send your birth certificate or adoption certificate. If your birth certificate does not show your place and country of birth or you do not have the original you can order an official copy at: https://www.gov.uk/order-copy-birth-death-marriage-certificate The formats we can accept We usually cannot accept photocopied documents unless we have told you we can for that type of document. Only send laminated documents if that is the only format the issuing authority provides for them. How to send us documents When you are sending us documents or letters, make sure you: we only want the items we have asked for use a strong envelope that is the right size for anything you need to send us check the weight and pay the correct postage – consider using a signed and tracked service send to this address – this includes the application reference so we can match anything you send us to your application HM Passport Office INT-DOCS 537 452 2543 Three Cherry Trees Lane Hemel Hempstead HP2 7HQ UK We will return any evidence you send us when we are finished with it.

-

Update - decided to bite the bullet as there is no way I can go back to the UK and if no passport Thailand will boot me out and I'll be effectively stateless forced to leave my home and wife. What a showa'o'<deleted>e our Government civil servants are? We are only here in the first place because Theresa May, wicked witch of Maidenhead while Home Secretary and refusing to endorse calls to leave the EU to cut immigration instead attacked foreign spouses and students instead. She raised financial thresholds way over twice the UK Standard Pension rate meaning those whose wives failed the Life in the UK test (designed for failure of course) would, unless their retired spouses could prove income over £18,650 , be deported irrespective of the family breakups this would cause. That figure I understand has now been increased dramatically. There has to be a special place in hell reserved for Theresa May and Priti Patel. So seeing this red light I sold everything and we fled here to stay together and 10 years later I do not miss the UK and it's over-reaching laws one bit. We have a nice home and apart from the minor inconvenience of annual extensions and 90 day reports life is good - until now! HMPO promised to return document with passport this morning so beloved wife has toddled off in the car with it and a letter in the packet to the nearest DHL Express some 10 miles away to get it expensively transported to HMPO in England. Letter tells them there is no documentation of what town I was born in, such details are sealed to protect the birth parent's anonymity so all the Birth Certificate does is prove I am British, adopted, and entitled to the last 3 passports and the new one applied for.

-

Well, following Googled advice although my passport does not expire until 16th January next year I decided to play it safe and apply now. At 79 I figure I can afford to loose a few months, So after initial hiccups with VFS caused by their web site being down and complaining I did get to make an appointment for 21st May once they settled in to their swanky new offices. I downloaded the form, filled it in, laboriously scanned and printed colour copies of every page of my extended passport (only used about 6 pages so won't do that again) and put together proof of residence and address - an AIS bill in my name with full address all in English and scans of my car and motorbike licences also giving the address in English. This will be my 4th renewal and HMPO have mailed the wrong email address needing more info, in spite of VFS Global emailing me from the address on the application form confirming sending the docs to the UK but the HMPO muppets were too careless. I only realised when they sent a text advising email sent but it never arrived. So I emailed the help line who came back quite quickly asking for various info like proof of address etc and sundry other info they already had. After the 1st 3 0r 4 replies to me it became clear they could not find the application based on what they said. However, each time they emailed me it was to ask a different question but the real killer came with their email no 7 where they basically refused to renew the passport unless I submitted documentary proof showing the town or village where I was born and proof I was British. Now I was adopted and apart from my parents telling me I was born in Herts there is nothing in writing. They have been dead for 40 years so I cannot ask them. HMPO apologised for waiting over 30 years (3 passports to date) to discover they didn't know the town or village I was born in but demanded documentary proof like original birth certificate. I have the one my parents were given after the adoption order in 1946 - but I have no Adoption Certificate nor am I likely to ever get one. The UK birth certificate notes I am an adopted child. Doesn't say where from of course and adoption details were mostly kept secret. So I am waiting HMPO email no 8 hopefully answering my query about if I send them this nearly 80 year old document, the original birth certificate, will they undertake to (a) not lose it and (b) send it back safely. Unspoken of course is how much more do they want to know that they've already been told This is totally farcical and with high blood pressure I don't need all this effing stress from morons. Who can I complain to as I feel a formal complaint is justified?

-

I don't walk so well so SWMBO (She Who Must Be Obeyed) decided to drive. Happy Wife = Quiet life! I prefer it actually, easier on legs and hips, plus aircon all the way. Wife says there is parking underneath so all good. Now busy printing colour copies of every page in a extended passport - didn't need it in the end - plus trying to see if I need anything else apart from Thai Driving Licence scans for address proof. Cannot find a payment mandate form anywhere on line so assume VFS will sort that out. Everything on old computer so doing it now, new super-dooper computer coming tomorrow so dealing with this while I got one still more or less working.

-

Well, either my somewhat pointed letter about corporate responsibility worked or my earlier (three) complaints bore fruit or none of the above but this morning the web site worked, albeit slowly, and I was able to register and activate account and sign in and get my booking at preferred time and date. So come May I'm off to do penance in Bkk traffic jams, I'll be taking a tent and sleeping bag and loads of provisions for a 2 day stay plus oxygen for breathing clean air. Ok, just kidding - I hope - but anyone who has driven in Bkk traffic will understand the thinking. You lose the will to live waiting to move sometimes.

-

Cannot email them because the response is automated no reply, cannot phone them - no Thai number. My wife found a number - it was VFS-Global India. Anyone else getting stone-walled from making a booking or contacting them? I wanted to renew my passport and being a compliant idiot tried for 3 hours to follow the rules, both on my computer and my android smartphone and my wife's i-phone. Just cannot get past the initial filling-in of the form, no button to submit so no way to verify my email address. Tried with an alternative email - same same! Any ideas - is it because they are all at lunch, having a gang=bang, moving offices, too lazy or whatever. I am fast losing the will to live. Looks like we'll have to go in person later on and demand answers and help from an actual living being and not a useless ai assistant. Anyone got similar problems?