Liquorice

Advanced Member-

Posts

4,855 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

DTV or retirement visa ?

Liquorice replied to tgw's topic in Thai Visas, Residency, and Work Permits

Just to add to that good advice, you couldn't apply for an extension based on retirement or Thai spouse from a DTV. You'd have to start afresh, obtaining the Non Imm O visa first. -

DTV or retirement visa ?

Liquorice replied to tgw's topic in Thai Visas, Residency, and Work Permits

The 179 days + 180 is an extension. -

DTV or retirement visa ?

Liquorice replied to tgw's topic in Thai Visas, Residency, and Work Permits

Just border runs every 180 days for a new 180 day entry. Of course, I would assume you will have to provide evidence on each entry of the reason. For digital nomads/remote workers I would imagine the same portfolio as used for the initial DTV. For the softer options, a letter of appointment or booking for a class. -

DTV or retirement visa ?

Liquorice replied to tgw's topic in Thai Visas, Residency, and Work Permits

Agree. It's a new class of visa just the same as the LTR visa is. Nowhere in the list of eligible foreigners for the DTV is the word 'tourist' mentioned. -

Pink I.D Card & Yellow Book

Liquorice replied to Bangkok Black's topic in Thai Visas, Residency, and Work Permits

If you'd done your research beforehand, you'd note the British Embassy quote fees in pounds. Payments are via UK debit/credit cards, or cash THB using their exchange rates of 45.5 baht to £1. -

60 day extension to NON-0

Liquorice replied to Sam555's topic in Thai Visas, Residency, and Work Permits

Originals; Passport. Marriage certificate. House book, wife's ID card. Completed TM7 form. Passport sized photo. Copies of; Passport data page Non O visa Entry stamp TM30 receipt Blue house book Wife's ID card Marriage certificate Updated Kor Ror 2 Wife must also attend. -

Money in the Bank Seasoning

Liquorice replied to bluemoon58's topic in Thai Visas, Residency, and Work Permits

-

Pink I.D Card & Yellow Book

Liquorice replied to Bangkok Black's topic in Thai Visas, Residency, and Work Permits

I'd double-check, but usually the certified copies and translations need legalising by the Consular section of the MFA before being accepted by the Amphoe. -

Who told you to file a Thai tax return?

-

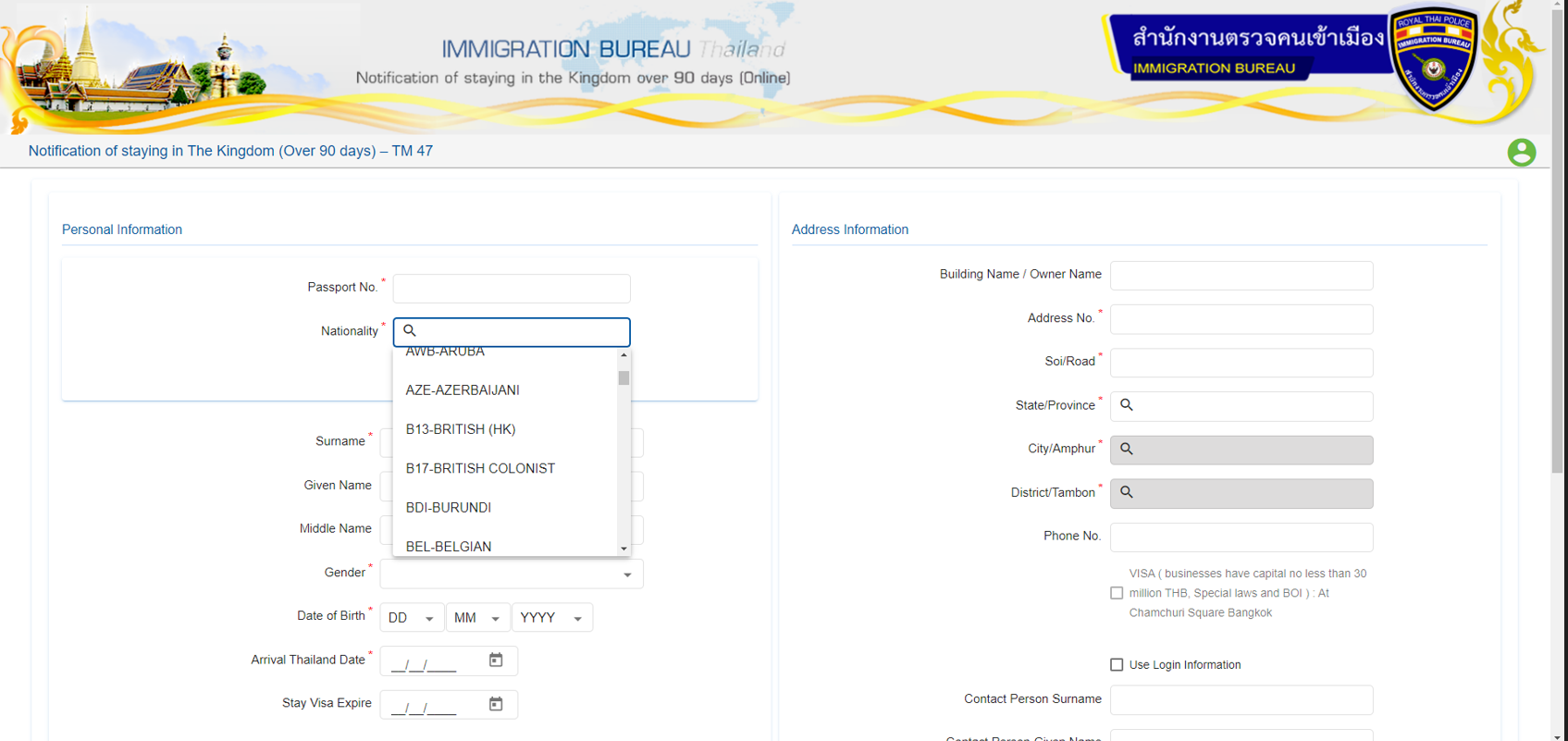

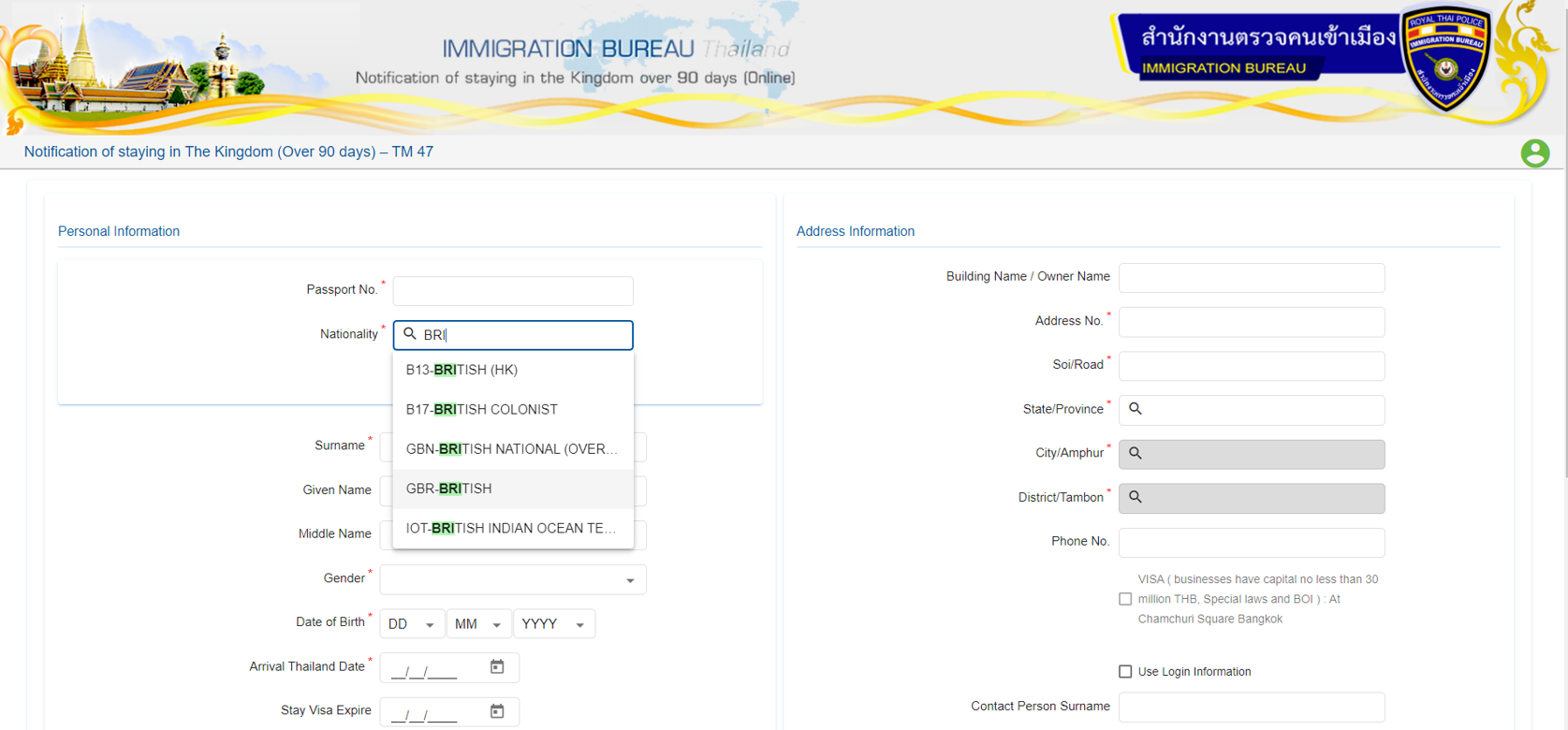

Furthermore, regarding the online system. 4 of my last 6 online reports have been rejected and when I previously enquired as to the reason, I was fobbed off with 'system glitch'. When I was rejected again earlier this month and had to report in person, I posed the question again. Initially, the IO blew his top and claimed it was the system and not to blame him as it wasn't his fault. I tried to calmly explain that the system always accepts my submission, but the option of refusal or acceptance is always performed manually by an IO. I was just seeking answers, as the same info was entered for each submission. Another IO heard his irate raised voice and came over to assist and calmed him down. The office was now empty. I'd printed my last 6 online submission and the emails of acceptance and refusals. They were now being very co-operative and checking their database. After a few minutes, one of the IO's informed me the reason for the refusals was due to me stating the wrong nationality. In the past, they always informed me to use the drop-down boxes where applicable and choose British GBR. I must confess previously I'd chosen British colonist, that being one of the only 2 options under 'B' for 'British'. The IO printed a list of nationalities of in alphabetical order, which when getting to British stated 4 options. British Colonist British GBR British HK British Indian British national (overseas) GBN When they checked my previous 6 reports, they were stunned to find the 2 that were approved also stated my nationality as British colonist, and in fact on one of the approved reports I'd made the error of entering the house and village numbers in the wrong order. These 2 wrongly approved reports were quickly explained away, by an admission it must have been a different IO and not himself! They allowed me to log into the 90 day online system, and this was the first time they saw what we see as such. Sure enough, in alphabetical order under 'B' for 'British', the only 2 options were British HK and British colonist (which given only those two options I chose 'colonist'). They were quite stunned by this, as it didn't match their alphabetical list. At least I now knew the reason for my previous refusals, albeit 2 approved in error. On returning home, I logged into the online system again and searched for British GBR, which in fact it listed under 'G' for GBR- British, along with GBN - British overseas. You have to scroll down to 'I' to find IOT' British Indian. The list, as they see it, is different to that displayed in the online list of nationalities. Next report is due Jan, so now I'm aware of the error, I can correct and see if it's approved.

-

I've concluded that whether successful or not 90 days after re-entering Thailand, depends on if the IO checks why your previous report was missed due to being out of Country and manually resets the new due date. My IO are obviously just too lazy to check, although they obviously can. Mail in after re-entry may be the way forward, as @DrJack54 advised.

-

Did you then try to report online 90 days after re-entering and how did that go. A couple of friends and I attempted to make some sense of the online 90-day report system. 1 year extension, multi re-entry permits, fly in and out 3 times a year. When they were out of Country between a due 90 day report, they were able to report as normal on the due date, even if that was 10 days after re-entry. On the other hand if they were out of Country and missed a due report, then tried within the 90 day after re-entry it was always refused. When I question Immigration why my 90 day report was refused in the latter case, I was advised it was because they couldn't find my previous report. When I stated the obvious, that I was out of Country at the time, he logged into another system and confirmed the date I departed then re-entered. According to him, so many miss the report, they don't check if the reason was because they were out of Country as it was too much trouble. He further stated if I miss a report due to being out of Country, then the next report must be made in person, as I'm out of sync with the automated online system, and the due report date has to be manually reset by an IO.

-

Pink I.D Card & Yellow Book

Liquorice replied to Bangkok Black's topic in Thai Visas, Residency, and Work Permits

Amphoes may also differ by what they name the holder of the book and others named in it. I have a number of translations from House books. The most common status name is the "head of household" or "householder" for the holder of the book. For other status, 'resident' is the most common term used. -

Pink I.D Card & Yellow Book

Liquorice replied to Bangkok Black's topic in Thai Visas, Residency, and Work Permits

He should have been removed from the book by virtue of a stamp across his details. Unfortunately, that still doesn't directly answer the question. The first page of any Blue book details the address of the residence. Flip the page and who is the first named person after the ex-husband in the book - they should have been designated as the 'householder' and it is they who would need to sign a consent form. Others in the book are simply designated as those who reside there. Ask the wife who is registered as the Jao Baan = householder, and Poo Asaai = person who resides here Take the Blue book, your Passport and the receipt of your TM30 confirming you have registered that address as your place of residence with Immigration to the Amphoe. Do not mention employment or a work permit, that will only confuse them. -

Non O based on Thai child

Liquorice replied to 248900_1469958220's topic in Thai Visas, Residency, and Work Permits

Have you remarried? -

More Immigration shenanigans 90 report

Liquorice replied to brianthainess's topic in Thai Visas, Residency, and Work Permits

Incorrect. A single entry is 'USED' on entry. However, you can exit and re-enter Thailand with a re-entry permit within the 90-day period of stay granted by the visa. Who is 'we'? Many obviously don't know and believe they are extending their visa. Factually correcting that belief is not being pedantic. -

More Immigration shenanigans 90 report

Liquorice replied to brianthainess's topic in Thai Visas, Residency, and Work Permits

Really. If you could extend a visa, you wouldn't need a re-entry permit. Visas allow entries. Extensions of one's period of stay, are permits, and do not allow entries, hence the need for a re-entry permit. -

Pink I.D Card & Yellow Book

Liquorice replied to Bangkok Black's topic in Thai Visas, Residency, and Work Permits

Its relevance is that in order to apply for a YB and ID card, the person responsible for the Blue book and named as the householder (first page after address) must sign a form at the Amphoes consenting to you using their address. Without this consent, you cannot apply.

.png.9e203b2bed3506cec7a8de9fb25f0555.png)